Updated on May 28th, 2025 by Bob CiuraSpreadsheet data updated daily

Micro-cap stocks are publicly-traded companies with market capitalizations between $50 million and $300 million.

These represent the smallest companies in the stock market.

The total number of micro-cap stocks varies depending upon market conditions. Right now there are hundreds of micro-cap stocks, so there are plenty for investors to choose from.

As the smallest stocks, micro-caps could have stronger growth potential over the long run than large-cap stocks or mega-cap stocks.

At the same time, micro-cap stocks carry a number of unique risk factors to consider.

You can download a free spreadsheet of 800+ micro cap stocks right now (along with important financial metrics such as price-to-earnings ratios and dividend yields) by clicking on the link below:

The downloadable micro-cap stocks list above was curated from two leading micro-cap stock ETFs:

iShares Micro-Cap ETF (IWC)

First Trust Dow Jones Select Micro-Cap Index Fund (FDM)

This article includes a spreadsheet and table of all of our micro-cap stocks, as well as detailed analysis on our Top 10 micro-cap stocks today.

Keep reading to see the 10 best micro-cap stocks analyzed in detail.

The 10 Best Micro Cap Stocks Today

Now that we’ve defined what a micro-cap stock is, let’s take a look at the 10 best micro-cap stocks, as defined by our Sure Analysis Research Database.

The database ranks total expected annual returns, combining current yield, forecast earnings growth and any change in price from the valuation.

Note: The Sure Analysis Research Database is focused on income producing securities. As a result, we do not track or rank securities that don’t pay dividends. Micro-cap stocks that don’t pay dividends were excluded from the Top 10 rankings below.

We’ve screened the micro-cap stocks with the highest 5-year expected returns and have provided them below, ranked from lowest to highest.

You can instantly jump to any individual stock analysis by using the links below:

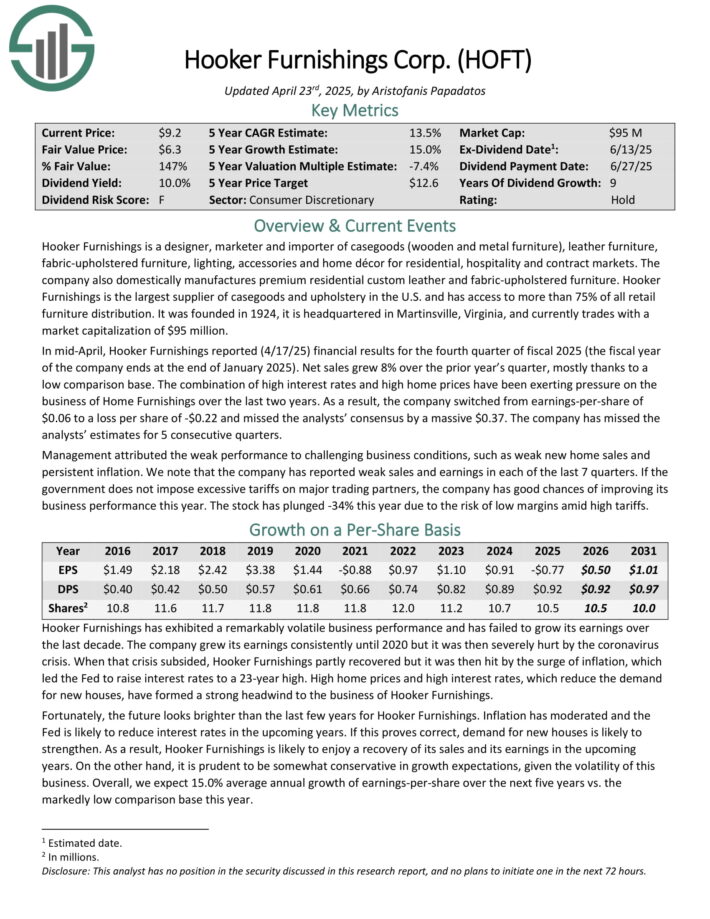

Micro Cap Stock #10: Hooker Furnishings (HOFT)

5-year expected annual returns: 12.8%

Hooker Furnishings is a designer, marketer and importer of casegoods (wooden and metal furniture), leather furniture, fabric-upholstered furniture, lighting, accessories and home décor for residential, hospitality and contract markets.

The company also domestically manufactures premium residential custom leather and fabric-upholstered furniture.

Hooker Furnishings is the largest supplier of casegoods and upholstery in the U.S. and has access to more than 75% of all retail furniture distribution.

In mid-April, Hooker Furnishings reported (4/17/25) financial results for the fourth quarter of fiscal 2025 (the fiscal year of the company ends at the end of January 2025). Net sales grew 8% over the prior year’s quarter, mostly thanks to a low comparison base.

The combination of high interest rates and high home prices have been exerting pressure on the business of Home Furnishings over the last two years. As a result, the company switched from earnings-per-share of $0.06 to a loss per share of -$0.22 and missed the analysts’ consensus.

Click here to download our most recent Sure Analysis report on HOFT (preview of page 1 of 3 shown below):

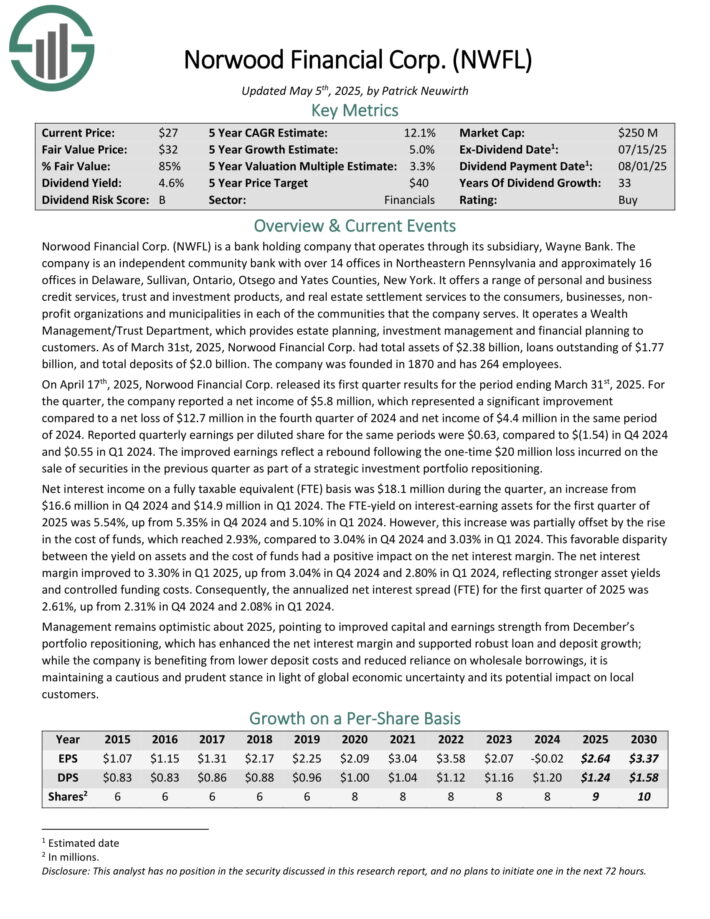

Micro Cap Stock #9: Norwood Financial (NWFL)

5-year expected annual returns: 12.8%

Norwood Financial Corp. (NWFL) is a bank holding company that operates through its subsidiary, Wayne Bank. The company is an independent community bank with over 14 offices in Northeastern Pennsylvania and approximately 16 offices in Delaware, Sullivan, Ontario, Otsego and Yates Counties, New York.

It operates a Wealth Management/Trust Department, which provides estate planning, investment management and financial planning to customers. As of March 31st, 2025, Norwood Financial Corp. had total assets of $2.38 billion, loans outstanding of $1.77 billion, and total deposits of $2.0 billion.

On April 17th, 2025, Norwood Financial Corp. released its first quarter results for the period ending March 31st, 2025. For the quarter, the company reported a net income of $5.8 million, which represented a significant improvement compared to a net loss of $12.7 million in the fourth quarter of 2024 and net income of $4.4 million in the same period of 2024.

Reported quarterly earnings per diluted share for the same periods were $0.63, compared to $(1.54) in Q4 2024 and $0.55 in Q1 2024. The improved earnings reflect a rebound following the one-time $20 million loss incurred on the sale of securities in the previous quarter as part of a strategic investment portfolio repositioning.

Click here to download our most recent Sure Analysis report on NWFL (preview of page 1 of 3 shown below):

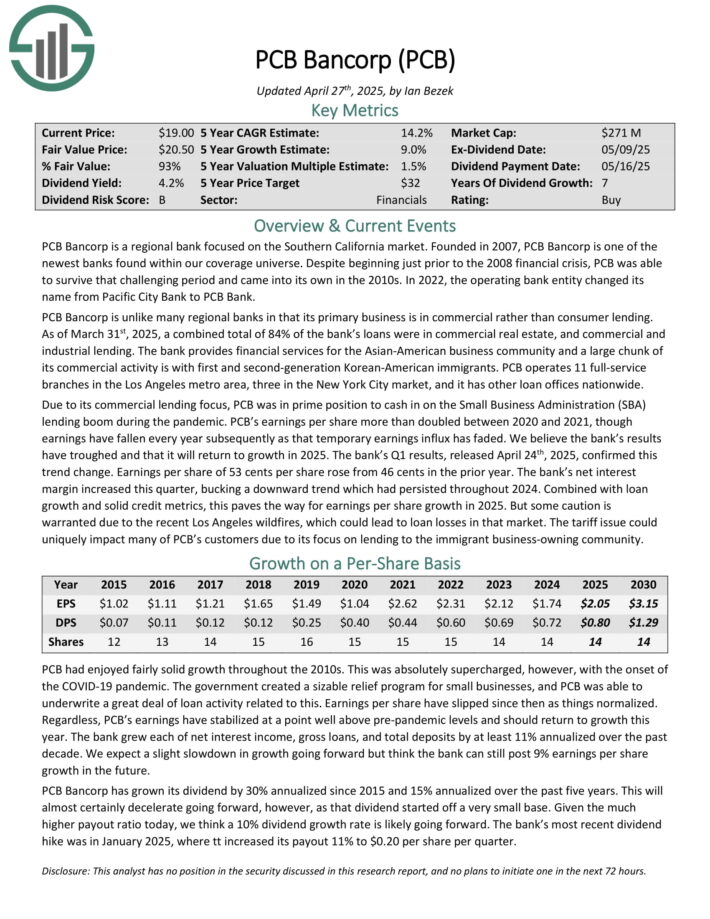

Micro Cap Stock #8: PCB Bancorp (PCB)

5-year expected annual returns: 13.1%

PCB Bancorp is a regional bank focused on the Southern California market. Founded in 2007, PCB Bancorp is one of the newest banks found within our coverage universe.

PCB Bancorp is unlike many regional banks in that its primary business is in commercial rather than consumer lending. As of March 31st, 2025, a combined total of 84% of the bank’s loans were in commercial real estate, and commercial and industrial lending.

The bank provides financial services for the Asian-American business community and a large chunk of its commercial activity is with first and second-generation Korean-American immigrants. PCB operates 11 full-service branches in the Los Angeles metro area, three in the New York City market, and it has other loan offices nationwide.

In the 2025 first quarter, earnings per share of 53 cents per share rose from 46 cents in the prior year. The bank’s net interest margin increased this quarter, bucking a downward trend which had persisted throughout 2024. Combined with loan growth and solid credit metrics, this paves the way for earnings per share growth in 2025.

Click here to download our most recent Sure Analysis report on PCB (preview of page 1 of 3 shown below):

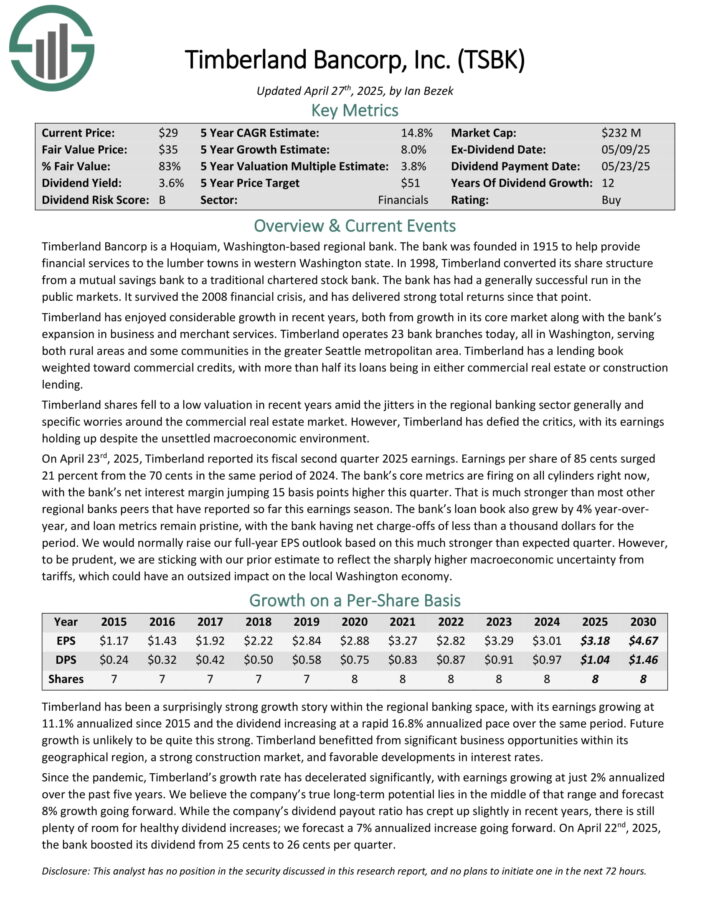

Micro Cap Stock #7: Timberland Bancorp (TSBK)

5-year expected annual returns: 13.3%

Timberland Bancorp is a Hoquiam, Washington-based regional bank. The bank was founded in 1915 to help provide financial services to the lumber towns in western Washington state.

Timberland operates 23 bank branches today, all in Washington, serving both rural areas and some communities in the greater Seattle metropolitan area. Timberland has a lending book weighted toward commercial credits, with more than half its loans being in either commercial real estate or construction lending.

On April 23rd, 2025, Timberland reported its fiscal second quarter 2025 earnings. Earnings per share of 85 cents surged 21 percent from the 70 cents in the same period of 2024. The bank’s core metrics are firing on all cylinders right now, with the bank’s net interest margin jumping 15 basis points higher this quarter.

That is much stronger than most other regional banks peers that have reported so far this earnings season. The bank’s loan book also grew by 4% year-over-year, and loan metrics remain pristine, with the bank having net charge-offs of less than a thousand dollars for the period.

Click here to download our most recent Sure Analysis report on TSBK (preview of page 1 of 3 shown below):

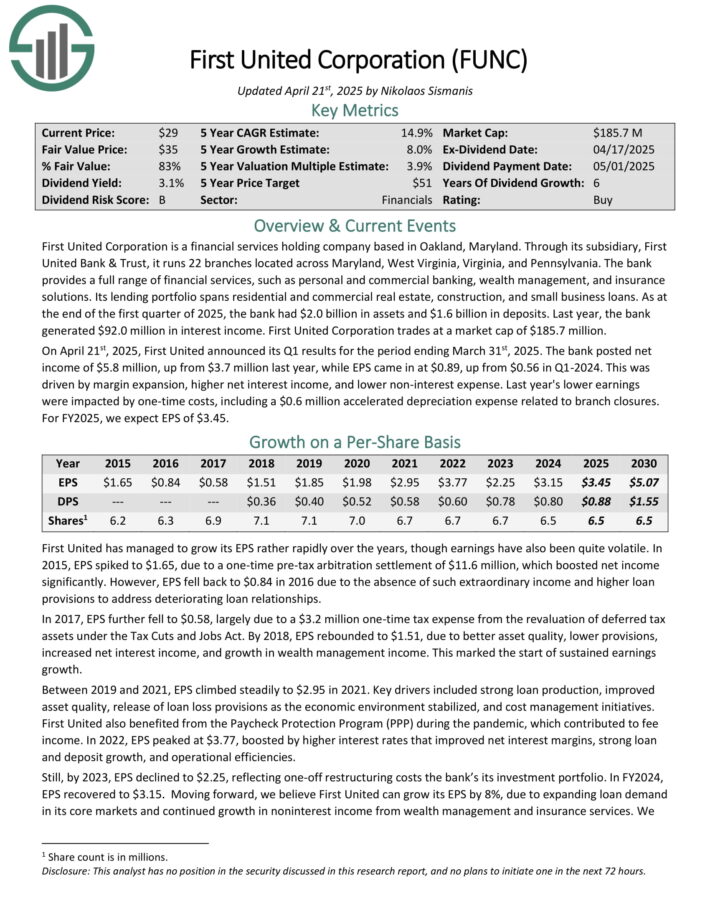

Micro Cap Stock #6: First United Corporation (FUNC)

5-year expected annual returns: 13.9%

First United Corporation is a financial services holding company based in Oakland, Maryland. Through its subsidiary, First United Bank & Trust, it runs 22 branches located across Maryland, West Virginia, Virginia, and Pennsylvania.

The bank provides a full range of financial services, such as personal and commercial banking, wealth management, and insurance solutions.

Its lending portfolio spans residential and commercial real estate, construction, and small business loans. As at the end of the fourth quarter of 2024, the bank had $2.0 billion in assets and $1.6 billion in deposits. Last year, the bank generated $92.0 million in interest income.

On April 21st, 2025, First United announced its Q1 results for the period ending March 31st, 2025. The bank posted net income of $5.8 million, up from $3.7 million last year, while EPS came in at $0.89, up from $0.56 in Q1-2024. This was driven by margin expansion, higher net interest income, and lower non-interest expense.

Last year’s lower earnings were impacted by one-time costs, including a $0.6 million accelerated depreciation expense related to branch closures.

Click here to download our most recent Sure Analysis report on FUNC (preview of page 1 of 3 shown below):

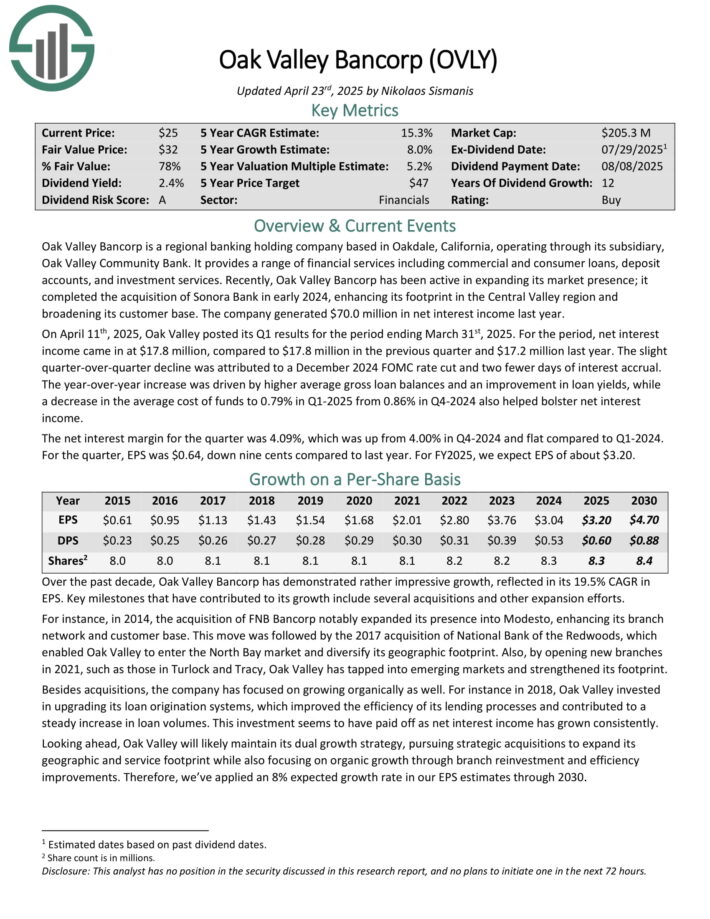

Micro Cap Stock #5: Oak Valley Bancorp (OVLY)

5-year expected annual returns: 14.3%

Oak Valley Bancorp is a regional banking holding company based in Oakdale, California, operating through its subsidiary, Oak Valley Community Bank. It provides a range of financial services including commercial and consumer loans, deposit accounts, and investment services.

On April 11th, 2025, Oak Valley posted its Q1 results for the period ending March 31st, 2025. For the period, net interest income came in at $17.8 million, compared to $17.8 million in the previous quarter and $17.2 million last year. The slight quarter-over-quarter decline was attributed to a December 2024 FOMC rate cut and two fewer days of interest accrual.

The year-over-year increase was driven by higher average gross loan balances and an improvement in loan yields, while a decrease in the average cost of funds to 0.79% in Q1-2025 from 0.86% in Q4-2024 also helped bolster net interest income.

The net interest margin for the quarter was 4.09%, which was up from 4.00% in Q4-2024 and flat compared to Q1-2024.

Click here to download our most recent Sure Analysis report on OVLY (preview of page 1 of 3 shown below):

Micro Cap Stock #4: Silvercrest Asset Management Group (SAMG)

5-year expected annual returns: 16.1%

Silvercrest Asset Management Group is a prominent investment management firm specializing in providing personalized wealth management services to high-net-worth individuals, families, and select institutional investors.

Silvercrest offers a wide range of services, including portfolio management, estate and tax planning, family office services, and philanthropic advisory.

On May 8, 2025, Silvercrest Asset Management Group reported its financial results for the first quarter ended March 31, 2025. The company achieved total revenue of $31.4 million, marking a 3.7% increase from the same period in the previous year, driven primarily by market appreciation.

However, net income attributable to Silvercrest decreased to $2.5 million, or $0.26 per basic and diluted share, down from $3.0 million, or $0.32 per share, in the first quarter of 2024.

Adjusted net income for the quarter was $3.9 million, or $0.29 per adjusted basic share and $0.27 per adjusted diluted share, compared to $4.7 million, or $0.34 per adjusted basic share and $0.33 per adjusted diluted share, in the same period of the previous year.

Click here to download our most recent Sure Analysis report on SAMG (preview of page 1 of 3 shown below):

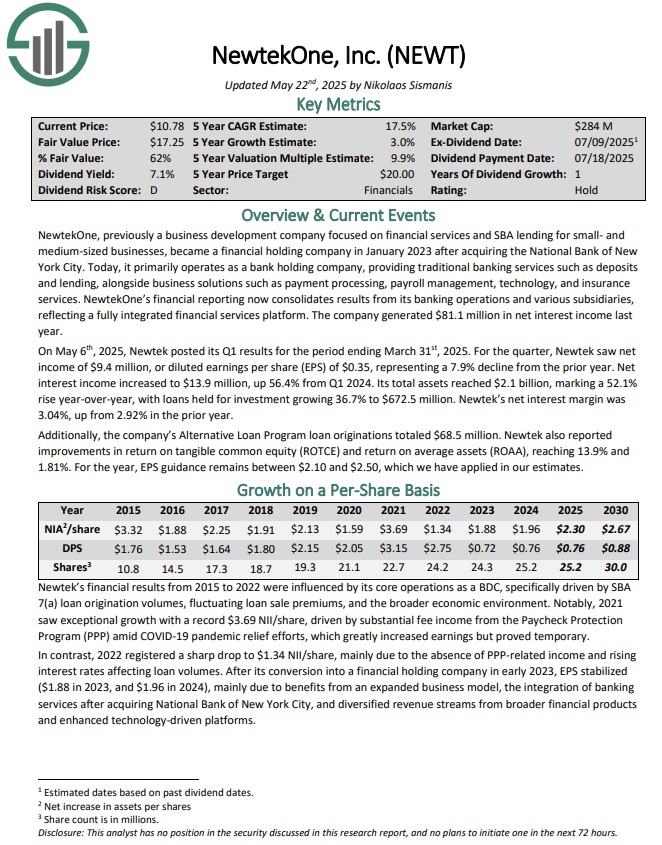

Micro Cap Stock #3: NewtekOne, Inc. (NEWT)

5-year expected annual returns: 16.8%

NewtekOne, previously a business development company focused on financial services and SBA lending for small- and medium-sized businesses, became a financial holding company in January 2023 after acquiring the National Bank of New York City.

Today, it primarily operates as a bank holding company, providing traditional banking services such as deposits and lending, alongside business solutions such as payment processing, payroll management, technology, and insurance services.

NewtekOne’s financial reporting now consolidates results from its banking operations and various subsidiaries, reflecting a fully integrated financial services platform. The company generated $81.1 million in net interest income last year.

On May 6th, 2025, Newtek posted its Q1 results for the period ending March 31st, 2025. For the quarter, Newtek saw net income of $9.4 million, or diluted earnings per share (EPS) of $0.35, representing a 7.9% decline from the prior year.

Net interest income increased to $13.9 million, up 56.4% from Q1 2024. Its total assets reached $2.1 billion, marking a 52.1% rise year-over-year, with loans held for investment growing 36.7% to $672.5 million. Newtek’s net interest margin was 3.04%, up from 2.92% in the prior year.

Click here to download our most recent Sure Analysis report on NEWT (preview of page 1 of 3 shown below):

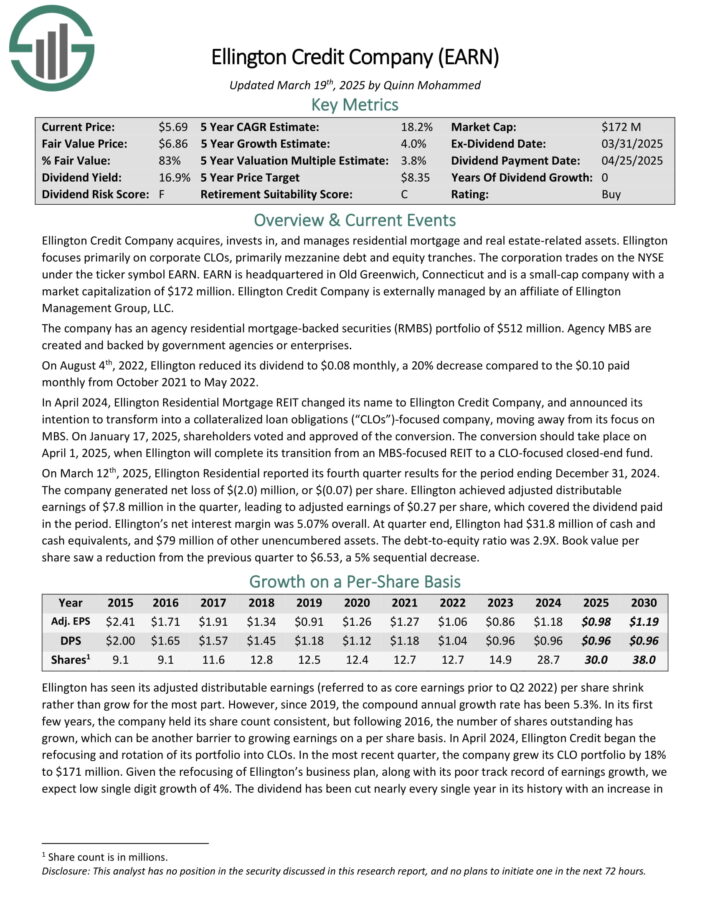

Micro Cap Stock #2: Ellington Credit Co. (EARN)

5-year expected annual returns: 18.0%

Ellington Credit Co. acquires, invests in, and manages residential mortgage and real estate related assets. Ellington focuses primarily on residential mortgage-backed securities, specifically those backed by a U.S. Government agency or U.S. government–sponsored enterprise.

Agency MBS are created and backed by government agencies or enterprises, while non-agency MBS are not guaranteed by the government.

On March 12th, 2025, Ellington Residential reported its fourth quarter results for the period ending December 31, 2024. The company generated a net loss of $(2.0) million, or $(0.07) per share.

Ellington achieved adjusted distributable earnings of $7.8 million in the quarter, leading to adjusted earnings of $0.27 per share, which covered the dividend paid in the period.

Ellington’s net interest margin was 5.07% overall. At quarter end, Ellington had $31.8 million of cash and cash equivalents, and $79 million of other unencumbered assets.

Click here to download our most recent Sure Analysis report on EARN (preview of page 1 of 3 shown below):

Micro Cap Stock #1: Clipper Realty (CLPR)

5-year expected annual returns: 21.8%

Clipper Realty is a Real Estate Investment Trust, or REIT, that was founded by the merger of four pre-existing real estate companies. The founders retain about 2/3 of the ownership and votes today, as they have never sold a share.

Clipper owns commercial (primarily multifamily and office with a small sliver of retail) real estate across New York City.

On May 12, 2025, Clipper Realty reported its financial results for the first quarter. The company achieved record quarterly revenues of $39.4 million, marking a 10.2% increase from the same period in 2024, driven by strong residential leasing and high occupancy rates across its portfolio.

Residential revenue rose by $3.1 million, or 11.8%, due to higher rental rates, occupancy, and collections, while commercial income increased by $0.6 million, or 5.7%, attributed to leasing smaller vacant spaces at Tribeca House and Aspen.

Despite the revenue growth, the company reported a net loss of $35.1 million, or $0.86 per share, primarily due to a $33.8 million impairment charge related to the 10 West 65th Street property, which is now held for sale. Excluding this impairment, the net loss was $1.3 million, or $0.03 per share.

Click here to download our most recent Sure Analysis report on CLPR (preview of page 1 of 3 shown below):

Final Thoughts

Micro-cap stocks are the smallest companies currently trading on the stock market. The potential benefit of investing in micro-cap stocks is the potential for higher growth, and shareholder returns, over time.

Of course, investors need to carefully consider the unique risks associated with investing in micro-cap stocks. The 10 micro-cap stocks on this list all pay dividends to shareholders and have positive expected returns.

As a result, these 10 micro-cap stocks could be attractive for dividend growth investors.

Other Dividend Lists

The following lists contain many more high-quality dividend stocks:

The Dividend Aristocrats List is comprised of 69 stocks in the S&P 500 Index with 25+ years of consecutive dividend increases.

The High Yield Dividend Aristocrats List is comprised of the 20 Dividend Aristocrats with the highest current yields.

The Dividend Achievers List is comprised of ~400 NASDAQ stocks with 10+ years of consecutive dividend increases.

The Dividend Kings List is even more exclusive than the Dividend Aristocrats. It is comprised of 55 stocks with 50+ years of consecutive dividend increases.

The High Yield Dividend Kings List is comprised of the 20 Dividend Kings with the highest current yields.

The High Dividend Stocks List: stocks that appeal to investors interested in the highest yields of 5% or more.

The Monthly Dividend Stocks List: stocks that pay dividends every month, for 12 dividend payments per year.

The Dividend Champions List: stocks that have increased their dividends for 25+ consecutive years.Note: Not all Dividend Champions are Dividend Aristocrats because Dividend Aristocrats have additional requirements like being in The S&P 500.

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].