Updated on May 23rd, 2025 by Bob Ciura

Spreadsheet data updated daily

Utility stocks can make excellent investments for long-term dividend growth investors.

Durable, regulatory-based competitive advantages allow these companies to consistently raise their rates over time. In turn, this allows them to raise their dividend payments year in and year out.

Even better, many utility stocks have above-average dividend yields, providing a compelling combination of income now and growth later for long-term investors.

Because of these favorable industry characteristics, we’ve compiled a list of utility stocks. The list is derived from the major utility sector exchange-traded funds JXI and XLU.

You can download the list of all utility stocks (along with important financial ratios such as dividend yields and payout ratios) by clicking on the link below:

Keep reading this article to learn more about the benefits of investing in utility stocks.

Table Of Contents

The following table of contents provides for easy navigation:

How To Use The Utility Dividend Stocks List To Find Investment Ideas

Having an Excel database of all the dividend-paying utility stocks combined with important investing metrics and ratios is very useful.

This tool becomes even more powerful when combined with knowledge of how to use Microsoft Excel to find the best investment opportunities.

With that in mind, this section will provide a quick explanation of how you can instantly search for utility stocks with particular characteristics, using two screens as an example.

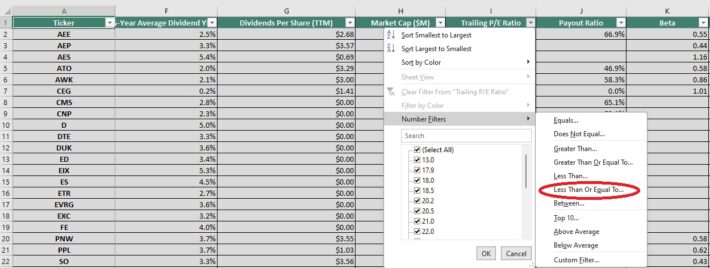

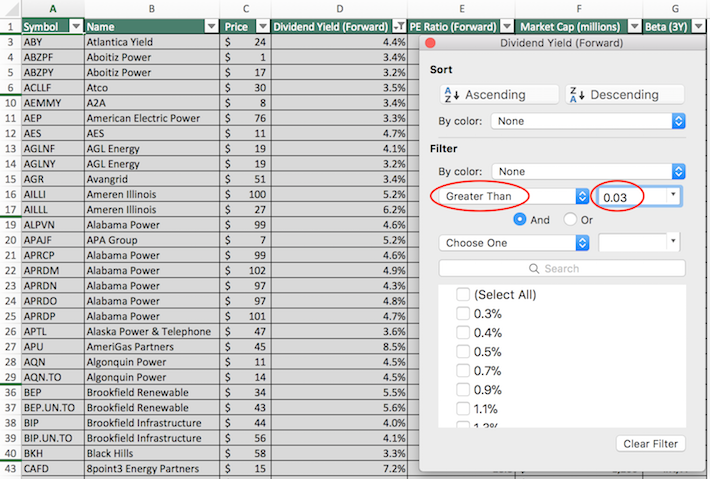

The first screen that we will implement is for utility stocks with price-to-earnings ratios below 15.

Screen 1: Low P/E Ratios

Step 1: Download the Utility Dividend Stocks Excel Spreadsheet List at the link above.

Step 2: Click the filter icon at the top of the price-to-earnings ratio column, as shown below.

Step 3: Change the filter field to “Less Than” and input “15” into the field beside it.

The remaining list of stocks contains dividend-paying utility stocks with price-to-earnings ratios less than 15. As you can see, there are relatively few securities (at the time of this writing) that meet this strict valuation cutoff.

The next section demonstrates how to screen for large-cap stocks with high dividend yields.

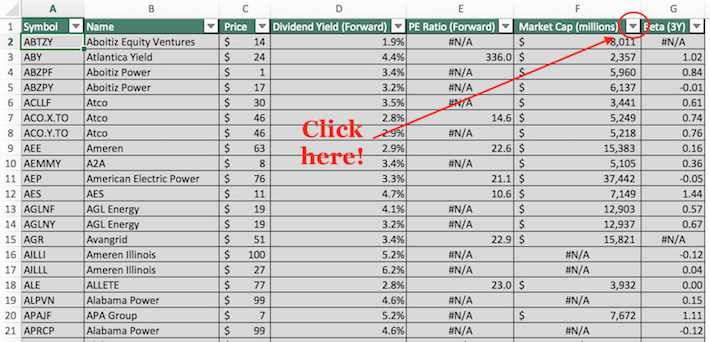

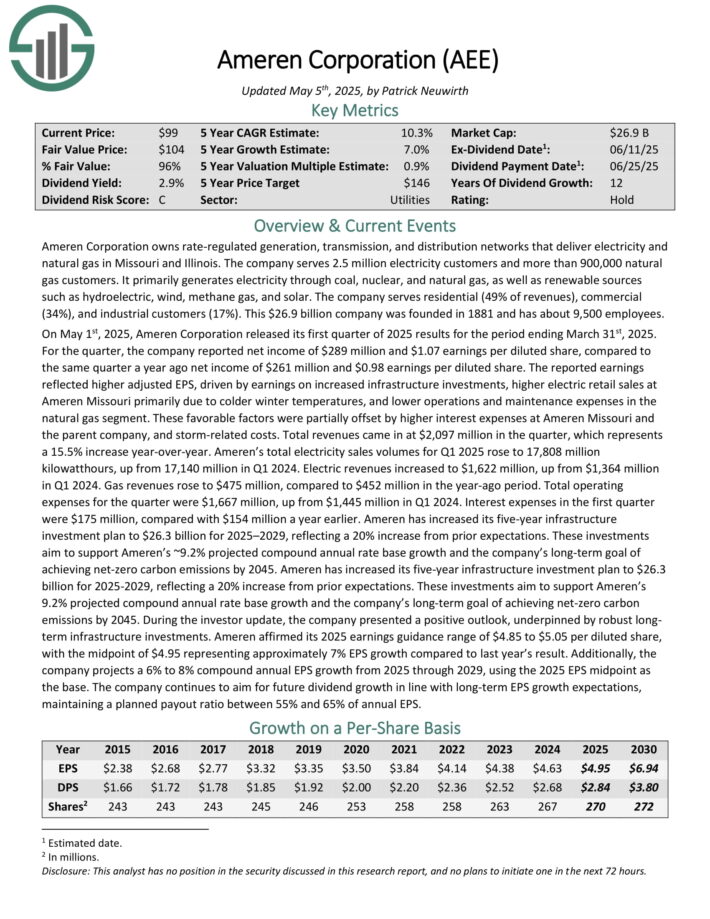

Screen 2: Large-Cap Stocks With High Dividend Yields

Businesses are often categorized based on their market capitalization. Market capitalization is calculated as stock price multiplied by the number of shares outstanding and gives a marked-to-market perception of what people think a business is worth on average.

Large-cap stocks are loosely defined as businesses with a market capitalization above $10 billion and are perceived as lower risk than their smaller counterparts. Accordingly, screening for large-cap stocks with high dividend yields could provide interesting investment opportunities for conservative, income-oriented investors.

Here’s how to use the Utility Dividend Stocks Excel Spreadsheet List to find such investment opportunities.

Step 1: Download the Utility Dividend Stocks Excel Spreadsheet List at the link above.

Step 2: Click the filter icon at the top of the Market Cap column, as shown below.

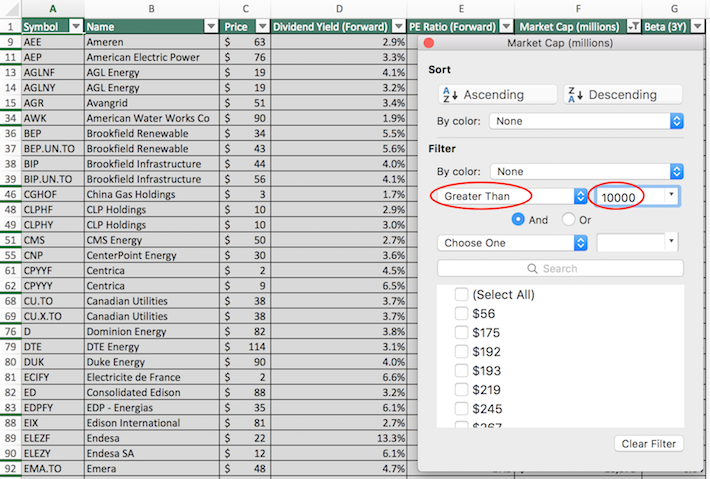

Step 3: Change the filter setting to “Greater Than”, and input 10000 into the field beside it. Note that since market capitalization is measured in millions of dollars in this Excel sheet, filtering for stocks with market capitalizations greater than “$10,000 millions” is equivalent for screening for those with market capitalizations exceeding $10 billion.

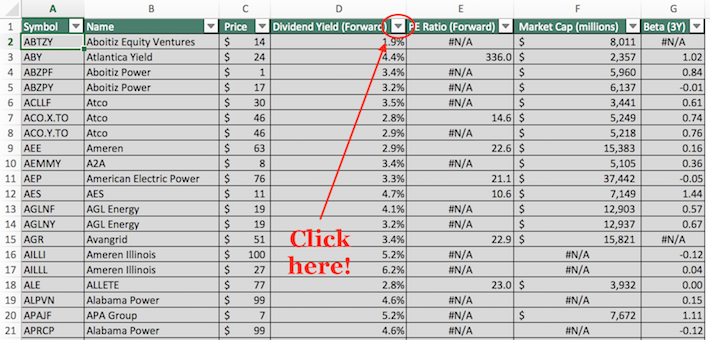

Step 4: Close that filter window (by exiting it, not by clicking ‘clear filter’) and click on the filter icon for the “dividend yield” column, as shown below.

Step 5: Change the filter setting to “Greater Than” and input 0.03 into the column beside it. Note that 0.03 is equivalent to 3%.

The remaining stocks in this list are those with market capitalizations above $10 billion and dividend yields above 3%. This narrowed investment universe is suitable for investors looking for low-risk, high-yield securities.

You now have a solid fundamental understanding of how to use the Utility Dividend Stocks Excel Spreadsheet List to its fullest potential.

The remainder of this article will discuss the characteristics that make the utility sector attractive for dividend growth investors.

Why Utility Dividend Stocks Make Attractive Investments

The word “utility” describes a wide variety of business models but is usually used as a reference to electric utilities — companies that engage in the generation, transmission, and distribution of electricity.

Other types of utilities include propane utilities and water utilities.

So why do these businesses make for attractive investments?

Utilities usually conduct business in highly regulated markets, complying with rules set by federal, state, and municipal governments.

While this sounds highly unattractive on the surface, what it means in practice is that utilities are basically legal monopolies.

The strict regulatory environment that utility businesses operate in creates a strong and durable competitive advantage for existing industry participants.

For this reason, electric utilities are among the most popular stocks for long-term dividend growth investors — especially because they tend to offer above-average dividend yields.

Indeed, the regulatory-based competitive advantages available to utility stocks give them the consistency to raise their dividends regularly.

Simply put, utility stocks are some of the most dependable dividend stocks around.

To provide a few examples, the following utility stocks have exceptionally long streaks of consecutive dividend increases:

Consolidated Edison (ED) — more than 25 years of consecutive dividend increases

American States Water (AWR) — a water utility — more than 50 years of consecutive dividend increases

SJW Group (SJW) — another water utility — more than 50 years of consecutive dividend increases

The long streak of consecutive dividend increases is possible only because of their unique industry-specific competitive advantages.

Clearly, the utility sector is very stable. People are going to need electricity and water in ever-increasing amounts for the foreseeable future.

One characteristic that does not describe utility stocks is high growth. One of the regulatory constraints imposed upon utility companies is the pace at which they can increase the fees paid by their customers.

These rate increases are usually in the low-single-digits, which provides a cap on the revenue growth experienced by these companies.

Utility stocks typically don’t offer strong total returns, but there are exceptions.

The Top 10 Utility Stocks Now

Taking all of the above into consideration, the following section discusses our top 10 list of North American utility stocks today, based on their expected annual returns over the next five years.

The rankings in this article are derived from our expected total return estimates from the Sure Analysis Research Database.

The 10 utility stocks with the highest projected five-year total returns are ranked in this article, from lowest to highest.

Related: Watch the video below to learn how to calculate expected total return for any stock.

Expected returns are calculated based upon the combination of current dividend yield, expected change in valuation, as well as expected annual earnings-per-share growth.

This determines which utility stocks offer the best total return potential for shareholders.

The top 10 list below includes the 10 utility stocks with the highest annual expected returns.

Further, only utility stocks with a Dividend Risk Score of ‘C’ or higher were included, to focus on the utility stocks with a high level of dividend safety.

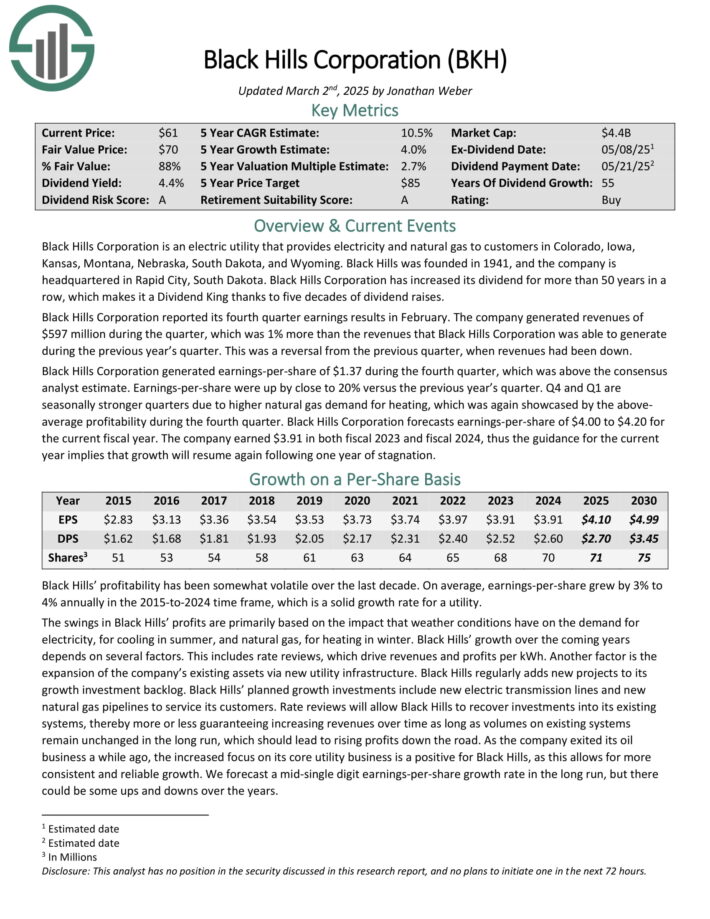

Top Utility Stock #10: Ameren Corp. (AEE)

5-year expected annual returns: 11.0%

Ameren Corporation owns rate-regulated generation, transmission, and distribution networks that deliver electricity and natural gas in Missouri and Illinois. The company serves 2.5 million electricity customers and more than 900,000 natural gas customers.

It primarily generates electricity through coal, nuclear, and natural gas, as well as renewable sources such as hydroelectric, wind, methane gas, and solar. The company serves residential (49% of revenues), commercial (34%), and industrial customers (17%).

On May 1st, 2025, Ameren Corporation released its first quarter of 2025 results for the period ending March 31st, 2025. For the quarter, the company reported net income of $289 million and $1.07 earnings per diluted share, compared to the same quarter a year ago net income of $261 million and $0.98 earnings per diluted share.

The reported earnings reflected higher adjusted EPS, driven by earnings on increased infrastructure investments, higher electric retail sales at Ameren Missouri primarily due to colder winter temperatures, and lower operations and maintenance expenses in the natural gas segment.

Click here to download our most recent Sure Analysis report on AEE (preview of page 1 of 3 shown below):

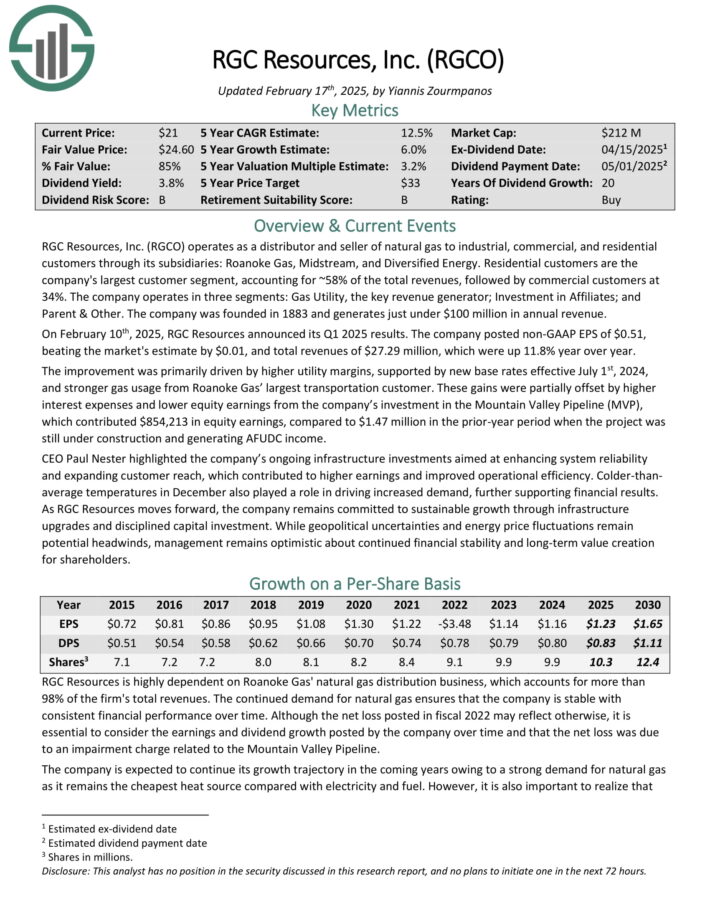

Top Utility Stock #9: Black Hills Corp. (BKH)

5-year expected annual returns: 11.6%

Black Hills Corporation is an electric utility that provides electricity and natural gas to customers in Colorado, Iowa, Kansas, Montana, Nebraska, South Dakota, and Wyoming. Black Hills was founded in 1941, and the company is headquartered in Rapid City, South Dakota.

Black Hills Corporation reported its fourth quarter earnings results in February. The company generated revenues of $597 million during the quarter, which was 1% more than the same quarter last year. This was a reversal from the previous quarter, when revenues had been down.

Black Hills Corporation generated earnings-per-share of $1.37 during the fourth quarter, which was above the consensus analyst estimate. Earnings-per-share were up by close to 20% versus the previous year’s quarter.

Q4 and Q1 are seasonally stronger quarters due to higher natural gas demand for heating, which was again showcased by the above average profitability during the fourth quarter.

Click here to download our most recent Sure Analysis report on BKH (preview of page 1 of 3 shown below):

Top Utility Stock #8: RGC Resources (RGCO)

5-year expected annual returns: 12.4%

RGC Resources, Inc. (RGCO) operates as a distributor and seller of natural gas to industrial, commercial, and residential customers through its subsidiaries: Roanoke Gas, Midstream, and Diversified Energy. Residential customers are the company’s largest customer segment, accounting for ~58% of the total revenues, followed by commercial customers at 34%.

The company operates in three segments: Gas Utility, the key revenue generator; Investment in Affiliates; and Parent & Other. The company was founded in 1883 and generates just under $100 million in annual revenue.

On February 10th, 2025, RGC Resources announced its Q1 2025 results. The company posted non-GAAP EPS of $0.51, beating the market’s estimate by $0.01, and total revenues of $27.29 million, which were up 11.8% year over year.

The improvement was primarily driven by higher utility margins, supported by new base rates effective July 1st, 2024, and stronger gas usage from Roanoke Gas’ largest transportation customer.

These gains were partially offset by higher interest expenses and lower equity earnings from the company’s investment in the Mountain Valley Pipeline (MVP), which contributed $854,213 in equity earnings

Click here to download our most recent Sure Analysis report on RGCO (preview of page 1 of 3 shown below):

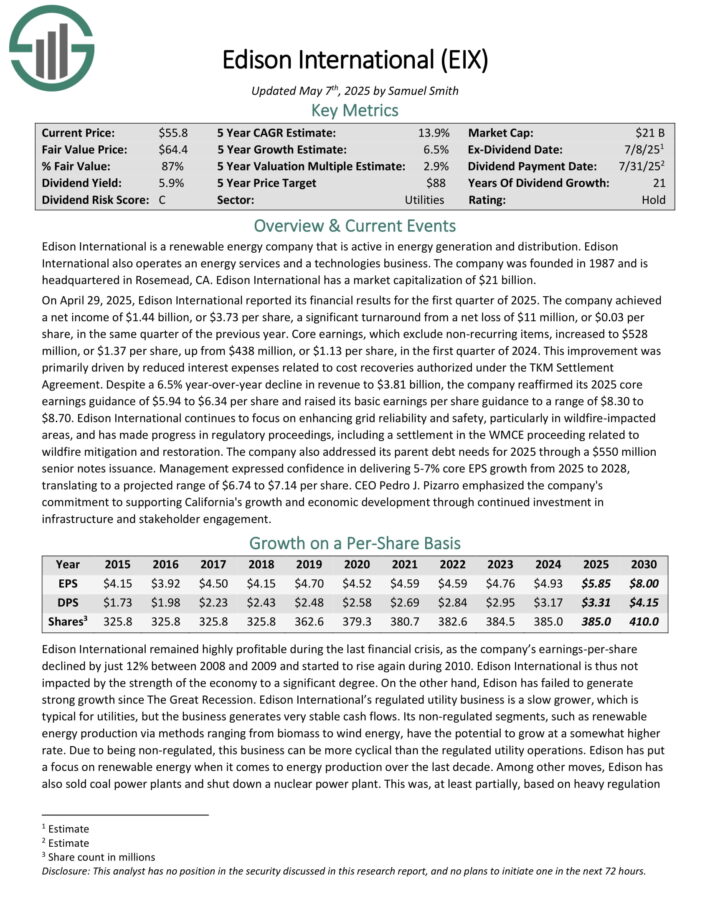

Top Utility Stock #7: Edison International (EIX)

5-year expected annual returns: 13.5%

Edison International is a renewable energy company that is active in energy generation and distribution. Edison International also operates an energy services and a technologies business. The company was founded in 1987 and is headquartered in Rosemead, CA.

On April 29, 2025, Edison International reported its financial results for the first quarter of 2025. The company achieved a net income of $1.44 billion, or $3.73 per share, a significant turnaround from a net loss of $11 million, or $0.03 per share, in the same quarter of the previous year.

Core earnings, which exclude non-recurring items, increased to $528 million, or $1.37 per share, up from $438 million, or $1.13 per share, in the first quarter of 2024.

This improvement was primarily driven by reduced interest expenses related to cost recoveries authorized under the TKM Settlement Agreement. Despite a 6.5% year-over-year decline in revenue to $3.81 billion, the company reaffirmed its 2025 core earnings guidance of $5.94 to $6.34 per share.

Click here to download our most recent Sure Analysis report on EIX (preview of page 1 of 3 shown below):

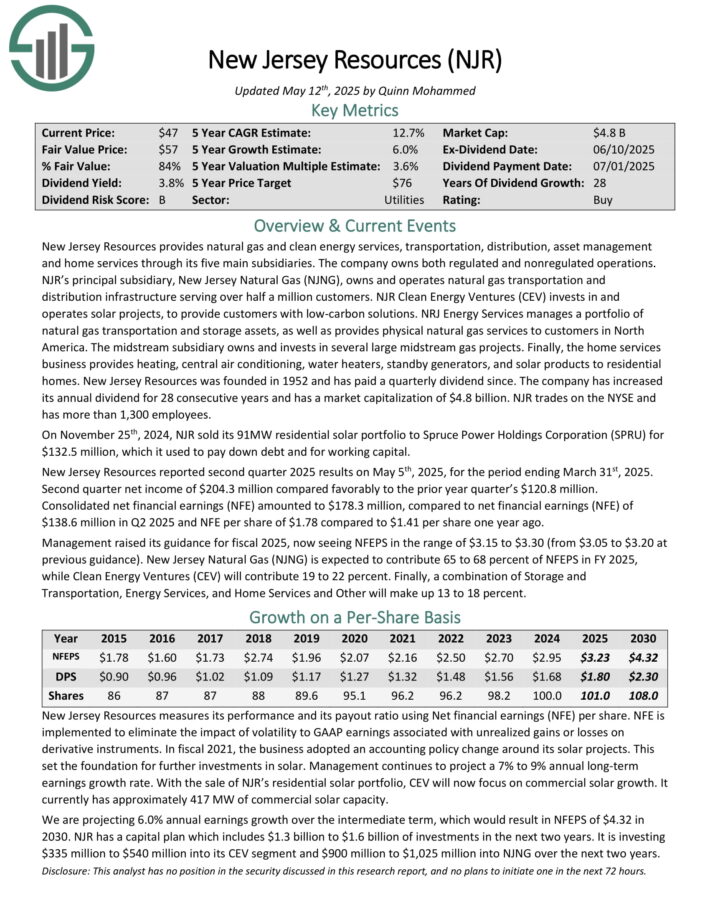

Top Utility Stock #6: New Jersey Resources (NJR)

5-year expected annual returns: 13.5%

New Jersey Resources provides natural gas and clean energy services, transportation, distribution, asset management and home services through its five main subsidiaries. The company owns both regulated and non-regulated operations.

NJR’s principal subsidiary, New Jersey Natural Gas (NJNG), owns and operates natural gas transportation and distribution infrastructure serving over half a million customers. NJR Clean Energy Ventures (CEV) invests in and operates solar projects, to provide customers with low-carbon solutions.

NRJ Energy Services manages a portfolio of natural gas transportation and storage assets, as well as provides physical natural gas services to customers in North America.

The midstream subsidiary owns and invests in several large midstream gas projects. Finally, the home services business provides heating, central air conditioning, water heaters, standby generators, and solar products to residential homes.

New Jersey Resources reported second quarter 2025 results on May 5th, 2025, for the period ending March 31st, 2025. Second quarter net income of $204.3 million compared favorably to the prior year quarter’s $120.8 million.

Consolidated net financial earnings (NFE) amounted to $178.3 million, compared to net financial earnings (NFE) of $138.6 million in Q2 2025 and NFE per share of $1.78 compared to $1.41 per share one year ago.

Management raised its guidance for fiscal 2025, now seeing NFEPS in the range of $3.15 to $3.30 (from $3.05 to $3.20 at previous guidance).

Click here to download our most recent Sure Analysis report on NJR (preview of page 1 of 3 shown below):

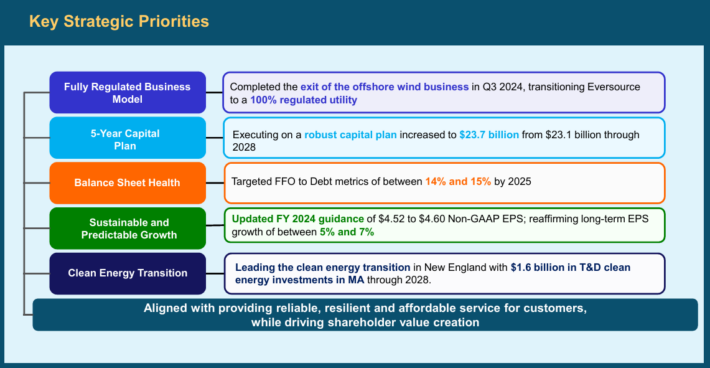

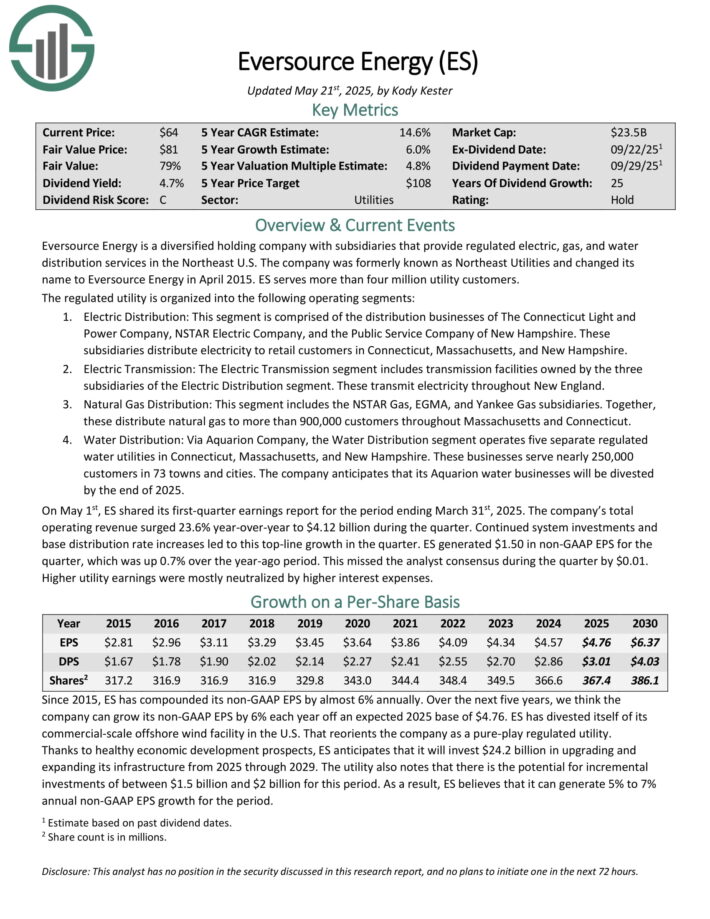

Top Utility Stock #5: Eversource Energy (ES)

5-year expected annual returns: 14.5%

Eversource Energy is a diversified holding company with subsidiaries that provide regulated electric, gas, and water distribution service in the Northeast U.S.

FactSet, Erie Indemnity, and Eversource Energy are the three new Dividend Aristocrats for 2025.

The company’s utilities serve more than 4 million customers. Eversource has delivered steady growth to shareholders for many years.

Source: Investor Presentation

On February 11th, 2025, Eversource Energy released its fourth-quarter and full-year 2024 results. For the quarter, the company reported net earnings of $72.5 million, a significant improvement from a net loss of $(1,288.5) million in the same quarter of last year, which reflected the impact of the company’s exit from offshore wind investments.

On May 1st, ES shared its first-quarter earnings report for the period ending March 31st, 2025. The company’s total operating revenue surged 23.6% year-over-year to $4.12 billion during the quarter.

Continued system investments and base distribution rate increases led to this top-line growth in the quarter. ES generated $1.50 in non-GAAP EPS for the quarter, which was up 0.7% over the year-ago period.

Click here to download our most recent Sure Analysis report on ES (preview of page 1 of 3 shown below):

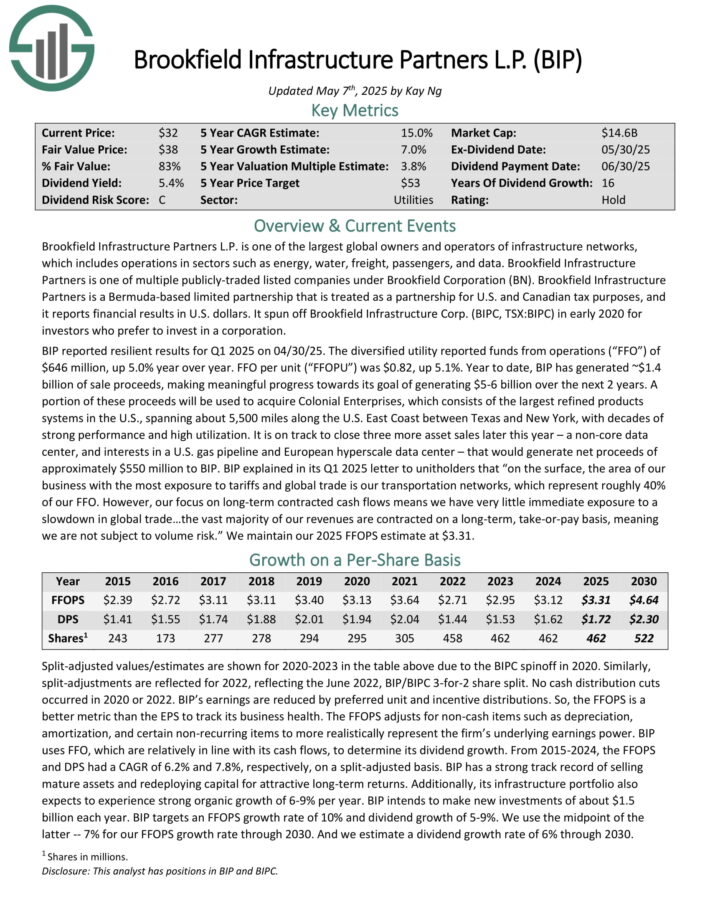

Top Utility Stock #4: Brookfield Infrastructure Partners (BIP)

5-year expected annual returns: 14.5%

Brookfield Infrastructure Partners L.P. is one of the largest global owners and operators of infrastructure networks, which includes operations in sectors such as energy, water, freight, passengers, and data.

BIP reported resilient results for Q1 2025 on 04/30/25. The diversified utility reported funds from operations (“FFO”) of $646 million, up 5.0% year over year. FFO per unit (“FFOPU”) was $0.82, up 5.1%.

Year to date, BIP has generated ~$1.4 billion of sale proceeds, making meaningful progress towards its goal of generating $5-6 billion over the next 2 years.

A portion of these proceeds will be used to acquire Colonial Enterprises, which consists of the largest refined products systems in the U.S., spanning about 5,500 miles along the U.S. East Coast between Texas and New York.

BIP has a strong track record of selling mature assets and redeploying capital for attractive long-term returns. Additionally, its infrastructure portfolio also expects to experience strong organic growth of 6-9% per year.

BIP intends to make new investments of about $1.5 billion each year. BIP targets an FFOPS growth rate of 10% and dividend growth of 5-9%.

Click here to download our most recent Sure Analysis report on BIP (preview of page 1 of 3 shown below):

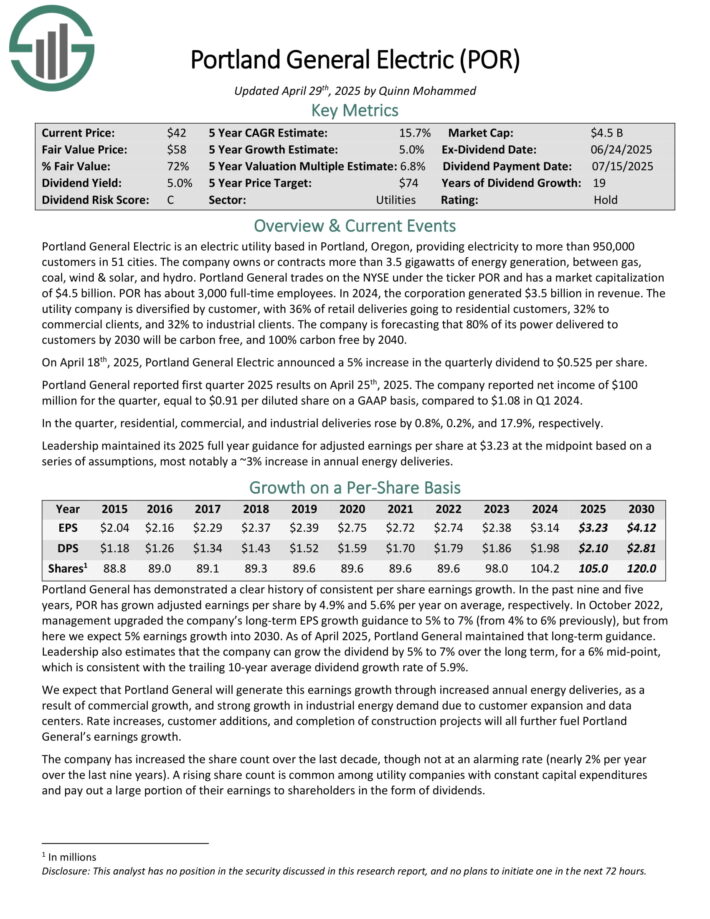

Top Utility Stock #3: Portland General Electric (POR)

5-year expected annual returns: 15.6%

Portland General Electric is an electric utility based in Portland, Oregon, providing electricity to more than 950,000 customers in 51 cities. The company owns or contracts more than 3.5 gigawatts of energy generation, between gas, coal, wind & solar, and hydro.

In 2024, the corporation generated $3.5 billion in revenue. The utility company is diversified by customer, with 36% of retail deliveries going to residential customers, 32% to commercial clients, and 32% to industrial clients. The company is forecasting that 80% of its power delivered to customers by 2030 will be carbon free, and 100% carbon free by 2040.

On April 18th, 2025, Portland General Electric announced a 5% increase in the quarterly dividend to $0.525 per share.

Portland General reported first quarter 2025 results on April 25th, 2025. The company reported net income of $100 million for the quarter, equal to $0.91 per diluted share on a GAAP basis, compared to $1.08 in Q1 2024.

In the quarter, residential, commercial, and industrial deliveries rose by 0.8%, 0.2%, and 17.9%, respectively. Leadership maintained its 2025 full year guidance for adjusted earnings per share at $3.23 at the midpoint.

Click here to download our most recent Sure Analysis report on POR (preview of page 1 of 3 shown below):

Top Utility Stock #2: H2O America (HTO)

5-year expected annual returns: 18.5%

H2O America, formerly SJW Group, is a water utility company that produces, purchases, stores, purifies and distributes water to consumers and businesses in the Silicon Valley area of California, the area north of San Antonio, Texas, Connecticut, and Maine.

It has a small real estate division that owns and develops properties for residential and warehouse customers in California and Tennessee. The company generates about $800 million in annual revenues.

On April 28th, 2025, the company reported first quarter results. For the quarter, revenue improved 18.2% to $176.6 million, which beat estimates by $16.1 million. Earnings-per-share of $0.50 compared favorably to earnings-per-share of $0.36 in the prior year and was $0.14 more than expected.

For the quarter, higher water rates overall added $17.2 million to results and higher customer usage added $1.0 million. Operating production expenses totaled $131.7 million, which was an 8% increase from the prior year. Most of the increase in expenses was once again related to higher water production costs.

Click here to download our most recent Sure Analysis report on HTO (preview of page 1 of 3 shown below):

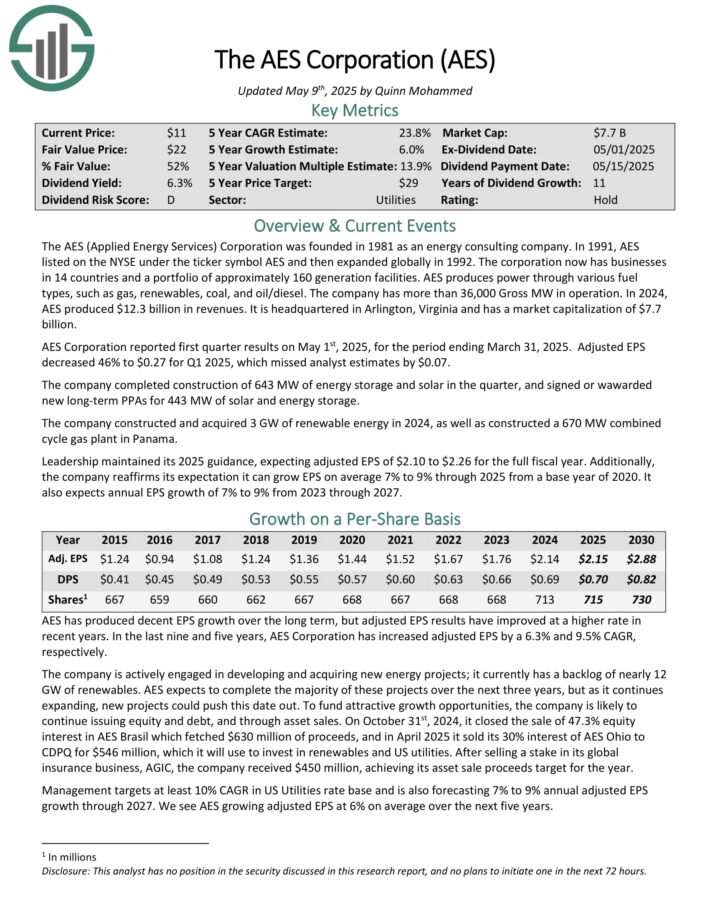

Top Utility Stock #1: AES Corp. (AES)

5-year expected annual returns: 26.5%

The AES (Applied Energy Services) Corporation has businesses in 14 countries and a portfolio of approximately 160 generation facilities. AES produces power through various fuel types, such as gas, renewables, coal, and oil/diesel.

The company has more than 36,000 Gross MW in operation. In 2024, AES produced $12.3 billion in revenues.

AES Corporation reported first quarter results on May 1st, 2025, for the period ending March 31, 2025. Adjusted EPS decreased 46% to $0.27 for Q1 2025, which missed analyst estimates by $0.07.

The company completed construction of 643 MW of energy storage and solar in the quarter, and signed or wawarded new long-term PPAs for 443 MW of solar and energy storage.

The company constructed and acquired 3 GW of renewable energy in 2024, as well as constructed a 670 MW combined cycle gas plant in Panama. Leadership maintained its 2025 guidance, expecting adjusted EPS of $2.10 to $2.26 for the full fiscal year.

Click here to download our most recent Sure Analysis report on AES (preview of page 1 of 3 shown below):

Final Thoughts

The utility sector is a great place to find high-quality dividend stocks suitable for long-term investment.

It is not, however, the only place to find attractive investments.

If you’re willing to venture outside of the utility industry for investment opportunities, the following Sure Dividend databases are very useful:

If you’re looking for other sector-specific dividend stocks, the following Sure Dividend databases will be useful:

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].