Updated on November 20th, 2025 by Bob Ciura

High dividend stocks means more income for every dollar invested. All other things equal, the higher the dividend yield, the better.

Income investors often like to find low-priced dividend stocks, as they can buy more shares than they could with higher-priced securities.

In this research report, we analyze 9 stocks trading below $10.00 per share and offering high dividend yields of 5.0% and greater.

Additionally, the free high dividend stocks list spreadsheet below has our full list of individual securities (stocks, REITs, MLPs, etc.) with with 5%+ dividend yields.

Keep reading to see analysis on these 9 high-yielding securities, based in the U.S., trading below $10 per share that we cover in the Sure Analysis Research Database.

The list is sorted by dividend yield, in ascending order.

Table of Contents

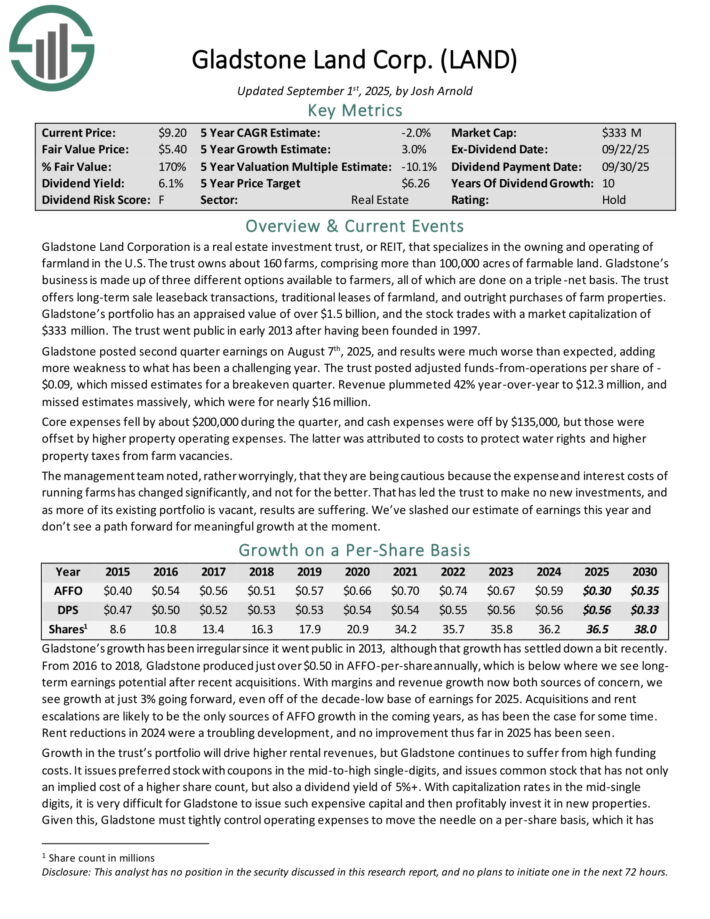

Low-Priced High Dividend Stock #9: Gladstone Land (LAND) – Dividend Yield of 6.0%

Gladstone Land Corporation is a REIT that specializes in the owning and operating of farmland in the U.S.

The trust owns about 160 farms, comprising more than 100,000 acres of farmable land. Gladstone’s business is made up of three different options available to farmers, all of which are done on a triple-net basis.

The trust offers long-term sale leaseback transactions, traditional leases of farmland, and outright purchases of farm properties. Gladstone’s portfolio has an appraised value of over $1.5 billion.

Gladstone posted second quarter earnings on August 7th, 2025, and results were much worse than expected, adding more weakness to what has been a challenging year. The trust posted adjusted funds-from-operations per share of $0.09, which missed estimates for a breakeven quarter.

Revenue plummeted 42% year-over-year to $12.3 million, and missed estimates massively, which were for nearly $16 million.

Core expenses fell by about $200,000 during the quarter, and cash expenses were off by $135,000, but those were offset by higher property operating expenses. The latter was attributed to costs to protect water rights and higher property taxes from farm vacancies.

Click here to download our most recent Sure Analysis report on LAND (preview of page 1 of 3 shown below):

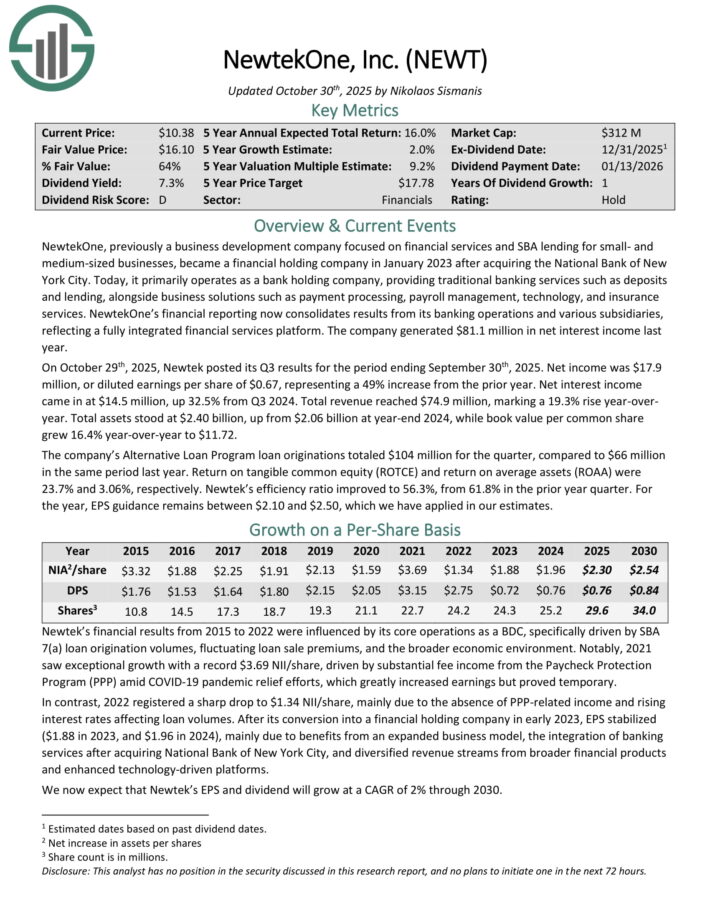

Low-Priced High Dividend Stock #8: NewtekOne Inc. (NEWT) – Dividend Yield of 7.8%

NewtekOne, previously a business development company focused on financial services and SBA lending for small- and medium-sized businesses, became a financial holding company in January 2023 after acquiring the National Bank of New York City.

Today, it primarily operates as a bank holding company, providing traditional banking services such as deposits and lending, alongside business solutions such as payment processing, payroll management, technology, and insurance services.

NewtekOne’s financial reporting now consolidates results from its banking operations and various subsidiaries, reflecting a fully integrated financial services platform. The company generated $81.1 million in net interest income last year.

On October 29th, 2025, Newtek posted its Q3 results. Net income was $17.9 million, or diluted earnings per share of $0.67, representing a 49% increase from the prior year. Net interest income came in at $14.5 million, up 32.5% from Q3 2024.

Total revenue reached $74.9 million, marking a 19.3% rise year-over-year. Total assets stood at $2.40 billion, up from $2.06 billion at year-end 2024, while book value per common share grew 16.4% year-over-year to $11.72.

The company’s Alternative Loan Program loan originations totaled $104 million for the quarter, compared to $66 million in the same period last year. Return on tangible common equity (ROTCE) and return on average assets (ROAA) were 23.7% and 3.06%, respectively.

Click here to download our most recent Sure Analysis report on NEWT (preview of page 1 of 3 shown below):

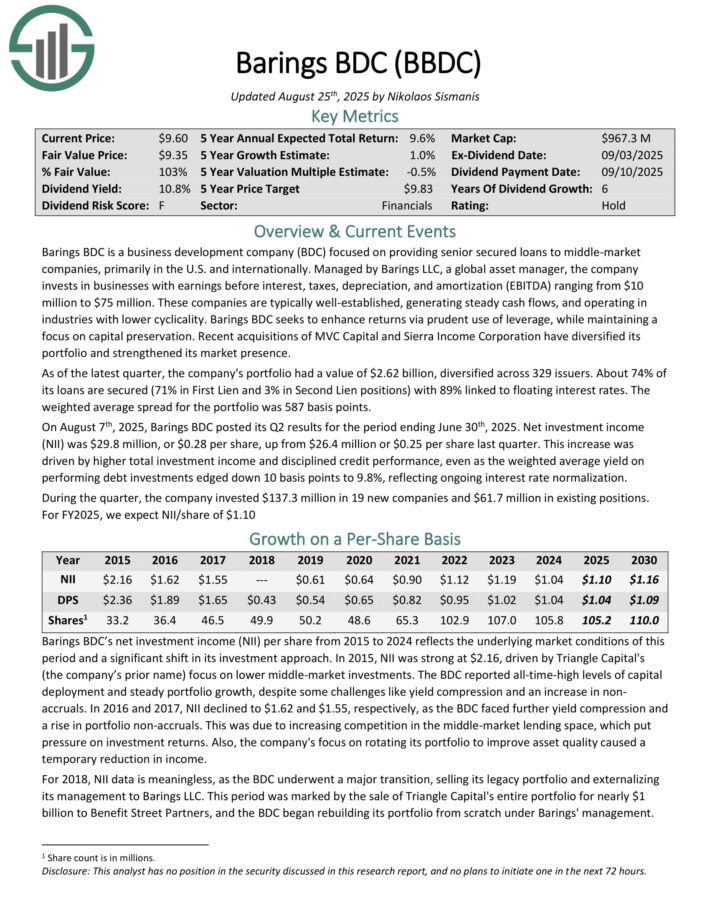

Low-Priced High Dividend Stock #7: Barings BDC (BBDC) – Dividend Yield of 11.9%

Barings BDC is a business development company (BDC) focused on providing senior secured loans to middle-market companies, primarily in the U.S. and internationally.

Managed by Barings LLC, a global asset manager, the company invests in businesses with earnings before interest, taxes, depreciation, and amortization (EBITDA) ranging from $10 million to $75 million.

As of the latest quarter, the company’s portfolio had a value of $2.62 billion, diversified across 329 issuers. About 74% of its loans are secured (71% in First Lien and 3% in Second Lien positions) with 89% linked to floating interest rates. The weighted average spread for the portfolio was 587 basis points.

On August 7th, 2025, Barings BDC posted its Q2 results for the period ending June 30th, 2025. Net investment income (NII) was $29.8 million, or $0.28 per share, up from $26.4 million or $0.25 per share last quarter.

This increase was driven by higher total investment income and disciplined credit performance, even as the weighted average yield on performing debt investments edged down 10 basis points to 9.8%, reflecting ongoing interest rate normalization.

During the quarter, the company invested $137.3 million in 19 new companies and $61.7 million in existing positions.

Click here to download our most recent Sure Analysis report on BBDC (preview of page 1 of 3 shown below):

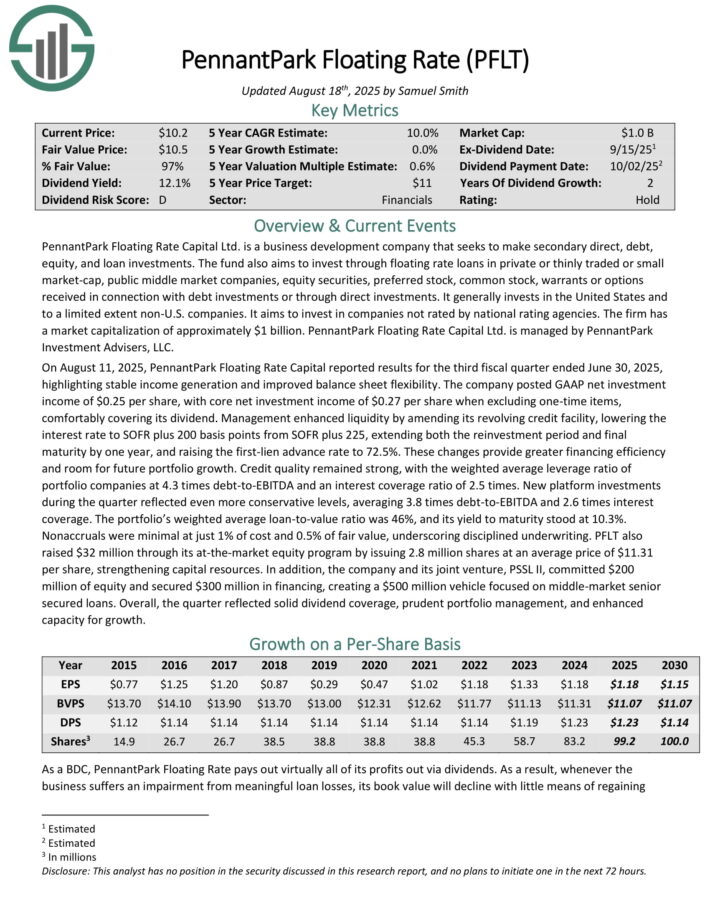

Low-Priced High Dividend Stock #6: PennantPark Floating Rate Capital (PFLT) – Dividend Yield of 13.7%

PennantPark Floating Rate Capital Ltd. is a business development company that seeks to make secondary direct, debt, equity, and loan investments.

The fund also aims to invest through floating rate loans in private or thinly traded or small market-cap, public middle market companies, equity securities, preferred stock, common stock, warrants or options received in connection with debt investments or through direct investments.

On August 11, 2025, PennantPark Floating Rate Capital reported results for the third fiscal quarter ended June 30, 2025, highlighting stable income generation and improved balance sheet flexibility.

The company posted GAAP net investment income of $0.25 per share, with core net investment income of $0.27 per share when excluding one-time items, comfortably covering its dividend.

Management enhanced liquidity by amending its revolving credit facility, lowering the interest rate to SOFR plus 200 basis points from SOFR plus 225, extending both the reinvestment period and final maturity by one year, and raising the first-lien advance rate to 72.5%.

These changes provide greater financing efficiency and room for future portfolio growth. Credit quality remained strong, with the weighted average leverage ratio of portfolio companies at 4.3 times debt-to-EBITDA and an interest coverage ratio of 2.5 times.

New platform investments during the quarter reflected even more conservative levels, averaging 3.8 times debt-to-EBITDA and 2.6 times interest coverage. The portfolio’s weighted average loan-to-value ratio was 46%, and its yield to maturity stood at 10.3%.

Nonaccruals were minimal at just 1% of cost and 0.5% of fair value, underscoring disciplined underwriting. PFLT also raised $32 million through its at-the-market equity program by issuing 2.8 million shares at an average price of $11.31 per share, strengthening capital resources.

In addition, the company and its joint venture, PSSL II, committed $200 million of equity and secured $300 million in financing, creating a $500 million vehicle focused on middle-market senior secured loans.

Click here to download our most recent Sure Analysis report on PFLT (preview of page 1 of 3 shown below):

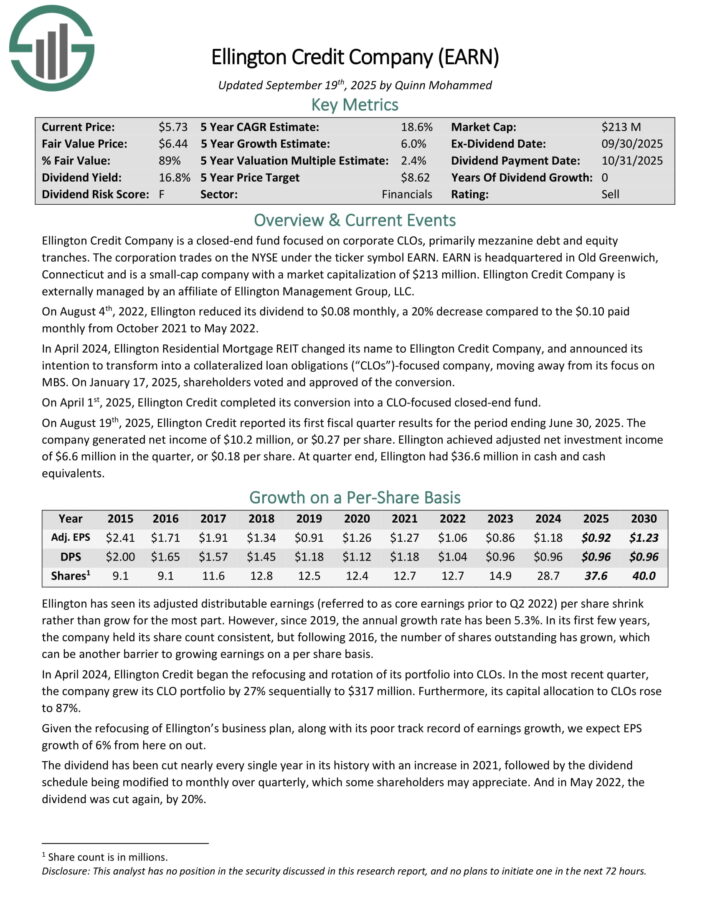

Low-Priced High Dividend Stock #5: Ellington Credit Co. (EARN) – Dividend Yield of 18.6%

Ellington Credit Co. acquires, invests in, and manages residential mortgage and real estate related assets. Ellington focuses primarily on residential mortgage-backed securities, specifically those backed by a U.S. Government agency or U.S. government–sponsored enterprise.

Agency MBS are created and backed by government agencies or enterprises, while non-agency MBS are not guaranteed by the government.

On August 19th, 2025, Ellington Credit reported its first fiscal quarter results for the period ending June 30, 2025. The company generated net income of $10.2 million, or $0.27 per share.

Ellington achieved adjusted net investment income of $6.6 million in the quarter, or $0.18 per share. At quarter end, Ellington had $36.6 million in cash and cash equivalents.

Click here to download our most recent Sure Analysis report on EARN (preview of page 1 of 3 shown below):

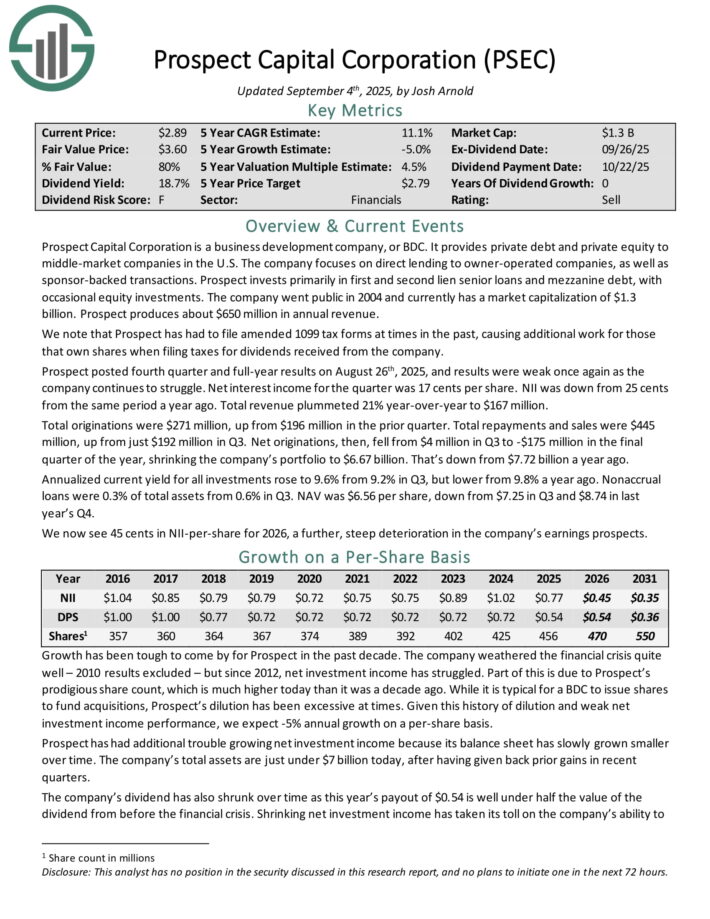

Low-Priced High Dividend Stock #4: Prospect Capital (PSEC) – Dividend Yield of 19.4%

Prospect Capital Corporation is a Business Development Company, or BDC, that provides private debt and private equity to middle–market companies in the U.S.

The company focuses on direct lending to owner–operated companies, as well as sponsor–backed transactions. Prospect invests primarily in first and second lien senior loans and mezzanine debt, with occasional equity investments.

Prospect posted fourth quarter and full-year results on August 26th, 2025, and results were weak once again as the company continues to struggle. Net interest income for the quarter was 17 cents per share. NII was down from 25 cents from the same period a year ago. Total revenue plummeted 21% year-over-year to $167 million.

Total originations were $271 million, up from $196 million in the prior quarter. Total repayments and sales were $445 million, up from just $192 million in Q3. Net originations, then, fell from $4 million in Q3 to -$175 million in the final quarter of the year, shrinking the company’s portfolio to $6.67 billion. That’s down from $7.72 billion a year ago.

Annualized current yield for all investments rose to 9.6% from 9.2% in Q3, but lower from 9.8% a year ago.

Click here to download our most recent Sure Analysis report on PSEC (preview of page 1 of 3 shown below):

Low-Priced High Dividend Stock #3: Orchid Island Capital (ORC) – Dividend Yield of 19.9%

Orchid Island Capital, Inc. is an mREIT that is externally managed by Bimini Advisors LLC and focuses on investing in residential mortgage-backed securities (RMBS), including pass-through and structured agency RMBSs.

These financial instruments generate cash flow based on residential loans such as mortgages, subprime, and home-equity loans.

On October 23, 2025, Orchid Island Capital, Inc. reported estimated net income of $0.53 per common share for Q3 2025, with book value per share estimated at $7.33 as of September 30, 2025.

The company declared a monthly dividend of $0.12 per share for October, keeping consistent with its monthly payout strategy.

The RMBS portfolio and derivatives portfolio evolved as the company remained focused on agency residential mortgage-backed securities paired with hedging strategies.

Orchid Island highlighted that the investment backdrop remains attractive with improving spreads and prepayment risk manageable given the portfolio’s coupon distribution and hedges.

Prepayment activity remained a focal point, with management noting the need for continued vigilance given higher coupon pools and refinancing dynamics.

Click here to download our most recent Sure Analysis report on Orchid Island Capital, Inc. (ORC) (preview of page 1 of 3 shown below):

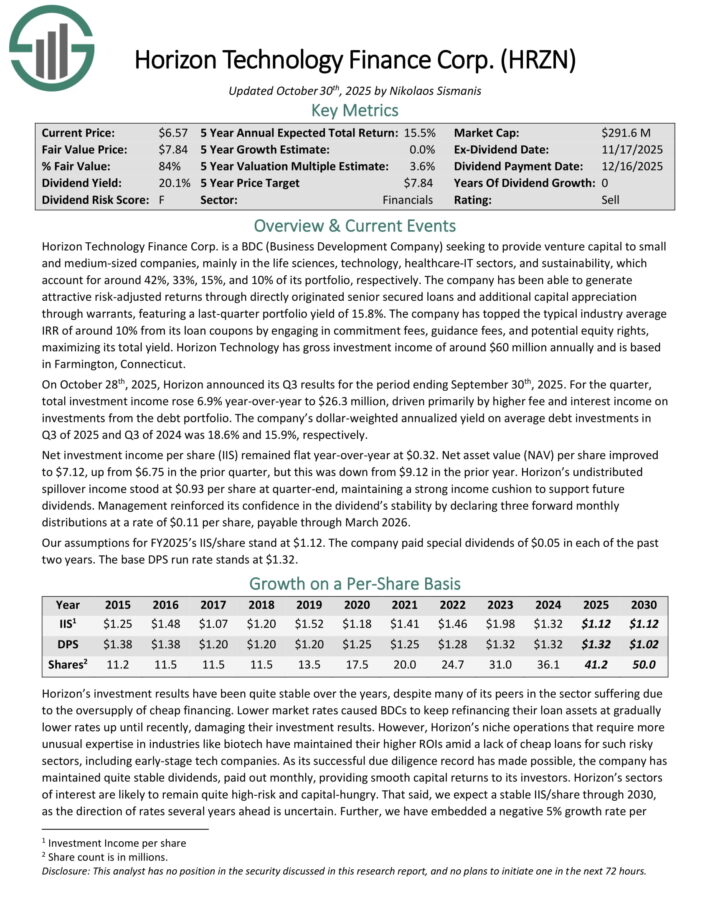

Low-Priced High Dividend Stock #2: Horizon Technology Finance (HRZN) – Dividend Yield of 20.7%

Horizon Technology Finance Corp. is a BDC that provides venture capital to small and medium–sized companies in the technology, life sciences, and healthcare–IT sectors.

On October 28th, 2025, Horizon announced its Q3 results. For the quarter, total investment income rose 6.9% year-over-year to $26.3 million, driven primarily by higher fee and interest income on investments from the debt portfolio.

The company’s dollar-weighted annualized yield on average debt investments in Q3 of 2025 and Q3 of 2024 was 18.6% and 15.9%, respectively.

Net investment income per share (IIS) remained flat year-over-year at $0.32. Net asset value (NAV) per share improved to $7.12, up from $6.75 in the prior quarter, but this was down from $9.12 in the prior year.

Horizon’s undistributed spillover income stood at $0.93 per share at quarter-end, maintaining a strong income cushion to support future dividends.

Click here to download our most recent Sure Analysis report on HRZN (preview of page 1 of 3 shown below):

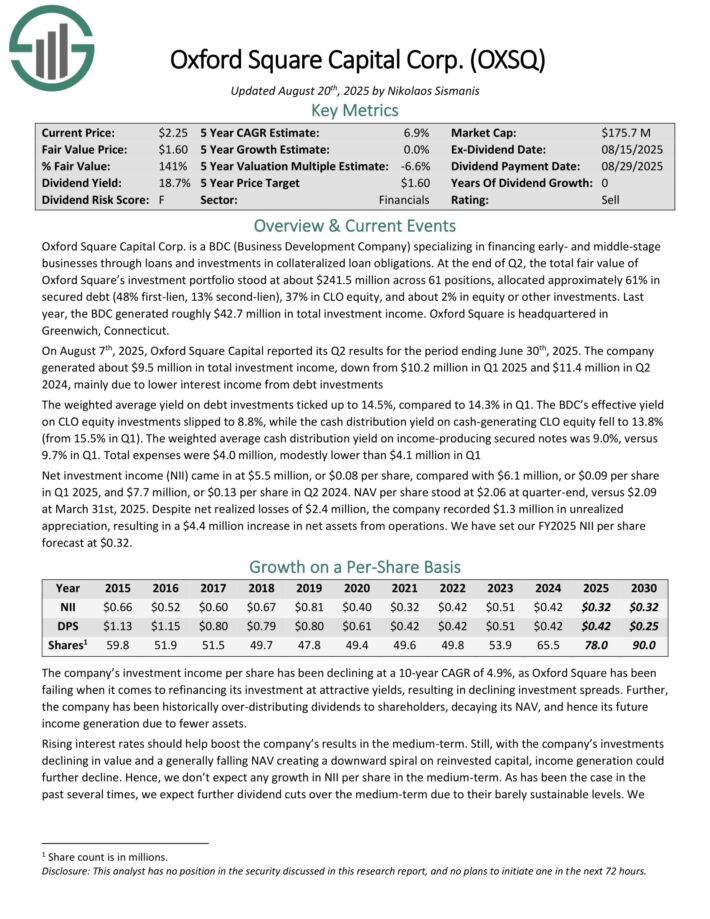

Low-Priced High Dividend Stock #1: Oxford Square Capital (OXSQ) – Dividend Yield of 22.3%

Oxford Square Capital Corp. is a BDC (Business Development Company) specializing in financing early- and middle-stage businesses through loans and investments in collateralized loan obligations.

At the end of last quarter, the total fair value of Oxford Square’s investment portfolio stood at about $243.2 million across 61 positions, allocated approximately 61% in secured debt (48% first-lien, 13% second-lien), 38% in CLO equity, and about 1% in equity or other investments. Last year, the BDC generated roughly $42.7 million in total investment income.

On August 7th, 2025, Oxford Square Capital reported its Q2 results for the period ending June 30th, 2025. The company generated about $9.5 million in total investment income, down from $10.2 million in Q1 2025 and $11.4 million in Q2 2024, mainly due to lower interest income from debt investments.

The weighted average yield on debt investments ticked up to 14.5%, compared to 14.3% in Q1. The BDC’s effective yield on CLO equity investments slipped to 8.8%, while the cash distribution yield on cash-generating CLO equity fell to 13.8% (from 15.5% in Q1).

The weighted average cash distribution yield on income-producing secured notes was 9.0%, versus 9.7% in Q1. Total expenses were $4.0 million, modestly lower than $4.1 million in Q1.

Net investment income (NII) came in at $5.5 million, or $0.08 per share, compared with $6.1 million, or $0.09 per share in Q1 2025, and $7.7 million, or $0.13 per share in Q2 2024.

Click here to download our most recent Sure Analysis report on OXSQ (preview of page 1 of 3 shown below):

Final Thoughts

When a stock offers an exceptionally high dividend yield, it usually signals that its dividend is at the risk of being cut. This certainly applies to most of the above stocks.

Nevertheless, some of the above stocks could be appealing to income investors even after a potential dividend cut, as many would still have high yields.

If you are interested in finding high-quality dividend growth stocks and/or other high-yield securities and income securities, the following Sure Dividend resources will be useful:

High-Yield Individual Security Research

Other Sure Dividend Resources

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].