Updated on April 30th, 2025 by Bob Ciura

As a business owner, selling products that have high profit margins along with strong brand awareness and an exceptionally loyal customer base is strongly desirable.

This allows for predictable revenue and high levels of profits over time.

The tobacco industry fits this model, despite declines over time in the number of customers that use its products.

Tobacco stocks are particularly attractive to income investors thanks to their generous dividends and defensive characteristics during economic downturns.

Tobacco stocks produce a lot of cash, but have very little capital expenditure needs, creating what could be considered perfect income stocks.

You can download a spreadsheet with all our tobacco stocks (along with important financial metrics such as dividend yields and price-to-earnings ratios) using the link below:

Tobacco stocks are widely prized by income investors thanks to their high dividend yields, stable payouts and dividend increase streaks. However, declining customer counts and usage rates are weighing on the group.

This article will analyze the prospects of 5 of the largest tobacco stocks that we cover in the Sure Analysis Research Database.

Rankings are in order of projected total returns from lowest to highest.

Table of Contents

You can instantly jump to any individual stock analysis by clicking on the links below:

But first, we’ll take a look at the tobacco industry’s primary concern, which is declining tobacco usage.

Industry Overview: Declining Smoking Rates

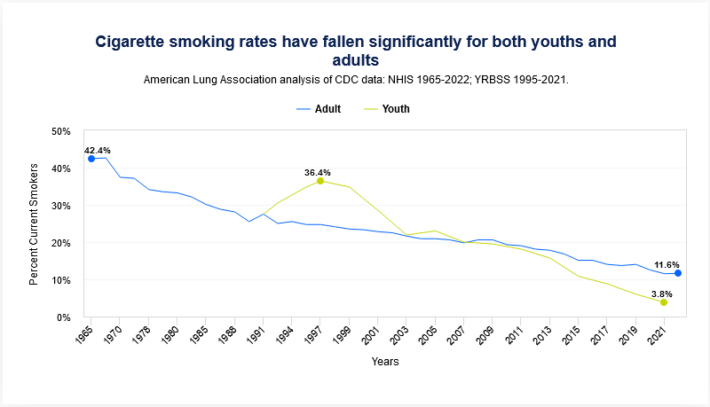

The percent of the U.S. population that smokes is in a continuous decline, and has been for decades.

Source: American Lung Association

The percent of the U.S. smoking adult population has steadily declined from 42% in 1965, to just 11.6% as of 2021. The declines among the youth population have been even bigger.

Young people now have a smoking rate of about one in 25. This sort of decline in an industry’s customer group generally spells trouble for the companies that operate within it.

Other forms of tobacco usage have seen similar rates of decline, including smokeless tobacco. This has been the case with every demographic group, so it is widespread among all of the companies’ potential customers.

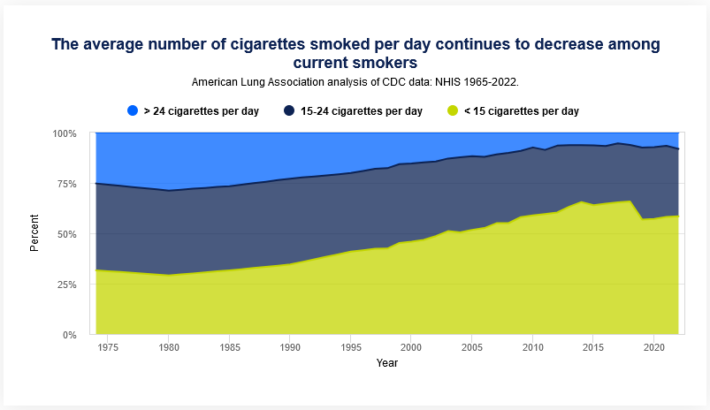

Not only are fewer people smoking, but the ones that do are smoking less than they used to.

Source: American Lung Association

The number of people smoking at least 15 cigarettes a day has plummeted in the past few decades. Today, the overwhelming majority of smokers use fewer than 15 cigarettes daily.

In other words, there are fewer customers for the industry. And, the ones that remain are using fewer products. This has negatively impacted demand from two directions.

This has led to much lower volumes of total cigarettes sold, producing a declining total to be split up among the various companies selling cigarettes.

An increasing number of U.S. states have significantly raised the tax on cigarettes to reduce their budget deficits, and to reduce the potential appeal of smoking for consumers.

Given the propensity of localities to use tax increases on cigarettes, the situation will likely only get worse for tobacco stocks.

In addition, pricing increases have the impact of reducing usage further. Demand will almost certainly continue to decline as taxes and prices rise.

Indeed, health organizations like the American Lung Association actively encourage localities to raise taxes on cigarettes and other tobacco products to discourage usage.

To make matters worse for tobacco companies, most of the world’s smoking population rate looks much the same as the above chart. It has become abundantly clear that consumers around the world are eschewing tobacco products for health concerns.

These negative trends have kept many investors away from tobacco stocks. However, tobacco stocks can still generate solid total returns given that they tend to offer high dividend yields.

The key behind an investment in tobacco stocks is the inelastic demand for cigarettes relative to their price due to the addictive nature of these products.

Tobacco companies have been able to raise their prices to help offset declining smoking rates. As a result, they have exceptional growth records.

In addition, population growth partly offsets the effect of the declining percent of smokers.

However, investors must keep in mind that the total volumes for the industry are in fairly steep decline, and all indications are that this is irreversible.

Tobacco Stock #5: Imperial Brands plc (IMBBY)

5-year expected returns: -3.7%

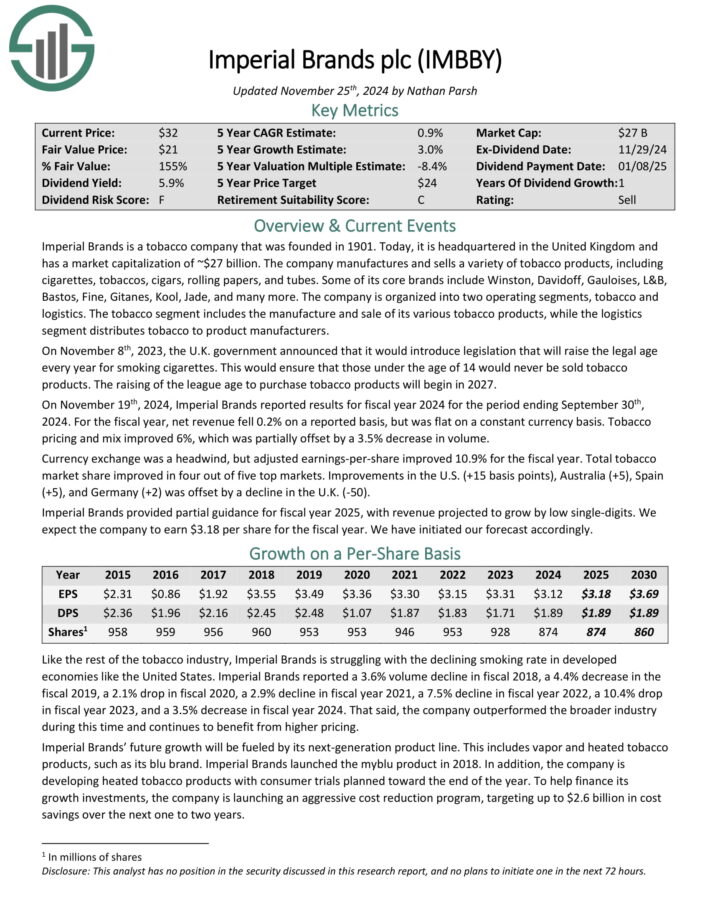

Imperial Brands is a tobacco company that was founded in 1901. Today, it is headquartered in the United Kingdom. The company manufactures and sells a variety of tobacco products, including cigarettes, tobaccos, cigars, rolling papers, and tubes.

Some of its core brands include Winston, Davidoff, Gauloises, L&B, Bastos, Fine, Gitanes, Kool, Jade, and many more.

The company is organized into two operating segments, tobacco and logistics. The tobacco segment includes the manufacture and sale of its various tobacco products, while the logistics segment distributes tobacco to product manufacturers.

Imperial Brands’ future growth will be fueled by its next-generation product line. This includes vapor and heated tobacco products, such as its blu brand. Imperial Brands launched the myblu product in 2018.

In addition, the company is developing heated tobacco products with consumer trials planned toward the end of the year. To help finance its growth investments, the company is launching an aggressive cost reduction program.

Click here to download our most recent Sure Analysis report on IMBBY (preview of page 1 of 3 shown below):

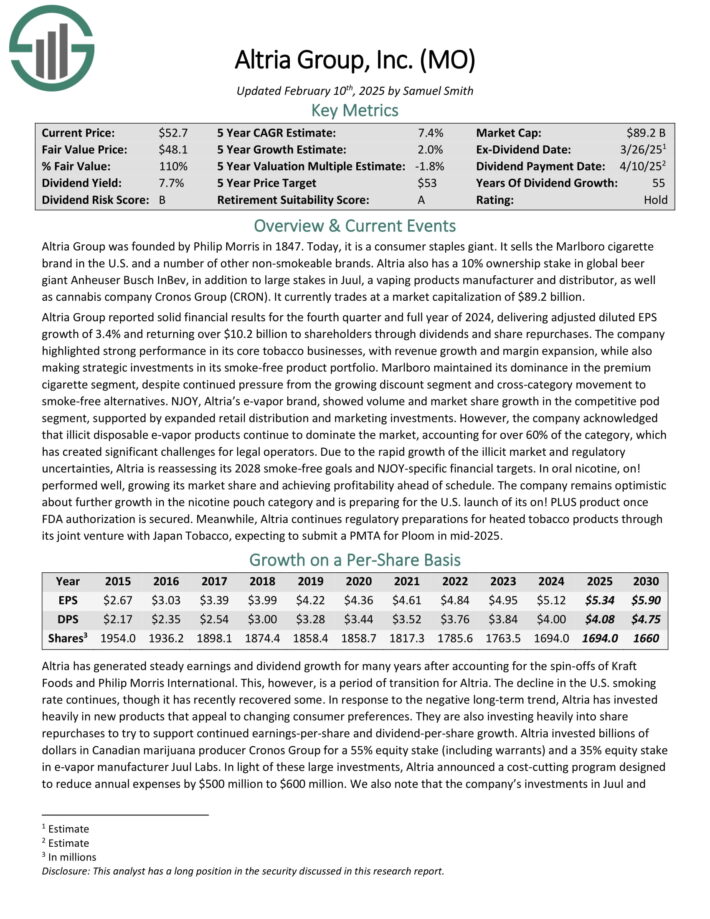

Tobacco Stock #4: Altria Group (MO)

5-year expected returns: 5.0%

Altria is a tobacco stock that sells cigarettes, chewing tobacco, cigars, e-cigarettes, and more under a variety of brands, including Marlboro, Skoal, and Copenhagen, among others.

The company also has a 35% investment stake in e-cigarette maker JUUL, and a 45% stake in the cannabis company Cronos Group (CRON).

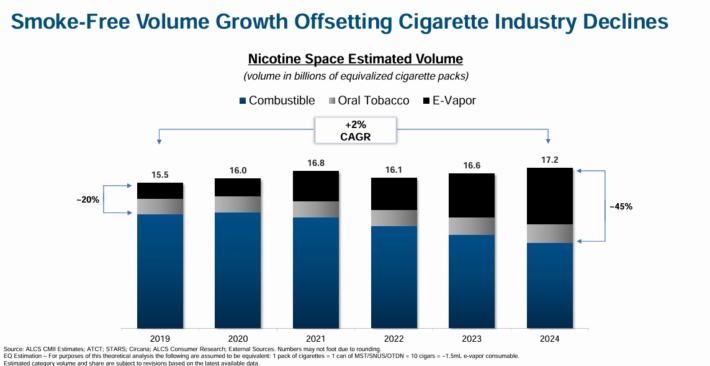

This is a period of transition for Altria. The decline in the U.S. smoking rate continues. In response, Altria has invested heavily in new products that appeal to changing consumer preferences, as the smoke-free category continues to grow.

Source: Investor Presentation

The company also has a 35% investment stake in e-cigarette maker JUUL, and a 45% stake in the Canadian cannabis producer Cronos Group (CRON).

Altria Group reported solid financial results for the fourth quarter and full year of 2024. For the fourth quarter, revenue of $5.1 billion beat analyst estimates by $50 million, and increased 1.6% year-over-year. Adjusted EPS of $1.29 beat by a penny.

For the full year, Altria generated adjusted diluted EPS growth of 3.4% and returned over $10.2 billion to shareholders through dividends and share repurchases.

For 2025, Altria expects adjusted diluted EPS in a range of $5.22 to $5.37. This represents an adjusted diluted EPS growth rate of 2% to 5% for 2025.

Click here to download our most recent Sure Analysis report on Altria (preview of page 1 of 3 shown below):

Tobacco Stock #3: British American Tobacco (BTI)

5-year expected returns: 5.1%

British American Tobacco is one of the largest tobacco companies in the world. It owns the following tobacco brands, among others: Kool, Benson & Hedges, Dunhill, Kent, and Lucky Strike.

British American Tobacco reported its fourth-quarter and full-year earnings results on February 13. During the year, British American Tobacco was able to generate revenues of 25.9 billion Pound Sterling, which was down by around 5% compared to one year earlier.

On an adjusted organic basis, revenues were up by 1.3%, but the company was negatively impacted by currency exchange rate movements. Its revenue from New Categories, which includes vapes and other non-smokable products, grew by a solid 9% on a currency-adjusted basis, relative to one year earlier.

Thanks to strong pricing, British American Tobacco was able to grow its gross profit slightly faster compared to its revenue.

British American Tobacco earned $4.57 during fiscal 2024 (363 pence), which represents an increase of 4% on a currency-adjusted and organic basis.

Click here to download our most recent Sure Analysis report on BTI (preview of page 1 of 3 shown below):

Tobacco Stock #2: Universal Corporation (UVV)

5-year expected returns: 6.6%

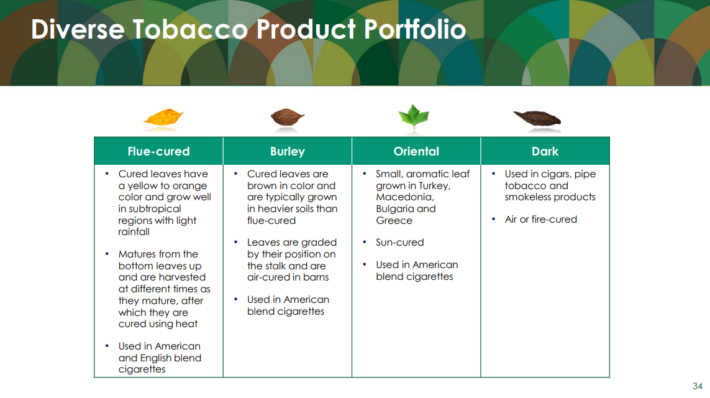

Universal Corporation is a market leader in supplying leaf tobacco and other plant-based inputs to consumer product manufacturers.

The Tobacco Operations segment buys and sells tobacco used to make cigarettes, cigars, pipe tobacco, and smokeless products.

Universal buys tobacco from its suppliers, processes it, and sells it to large tobacco companies in the US and internationally.

Source: Investor Presentation

The Ingredient Operations deal mainly with vegetables and fruits but is significantly smaller than the tobacco operations.

Universal Corporation reported its third quarter earnings results in February. The company generated revenues of $937 million during the quarter, which was more than the revenues that Universal Corporation generated during the previous period.

Revenues were positively impacted by product mix changes, while larger and better-yielding crops also had a positive impact on the company’s top-line. Universal Corporation’s revenues also rose on a year-over-year basis, showing a 14% increase.

Click here to download our most recent Sure Analysis report on Universal (preview of page 1 of 3 shown below):

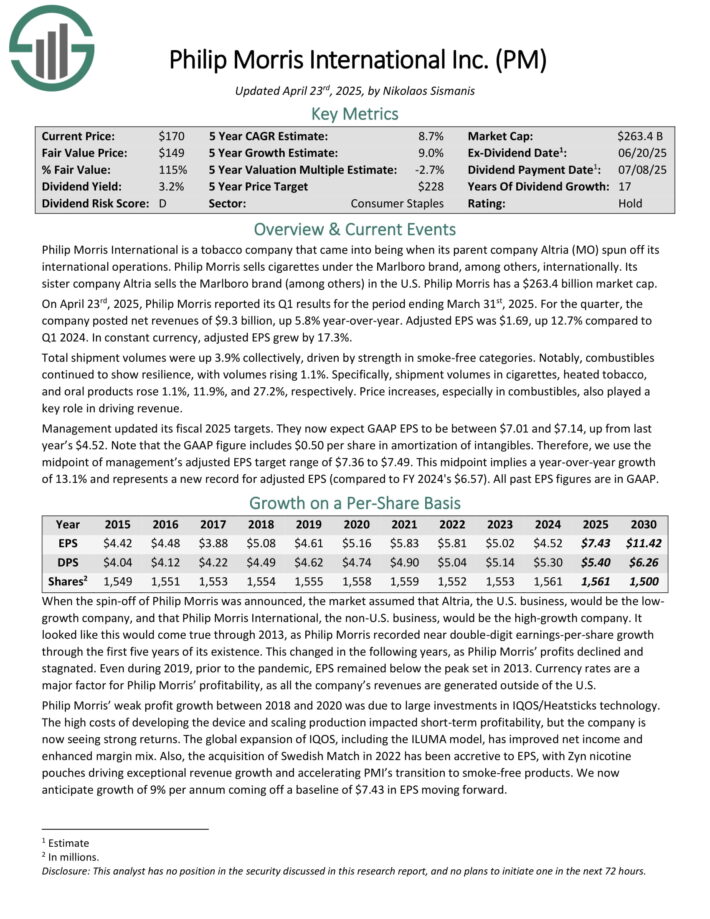

Tobacco Stock #1: Philip Morris International (PM)

5-year expected returns: 8.6%

Philip Morris International was spun off from Altria in 2008, and is charged with the production and distribution of Altria’s products outside of the United States. This distribution includes the Marlboro brand.

On April 23rd, 2025, Philip Morris reported its Q1 results for the period ending March 31st, 2025. For the quarter, the company posted net revenues of $9.3 billion, up 5.8% year-over-year. Adjusted EPS was $1.69, up 12.7% compared to Q1 2024. In constant currency, adjusted EPS grew by 17.3%.

Total shipment volumes were up 3.9% collectively, driven by strength in smoke-free categories. Notably, combustibles continued to show resilience, with volumes rising 1.1%.

Specifically, shipment volumes in cigarettes, heated tobacco, and oral products rose 1.1%, 11.9%, and 27.2%, respectively. Price increases, especially in combustibles, also played a key role in driving revenue.

Click here to download our most recent Sure Analysis report on Philip Morris International (PM) (preview of page 1 of 3 shown below):

Final Thoughts

Tobacco stocks as a group have had a difficult time in the past couple of years. Regulatory and consumer preference changes continue to plague the group.

But valuations are relatively low, dividend yields are high, and most companies are diversifying away from tobacco.

We see PM, UVV, and BTI currently offering the highest expected total returns. And, all offer sizable dividend yields.

Dividend sustainability varies by stock in this group, but overall, there is a lot for income investors to like when it comes to these 5 tobacco stocks.

Further Reading

If you are interested in finding high-quality dividend growth stocks suitable for long-term investment, the following Sure Dividend databases will be useful:

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].