Updated on December 2nd, 2025 by Bob Ciura

Investors looking to generate higher income levels from their investment portfolios should look at Real Estate Investment Trusts or REITs.

These are companies that own real estate properties and lease them to tenants, or invest in real estate backed loans, both of which generate a steady stream of income.

The bulk of their income is then passed on to shareholders through dividends.

You can see all 200+ REITs here.

You can download our full list of REITs, along with important metrics such as dividend yields and market capitalizations, by clicking on the link below:

The beauty of REITs for income investors is that they are required to distribute 90% of their taxable income to shareholders annually in the form of dividends. In return, REITs typically do not pay corporate taxes.

As a result, many of the 200+ REITs we track offer high dividend yields of 5%+.

But not all high-yielding stocks are automatic buys. Investors should carefully assess the fundamentals to ensure that high yields are sustainable.

Note that while the securities in this article have very high yields, a high yield alone does not make for a solid investment. Dividend safety, valuation, management, balance sheet health, and growth are also very important factors.

We urge investors to use the analysis below as informative but to do significant due diligence before buying into any security – especially high-yield securities.

Many (but not all) high-yield securities have a significant risk of a dividend reduction and/or deteriorating business results.

Table of Contents

You can instantly jump to any specific section of the article by using the links below:

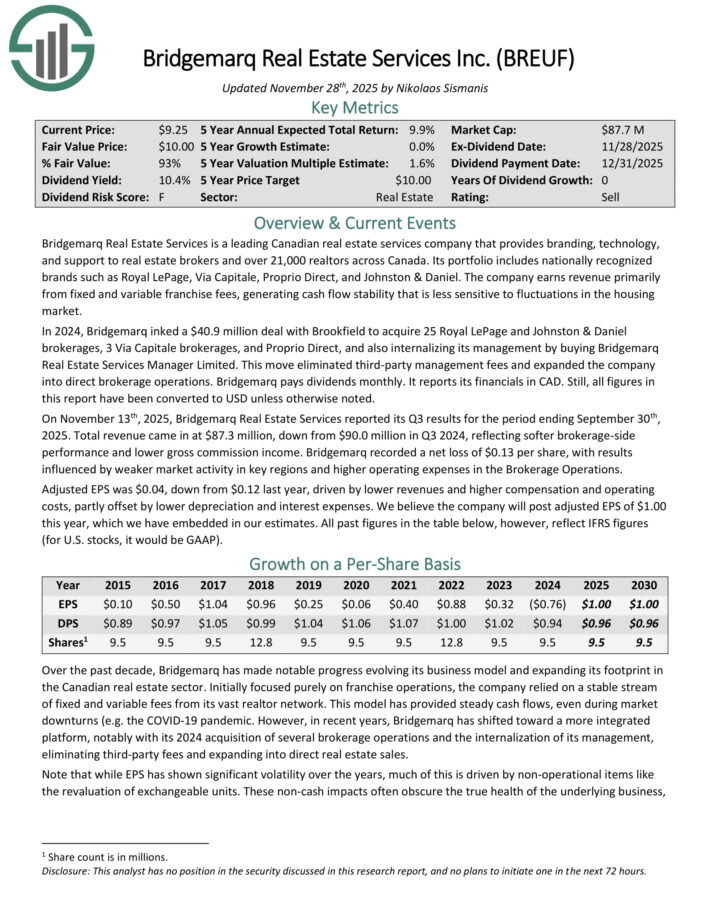

High-Yield REIT No. 10: Bridgemarq Real Estate Services (BREUF)

Bridgemarq Real Estate Services is a leading Canadian real estate services company that provides branding, technology, and support to real estate brokers and over 21,000 realtors across Canada.

Its portfolio includes nationally recognized brands such as Royal LePage, Via Capitale, Proprio Direct, and Johnston & Daniel.

The company earns revenue primarily from fixed and variable franchise fees, generating cash flow stability that is less sensitive to fluctuations in the housing market.

On November 13th, 2025, Bridgemarq Real Estate Services reported its Q3 results for the period ending September 30th, 2025. Total revenue came in at $87.3 million, down from $90.0 million in Q3 2024, reflecting softer brokerage-side performance and lower gross commission income.

Bridgemarq recorded a net loss of $0.13 per share, with results influenced by weaker market activity in key regions and higher operating expenses in the Brokerage Operations.

Adjusted EPS was $0.04, down from $0.12 last year, driven by lower revenues and higher compensation and operating costs, partly offset by lower depreciation and interest expenses.

Click here to download our most recent Sure Analysis report on BREUF (preview of page 1 of 3 shown below):

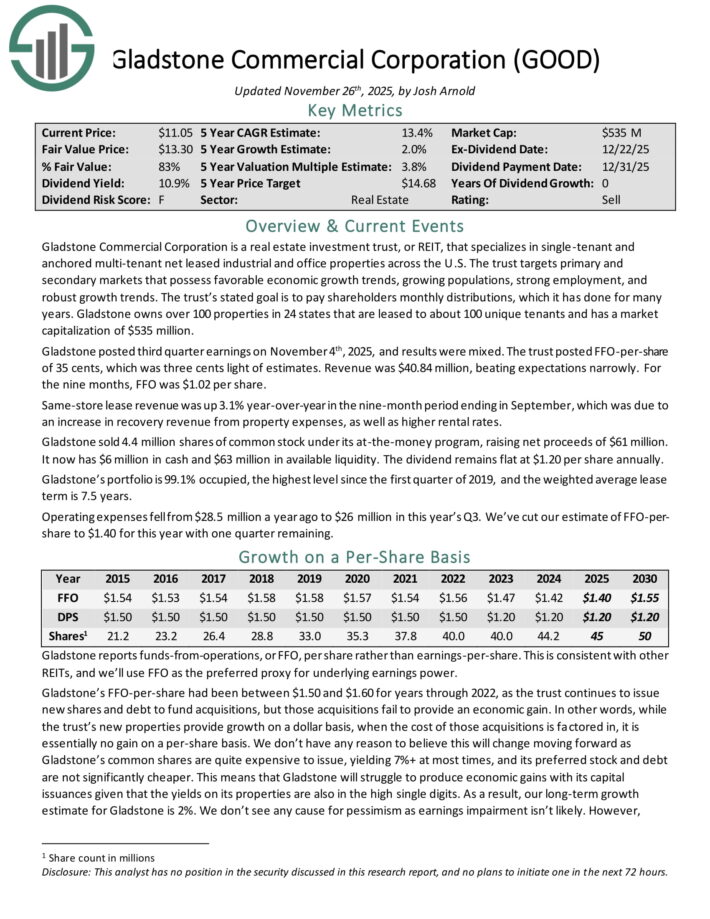

High-Yield REIT No. 9: Gladstone Commercial Corp. (GOOD)

Gladstone Commercial Corporation is a real estate investment trust, or REIT, that specializes in single-tenant and anchored multi-tenant net leased industrial and office properties across the U.S.

The trust targets primary and secondary markets that possess favorable economic growth trends, growing populations, strong employment, and robust growth trends.

The trust’s stated goal is to pay shareholders monthly distributions, which it has done for more than 17 consecutive years. Gladstone owns over 100 properties in 24 states that are leased to about 100 unique tenants.

Gladstone posted third quarter earnings on November 4th, 2025, and results were mixed. The trust posted FFO-per-share of 35 cents, which was three cents light of estimates. Revenue was $40.84 million, beating expectations narrowly. For the nine months, FFO was $1.02 per share.

Same-store lease revenue was up 3.1% year-over-year in the nine-month period ending in September, which was due to an increase in recovery revenue from property expenses, as well as higher rental rates.

Gladstone sold 4.4 million shares of common stock under its at-the-money program, raising net proceeds of $61 million. It now has $6 million in cash and $63 million in available liquidity.

The dividend remains flat at $1.20 per share annually. Gladstone’s portfolio is 99.1% occupied, the highest level since the first quarter of 2019, and the weighted average lease term is 7.5 years.

Click here to download our most recent Sure Analysis report on GOOD (preview of page 1 of 3 shown below):

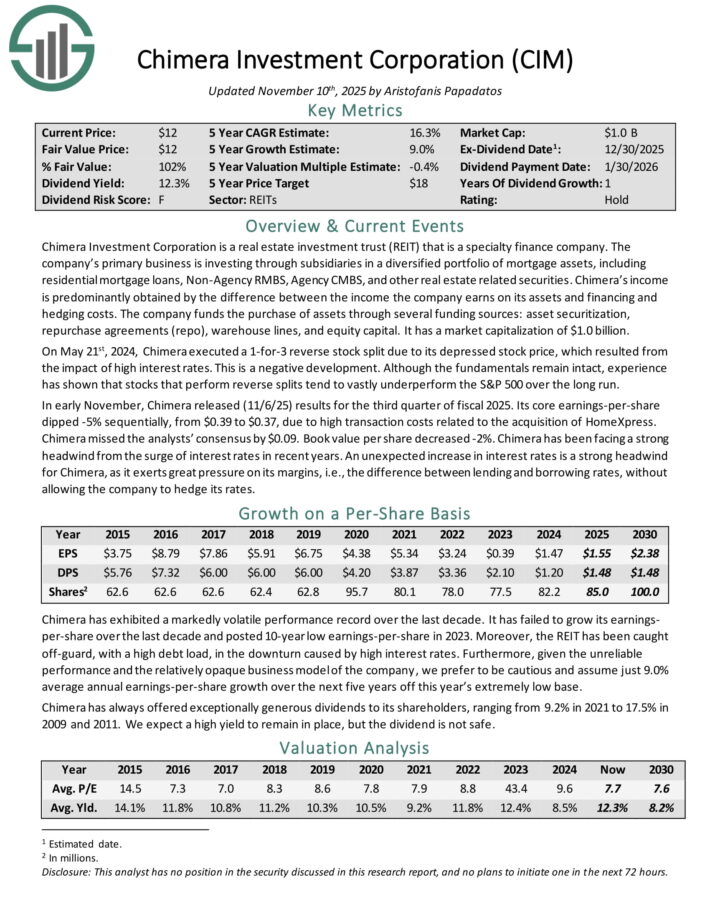

High-Yield REIT No. 8: Chimera Investment Corp. (CIM)

Chimera Investment Corporation is a real estate investment trust (REIT) that is a specialty finance company. The company’s primary business is in investing through subsidiaries in a diversified portfolio of mortgage assets, including residential mortgage loans, Non-Agency RMBS, Agency CMBS, and other real estate related securities.

Chimera’s income is predominantly obtained by the difference between the income the company earns on its assets and financing and hedging costs.

The company funds the purchase of assets through several funding sources: asset securitization, repurchase agreements (repo), warehouse lines, and equity capital.

In early November, Chimera released (11/6/25) results for the third quarter of fiscal 2025. Its core earnings-per-share dipped -5% sequentially, from $0.39 to $0.37, due to high transaction costs related to the acquisition of HomeXpress.

Chimera missed the analysts’ consensus by $0.09. Book value per share decreased -2%. Chimera has been facing a strong headwind from the surge of interest rates in recent years. An unexpected increase in interest rates is a strong headwind for Chimera, as it exerts great pressure on its margins.

Click here to download our most recent Sure Analysis report on CIM (preview of page 1 of 3 shown below):

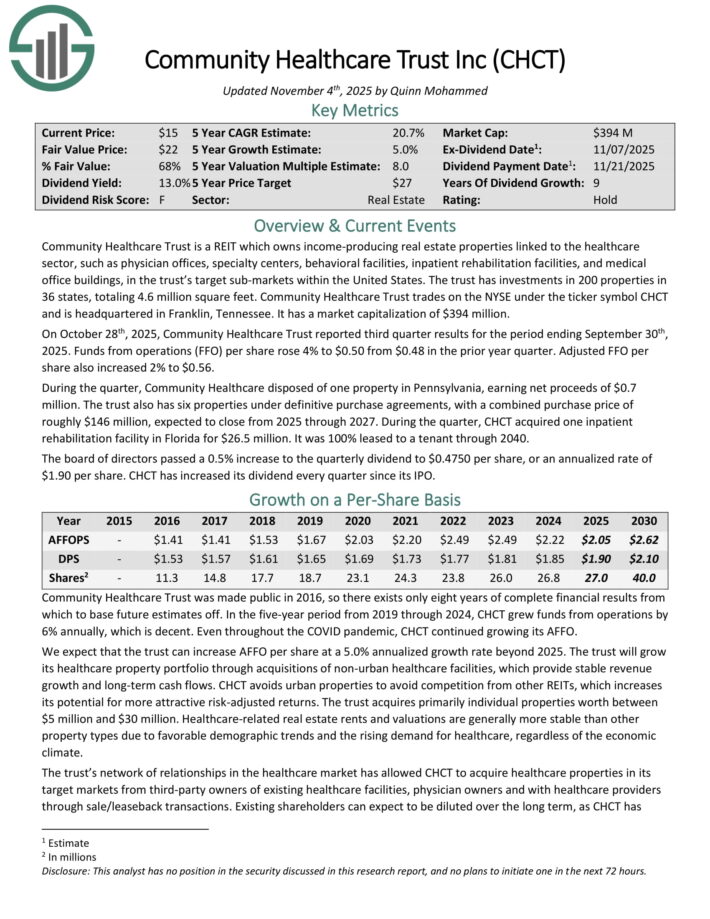

High-Yield REIT No. 7: Community Healthcare Trust (CHCT)

Community Healthcare Trust is a REIT which owns income-producing real estate properties linked to the healthcare sector, such as physician offices, specialty centers, behavioral facilities, inpatient rehabilitation facilities, and medical office buildings, in the trust’s target sub-markets within the United States.

The trust has investments in 200 properties in 36 states, totaling 4.6 million square feet.

On October 28th, 2025, Community Healthcare Trust reported third quarter results. Funds from operations (FFO) per share rose 4% to $0.50 from $0.48 in the prior year quarter. Adjusted FFO per share also increased 2% to $0.56.

During the quarter, Community Healthcare disposed of one property in Pennsylvania, earning net proceeds of $0.7 million.

The trust also has six properties under definitive purchase agreements, with a combined purchase price of roughly $146 million, expected to close from 2025 through 2027.

During the quarter, CHCT acquired one inpatient rehabilitation facility in Florida for $26.5 million. It was 100% leased to a tenant through 2040.

The board of directors passed a 0.5% increase to the quarterly dividend to $0.4750 per share, or an annualized rate of $1.90 per share. CHCT has increased its dividend every quarter since its IPO.

Click here to download our most recent Sure Analysis report on CHCT (preview of page 1 of 3 shown below):

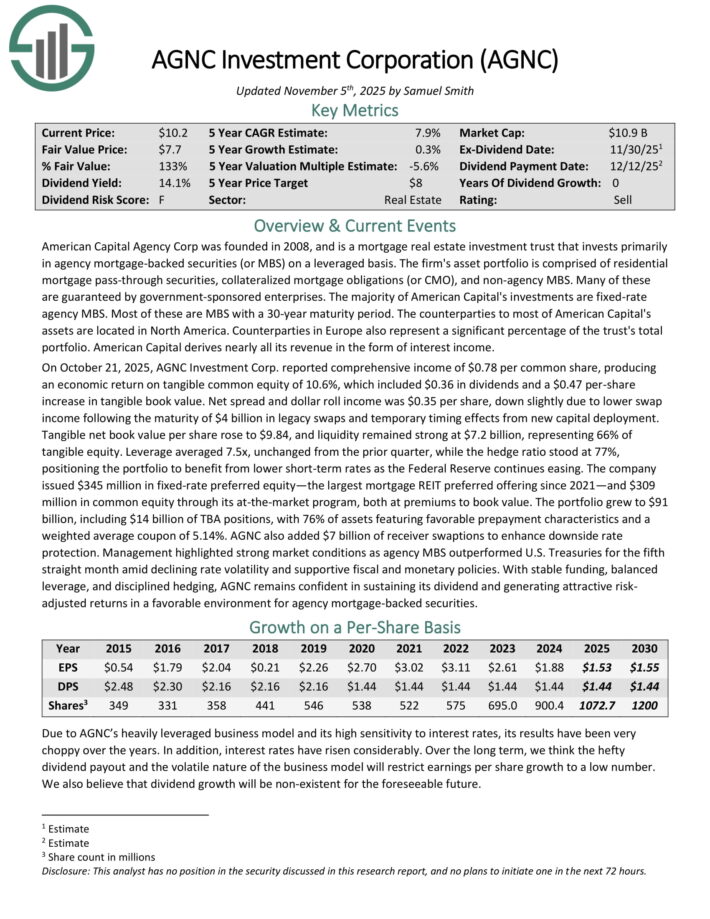

High-Yield REIT No. 6: AGNC Investment Corp. (AGNC)

American Capital Agency Corp is a mortgage real estate investment trust that invests primarily in agency mortgage–backed securities (or MBS) on a leveraged basis.

The firm’s asset portfolio is comprised of residential mortgage pass–through securities, collateralized mortgage obligations (or CMO), and non–agency MBS. Many of these are guaranteed by government–sponsored enterprises.

On October 21, 2025, AGNC Investment Corp. reported comprehensive income of $0.78 per common share, producing an economic return on tangible common equity of 10.6%, which included $0.36 in dividends and a $0.47 per-share increase in tangible book value.

Net spread and dollar roll income was $0.35 per share, down slightly due to lower swap income following the maturity of $4 billion in legacy swaps and temporary timing effects from new capital deployment.

Tangible net book value per share rose to $9.84, and liquidity remained strong at $7.2 billion, representing 66% of tangible equity.

Click here to download our most recent Sure Analysis report on AGNC Investment Corp (AGNC) (preview of page 1 of 3 shown below):

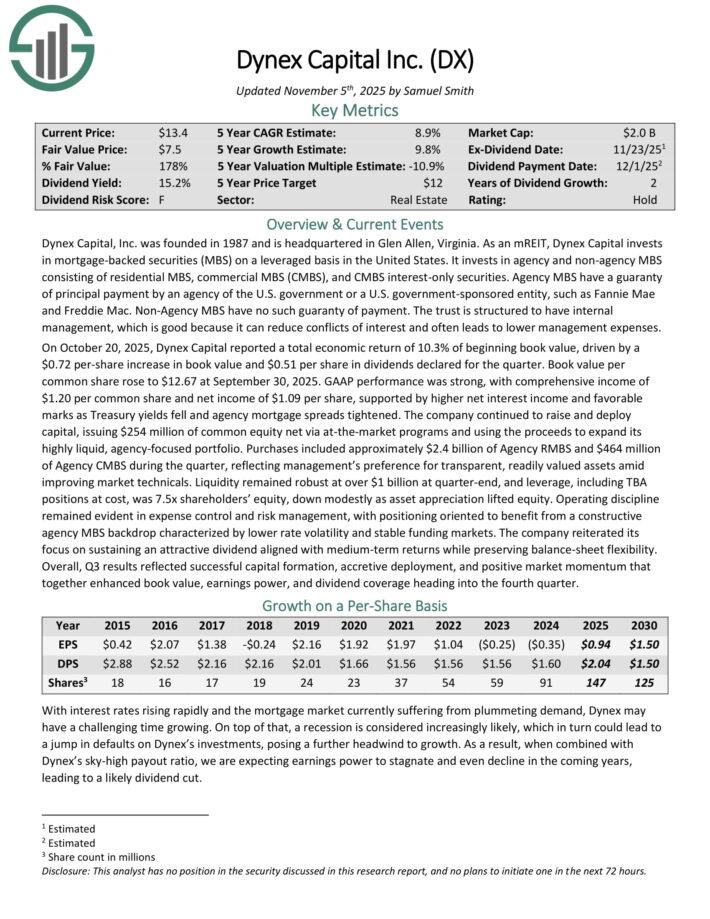

High-Yield REIT No. 5: Dynex Capital (DX)

Dynex Capital invests in mortgage–backed securities (MBS) on a leveraged basis in the United States. It invests in agency and non–agency MBS consisting of residential MBS, commercial MBS (CMBS), and CMBS interest–only securities.

On October 20, 2025, Dynex Capital reported a total economic return of 10.3% of beginning book value, driven by a $0.72 per-share increase in book value and $0.51 per share in dividends declared for the quarter.

Book value per common share rose to $12.67 at September 30, 2025. GAAP performance was strong, with comprehensive income of $1.20 per common share and net income of $1.09 per share, supported by higher net interest income and favorable marks as Treasury yields fell and agency mortgage spreads tightened.

The company continued to raise and deploy capital, issuing $254 million of common equity net via at-the-market programs and using the proceeds to expand its highly liquid, agency-focused portfolio.

Purchases included approximately $2.4 billion of Agency RMBS and $464 million of Agency CMBS during the quarter, reflecting management’s preference for transparent, readily valued assets amid improving market technicals.

Click here to download our most recent Sure Analysis report on DX (preview of page 1 of 3 shown below):

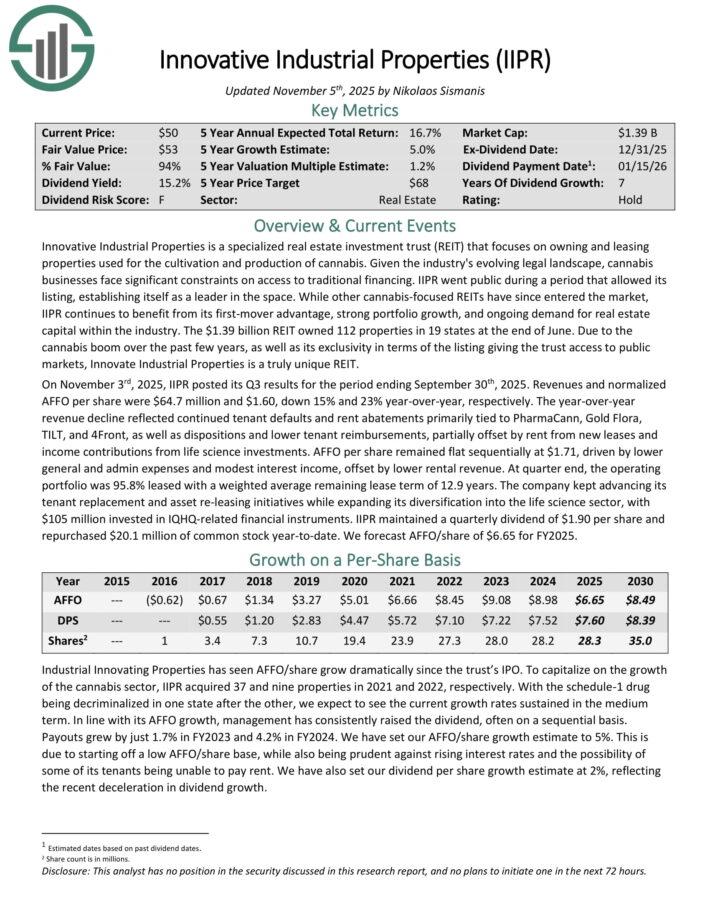

High-Yield REIT No. 4: Innovative Industrial Properties (IIPR)

Innovative Industrial Properties, Inc. is a single-use “specialty REIT” that exclusively focuses on owning properties used for the cultivation and production of cannabis.

The REIT owned 112 properties in 19 states at the end of June. Due to the cannabis boom over the past few years, as well as its exclusivity in terms of the listing giving the trust access to public markets, Innovate Industrial Properties is a truly unique REIT.

On November 3rd, 2025, IIPR posted its Q3 results. Revenues and normalized AFFO per share were $64.7 million and $1.60, down 15% and 23% year-over-year, respectively.

The year-over-year revenue decline reflected continued tenant defaults and rent abatements primarily tied to PharmaCann, Gold Flora, TILT, and 4Front, as well as dispositions and lower tenant reimbursements, partially offset by rent from new leases and income contributions from life science investments.

AFFO per share remained flat sequentially at $1.71, driven by lower general and admin expenses and modest interest income, offset by lower rental revenue.

At quarter end, the operating portfolio was 95.8% leased with a weighted average remaining lease term of 12.9 years.

Click here to download our most recent Sure Analysis report on IIPR (preview of page 1 of 3 shown below):

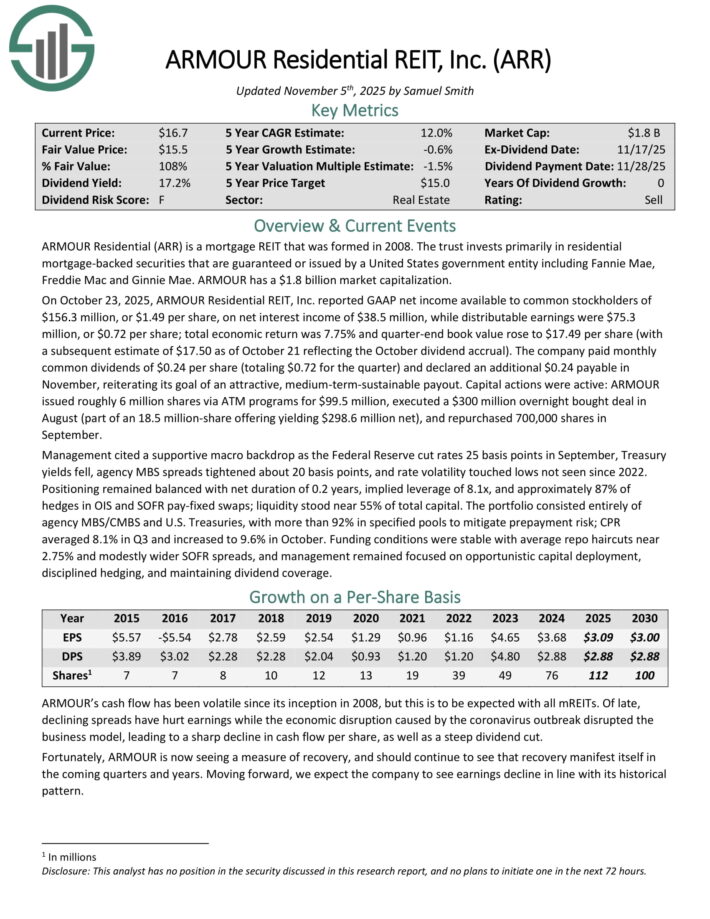

High-Yield REIT No. 3: ARMOUR Residential REIT (ARR)

ARMOUR Residential invests in residential mortgage-backed securities that include U.S. Government-sponsored entities (GSE) such as Fannie Mae and Freddie Mac.

It also includes Ginnie Mae, the Government National Mortgage Administration’s issued or guaranteed securities backed by fixed-rate, hybrid adjustable-rate, and adjustable-rate home loans.

Unsecured notes and bonds issued by the GSE and the US Treasury, money market instruments, and non-GSE or government agency-backed securities are examples of other types of investments.

On October 23, 2025, ARMOUR Residential REIT reported GAAP net income available to common stockholders of $156.3 million, or $1.49 per share, on net interest income of $38.5 million, while distributable earnings were $75.3 million, or $0.72 per share.

Total economic return was 7.75% and quarter-end book value rose to $17.49 per share. The company paid monthly common dividends of $0.24 per share (totaling $0.72 for the quarter) and declared an additional $0.24 payable in November.

Click here to download our most recent Sure Analysis report on ARMOUR Residential REIT Inc (ARR) (preview of page 1 of 3 shown below):

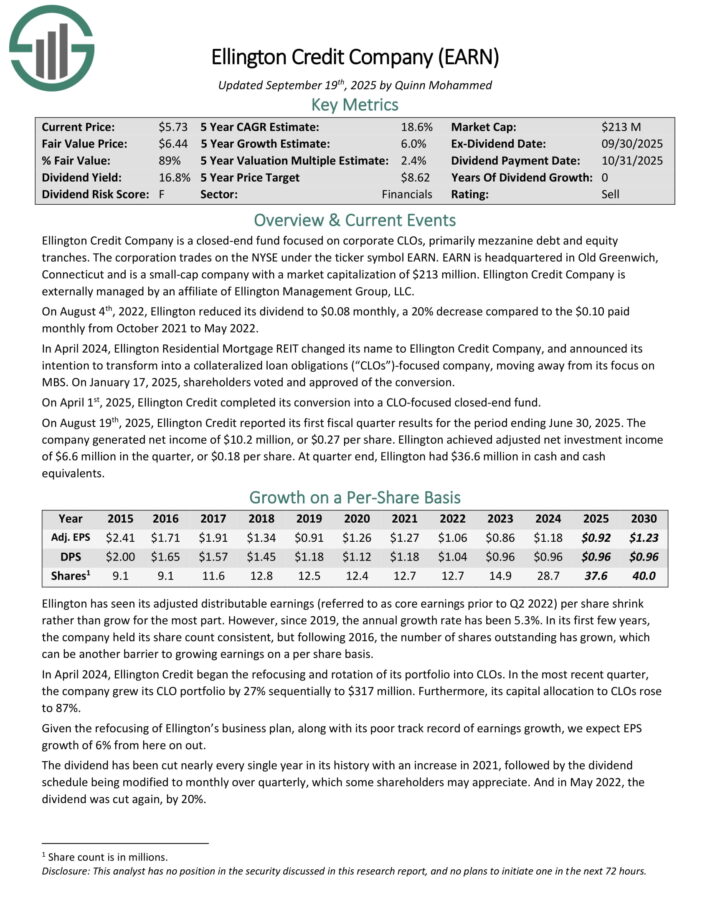

High-Yield REIT No. 2: Ellington Credit Co. (EARN)

Ellington Credit Co. acquires, invests in, and manages residential mortgage and real estate related assets. Ellington focuses primarily on residential mortgage-backed securities, specifically those backed by a U.S. Government agency or U.S. government–sponsored enterprise.

Agency MBS are created and backed by government agencies or enterprises, while non-agency MBS are not guaranteed by the government.

On August 19th, 2025, Ellington Credit reported its first fiscal quarter results for the period ending June 30, 2025. The company generated net income of $10.2 million, or $0.27 per share.

Ellington achieved adjusted net investment income of $6.6 million in the quarter, or $0.18 per share. At quarter end, Ellington had $36.6 million in cash and cash equivalents.

Click here to download our most recent Sure Analysis report on EARN (preview of page 1 of 3 shown below):

High-Yield REIT No. 1: Orchid Island Capital Inc (ORC)

Orchid Island Capital is a mortgage REIT that is externally managed by Bimini Advisors LLC and focuses on investing in residential mortgage-backed securities (RMBS), including pass-through and structured agency RMBSs.

These financial instruments generate cash flow based on residential loans such as mortgages, subprime, and home-equity loans.

On October 23, 2025, Orchid Island Capital, Inc. reported estimated net income of $0.53 per common share for Q3 2025, with book value per share estimated at $7.33 as of September 30, 2025.

The company declared a monthly dividend of $0.12 per share for October, keeping consistent with its monthly payout strategy.

The RMBS portfolio and derivatives portfolio evolved as the company remained focused on agency residential mortgage-backed securities paired with hedging strategies.

Orchid Island highlighted that the investment backdrop remains attractive with improving spreads and prepayment risk manageable given the portfolio’s coupon distribution and hedges.

Prepayment activity remained a focal point, with management noting the need for continued vigilance given higher coupon pools and refinancing dynamics.

Click here to download our most recent Sure Analysis report on Orchid Island Capital, Inc. (ORC) (preview of page 1 of 3 shown below):

Final Thoughts

REITs have significant appeal for income investors due to their high yields. These 10 extremely high-yielding REITs are especially attractive on the surface, although investors should be aware that abnormally high yields are often accompanied by elevated risks.

If you are interested in finding high-quality dividend growth stocks and/or other high-yield securities and income securities, the following Sure Dividend resources will be useful:

High-Yield Individual Security Research

Other Sure Dividend Resources

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].