Updated on March 28th, 2025 by Bob Ciura

High dividend stocks means more income for every dollar invested. All other things equal, the higher the dividend yield, the better.

Income investors often like to find low-priced dividend stocks, as they can buy more shares than they could with higher-priced securities.

In this research report, we analyze 11 stocks trading below $10.00 per share and offering high dividend yields of 5.0% and greater.

Additionally, the free high dividend stocks list spreadsheet below has our full list of individual securities (stocks, REITs, MLPs, etc.) with with 5%+ dividend yields.

Keep reading to see analysis on these 11 high-yielding securities, based in the U.S., trading below $10.00 per share that we cover in the Sure Analysis Research Database.

The list is sorted by dividend yield, in ascending order.

Table of Contents

Low-Priced High Dividend Stock #11: Ford Motor Co. (F) – Dividend Yield of 6.1%

Ford Motor Company was first incorporated in 1903 and in the past 120 years, it has become one of the world’s largest automakers. It operates a large financing business as well as its core manufacturing division, which produces a popular assortment of cars, trucks, and SUVs.

Ford posted fourth quarter and full-year earnings on February 5th, 2025, and results were better than expected. Adjusted earnings-per-share came to 39 cents, which was seven cents ahead of estimates.

Revenue was up almost 5% year-over-year for the quarter to $48.2 billion, which also beat estimates by $5.37 billion. The fourth quarter was the highest revenue total the company has ever produced.

Ford Blue increased 4.2% to $27.3 billion in revenue for the fourth quarter, beating estimates of $25.9 billion. Model e revenue was down 13% year-over-year to $1.4 billion, $400 million less than expected.

Ford Pro revenue was up 5.3% to $16.2 billion, beating estimates for $15.6 billion.

For this year, Ford expects full-year adjusted EBIT of $7 to $8.5 billion, and for adjusted free cash flow of $3.5 billion to $4.5 billion, with capex of $8 to $9.5 billion.

Click here to download our most recent Sure Analysis report on Ford (preview of page 1 of 3 shown below):

Low-Priced High Dividend Stock #10: LXP Industrial Trust (LXP) – Dividend Yield of 6.1%

Lexington Realty Trust owns equity and debt investments in single-tenant properties and land across the United States. The trust’s portfolio is primarily industrial equity investments.

The trust grows the industrial portfolio by financing, or by acquiring new investments with long-term leases, repositioning the portfolio by recycling capital and opportunistically taking advantage of capital markets.

Additionally, the company supplies investment advisory and asset management services for investors in the single-tenant net-lease asset market.

On February 13th, 2025, Lexington reported fourth quarter 2024 results for the period ending December 31st, 2024. The trust announced adjusted funds from operations (AFFO) of $0.16 per share for the quarter, a penny short of the prior year quarter.

For Q4, the trust completed 1.0M square feet of new leases and lease extensions, which increased base and cash base rents by 66.3% and 42.6%, respectively. Lexington also invested $21 million in ongoing development projects. The trust’s stabilized industrial portfolio was 93.6% leased. At quarter end, Lexington had leverage of 5.9X net debt to adjusted EBITDA.

Click here to download our most recent Sure Analysis report on LXP (preview of page 1 of 3 shown below):

Low-Priced High Dividend Stock #9: Kearny Financial Corp. (KRNY) – Dividend Yield of 6.9%

Kearny Financial Corp. is a bank holding company. Headquartered in Fairfield, New Jersey, the bank operates 43 branches, primarily in New Jersey along with a couple of locations in New York City. Over the years, Kearny has evolved from being a traditional thrift institution into a full-service community bank.

Kearny had enjoyed tremendous growth over the past decade as it executed on this strategy to enlarge and diversify the bank. However, the shift in the interest rate environment and uncertainty in the commercial real estate market has provoked significant uncertainty around Kearny’s operating outlook going forward.

Kearny reported a large loss tied to one-time expenses in 2024, and the company has been hampered by falling net interest income as well.

In the company’s Q2 2025 results, reported January 30th, 2025, Kearny reported a profit of $0.11 per share. This was up sharply from a 22 cent per share loss in the same period of the prior year, though that number reflects various one-time non-recurring charges.

Click here to download our most recent Sure Analysis report on KRNY (preview of page 1 of 3 shown below):

Low-Priced High Dividend Stock #8: Clipper Realty (CLPR) – Dividend Yield of 9.5%

Clipper Realty is a Real Estate Investment Trust, or REIT, that was founded by the merger of four pre-existing real estate companies. The founders retain about 2/3 of the ownership and votes today, as they have never sold a share.

Clipper owns commercial (primarily multifamily and office with a small sliver of retail) real estate across New York City.

On February 18, 2025, Clipper Realty Inc. reported its financial results for the fourth quarter of 2024. The company achieved record quarterly revenue of $38 million, marking a 9.1% increase from the previous year.

Net Operating Income (NOI) rose to $22.5 million, reflecting a 12.5% growth, while Adjusted Funds From Operations (AFFO) reached $8.1 million, up 29%.

This performance was primarily driven by a $2.9 million increase in residential revenue, attributed to strong leasing activities and operational efficiencies.

Click here to download our most recent Sure Analysis report on CLPR (preview of page 1 of 3 shown below):

Low-Priced High Dividend Stock #7: Fortitude Gold Corp. (FTCO) – Dividend Yield of 9.9%

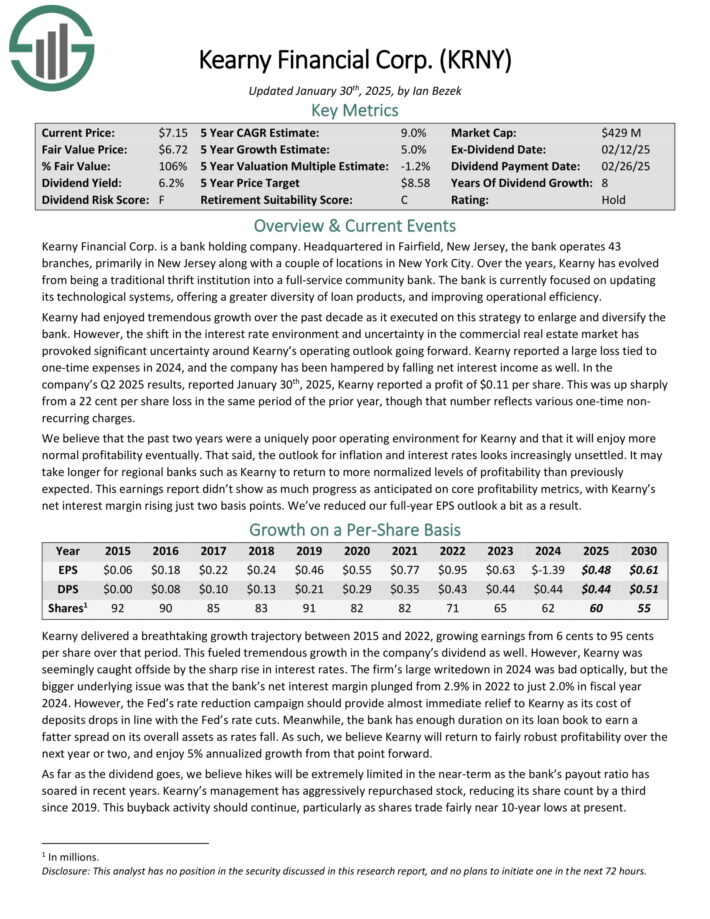

Fortitude Gold is a junior gold producer with operations in Nevada, U.S.A, one of the world’s premier mining friendly jurisdictions. The company targets high-grade gold open pit heap leach operations averaging one gram per tonne of gold or greater.

Its property portfolio currently consists of 100% ownership in six high-grade gold properties. All six properties are within an approximate 30-mile radius of one another within the prolific Walker Lane Mineral Belt.

Source: Investor Presentation

On February 25th, 2025, Fortitude Gold released its full-year 2024 results for the period ending December 31st, 2024. For the year, revenues came in at $37.3 million, representing a 49% decline compared to 2023.

The decrease in revenue was largely due to a 58% drop in gold sales volume and a 22% decrease in silver sales volume. These declines were partially offset by a 22% increase in gold prices and an 18% increase in silver prices.

Moving to the bottom line, the company reported a mine gross profit of $18.3 million compared to $41.2 million the previous year, reflecting the lower net sales.

Fortitude recorded a net loss of $2.0 million versus a net income of $17.0 million in 2023. On a per-share basis, the company posted a net loss of $0.08 compared to net income of $0.71 per share in the prior year.

Click here to download our most recent Sure Analysis report on FTCO (preview of page 1 of 3 shown below):

Low-Priced High Dividend Stock #6: Barings BDC (BBDC) – Dividend Yield of 10.8%

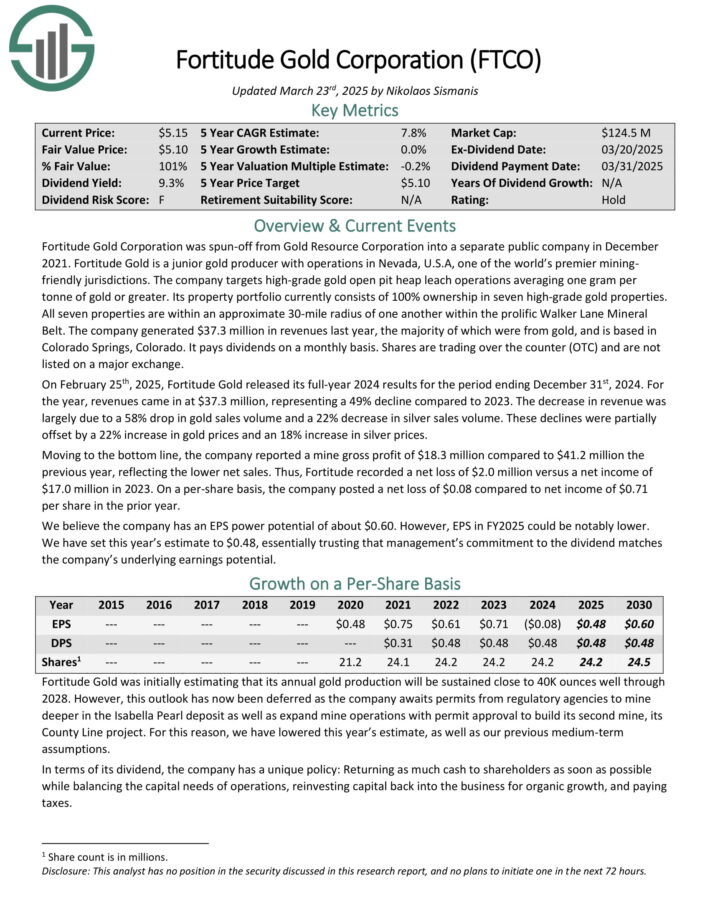

Barings BDC is a business development company (BDC) focused on providing senior secured loans to middle-market companies, primarily in the U.S. and internationally.

Managed by Barings LLC, a global asset manager, the company invests in businesses with earnings before interest, taxes, depreciation, and amortization (EBITDA) ranging from $10 million to $75 million.

Source: Investor Presentation

On February 20th, 2025, Barings BDC posted its Q4 and full–year results for the period ending December 31st, 2024. Net investment income (NII) was $29.5 million, or $0.28 per share, down from $30.2 million or $0.29 per share last quarter.

This decline was driven by a lower weighted average yield on performing debt investments, which fell 110 basis points to 9.5%, due to interest rates normalizing. For the year, NII/share was $1.04.

During the quarter, the company invested $137.9 million in 15 new companies and $156.5 million in existing positions. For FY2025, we expect NII/share of $1.10.

Click here to download our most recent Sure Analysis report on BBDC (preview of page 1 of 3 shown below):

Low-Priced High Dividend Stock #5: Prospect Capital (PSEC) – Dividend Yield of 12.9%

Prospect Capital Corporation is a Business Development Company, or BDC, that provides private debt and private equity to middle–market companies in the U.S.

The company focuses on direct lending to owner–operated companies, as well as sponsor–backed transactions. Prospect invests primarily in first and second lien senior loans and mezzanine debt, with occasional equity investments.

Source: Investor Presentation

Prospect posted second quarter earnings on February 10th, 2025, and results were somewhat weak. Net investment income per-share acme to 20 cents, while total investment income fell from $211 million to $185 million year-over-year.

NII per-share fell from 21 cents in Q1, and 24 cents from the year-ago period. Total interest income was $169 million for the quarter, down from $185 million in the prior quarter, and $195 million a year ago. It also missed estimates by about $2 million.

Total originations were $135 million, down sharply from $291 million in the previous quarter. Total payments and sales were $383 million, up from $282 million in Q1.

Click here to download our most recent Sure Analysis report on PSEC (preview of page 1 of 3 shown below):

Low-Priced High Dividend Stock #4: Horizon Technology Finance (HRZN) – Dividend Yield of 13.9%

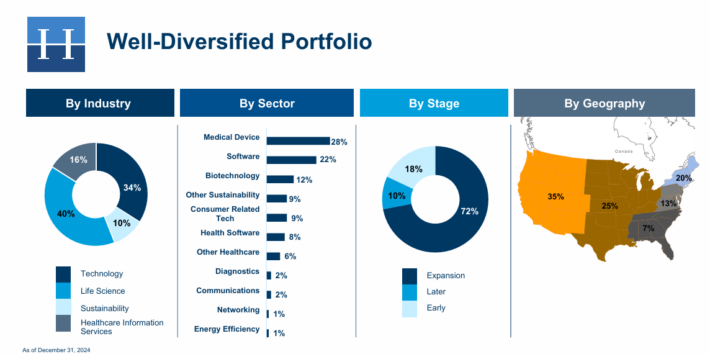

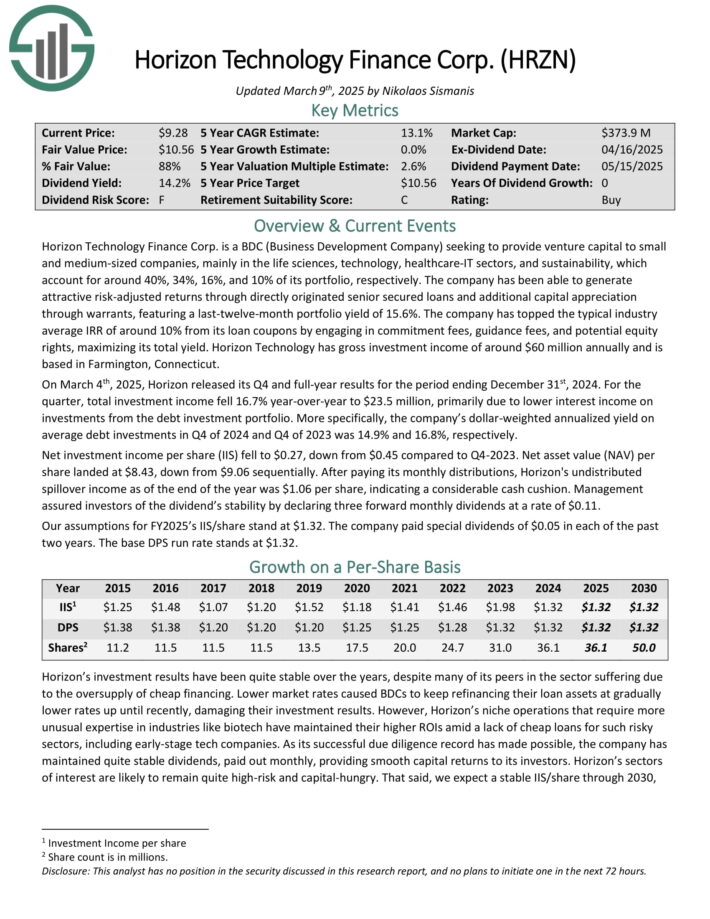

Horizon Technology Finance Corp. is a BDC that provides venture capital to small and medium–sized companies in the technology, life sciences, and healthcare–IT sectors.

The company has generated attractive risk–adjusted returns through directly originated senior secured loans and additional capital appreciation through warrants.

Source: Investor Presentation

On March 4th, 2025, Horizon released its Q4 and full-year results for the period ending December 31st, 2024. For the quarter, total investment income fell 16.7% year-over-year to $23.5 million, primarily due to lower interest income on investments from the debt investment portfolio.

More specifically, the company’s dollar-weighted annualized yield on average debt investments in Q4 of 2024 and Q4 of 2023 was 14.9% and 16.8%, respectively.

Net investment income per share (IIS) fell to $0.27, down from $0.45 compared to Q4-2023. Net asset value (NAV) per share landed at $8.43, down from $9.06 sequentially.

Click here to download our most recent Sure Analysis report on HRZN (preview of page 1 of 3 shown below):

Low-Priced High Dividend Stock #3: AGNC Investment Corp. (AGNC) – Dividend Yield of 14.7%

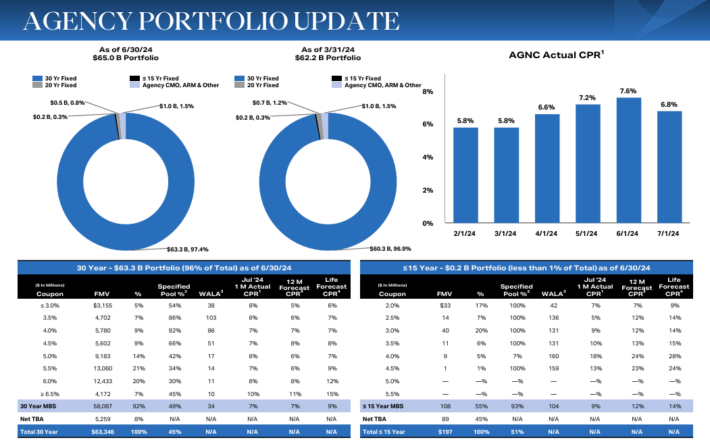

American Capital Agency Corp is a mortgage real estate investment trust that invests primarily in agency mortgage–backed securities (or MBS) on a leveraged basis.

The firm’s asset portfolio is comprised of residential mortgage pass–through securities, collateralized mortgage obligations (or CMO), and non–agency MBS. Many of these are guaranteed by government–sponsored enterprises.

Source: Investor Presentation

AGNC Investment Corp. reported strong financial results for the third quarter ended September 30, 2024. The company achieved a comprehensive income of $0.63 per common share, driven by a net income of $0.39 and other comprehensive income of $0.24 from marked-to-market investments.

Net spread and dollar roll income contributed $0.43 per share. The tangible net book value increased by $0.42 per share to $8.82, reflecting a 5.0% growth from the previous quarter.

AGNC declared dividends of $0.36 per share, resulting in a 9.3% economic return on tangible common equity, which includes both dividends and the increase in net book value.

Click here to download our most recent Sure Analysis report on AGNC Investment Corp (AGNC) (preview of page 1 of 3 shown below):

Low-Priced High Dividend Stock #2: Ellington Credit Co. (EARN) – Dividend Yield of 16.1%

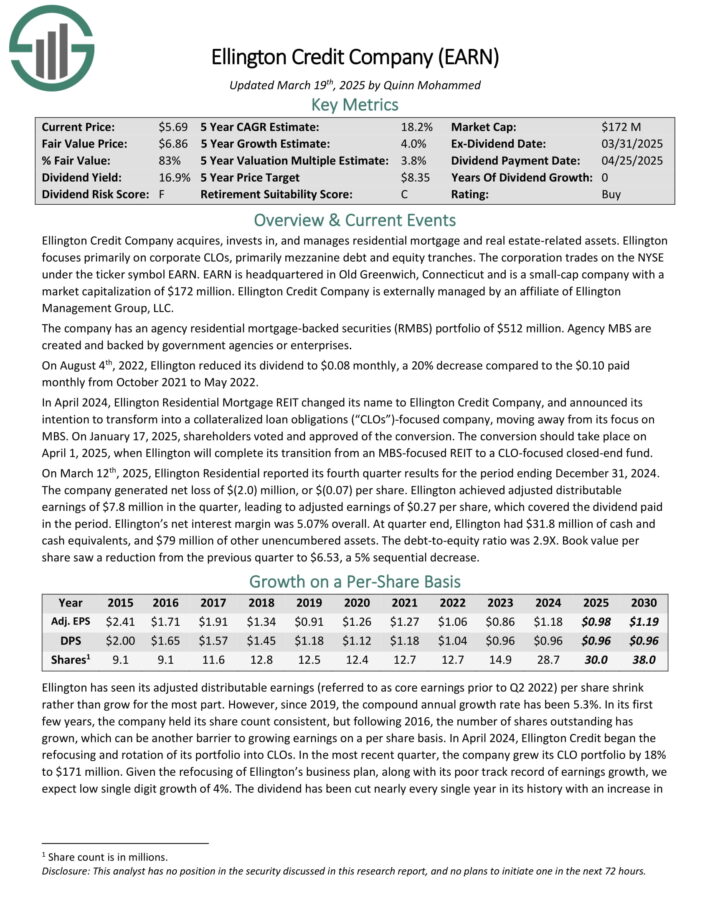

Ellington Credit Co. acquires, invests in, and manages residential mortgage and real estate related assets.

It focuses primarily on residential mortgage-backed securities, specifically those backed by a U.S. Government agency or U.S. government–sponsored enterprise.

Agency MBS are created and backed by government agencies or enterprises, while non-agency MBS are not guaranteed by the government.

On March 12th, 2025, Ellington Residential reported its fourth quarter results for the period ending December 31, 2024. The company generated a net loss of $(2.0) million, or $(0.07) per share.

Ellington achieved adjusted distributable earnings of $7.8 million in the quarter, leading to adjusted earnings of $0.27 per share, which covered the dividend paid in the period.

Ellington’s net interest margin was 5.07% overall. At quarter end, Ellington had $31.8 million of cash and cash equivalents, and $79 million of other unencumbered assets.

Click here to download our most recent Sure Analysis report on EARN (preview of page 1 of 3 shown below):

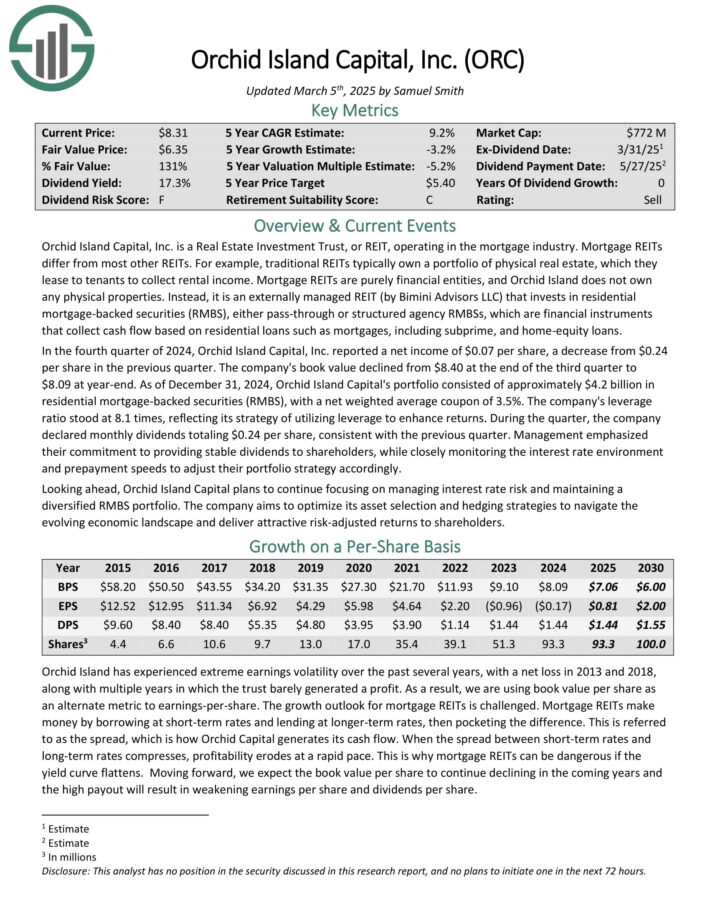

Low-Priced High Dividend Stock #1: Orchid Island Capital (ORC) – Dividend Yield of 18.0%

Orchid Island Capital, Inc. is an mREIT that is externally managed by Bimini Advisors LLC and focuses on investing in residential mortgage-backed securities (RMBS), including pass-through and structured agency RMBSs.

These financial instruments generate cash flow based on residential loans such as mortgages, subprime, and home-equity loans.

In the fourth quarter of 2024, Orchid Island Capital, Inc. reported a net income of $0.07 per share, a decrease from $0.24 per share in the previous quarter. The company’s book value declined from $8.40 at the end of the third quarter to $8.09 at year-end.

As of December 31, 2024, Orchid Island Capital’s portfolio consisted of approximately $4.2 billion in residential mortgage-backed securities (RMBS), with a net weighted average coupon of 3.5%. The company’s leverage ratio stood at 8.1 times, reflecting its strategy of utilizing leverage to enhance returns.

Click here to download our most recent Sure Analysis report on Orchid Island Capital, Inc. (ORC) (preview of page 1 of 3 shown below):

Final Thoughts

When a stock offers an exceptionally high dividend yield, it usually signals that its dividend is at the risk of being cut. This rule certainly applies to most of the above stocks.

Nevertheless, some of the above stocks are highly attractive now thanks to their cheap valuation and still-high yield even after a potential reasonable dividend cut.

If you are interested in finding high-quality dividend growth stocks and/or other high-yield securities and income securities, the following Sure Dividend resources will be useful:

High-Yield Individual Security Research

Other Sure Dividend Resources

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].