Updated on March 28th, 2025 by Bob Ciura

Mortgage Real Estate Investment Trusts (i.e., “REITs”) – often referred to as “mREITs” – can provide a very attractive source of income for investors.

This is because they invest in mortgages that are typically backed by hard assets (commercial and/or residential real estate) with fairly conservative loan-to-value ratios.

Mortgage REITs finance these portfolios with a mixture of equity (that they raise by selling shares to investors) and debt that they generally raise at an interest cost that is meaningfully lower than the interest rates they can command on their real estate mortgage investments.

The result is significant and stable cash flow for the mREIT.

You can download your free 200+ REIT list (along with important financial metrics like dividend yields and payout ratios) by clicking on the link below:

Moreover, as REITs they are exempt from having to pay corporate taxes on their net interest income and are required to pay out at least 90% of their taxable income to shareholders via dividends.

This generally means that mREIT shareholders earn very high dividend yields, making mREIT shares an exceptional source of passive income.

Of course, due to their significant amount of leverage, mortgage REITs come with risks that occasionally lead to dividend cuts.

As a result, investors need to be prudent when selecting which mREITs to invest in.

This article will list the 5 highest yielding mortgage REITs in the Sure Analysis Research Database.

Table of Contents

You can instantly jump to any specific section of the article by using the links below:

#5: AGNC Investment Corporation (AGNC)

American Capital Agency Corp is a mortgage real estate investment trust that invests primarily in agency mortgage–backed securities (or MBS) on a leveraged basis.

The firm’s asset portfolio is comprised of residential mortgage pass–through securities, collateralized mortgage obligations (or CMO), and non–agency MBS. Many of these are guaranteed by government–sponsored enterprises.

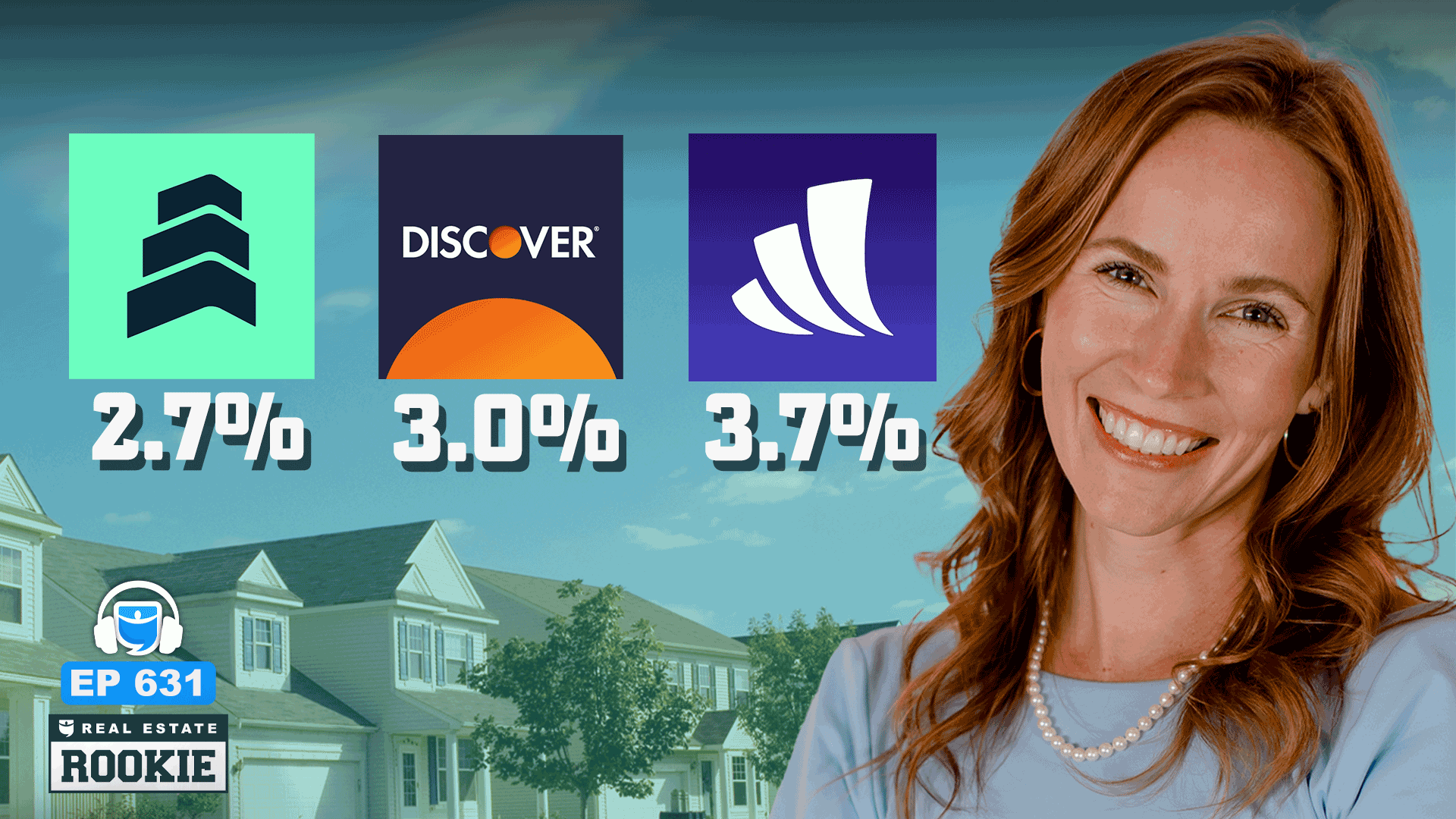

Source: Investor Presentation

AGNC Investment Corp. reported strong financial results for the third quarter ended September 30, 2024. The company achieved a comprehensive income of $0.63 per common share, driven by a net income of $0.39 and other comprehensive income of $0.24 from marked-to-market investments.

Net spread and dollar roll income contributed $0.43 per share. The tangible net book value increased by $0.42 per share to $8.82, reflecting a 5.0% growth from the previous quarter.

AGNC declared dividends of $0.36 per share, resulting in a 9.3% economic return on tangible common equity, which includes both dividends and the increase in net book value.

Click here to download our most recent Sure Analysis report on AGNC Investment Corp (AGNC) (preview of page 1 of 3 shown below):

#4: Dynex Capital (DX)

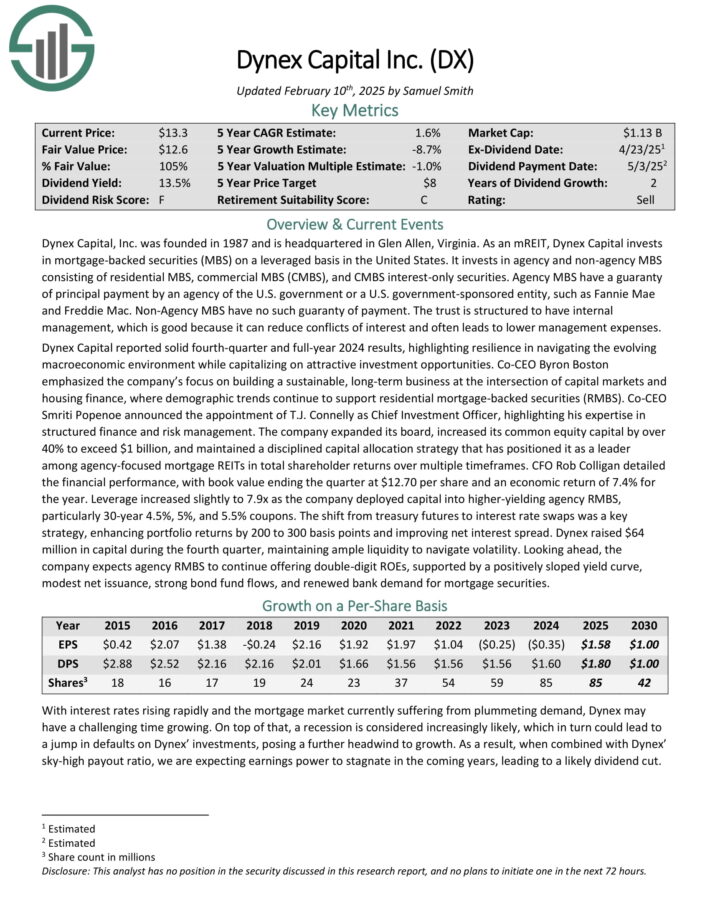

Dynex Capital invests in mortgage–backed securities (MBS) on a leveraged basis in the United States. It invests in agency and non–agency MBS consisting of residential MBS, commercial MBS (CMBS), and CMBS interest–only securities.

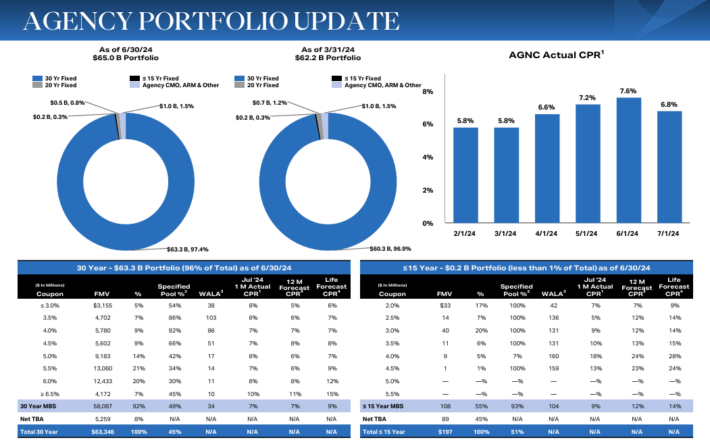

Source: Investor Presentation

Dynex Capital released its fourth-quarter 2024 financial results, with book value ending the quarter at $12.70 per share and an economic return of 7.4% for the year.

Leverage increased slightly to 7.9x as the company deployed capital into higher-yielding agency RMBS, particularly 30-year 4.5%, 5%, and 5.5% coupons.

The shift from treasury futures to interest rate swaps was a key strategy, enhancing portfolio returns by 200 to 300 basis points and improving net interest spread.

Click here to download our most recent Sure Analysis report on DX (preview of page 1 of 3 shown below):

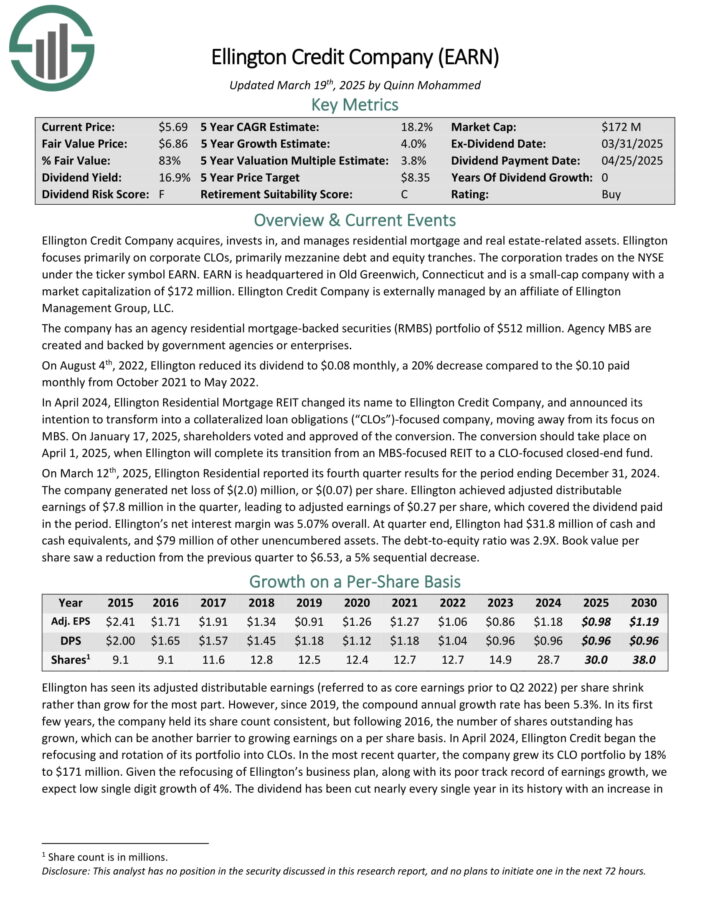

#3: Ellington Credit Co. (EARN)

Ellington Credit Co. acquires, invests in, and manages residential mortgage and real estate related assets. Ellington focuses primarily on residential mortgage-backed securities, specifically those backed by a U.S. Government agency or U.S. government–sponsored enterprise.

Agency MBS are created and backed by government agencies or enterprises, while non-agency MBS are not guaranteed by the government.

On March 12th, 2025, Ellington Residential reported its fourth quarter results for the period ending December 31, 2024. The company generated a net loss of $(2.0) million, or $(0.07) per share.

Ellington achieved adjusted distributable earnings of $7.8 million in the quarter, leading to adjusted earnings of $0.27 per share, which covered the dividend paid in the period.

Ellington’s net interest margin was 5.07% overall. At quarter end, Ellington had $31.8 million of cash and cash equivalents, and $79 million of other unencumbered assets.

Click here to download our most recent Sure Analysis report on EARN (preview of page 1 of 3 shown below):

#2: ARMOUR Residential REIT (ARR)

ARMOUR Residential invests in residential mortgage-backed securities that include U.S. Government-sponsored entities (GSE) such as Fannie Mae and Freddie Mac.

It also includes Ginnie Mae, the Government National Mortgage Administration’s issued or guaranteed securities backed by fixed-rate, hybrid adjustable-rate, and adjustable-rate home loans.

Unsecured notes and bonds issued by the GSE and the US Treasury, money market instruments, and non-GSE or government agency-backed securities are examples of other types of investments.

ARMOUR’s cash flow has been volatile since its inception in 2008, but this is to be expected with all mREITs. Of late, declining spreads have hurt earnings, leading to a sharp decline in cash flow per share.

Fortunately, ARMOUR is now seeing a measure of recovery, and should continue to see that recovery manifest itself in the coming quarters and years.

Click here to download our most recent Sure Analysis report on ARMOUR Residential REIT Inc (ARR) (preview of page 1 of 3 shown below):

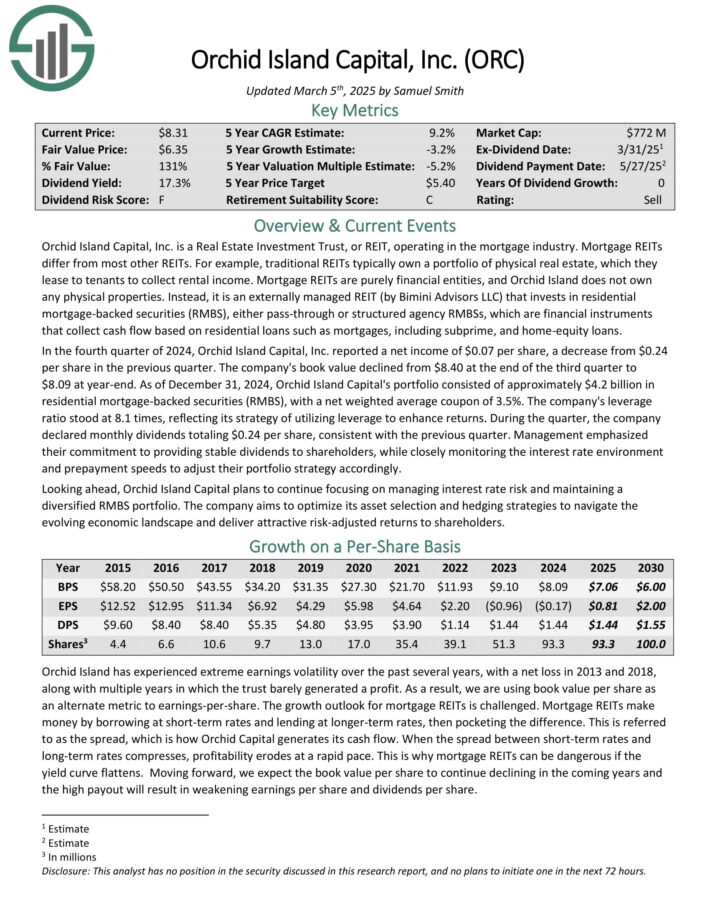

#1: Orchid Island Capital, Inc. (ORC)

Orchid Island Capital, Inc. is an mREIT that is externally managed by Bimini Advisors LLC and focuses on investing in residential mortgage-backed securities (RMBS), including pass-through and structured agency RMBSs.

These financial instruments generate cash flow based on residential loans such as mortgages, subprime, and home-equity loans.

In the fourth quarter of 2024, Orchid Island Capital, Inc. reported a net income of $0.07 per share, a decrease from $0.24 per share in the previous quarter. The company’s book value declined from $8.40 at the end of the third quarter to $8.09 at year-end.

As of December 31, 2024, Orchid Island Capital’s portfolio consisted of approximately $4.2 billion in residential mortgage-backed securities (RMBS), with a net weighted average coupon of 3.5%. The company’s leverage ratio stood at 8.1 times, reflecting its strategy of utilizing leverage to enhance returns.

Click here to download our most recent Sure Analysis report on Orchid Island Capital, Inc. (ORC) (preview of page 1 of 3 shown below):

Conclusion

As you can see from the dividend yields offered by the ten stocks discussed in this article, mREITs can be powerful passive income generators.

However, investors need to be careful before investing in this sector, given that dividend cuts can be common during periods of economic stress. As a result, diversification and a focus on quality are essential.

Additional Reading

You can see more high-quality dividend stocks in the following Sure Dividend databases, each based on long streaks of steadily rising dividend payments:

Alternatively, another great place to look for high-quality business is inside the portfolios of highly successful investors.

By analyzing the portfolios of legendary investors running multi-billion dollar investment portfolios, we are able to indirectly benefit from their million-dollar research budgets and personal investing expertise.

To that end, Sure Dividend has created the following two articles:

You might also be looking to create a highly customized dividend income stream to pay for life’s expenses.

The following lists provide useful information on high dividend stocks and stocks that pay monthly dividends:

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].