Published on July 14th, 2025 by Bob Ciura

The S&P 500 has been historically overvalued (in hindsight) non-stop since 2010 using the Shiller P/E ratio.

The Shiller P/E ratio uses an average of 10 years of earnings for the “E” (earnings) in the P/E ratio to smooth out results and make the metric relevant when earnings temporary turn negative, during recessions.

The historical average Shiller P/E ratio is 17.3. It’s currently at 38.1. Therefore, the S&P 500 is 121% overvalued according to the Shiller P/E ratio.

The big takeaway from this is that the market is trading at a very high valuation multiple today, relative to its history.

When the market is overvalued, investors should look to dividend stocks to reduce portfolio volatility, and for dividend income which provides a buffer against falling stock prices.

For example, the free high dividend stocks list spreadsheet below has our full list of individual securities (stocks, REITs, MLPs, etc.) with with 5%+ dividend yields.

Buying overvalued dividend stocks can jeopardize future returns. Even quality companies can amount to mediocre or poor investments, if too high price is paid.

Falling valuations can lead to low (or even negative) total returns, even including dividends.

Therefore, investors should be cautious when it comes to overvalued dividend stocks. The following 10 overvalued dividend stocks should be avoided.

The list is sorted by the level of overvaluation.

Table of Contents

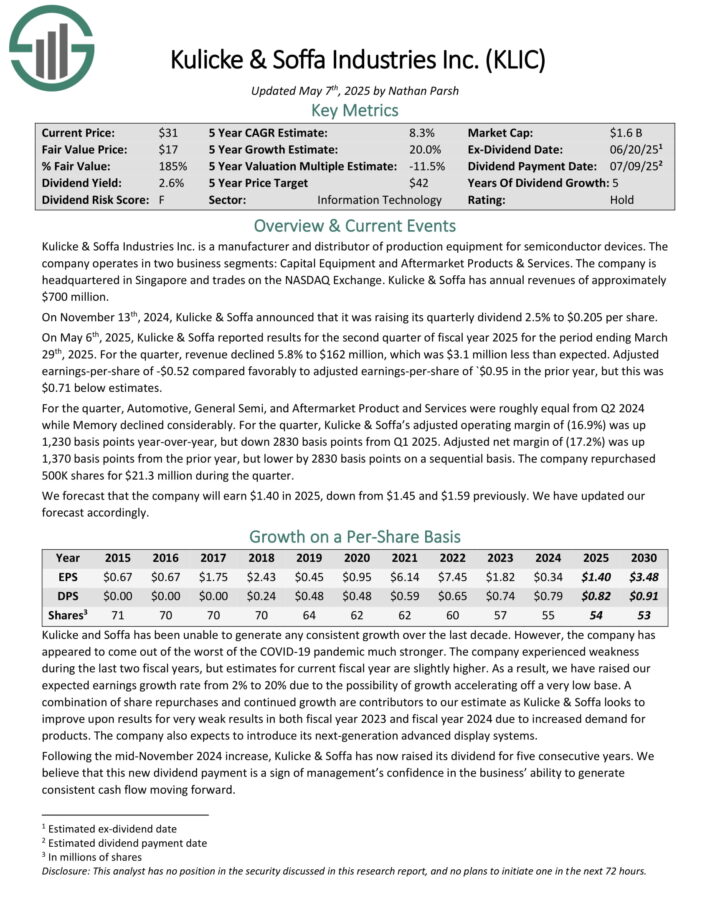

Overvalued Dividend Stock #10: Kulicke & Soffa Industries (KLIC)

Annual Valuation Return: -14.0%

Kulicke & Soffa Industries Inc. is a manufacturer and distributor of production equipment for semiconductor devices. The company operates in two business segments: Capital Equipment and Aftermarket Products & Services.

It is headquartered in Singapore and trades on the NASDAQ Exchange. Kulicke & Soffa has annual revenues of approximately $700 million.

On May 6th, 2025, Kulicke & Soffa reported results for the second quarter of fiscal year 2025. For the quarter, revenue declined 5.8% to $162 million, which was $3.1 million less than expected.

Adjusted earnings-per-share of -$0.52 compared favorably to adjusted earnings-per-share of -$0.95 in the prior year.

For the quarter, Automotive, General Semi, and Aftermarket Product and Services were roughly equal from Q2 2024 while Memory declined considerably.

For the quarter, Kulicke & Soffa’s adjusted operating margin of (16.9%) was up 1,230 basis points year-over-year, but down 2830 basis points from Q1 2025.

Click here to download our most recent Sure Analysis report on KLIC (preview of page 1 of 3 shown below):

Overvalued Dividend Stock #9: Fortitude Gold (FTCO)

Annual Valuation Return: -14.3%

Fortitude Gold Corporation was spun-off from Gold Resource Corporation into a separate public company in December 2021. Fortitude Gold is a junior gold producer with operations in Nevada, U.S.A, one of the world’s premier mining friendly jurisdictions.

The company targets high-grade gold open pit heap leach operations averaging one gram per tonne of gold or greater. Its property portfolio currently consists of 100% ownership in seven high-grade gold properties.

All seven properties are within an approximate 30-mile radius of one another within the prolific Walker Lane Mineral Belt. The company generated $37.3 million in revenues last year, the majority of which were from gold, and is based in Colorado Springs, Colorado.

On April 29th, 2025, Fortitude Gold released its first-quarter 2025 results for the period ending March 31st, 2025. For the quarter, revenues came in at $6.5 million, marking a 20% decline compared to Q1 2024.

The decrease in revenue was largely due to a 41% drop in gold sales volume and a 26% decrease in silver sales volume. These declines were partially offset by a 38% increase in gold prices and a 38% increase in silver prices.

Moving to the bottom line, Fortitude reported a mine gross profit of $3.3 million compared to $4.2 million the previous year, reflecting the lower net sales.

The company also announced a reduction in its monthly dividend from $0.04 to $0.01 per share, effective with the May 2025 payment.

Click here to download our most recent Sure Analysis report on FTCO (preview of page 1 of 3 shown below):

Overvalued Dividend Stock #8: KKR & Co. (KKR)

Annual Valuation Return: -15.1%

KKR & Co is a global investment company with assets under management (AUM) of $496 billion. KKR operates on four business lines: Private markets, public markets, capital markets, and principal activities.

KKR manages private equity funds that invest capital for long-term appreciation through the Private Markets business line.

KKR & Co released Q1 2025 results on May 1st, 2025. In Q1, KKR reported fee-related earnings of $823 million, up 23% year-over-year, and total operating earnings of $1.1 billion, which was a 16% increase.

Adjusted net income reached $1.0 billion, marking a 20% rise. Fee-related earnings grew 37% to $3.4 billion for the last twelve months, while total operating earnings climbed 32% to $4.5 billion.

Adjusted net income totaled $4.4 billion, reflecting a 37% increase. KKR’s assets under management (AUM) rose 15% year-over-year to $664 billion, with fee-paying AUMs up 12% to $526 billion.

Click here to download our most recent Sure Analysis report on KKR (preview of page 1 of 3 shown below):

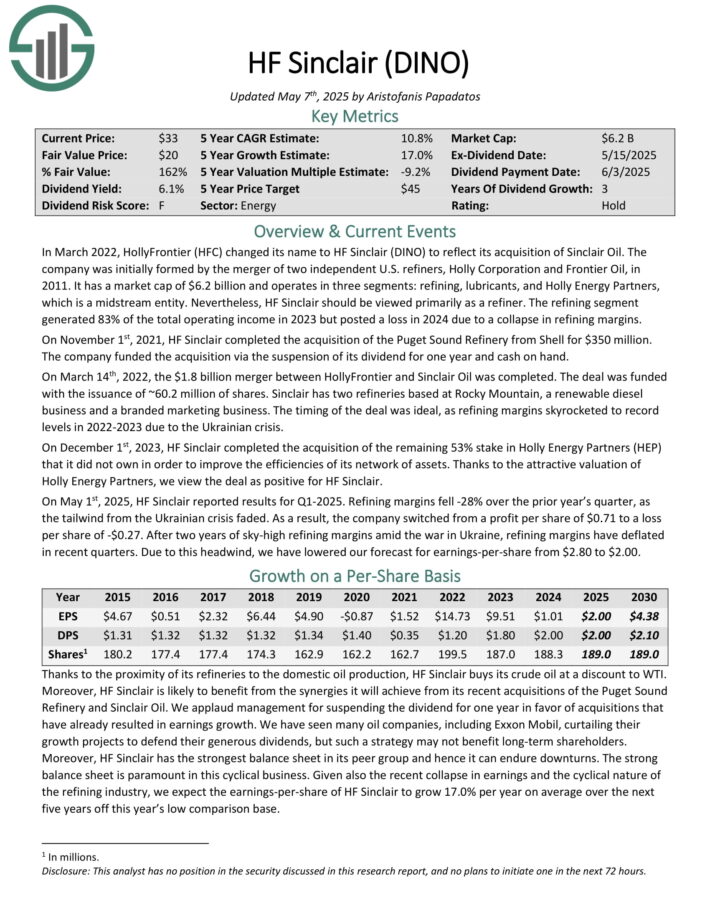

Overvalued Dividend Stock #7: HF Sinclair (DINO)

Annual Valuation Return: -15.3%

HF Sinclair was initially formed by the merger of two independent U.S. refiners, Holly Corporation and Frontier Oil, in2011. It operates in three segments: refining, lubricants, and Holly Energy Partners, which is a midstream entity.

HF Sinclair should be viewed primarily as a refiner. The refining segment generated 83% of the total operating income in 2023 but posted a loss in 2024 due to a collapse in refining margins.

On May 1st, 2025, HF Sinclair reported results for Q1-2025. Refining margins fell -28% over the prior year’s quarter, as the tailwind from the Ukrainian crisis faded. As a result, the company switched from a profit per share of $0.71 to a loss per share of -$0.27.

Thanks to the proximity of its refineries to the domestic oil production, HF Sinclair buys its crude oil at a discount to WTI.

Moreover, HF Sinclair is likely to benefit from the synergies it will achieve from its recent acquisitions of the Puget Sound Refinery and Sinclair Oil.

HF Sinclair has the strongest balance sheet in its peer group and it can endure downturns. The strong balance sheet is paramount in this cyclical business.

Click here to download our most recent Sure Analysis report on DINO (preview of page 1 of 3 shown below):

Overvalued Dividend Stock #6: Constellation Energy (CEG)

Annual Valuation Return: -15.3%

Constellation Energy Corporation was spun off from Exelon Corporation on February 1st, 2022. Constellation Energy provides clean and sustainable energy solutions to homes, commercial businesses, and wholesale customers such as municipalities and cooperatives.

The company’s energy products include electric, natural gas, and renewables and markets such products to companies of all sizes.

Constellation Energy operates 13 nuclear plants with a combined 21 gigawatts of capacity. The company operates in the lower 48 U.S. states, Canada, and the United Kingdom.

On January 10th, 2025, the company announced that it had agreed to purchase Calpine Corp. using a mix of cash and stock. This transaction will make Constellation Energy the largest clean energy provider in the U.S.

On May 6th, 2025, Constellation Energy reported first quarter results for the period ending March 31st, 2025. For the quarter, revenue grew 8.6% to $6.69 billion, which was $1.35 billion above estimates.

On an adjusted basis, earnings-per-share totaled $2.14, which compared favorably to adjusted earnings-per-share of $1.82 in the prior year, but was $0.08 below expectations.

Constellation Energy’s nuclear fleet produced 45,582 gigawatt-hours in the first quarter, up from 45,391 gigawatt-hours in the prior year. Nuclear plants achieved a 94.1% capacity factor, compared to 93.3% in Q1 2024.

Click here to download our most recent Sure Analysis report on CEG (preview of page 1 of 3 shown below):

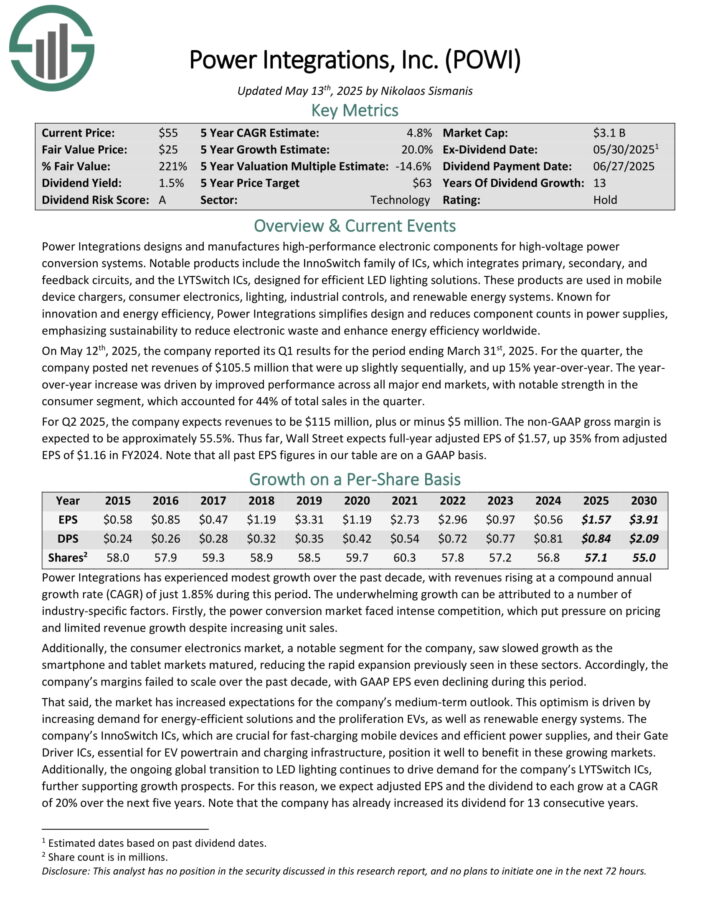

Overvalued Dividend Stock #5: Power Integrations Inc. (POWI)

Annual Valuation Return: -15.5%

Power Integrations designs and manufactures high-performance electronic components for high-voltage power conversion systems.

Notable products include the InnoSwitch family of ICs, which integrates primary, secondary, and feedback circuits, and the LYTSwitch ICs, designed for efficient LED lighting solutions.

These products are used in mobile device chargers, consumer electronics, lighting, industrial controls, and renewable energy systems.

On May 12th, 2025, the company reported its Q1 results for the period ending March 31st, 2025. For the quarter, the company posted net revenues of $105.5 million that were up slightly sequentially, and up 15% year-over-year.

The year-over-year increase was driven by improved performance across all major end markets, with notable strength in the consumer segment, which accounted for 44% of total sales in the quarter.

Click here to download our most recent Sure Analysis report on POWI (preview of page 1 of 3 shown below):

Overvalued Dividend Stock #4: Hyster Yale (HY)

Annual Valuation Return: -15.8%

Hyster-Yale Materials Handling was founded in 1985 and has since become a prominent global player in the materials handling industry.

The company designs, manufactures, and sells a comprehensive range of lift trucks and aftermarket parts, serving diverse customers across various sectors, including manufacturing, warehousing, and logistics.

The company segments its revenue primarily into three categories: new equipment sales, parts sales, and service revenues.

On May 6th, 2025, the company announced results for the first quarter of 2025. The company reported Q1 non-GAAP EPS of $0.49, in-line with analysts’ estimates, and produced revenue of $910.4 million, which was down 14.1% year-over-year.

Hyster-Yale opened the year with Q1 2025 consolidated revenues of $910 million, down 14% from last year, as softer lift truck demand carried over from late 2024.

Net income dipped to $8.6 million compared to $51.5 million a year ago, as lower production volumes and cost pressures weighed on margins. Inventory levels improved, down $69 million versus Q1 2024, showing early progress in aligning production with current demand trends.

Encouragingly, the lift truck segment saw a notable rebound in bookings, up 13% year-over-year and 48% sequentially, driven by strength in the Americas and EMEA.

Click here to download our most recent Sure Analysis report on HY (preview of page 1 of 3 shown below):

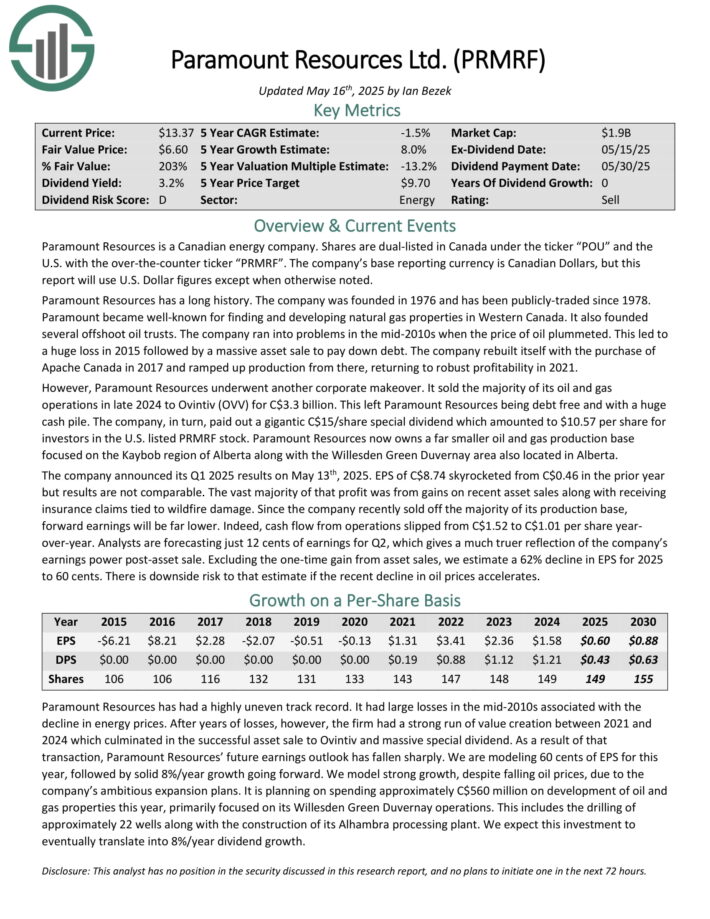

Overvalued Dividend Stock #3: Paramount Resources Ltd. (PRMRF)

Annual Valuation Return: -16.0%

Paramount Resources is a Canadian energy company. Paramount Resources has a long history. The company was founded in 1976 and has been publicly-traded since 1978.

Paramount Resources now owns a far smaller oil and gas production base focused on the Kaybob region of Alberta along with the Willesden Green Duvernay area also located in Alberta.

The company announced its Q1 2025 results on May 13th, 2025. EPS of C$8.74 skyrocketed from C$0.46 in the prior year but results are not comparable. The vast majority of that profit was from gains on recent asset sales along with receiving insurance claims tied to wildfire damage.

Since the company recently sold off the majority of its production base, forward earnings will be far lower. Indeed, cash flow from operations slipped from C$1.52 to C$1.01 per share year-over-year.

Analysts are forecasting just 12 cents of earnings for Q2, which gives a much truer reflection of the company’s earnings power post-asset sale.

Click here to download our most recent Sure Analysis report on PRMRF (preview of page 1 of 3 shown below):

Overvalued Dividend Stock #2: Wingstop Inc. (WING)

Annual Valuation Return: -16.1%

Wingstop is headquartered in Addison, Texas and franchises and operates restaurants under the Wingstop brand.

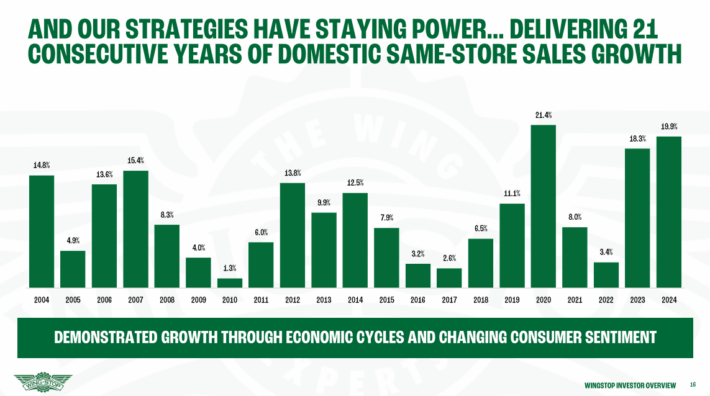

The company has a long track record of high growth.

Source: Investor Presentation

On April 30, 2025, Wingstop Inc. reported its financial results for the fiscal first quarter ended March 29, 2025. Thecompany achieved total revenue of $171.1 million, marking a 17.4% increase compared to the same period in 2024.

System-wide sales grew by 15.7% to $1.3 billion, driven by a record 126 net new restaurant openings, representing an 18% net new unit growth. Domestic same-store sales experienced a modest increase of 0.5%, while company-owned domestic same-store sales grew by 1.4%.

Net income surged by 221% to $92.3 million, or $3.24 per diluted share, primarily due to a $97.2 million gain from the sale of Wingstop’s non-controlling interest in its United Kingdom master franchisee, Lemon Pepper Holdings, Ltd.

Adjusted net income stood at $28.3 million, or $0.99 per diluted share, surpassing analyst expectations of $0.87 per share. Adjusted EBITDA increased by 18.4% year-over-year to $59.5 million.

Click here to download our most recent Sure Analysis report on WING (preview of page 1 of 3 shown below):

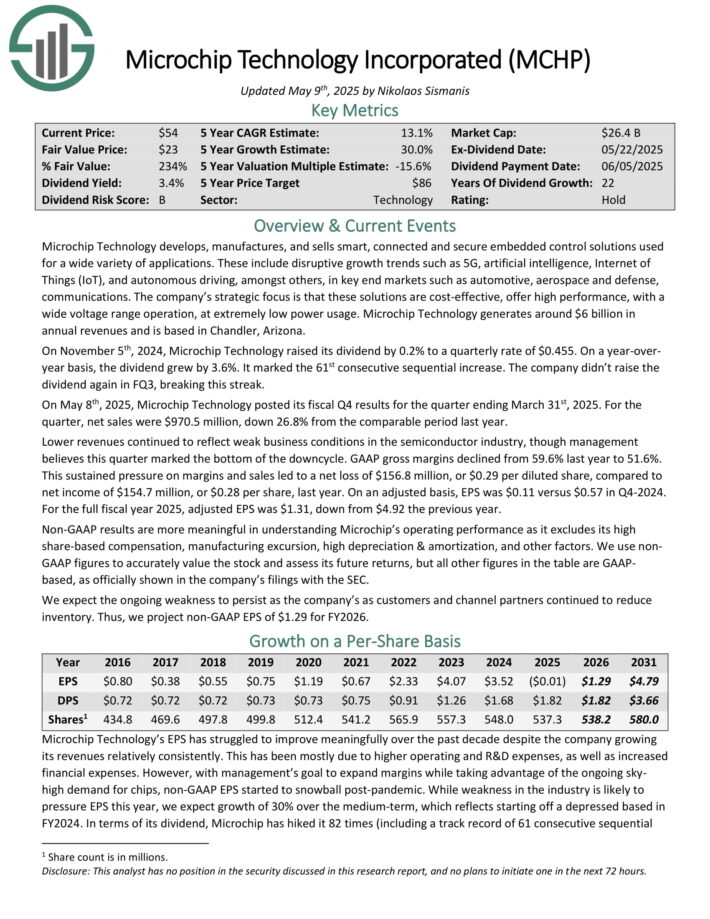

Overvalued Dividend Stock #1: Microchip Technology (MCHP)

Annual Valuation Return: -20.9%

Microchip Technology develops, manufactures, and sells smart, connected and secure embedded control solutions used for a wide variety of applications.

These include disruptive growth trends such as 5G, artificial intelligence, Internet of Things (IoT), and autonomous driving, amongst others, in key end markets such as automotive, aerospace and defense, communications.

Microchip Technology generates around $6 billion in annual revenues and is based in Chandler, Arizona.

On May 8th, 2025, Microchip Technology posted its fiscal Q4 results for the quarter ending March 31st, 2025. For the quarter, net sales were $970.5 million, down 26.8% from the comparable period last year.

Lower revenues continued to reflect weak business conditions in the semiconductor industry, though management believes this quarter marked the bottom of the downcycle. GAAP gross margins declined from 59.6% last year to 51.6%.

This sustained pressure on margins and sales led to a net loss of $156.8 million, or $0.29 per diluted share, compared to net income of $154.7 million, or $0.28 per share, last year. On an adjusted basis, EPS was $0.11 versus $0.57 in Q4-2024.

Click here to download our most recent Sure Analysis report on MCHP (preview of page 1 of 3 shown below):

Final Thoughts

The stock market has been on a nearly uninterrupted rally since the Great Recession. After a brief downturn during the coronavirus pandemic, the stock market has once again raced to record highs.

As a result, the S&P 500 is now markedly overvalued according to several valuation metrics, such as the Shiller P/E ratio.

Therefore, risk-averse income investors should be wary of overvalued dividend stocks such as the 10 in this article.

If you are interested in finding high-quality dividend growth stocks and/or other high-yield securities and income securities, the following Sure Dividend resources will be useful:

High-Yield Individual Security Research

Other Sure Dividend Resources

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].