Updated on October 24th, 2025 by Bob CiuraData updated daily, constituents updated annually

Energy stocks can be among the best performing sectors of the stock market – during the good times, at least.

Unfortunately, the defining trait of the energy sector is its cyclicality. The performance of energy stocks is inherently linked to the price of oil, which fluctuates according to global changes in supply and demand.

Because of this, financially weak energy stocks often make terrible investments because of their poor recession performance. Due diligence is required to find suitable investments within this sector.

To help with this, we’ve compiled a list of nearly 50 energy stocks (along with important investing metrics such as dividend yields), available for download below:

Constituents were derived from these major energy sector ETFs:

Energy Select Sector SDPR ETF (XLE)

iShares Global Energy ETF (IXC)

Keep reading this article to learn about the merits of investing in dividend-paying energy stocks.

How To Use The Energy Stocks List To Find Investment Ideas

Having an Excel document with the names, tickers, and financial information of all dividend-paying energy stocks can be tremendously useful.

This resource becomes even more powerful when combined with a fundamental knowledge of Microsoft Excel.

With that in mind, this section will provide a tutorial of how to implement two actionable investing filters to the Energy Stocks List:

A filter for stocks with dividend yields above 4%

A filter for stocks with market capitalizations above $5 billion and betas below 1.2

Screen 1: High Dividend Yield Energy Stocks

Step 1: Download the Energy Stocks List at the link above.

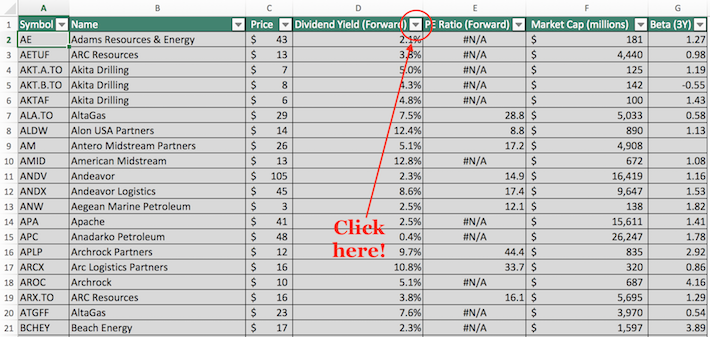

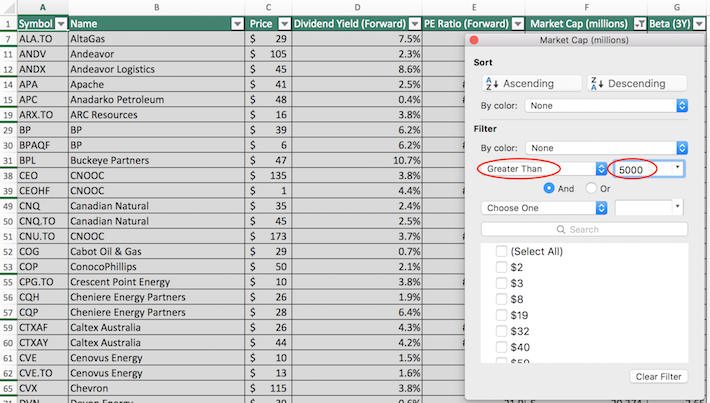

Step 2: Click on the filter icon at the top of the dividend yield column, as shown below.

Step 3: Change the filter setting to “Greater Than” and input 0.04 into the field beside it.

The remaining stocks in this spreadsheet are dividend-paying energy stocks with yields above 4%.

The next section will show you how to identify energy stocks with market capitalizations larger than $5 billion and betas lower than 1.2.

Screen 2: Large Market Capitalization, Low Volatility

Step 1: Download the Energy Stocks List at the link above.

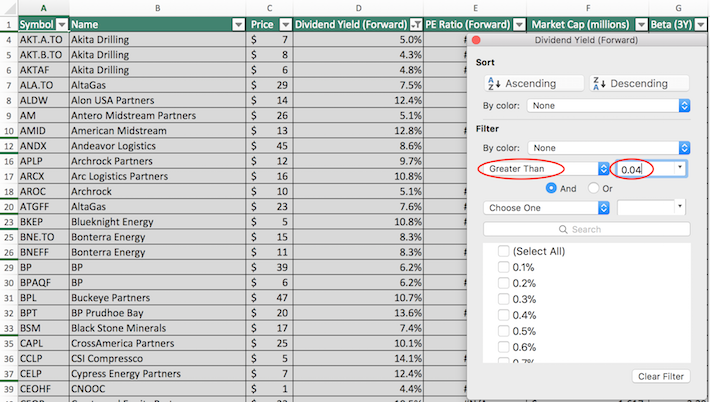

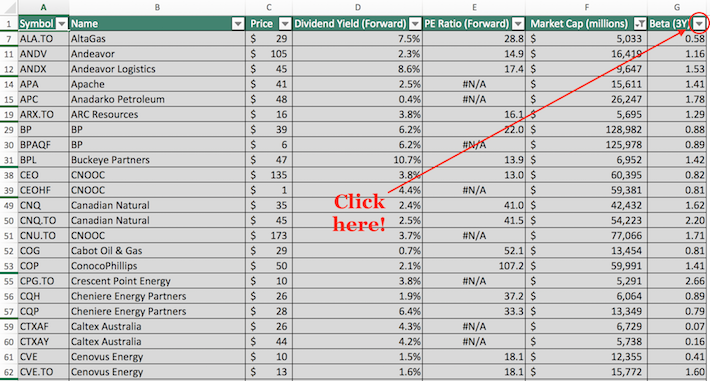

Step 2: Click on the filter icon at the top of the market capitalization column, as shown below.

Step 3: In the resulting window, change the filter setting to “Greater Than” and input 5000 into the field beside it. Note that since the market capitalization column is measured in millions of dollars, inputting “$5000 million” is equivalent to screening for stocks with a market capitalization above $5 billion.

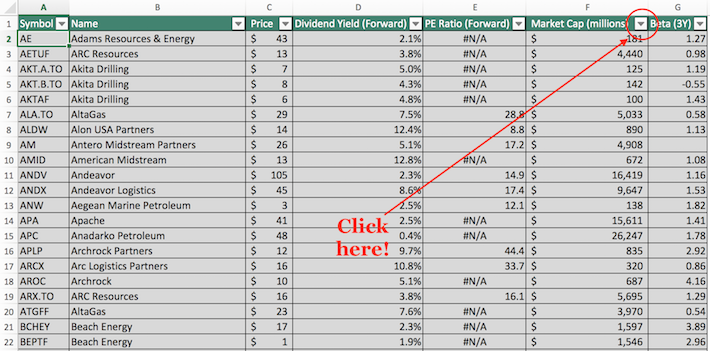

Step 4: Close out of the filter window by clicking the exit button, not by clicking the “Clear Filter” button. Then, click on the filter icon at the top of the Beta column, as shown below.

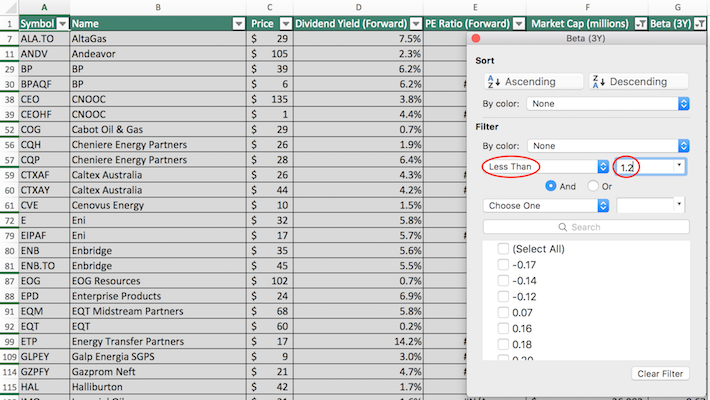

Step 5: Change the filter setting to “Less Than”, and input 1.2 into the field beside it.

The remaining stocks in this spreadsheet are dividend-paying energy stocks with market capitalizations above $5 billion and betas below 1.2. These are large companies with reasonable levels of volatility, providing appeal to conservative, risk-averse investors.

You now have a solid understanding of how to use the Energy Stocks List to find high-quality investment ideas.

The next section discusses why the energy sector deserves a spot in your investment portfolio.

Why Invest In Energy Stocks

As discussed, the defining characteristic of energy stocks is their volatility. Some energy stocks will naturally move in tandem with the price of oil and other commodities, which in turn fluctuate in response to changes in supply in demand.

Some energy stocks move in tandem with oil prices. Upstream energy stocks and drilling businesses are great examples of this. The oilfield services industry is another prime example.

With that said, not every stock in the energy sector rises and falls with oil prices. Oil refiners, as an example, move more with the crack spread than with actual oil prices.

This might lead you to wonder why investors would ever buy stocks in this sector. After all, there are plenty of other good-performing sectors that actually have below-average volatility (with healthcare and consumer staples being the best examples).

Well, exposure to the energy sector is a key component of any well-diversified investment portfolio because of its importance to the global economy.

Energy demand is also expected to grow tremendously over the next several decades, which provides a broad tailwind for energy stocks in general. While there are a multitude of factors that impact energy demand, the two most important are population growth and economic growth.

The composition of the supply of energy is likely to change over time. In 50 years, energy giants aren’t likely to be oil & gas companies due to the rise of solar, wind, and other alternative energy sources.

With that said, the broad tailwinds facing the energy sector today means that there’s still plenty of room for growth in this component of the stock market.

Still, there is the ever-present concern about energy sector volatility. Importantly, there are many measures that investors can take to reduce the impact that the volatility of energy stocks will have on their investment portfolio.

The most obvious step is to appropriately diversify. The effect of energy sector volatility will be minimized if your portfolio’s exposure to the sector is only, say, 10%.

Volatility can also be reduced by investing in only the strongest and most financial secure energy businesses. In our view, there are two energy stocks (both of which are energy ‘super majors’) that stand out in terms of financial strength:

Both of these companies are Dividend Aristocrats, which means they have increased their annual dividends for more than 25 consecutive years. Their multi-decade streak of dividend increases gives us confidence that they will continue to be solid performers in the years to come.

Final Thoughts

The energy sector has many quality dividend stocks, a select few of which have maintained long histories of increasing their dividends.

With that said, it’s not the only place where great investments can be found.

For investors that already have a full dose of energy exposure but are still looking for high-quality investment opportunities, the following Sure Dividend databases will be useful:

The Dividend Aristocrats List: dividend stocks in the S&P 500 with 25+ years of consecutive dividend increases.

The Dividend Achievers List: dividend stocks with 10+ years of consecutive increases in the NASDAQ US Benchmark Index.

The Dividend Kings List: containing the ‘best-of-the-best’ when it comes to dividend growth, the Dividend Kings List is composed of dividend stocks with 50+ years of consecutive dividend increases.

The Blue Chip Stocks List: dividend stocks with 10+ years of dividend increases that represent quality long-term investments.

If you’re looking for other sector-specific dividend stocks, the following Sure Dividend databases will be useful:

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].