Published on September 9th, 2025 by Bob Ciura

The S&P 500 is overvalued.

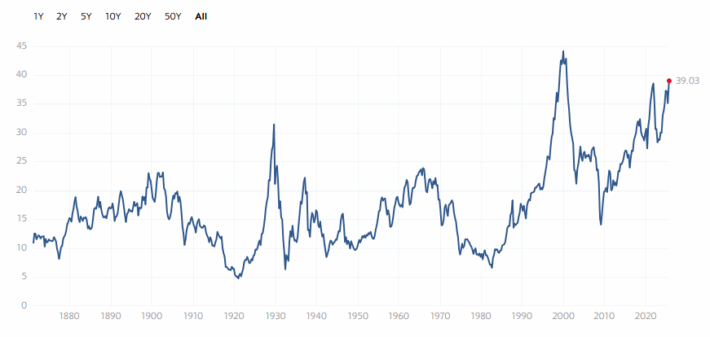

The image below shows the long-term trend of the Shiller PE ratio for the S&P 500.

Source: Multpl.com

The Shiller PE ratio “smooths” the PE ratio by using 10-year inflation-adjusted average earnings for earnings, instead of trailing-twelve-month earnings. This helps the ratio to be meaningful even when earnings are very low (like during recessions).

There’s no question the S&P 500 is overvalued from a historical perspective…

And it’s not “just” the Shiller PE. The standard PE ratio is ~30 for the S&P 500 at the time of this writing – one of the highest non-recession (when the ‘E’ in the ratio falls, pushing up the ratio) levels ever.

But one need not invest broadly in the historically overvalued S&P 500…

For example, the free high dividend stocks list spreadsheet below has our full list of individual securities (stocks, REITs, MLPs, etc.) with with 5%+ dividend yields.

Buying overvalued dividend stocks can jeopardize future returns. Even quality companies can amount to mediocre or poor investments, if too high price is paid.

Falling valuations can lead to low (or even negative) total returns, even including dividends.

Therefore, investors should be cautious when it comes to overvalued dividend stocks. The following 10 overvalued dividend stocks should be avoided.

The list is sorted by the level of overvaluation.

Table of Contents

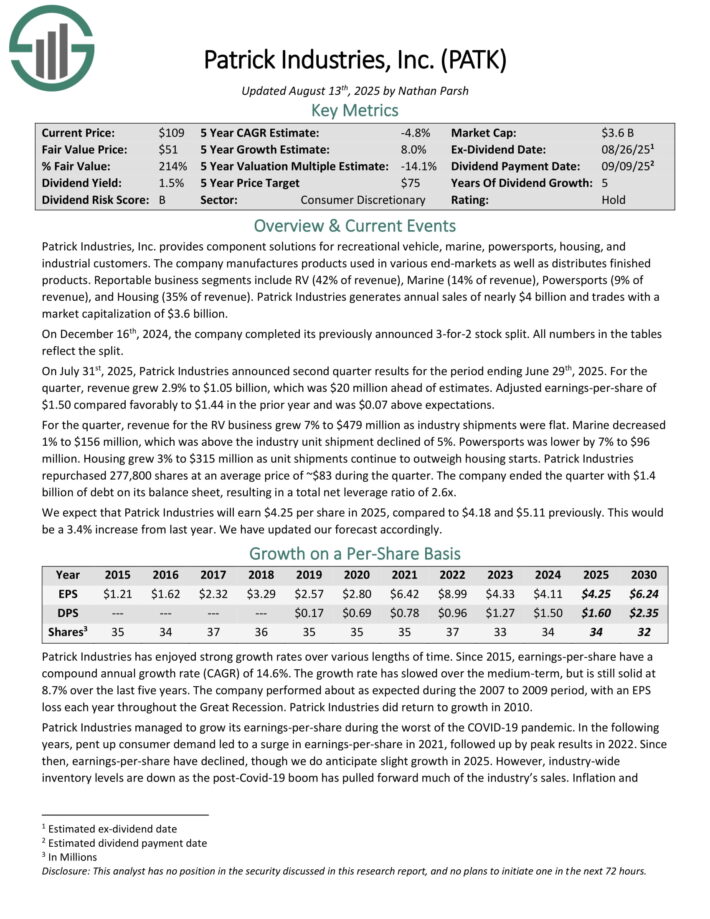

Overvalued Dividend Stock #10: Patrick Industries (PATK)

Annual Valuation Return: -14.7%

Patrick Industries provides component solutions for recreational vehicle, marine, power sports, housing, and industrial customers.

The company manufactures products used in various end-markets as well as distributes finished products. Reportable business segments include RV (42% of revenue), Marine (14% of revenue), Power sports (9% of revenue), and Housing (35% of revenue). Patrick Industries generates annual sales of nearly $4 billion.

On July 31st, 2025, Patrick Industries announced second quarter results for the period ending June 29th, 2025. For the quarter, revenue grew 2.9% to $1.05 billion, which was $20 million ahead of estimates. Adjusted earnings-per-share of $1.50 compared favorably to $1.44 in the prior year and was $0.07 above expectations.

For the quarter, revenue for the RV business grew 7% to $479 million as industry shipments were flat. Marine decreased 1% to $156 million, which was above the industry unit shipment declined of 5%. Power sports was lower by 7% to $96 million. Housing grew 3% to $315 million as unit shipments continue to outweigh housing starts.

Patrick Industries repurchased 277,800 shares at an average price of ~$83 during the quarter. The company ended the quarter with $1.4 billion of debt on its balance sheet, resulting in a total net leverage ratio of 2.6x.

Click here to download our most recent Sure Analysis report on PATK (preview of page 1 of 3 shown below):

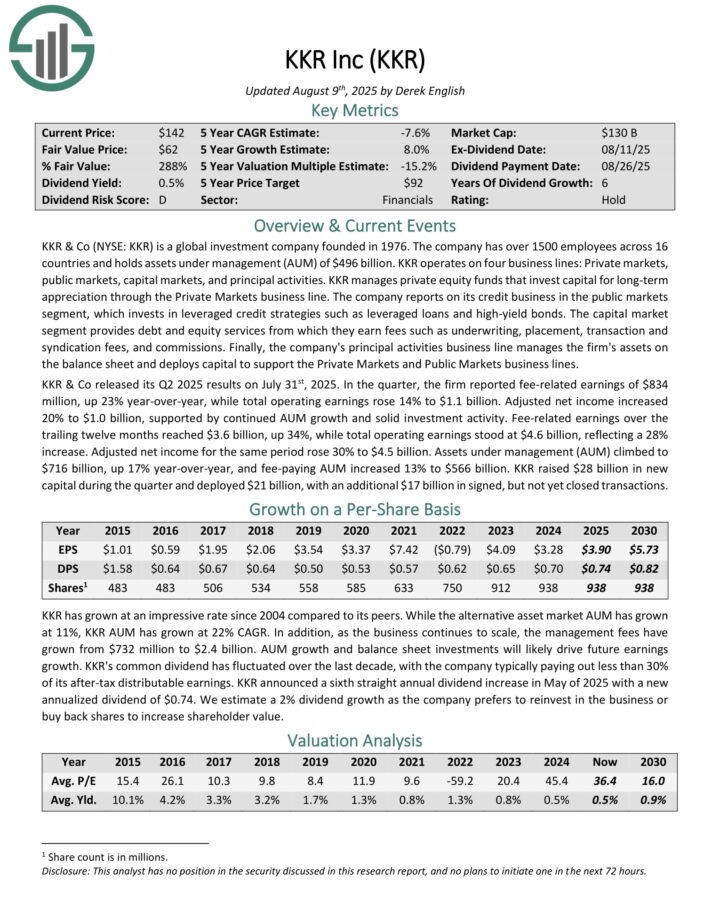

Overvalued Dividend Stock #9: KKR & Co. (KKR)

Annual Valuation Return: -15.1%

KKR & Co is a global investment company with assets under management (AUM) of $496 billion. KKR operates on four business lines: Private markets, public markets, capital markets, and principal activities.

KKR manages private equity funds that invest capital for long-term appreciation through the Private Markets business line.

KKR & Co released its Q2 2025 results on July 31st, 2025. In the quarter, the firm reported fee-related earnings of $834 million, up 23% year-over-year, while total operating earnings rose 14% to $1.1 billion.

Adjusted net income increased 20% to $1.0 billion, supported by continued AUM growth and solid investment activity.

Fee-related earnings over the trailing twelve months reached $3.6 billion, up 34%, while total operating earnings stood at $4.6 billion, reflecting a 28% increase. Adjusted net income for the same period rose 30% to $4.5 billion.

Assets under management (AUM) climbed to $716 billion, up 17% year-over-year, and fee-paying AUM increased 13% to $566 billion.

Click here to download our most recent Sure Analysis report on KKR (preview of page 1 of 3 shown below):

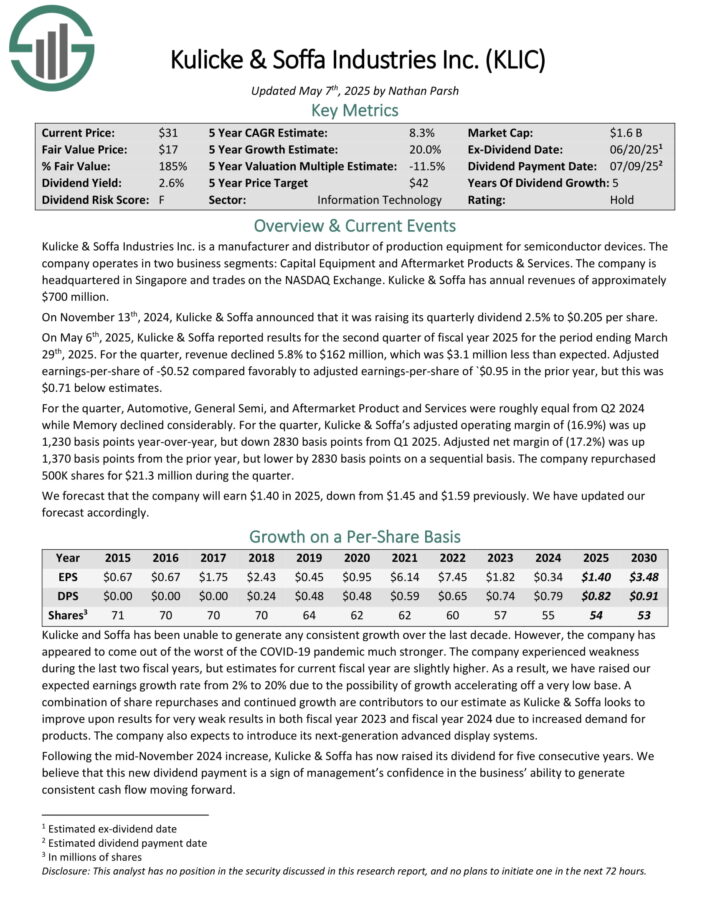

Overvalued Dividend Stock #8: Kulicke & Soffa Industries (KLIC)

Annual Valuation Return: -14.0%

Kulicke & Soffa Industries Inc. is a manufacturer and distributor of production equipment for semiconductor devices. The company operates in two business segments: Capital Equipment and Aftermarket Products & Services.

It is headquartered in Singapore and trades on the NASDAQ Exchange. Kulicke & Soffa has annual revenues of approximately $700 million.

On May 6th, 2025, Kulicke & Soffa reported results for the second quarter of fiscal year 2025. For the quarter, revenue declined 5.8% to $162 million, which was $3.1 million less than expected.

Adjusted earnings-per-share of -$0.52 compared favorably to adjusted earnings-per-share of -$0.95 in the prior year.

For the quarter, Automotive, General Semi, and Aftermarket Product and Services were roughly equal from Q2 2024 while Memory declined considerably.

For the quarter, Kulicke & Soffa’s adjusted operating margin of (16.9%) was up 1,230 basis points year-over-year, but down 2830 basis points from Q1 2025.

Click here to download our most recent Sure Analysis report on KLIC (preview of page 1 of 3 shown below):

Overvalued Dividend Stock #7: Blackstone Mortgage Trust (BXMT)

Annual Valuation Return: -15.3%

On July 30, 2025, Blackstone Mortgage Trust, Inc. reported its financial results for the second quarter of 2025. The company posted net income of $7.0 million, or $0.04 per share, a return to profitability from a $0.00 EPS in Q1 2025 and a $61.1 million loss in Q2 2024.

Distributable EPS was $0.19, up from $0.17 in Q1, while Distributable EPS prior to charge-offs reached $0.45, compared to $0.42 previously. Dividends remained at $0.47 per share, yielding 9.7% annualized based on the July 29 share price of $19.36.

Total revenues were $133.9 million, with net income from loans and investments at $94.8 million after $264.7 million in interest expenses. The balance sheet showed total assets of $20.6 billion, including $19.0 billion in net loans receivable after CECL reserves.

Equity stood at $3.6 billion, with book value per share declining to $21.04 from $21.42 in Q1, reflecting $4.39 per share in reserves. Liquidity was strong at $1.1 billion, with a 3.8x debt-to-equity ratio.

The portfolio grew to $18.4 billion across 144 loans, up $1.4 billion over two quarters, with 82% of Q2 originations in multifamily and industrial sectors, and 68% international. Office exposure dropped to 28% from 36% year-over-year.

Impaired loans fell 55% from peak to $1.0 billion, with $0.2 billion resolved above carrying value. CECL reserves held steady at $755 million (3.8% of principal), and portfolio performance was 94%.

Click here to download our most recent Sure Analysis report on BXMT (preview of page 1 of 3 shown below):

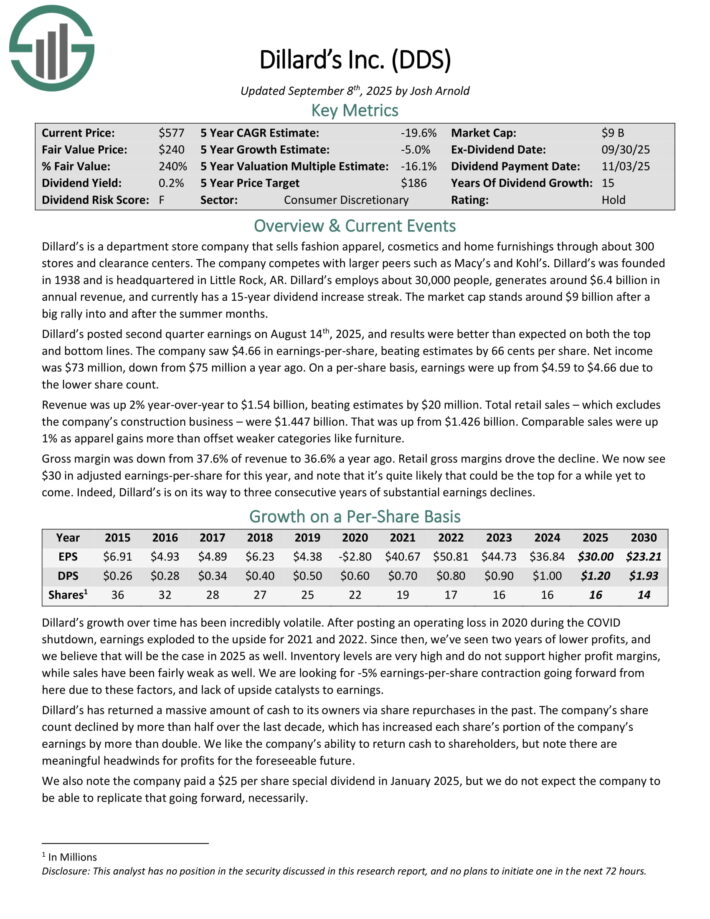

Overvalued Dividend Stock #6: Dillard’s Inc. (DDS)

Annual Valuation Return: -16.1%

Dillard’s is a department store company that sells fashion apparel, cosmetics and home furnishings through about 300 stores and clearance centers. The company competes with larger peers such as Macy’s and Kohl’s.

Dillard’s employs about 30,000 people, generates around $6.4 billion in annual revenue, and currently has a 15-year dividend increase streak.

Dillard’s posted second quarter earnings on August 14th, 2025, and results were better than expected on both the top and bottom lines. The company saw $4.66 in earnings-per-share, beating estimates by 66 cents per share.

Net income was $73 million, down from $75 million a year ago. On a per-share basis, earnings were up from $4.59 to $4.66 due to the lower share count.

Revenue was up 2% year-over-year to $1.54 billion, beating estimates by $20 million. Total retail sales – which excludes the company’s construction business – were $1.447 billion. That was up from $1.426 billion. Comparable sales were up 1% as apparel gains more than offset weaker categories like furniture.

Gross margin was down from 37.6% of revenue to 36.6% a year ago. Retail gross margins drove the decline.

We now see $30 in adjusted earnings-per-share for this year, and note that it’s quite likely that could be the top for a while yet to come. Indeed, Dillard’s is on its way to three consecutive years of substantial earnings declines.

Click here to download our most recent Sure Analysis report on DDS (preview of page 1 of 3 shown below):

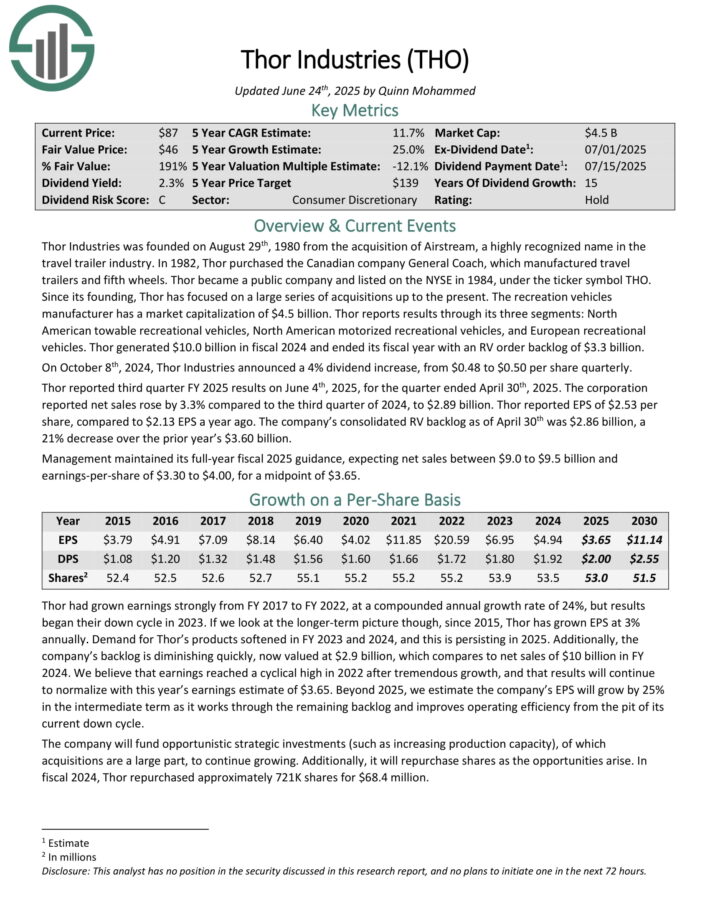

Overvalued Dividend Stock #5: Thor Industries (THO)

Annual Valuation Return: -16.4%

Thor Industries was founded on August 29th, 1980 from the acquisition of Airstream, a highly recognized name in the travel trailer industry. Thor has focused on a large series of acquisitions up to the present.

Thor reports results through its three segments: North American towable recreational vehicles, North American motorized recreational vehicles, and European recreational vehicles.

Thor generated $10.0 billion in fiscal 2024 and ended its fiscal year with an RV order backlog of $3.3 billion.

Thor reported third quarter FY 2025 results on June 4th, 2025, for the quarter ended April 30th, 2025. The corporation reported net sales rose by 3.3% compared to the third quarter of 2024, to $2.89 billion.

Thor reported EPS of $2.53 per share, compared to $2.13 EPS a year ago. The company’s consolidated RV backlog as of April 30th was $2.86 billion, a 21% decrease over the prior year’s $3.60 billion.

Management maintained its full-year fiscal 2025 guidance, expecting net sales between $9.0 to $9.5 billion and earnings-per-share of $3.30 to $4.00.

Click here to download our most recent Sure Analysis report on THO (preview of page 1 of 3 shown below):

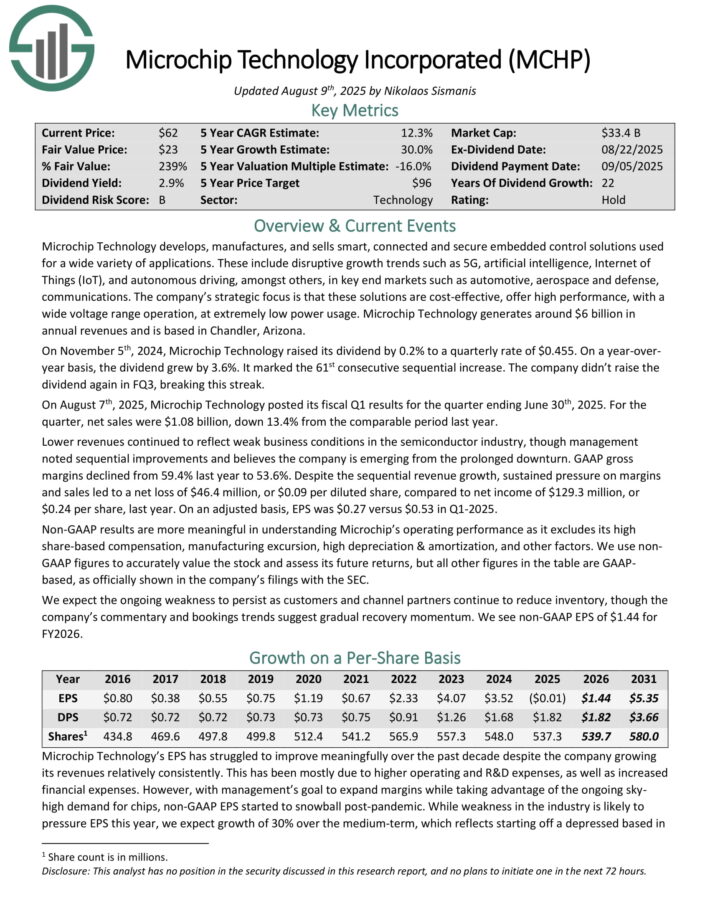

Overvalued Dividend Stock #4: Microchip Technology (MCHP)

Annual Valuation Return: -16.9%

Microchip Technology develops, manufactures, and sells smart, connected and secure embedded control solutions used for a wide variety of applications.

These include disruptive growth trends such as 5G, artificial intelligence, Internet of Things (IoT), and autonomous driving, amongst others, in key end markets such as automotive, aerospace and defense, communications.

Microchip Technology generates around $6 billion in annual revenues and is based in Chandler, Arizona.

On August 7th, 2025, Microchip Technology posted its fiscal Q1 results for the quarter ending June 30th, 2025. For the quarter, net sales were $1.08 billion, down 13.4% from the comparable period last year.

Lower revenues continued to reflect weak business conditions in the semiconductor industry, though management noted sequential improvements and believes the company is emerging from the prolonged downturn.

GAAP gross margins declined from 59.4% last year to 53.6%. Despite the sequential revenue growth, sustained pressure on margins and sales led to a net loss of $46.4 million, or $0.09 per diluted share, compared to net income of $129.3 million, or $0.24 per share, last year.

On an adjusted basis, EPS was $0.27 versus $0.53 in Q1-2025.

Click here to download our most recent Sure Analysis report on MCHP (preview of page 1 of 3 shown below):

Overvalued Dividend Stock #3: Fortitude Gold (FTCO)

Annual Valuation Return: -17.3%

Fortitude Gold Corporation was spun-off from Gold Resource Corporation into a separate public company in December 2021. Fortitude Gold is a junior gold producer with operations in Nevada, U.S.A, one of the world’s premier mining friendly jurisdictions.

The company targets high-grade gold open pit heap leach operations averaging one gram per tonne of gold or greater. Its property portfolio currently consists of 100% ownership in seven high-grade gold properties.

All seven properties are within an approximate 30-mile radius of one another within the prolific Walker Lane Mineral Belt. The company generated $37.3 million in revenues last year, the majority of which were from gold, and is based in Colorado Springs, Colorado.

On April 29th, 2025, Fortitude Gold released its first-quarter 2025 results for the period ending March 31st, 2025. For the quarter, revenues came in at $6.5 million, marking a 20% decline compared to Q1 2024.

The decrease in revenue was largely due to a 41% drop in gold sales volume and a 26% decrease in silver sales volume. These declines were partially offset by a 38% increase in gold prices and a 38% increase in silver prices.

Moving to the bottom line, Fortitude reported a mine gross profit of $3.3 million compared to $4.2 million the previous year, reflecting the lower net sales.

The company also announced a reduction in its monthly dividend from $0.04 to $0.01 per share, effective with the May 2025 payment.

Click here to download our most recent Sure Analysis report on FTCO (preview of page 1 of 3 shown below):

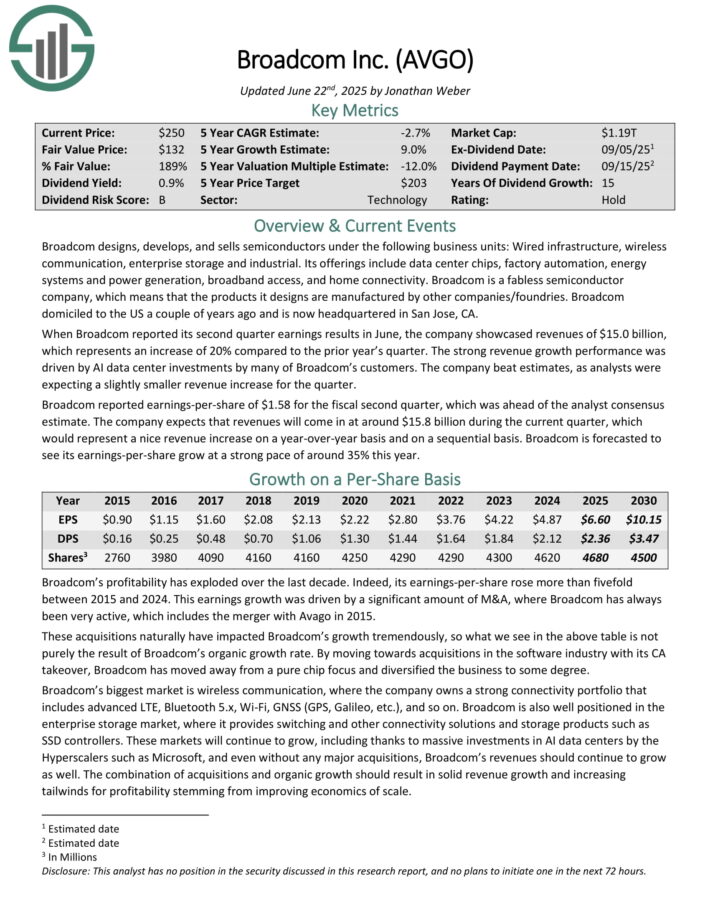

Overvalued Dividend Stock #2: Broadcom Inc. (AVGO)

Annual Valuation Return: -17.7%

Broadcom designs, develops, and sells semiconductors under the following business units: Wired infrastructure, wireless communication, enterprise storage and industrial. Its offerings include data center chips, factory automation, energy systems and power generation, broadband access, and home connectivity.

Broadcom is a fabless semiconductor company, which means that the products it designs are manufactured by other companies/foundries. Broadcom domiciled to the US a couple of years ago and is now headquartered in San Jose, CA.

When Broadcom reported its second quarter earnings results in June, the company showcased revenues of $15.0 billion, which represents an increase of 20% compared to the prior year’s quarter.

The strong revenue growth performance was driven by AI data center investments by many of Broadcom’s customers. The company beat estimates, as analysts were expecting a slightly smaller revenue increase for the quarter.

Broadcom reported earnings-per-share of $1.58 for the fiscal second quarter, which was ahead of the analyst consensus estimate. The company expects that revenues will come in at around $15.8 billion during the current quarter, which would represent a nice revenue increase on a year-over-year basis and on a sequential basis.

Click here to download our most recent Sure Analysis report on AVGO (preview of page 1 of 3 shown below):

Overvalued Dividend Stock #1: Hyster Yale (HY)

Annual Valuation Return: -24.8%

Hyster-Yale Materials Handling was founded in 1985 and has since become a prominent global player in the materials handling industry.

The company designs, manufactures, and sells a comprehensive range of lift trucks and aftermarket parts, serving diverse customers across various sectors, including manufacturing, warehousing, and logistics.

The company segments its revenue primarily into three categories: new equipment sales, parts sales, and service revenues.

On May 6th, 2025, the company announced results for the first quarter of 2025. The company reported Q1 non-GAAP EPS of $0.49, in-line with analysts’ estimates, and produced revenue of $910.4 million, which was down 14.1% year-over-year.

Hyster-Yale opened the year with Q1 2025 consolidated revenues of $910 million, down 14% from last year, as softer lift truck demand carried over from late 2024.

Net income dipped to $8.6 million compared to $51.5 million a year ago, as lower production volumes and cost pressures weighed on margins. Inventory levels improved, down $69 million versus Q1 2024, showing early progress in aligning production with current demand trends.

Encouragingly, the lift truck segment saw a notable rebound in bookings, up 13% year-over-year and 48% sequentially, driven by strength in the Americas and EMEA.

Click here to download our most recent Sure Analysis report on HY (preview of page 1 of 3 shown below):

Final Thoughts

The stock market has been on a nearly uninterrupted rally since the Great Recession. After a brief downturn during the coronavirus pandemic, the stock market has once again raced to record highs.

As a result, the S&P 500 is now markedly overvalued according to several valuation metrics, such as the Shiller P/E ratio.

Therefore, risk-averse income investors should be wary of overvalued dividend stocks such as the 10 in this article.

If you are interested in finding high-quality dividend growth stocks and/or other high-yield securities and income securities, the following Sure Dividend resources will be useful:

High-Yield Individual Security Research

Other Sure Dividend Resources

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].