Updated on February 12th, 2026 by Nathan Parsh

Insurance can be a great business. Insurers collect revenue from policy premiums and make money by investing the accumulated premiums not paid out in claims, known as the float.

Even legendary investor Warren Buffet sees the value of insurance stocks –his investment conglomerate Berkshire Hathaway (BRK.A) (BRK.B) owns GEICO, General Re, and more.

High profitability allows many insurance companies to pay dividends to shareholders and raise their dividends over time. For example, Aflac (AFL) has increased its dividend for 44 years in a row.

This means the company qualifies as a Dividend Aristocrat – a group of 69 companies in the S&P 500 Index with 25+ consecutive years of dividend increases.

You can download a free list of all 69 Dividend Aristocrats, along with important metrics like dividend yields and price-to-earnings ratios, by clicking on the link below:

Disclaimer: Sure Dividend is not affiliated with S&P Global in any way. S&P Global owns and maintains The Dividend Aristocrats Index. The information in this article and downloadable spreadsheet is based on Sure Dividend’s own review, summary, and analysis of the S&P 500 Dividend Aristocrats ETF (NOBL) and other sources, and is meant to help individual investors better understand this ETF and the index upon which it is based. None of the information in this article or spreadsheet is official data from S&P Global. Consult S&P Global for official information.

This article will take an inside look at Aflac’s business model and what drives its impressive dividend growth.

Business Overview

Aflac was formed in 1955 by three brothers: John, Paul, and Bill Amos. Together, they came up with the idea to sell insurance products that paid cash if a policyholder got sick or injured. In the mid-twentieth century, workplace injuries were common, and no insurance product covered this risk.

Today, Aflac offers a wide range of products, including accident, short-term disability, critical illness, hospital indemnity, dental, vision, and life insurance.

The company specializes in supplemental insurance, which pays out to policyholders if they are sick or injured and cannot work. Aflac operates in the U.S. and Japan, with Japan accounting for more than half of the company’s net earned premiums. Because of this, investors are exposed to currency risk.

Aflac’s earnings will fluctuate based on exchange rates between the Japanese yen and the U.S. dollar. When the yen rises against the dollar, it helps Aflac because each yen earned becomes more valuable when reported in U.S. dollars.

Aflac’s strategy is to increase premium growth through new customers and increase sales to existing customers. It is also investing in expanding its distribution channels, including its digital footprint, in the U.S. and Japan.

Aflac continues to perform decently overall, though recent results were mixed. On February 6th, 2026, Aflac released fourth-quarter and full-year financial results.

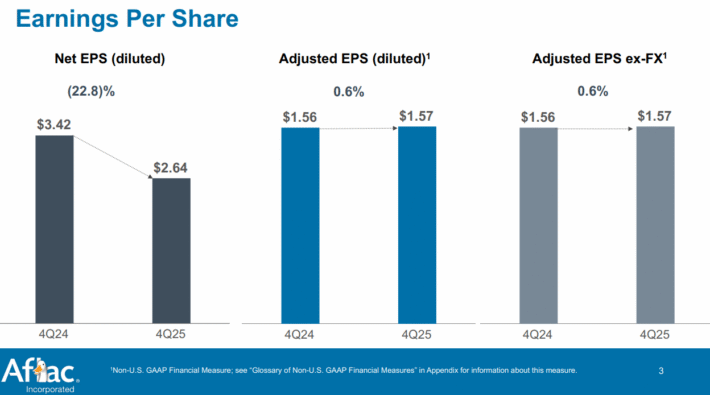

Source: Investor Presentation

For the quarter, the company reported $4.9billion in revenue, which was a 9.3% increase compared to Q4 of 2024 and $510 million less than expected. Net earnings equaled $1.4 billion, or $2.64 per share, compared to net earnings of $1.9 billion, or $3.42 per share, in the prior year.

However, this included $537 million in investment gains, which are excluded from adjusted earnings. On an adjusted basis, earnings-per-share equaled $1.57 versus $1.56 in the prior year, but this was $0.12 below expectations.

For 2025, revenue declined 9.3% to $17.2 billion while adjusted earnings-per-share were $7.49 compared to $7.21 in the prior year.

In U.S. dollars, Aflac Japan’s quarterly net earned premiums fell 3% to $1.6 billion for the quarter while Aflac U.S. net earned premiums grew 4.0% to $1.5 billion.

The adjusted book value of $54.06 compared to $52.87 in the prior year.

Aflac has also aggressive reduced its share count, repurchasing 7.2 million shares at an average price of ~$111 in Q4 2025. The company has 114.3 million shares, or 22% of its outstanding share count, remaining on its repurchase authorization.

Growth Prospects

From 2016 through 2025, Aflac grew earnings-per-share by an average compound rate of 9.2% per year. Growth has slowed over the medium-term to just 4.3% annually over the last five years.

In Japan, Aflac wants to defend its strong core position while expanding and evolving to customer needs. To this point, Aflac Japan is expanding its “third-sector” product offerings. These include non-traditional products such as cancer insurance and medical and income support.

Aflac has enjoyed strong demand in Japan for third-sector products due to the country’s aging population and declining birth rate.

Aflac has two sources of revenue: income from premiums and income from investments. The premium side is generally sticky, with policy renewals making up the bulk of income. However, Aflac operates in two developed markets where we would not anticipate seeing outsized growth in the business.

The other lever available is on the investment side, where most of the portfolio is in bonds. In addition, the share repurchase program has been an important factor, and we believe it will continue to drive earnings per share.

We are forecasting 7% annual growth rate over the next five years.

Competitive Advantages & Recession Performance

Aflac has many competitive advantages. First, it dominates its niche. It operates in supplemental insurance products and is the leading company in that category. Its business model requires low capital expenditures and sells a product that enjoys steady demand.

Aflac’s strong brand is a key competitive advantage. Competition is intense in the insurance industry, considering the commodity-like nature of the products. To retain customers and attract new customers, Aflac invests heavily in advertising.

Aflac is also a recession-resistant company. It remained profitable even during the Great Recession:

2007 earnings-per-share of $1.64

2008 earnings-per-share of $1.31 (-20% decline)

2009 earnings-per-share of $1.96 (49.6% increase)

2010 earnings-per-share of $2.57 (31.1% increase)

Notably, Aflac had a tough year in 2008, which is understandable given the deep recession at the time. However, its earnings-per-share came roaring back in 2009 and 2010. More recently, the company continued to grow even during the worst COVID-19 pandemic. Aflac’s earnings-per-share have increased or remained stable over the last 10 years.

Valuation & Expected Returns

Over the last decade, shares of Aflac have traded hands with an average P/E ratio of roughly 12x times earnings.

We believe this is more or less fair value for the security, considering that many insurers trade at a comparable multiple. This lower average valuation multiple makes the robust share repurchase program more effective.

Based on 2026’s expected earnings-per-share of $7.34, shares are presently trading hands at 15.8 times earnings. As such, this implies an annual valuation headwind of 5.4% should shares revert to 12 times earnings over the next five years.

In addition, the 7% growth rate and 2.1% starting dividend yield should aid shareholder returns. When all three components are combined, this implies the potential for 3.6% annualized returns.

Aflac’s dividend appears very safe, with an expected dividend payout ratio of 33% for 2026. The dividend has room for future increases even if EPS growth slows. The dividend has a CAGR of 12.1% since 2016, but this growth rate accelerates to 13.1% over the last five years.

Final Thoughts

Aflac is a high-quality company with a profitable business and a strong brand.

The company has increased its dividend for 44 years in a row. Thanks to a low payout ratio and future earnings growth, it should continue to do so.

Aflac is not a high-dividend stock, with a current yield of 2.1%. However, it offers steady dividend increases and a highly sustainable payout.

Shares are currently trading higher than the company’s historical valuation. This results in low single-digit total returns expected over the next five years, so the security earns a hold rating.

If you are interested in finding high-quality dividend growth stocks suitable for long-term investment, the following Sure Dividend databases will be useful:

The major domestic stock market indices are another solid resource for finding investment ideas. Sure Dividend compiles the following stock market databases and updates them monthly:

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].