Published on November 25th, 2025 by Bob Ciura

The dividend payout ratio is simply a company’s annual per-share dividend, divided by the company’s annual earnings-per-share. It is a measure of the level of earnings a company distributes to its shareholders via dividends.

The payout ratio is a valuable investing metric because it differentiates the safest dividend stocks that have low payout ratios that room for dividend growth, from companies with high payout ratios whose dividends may not be sustainable.

Indeed, research has shown that companies with higher dividend growth have outperformed companies with lower dividend growth or no dividend growth.

Investors can screen for low payout ratio dividend stocks that also have high dividend yields.

You can download your copy of the high dividend stocks list below:

This article will list 10 low payout ratio dividend stocks with high yields above 5%, making them attractive options for income investors looking for a combination of high income and dividend safety.

The stocks are listed below according to their payout ratio, in ascending order.

Table of Contents

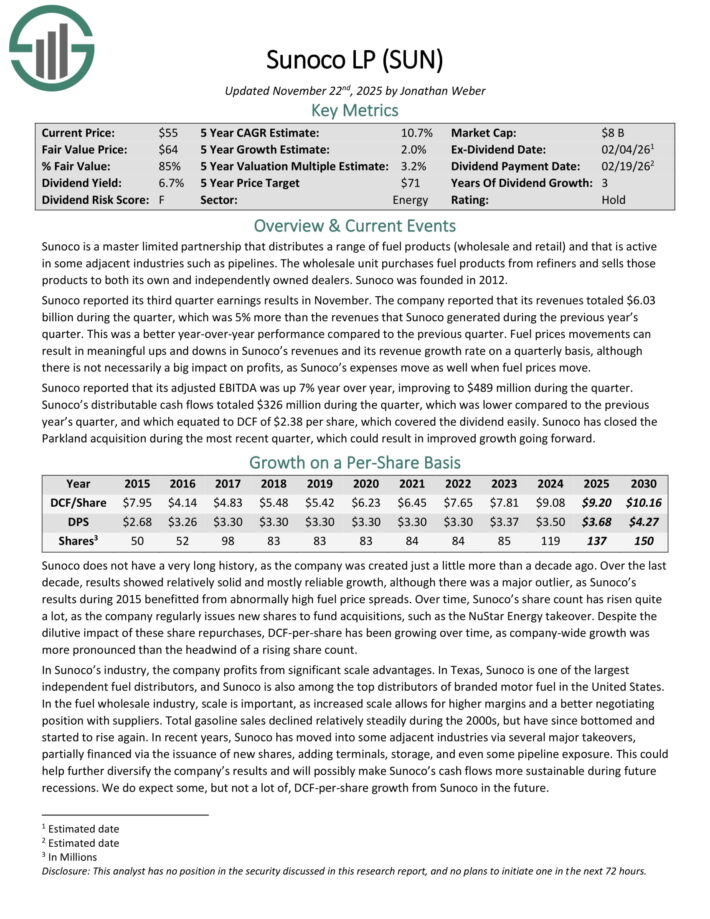

Low Payout Ratio High Dividend Stock #10: Sunoco LP (SUN)

Dividend Yield: 6.6%

Payout Ratio: 40.0%

Sunoco is a master limited partnership that distributes a range of fuel products (wholesale and retail) and that is active in some adjacent industries such as pipelines.

The wholesale unit purchases fuel products from refiners and sells those products to both its own and independently owned dealers.

Sunoco reported its third quarter earnings results in November. The company reported that its revenues totaled $6.03 billion during the quarter, which was 5% more than the revenues that Sunoco generated during the previous year’s quarter. This was a better year-over-year performance compared to the previous quarter.

Fuel prices movements can result in meaningful ups and downs in Sunoco’s revenues and its revenue growth rate on a quarterly basis, although there is not necessarily a big impact on profits, as Sunoco’s expenses move as well when fuel prices move.

Sunoco reported that its adjusted EBITDA was up 7% year over year, improving to $489 million during the quarter. Distributable cash flows totaled $326 million during the quarter, which was lower compared to the previous year’s quarter, and which equated to DCF of $2.38 per share, which covered the dividend easily.

Sunoco has closed the Parkland acquisition during the most recent quarter, which could result in improved growth going forward..

Click here to download our most recent Sure Analysis report on SUN (preview of page 1 of 3 shown below):

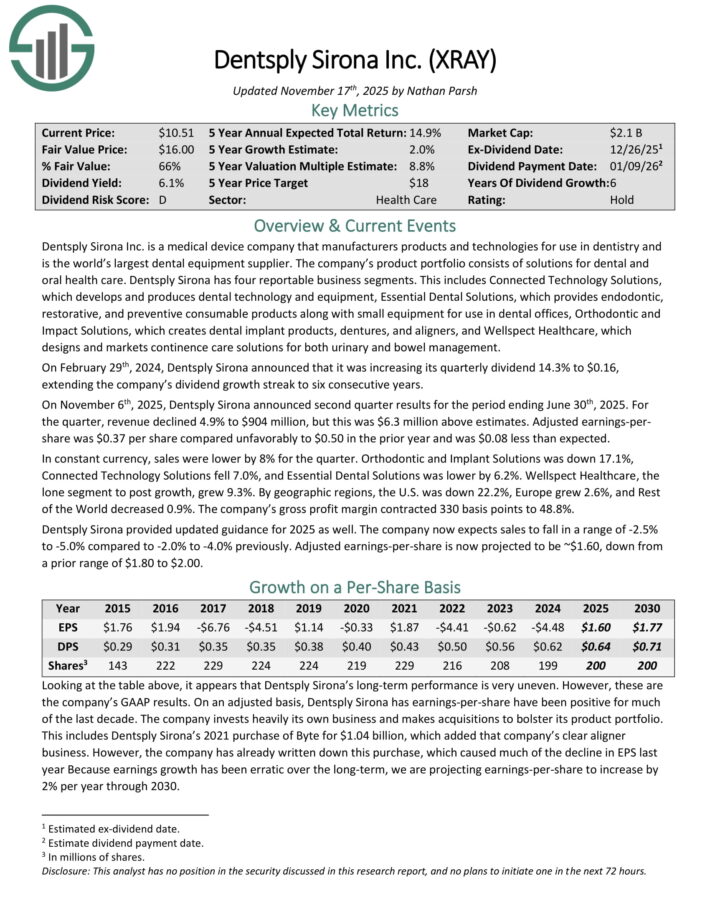

Low Payout Ratio High Dividend Stock #9: DENTSPLY Sirona (XRAY)

Dividend Yield: 6.0%

Payout Ratio: 40.0%

Dentsply Sirona is a medical device company that manufacturers products and technologies for use in dentistry and is the world’s largest dental equipment supplier. The company’s product portfolio consists of solutions for dental and oral health care. Dentsply Sirona has four reportable business segments.

This includes Connected Technology Solutions, which develops and produces dental technology and equipment, and Essential Dental Solutions, which provides endodontic, restorative, and preventive consumable products along with small equipment for use in dental offices.

Other business segments include Orthodontic and Impact Solutions, which creates dental implant products, dentures, and aligners, and Wellspect Healthcare, which designs and markets continence care solutions for both urinary and bowel management.

On November 6th, 2025, Dentsply Sirona announced second quarter results for the period ending June 30th, 2025. For the quarter, revenue declined 4.9% to $904 million, but this was $6.3 million above estimates. Adjusted earnings-per-share was $0.37 per share compared unfavorably to $0.50 in the prior year and was $0.08 less than expected.

In constant currency, sales were lower by 8% for the quarter. Orthodontic and Implant Solutions was down 17.1%, Connected Technology Solutions fell 7.0%, and Essential Dental Solutions was lower by 6.2%.

Wellspect Healthcare, the lone segment to post growth, grew 9.3%. By geographic regions, the U.S. was down 22.2%, Europe grew 2.6%, and Rest of the World decreased 0.9%. The company’s gross profit margin contracted 330 basis points to 48.8%.

Dentsply Sirona provided updated guidance for 2025 as well. The company now expects sales to fall in a range of -2.5% to -5.0% compared to -2.0% to -4.0% previously. Adjusted earnings-per-share is now projected to be ~$1.60, down from a prior range of $1.80 to $2.00.

Click here to download our most recent Sure Analysis report on XRAY (preview of page 1 of 3 shown below):

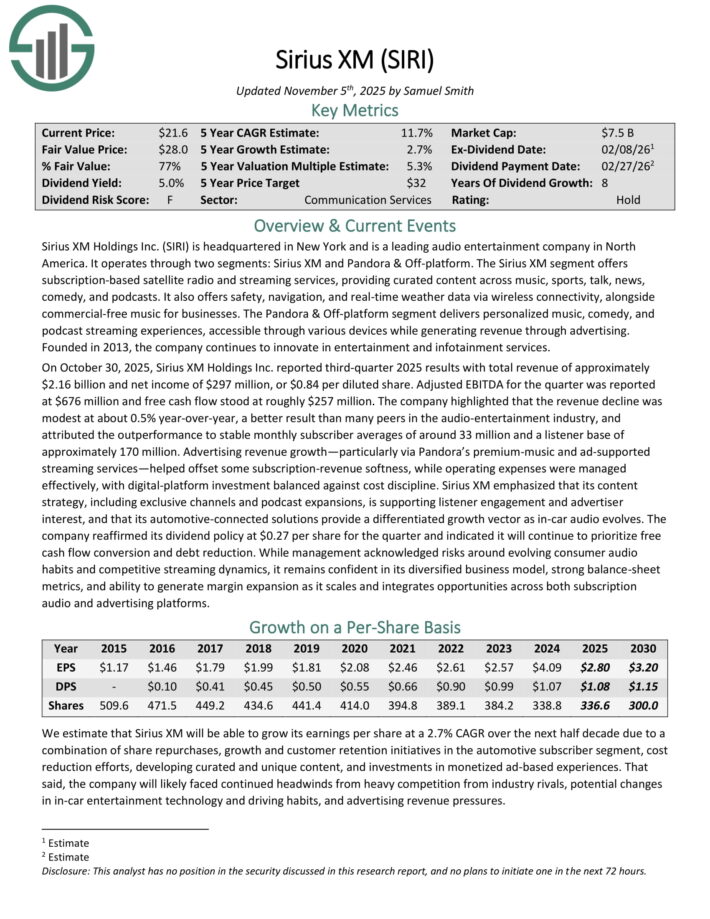

Low Payout Ratio High Dividend Stock #8: Sirius XM Holdings (SIRI)

Dividend Yield: 5.2%

Payout Ratio: 38.6%

Sirius XM Holdings is a leading audio entertainment company in North America. It operates through two segments: Sirius XM and Pandora & Off-platform.

The Sirius XM segment offers subscription-based satellite radio and streaming services, providing curated content across music, sports, talk, news, comedy, and podcasts.

It also offers safety, navigation, and real-time weather data via wireless connectivity, alongside commercial-free music for businesses.

The Pandora & Off-platform segment delivers personalized music, comedy, and podcast streaming experiences, accessible through various devices while generating revenue through advertising.

On October 30, 2025, Sirius XM Holdings Inc. reported third-quarter 2025 results with total revenue of approximately $2.16 billion and net income of $297 million, or $0.84 per diluted share. Adjusted EBITDA for the quarter was reported at $676 million and free cash flow stood at roughly $257 million.

Advertising revenue growth—particularly via Pandora’s premium-music and ad-supported streaming services—helped offset some subscription-revenue softness, while operating expenses were managed effectively, with digital-platform investment balanced against cost discipline.

The company reaffirmed its dividend policy at $0.27 per share for the quarter and indicated it will continue to prioritize free cash flow conversion and debt reduction.

Click here to download our most recent Sure Analysis report on SIRI (preview of page 1 of 3 shown below):

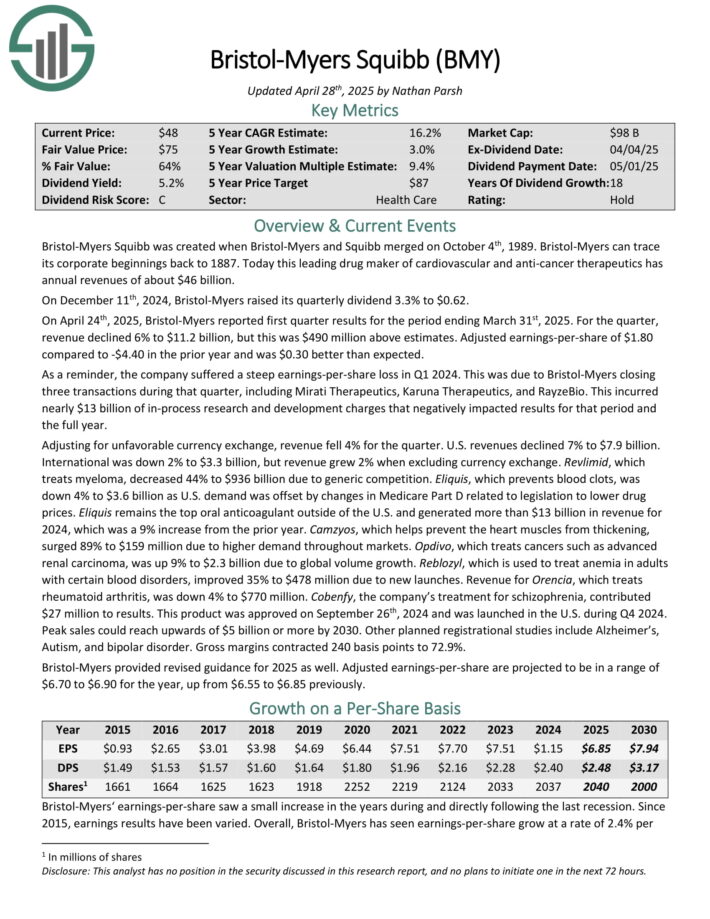

Low Payout Ratio High Dividend Stock #7: Bristol-Myers Squibb (BMY)

Dividend Yield: 5.2%

Payout Ratio: 38.2%

Bristol-Myers Squibb is a leading drug maker of cardiovascular and anti-cancer therapeutics, and has annual revenues of about $46 billion.

On October 30th, 2025, Bristol-Myers reported third quarter results for the period ending September 30th, 2025. For the quarter, revenue grew 2.8% to $12.2 billion, which was $420 million above estimates. Adjusted earnings-per-share of $1.63 compared unfavorably to $1.80 in the prior year, but this was $0.11 more than expected.

Excluding currency exchange, sales were up 2%. U.S. revenues grew 1% to $8.3 billion. International grew 6% to $3.9 billion, but revenue was up 3% when excluding currency exchange.

Eliquis, which prevents blood clots, grew 25% to $3.75 billion as demand was strong for the product. Eliquis remains the top oral anticoagulant outside of the U.S. and generated more than $13 billion in revenue for 2024, which was a 9% increase from the prior year.

Opdivo, which treats cancers such as advanced renal carcinoma, was higher by 7% to $2.5 billion as global demand remains high.

Bristol-Myers provided revised guidance for 2025 as well. Adjusted earnings-per-share are now projected to be in a range of $6.40 to $6.60 for the year.

Click here to download our most recent Sure Analysis report on BMY (preview of page 1 of 3 shown below):

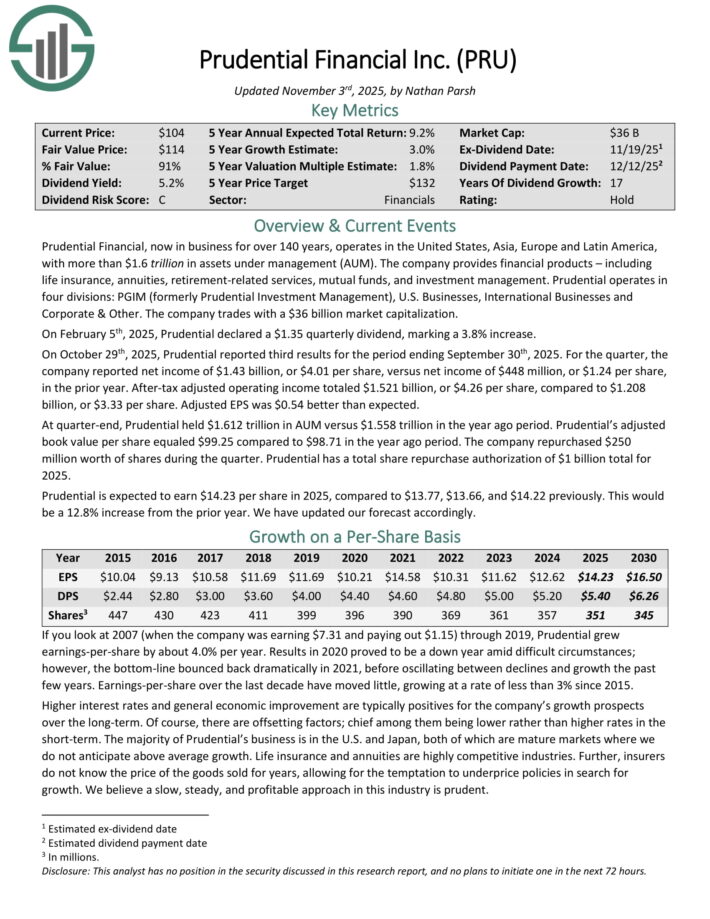

Low Payout Ratio High Dividend Stock #6: Prudential Financial (PRU)

Dividend Yield: 5.0%

Payout Ratio: 37.9%

Prudential Financial, now in business for over 140 years, operates in the United States, Asia, Europe and Latin America, with more than $1.5 trillion in assets under management (AUM).

The company provides financial products – including life insurance, annuities, retirement-related services, mutual funds, and investment management.

Prudential operates in four divisions: PGIM (formerly Prudential Investment Management), U.S. Businesses, International Businesses and Corporate & Other.

On October 29th, 2025, Prudential reported third results. For the quarter, the company reported net income of $1.43 billion, or $4.01 per share, versus net income of $448 million, or $1.24 per share, in the prior year.

After-tax adjusted operating income totaled $1.521 billion, or $4.26 per share, compared to $1.208 billion, or $3.33 per share. Adjusted EPS was $0.54 better than expected.

At quarter-end, Prudential held $1.612 trillion in AUM versus $1.558 trillion in the year ago period. Prudential’s adjusted book value per share equaled $99.25 compared to $98.71 in the year ago period.

The company repurchased $250 million worth of shares during the quarter. Prudential has a total share repurchase authorization of $1 billion total for 2025.

Click here to download our most recent Sure Analysis report on PRU (preview of page 1 of 3 shown below):

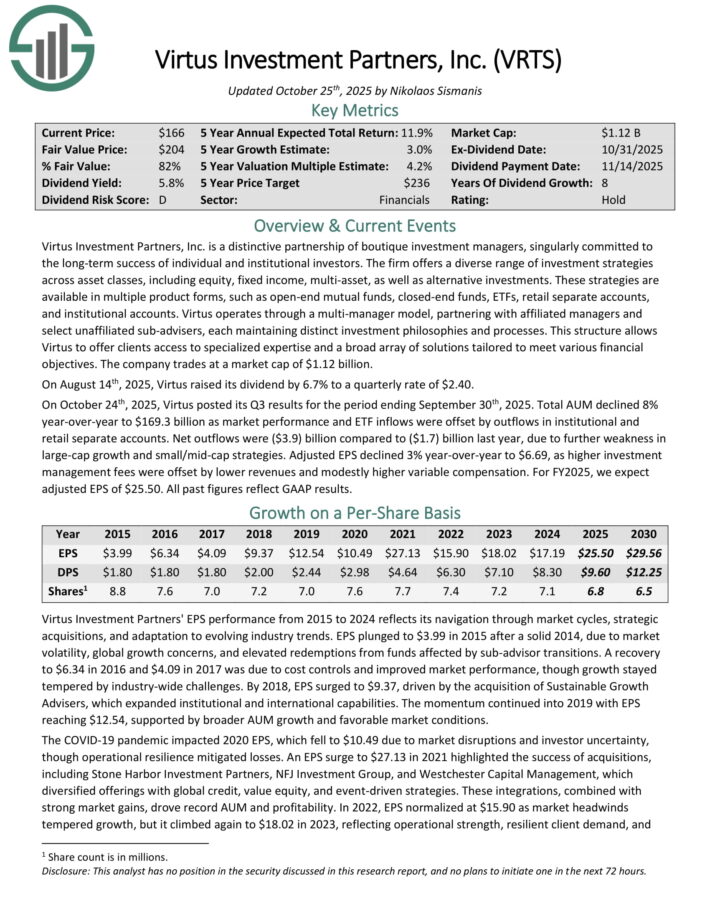

Low Payout Ratio High Dividend Stock #5: Virtus Investment Partners (VRTS)

Dividend Yield: 6.2%

Payout Ratio: 37.6%

Virtus Investment Partners, Inc. is a distinctive partnership of boutique investment managers. The firm offers a diverse range of investment strategies across asset classes, including equity, fixed income, multi-asset, as well as alternative investments.

These strategies are available in multiple product forms, such as open-end mutual funds, closed-end funds, ETFs, retail separate accounts, and institutional accounts.

Virtus operates through a multi-manager model, partnering with affiliated managers and select unaffiliated sub-advisers, each maintaining distinct investment philosophies and processes.

This structure allows Virtus to offer clients access to specialized expertise and a broad array of solutions tailored to meet various financial objectives.

On October 24th, 2025, Virtus posted its Q3 results for the period ending September 30th, 2025. Total AUM declined 8% year-over-year to $169.3 billion as market performance and ETF inflows were offset by outflows in institutional and retail separate accounts.

Net outflows were ($3.9) billion compared to ($1.7) billion last year, due to further weakness in large-cap growth and small/mid-cap strategies. Adjusted EPS declined 3% year-over-year to $6.69.

Click here to download our most recent Sure Analysis report on VRTS (preview of page 1 of 3 shown below):

Low Payout Ratio High Dividend Stock #4: Sonoco Products (SON)

Dividend Yield: 5.2%

Payout Ratio: 37.2%

Bristol-Myers Squibb was created when Bristol-Myers and Squibb merged on October 4th, 1989. This leading drug maker of cardiovascular and anti-cancer therapeutics has annual revenues of about $46 billion.

On December 11th, 2024, Bristol-Myers raised its quarterly dividend 3.3% to $0.62.

On April 24th, 2025, Bristol-Myers reported first quarter results for the period ending March 31st, 2025. For the quarter, revenue declined 6% to $11.2 billion, but this was $490 million above estimates.

Adjusted earnings-per-share of $1.80 compared to -$4.40 in the prior year and was $0.30 better than expected. The company suffered a steep earnings-per-share loss in Q1 2024.

Adjusting for unfavorable currency exchange, revenue fell 4% for the quarter. U.S. revenues declined 7% to $7.9 billion. International was down 2% to $3.3 billion, but revenue grew 2% when excluding currency exchange.

Revlimid, which treats myeloma, decreased 44% to $936 billion due to generic competition.

Bristol-Myers provided revised guidance for 2025 as well. Adjusted earnings-per-share are projected to be in a range of $6.70 to $6.90 for the year, up from $6.55 to $6.85 previously.

Click here to download our most recent Sure Analysis report on BMY (preview of page 1 of 3 shown below):

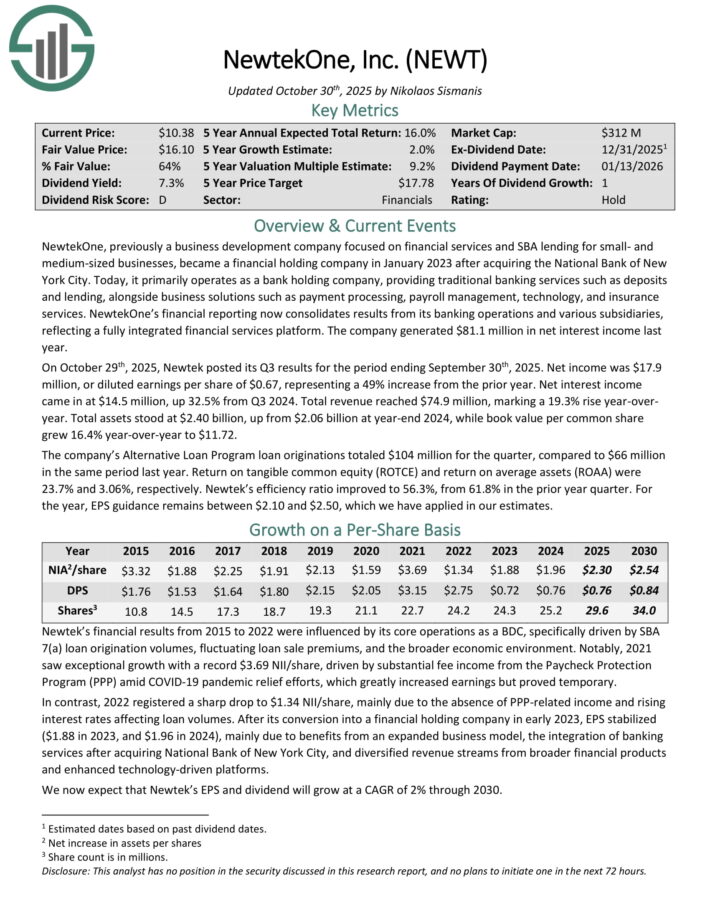

Low Payout Ratio High Dividend Stock #3: NewtekOne Inc. (NEWT)

Dividend Yield: 7.4%

Payout Ratio: 33.0%

NewtekOne, previously a business development company focused on financial services and SBA lending for small- and medium-sized businesses, became a financial holding company in January 2023 after acquiring the National Bank of New York City.

Today, it primarily operates as a bank holding company, providing traditional banking services such as deposits and lending, alongside business solutions such as payment processing, payroll management, technology, and insurance services.

NewtekOne’s financial reporting now consolidates results from its banking operations and various subsidiaries, reflecting a fully integrated financial services platform. The company generated $81.1 million in net interest income last year.

On October 29th, 2025, Newtek posted its Q3 results. Net income was $17.9 million, or diluted earnings per share of $0.67, representing a 49% increase from the prior year. Net interest income came in at $14.5 million, up 32.5% from Q3 2024.

Total revenue reached $74.9 million, marking a 19.3% rise year-over-year. Total assets stood at $2.40 billion, up from $2.06 billion at year-end 2024, while book value per common share grew 16.4% year-over-year to $11.72.

The company’s Alternative Loan Program loan originations totaled $104 million for the quarter, compared to $66 million in the same period last year. Return on tangible common equity (ROTCE) and return on average assets (ROAA) were 23.7% and 3.06%, respectively.

Click here to download our most recent Sure Analysis report on NEWT (preview of page 1 of 3 shown below):

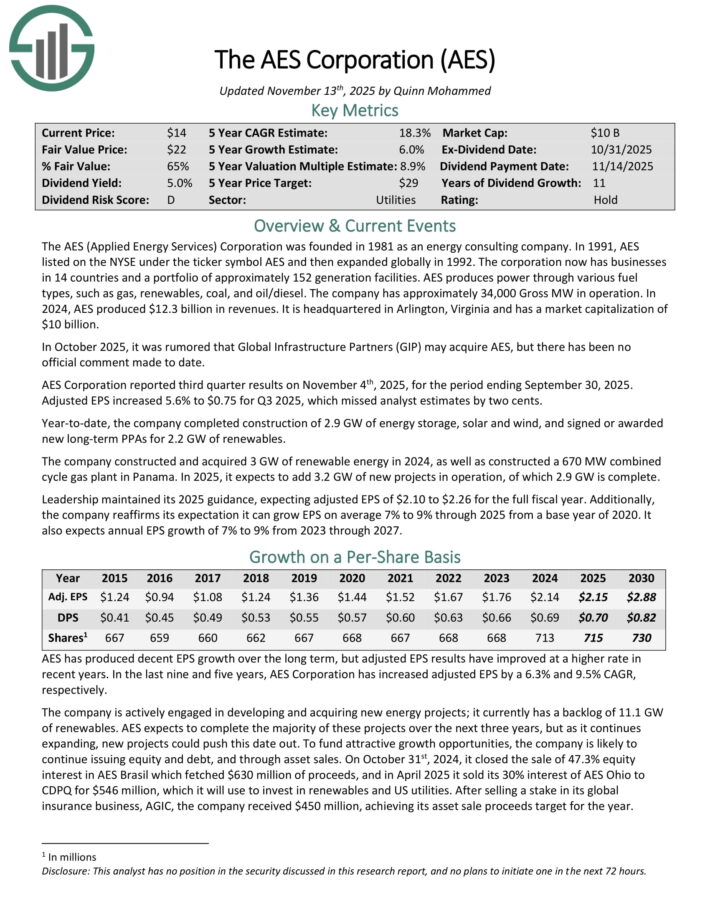

Low Payout Ratio High Dividend Stock #2: AES Corp. (AES)

Dividend Yield: 5.1%

Payout Ratio: 32.6%

AES is a utility stock with businesses in 14 countries and a portfolio of approximately 152 generation facilities. AES produces power through various fuel types, such as gas, renewables, coal, and oil/diesel.

The company has approximately 34,000 Gross MW in operation. In 2024, AES produced $12.3 billion in revenues.

AES Corporation reported third quarter results on November 4th, 2025, for the period ending September 30, 2025. Adjusted EPS increased 5.6% to $0.75 for Q3 2025, which missed analyst estimates by two cents.

Year-to-date, the company completed construction of 2.9 GW of energy storage, solar and wind, and signed or awarded new long-term PPAs for 2.2 GW of renewables.

The company constructed and acquired 3 GW of renewable energy in 2024, as well as constructed a 670 MW combined cycle gas plant in Panama. In 2025, it expects to add 3.2 GW of new projects in operation, of which 2.9 GW is complete.

Leadership maintained its 2025 guidance, expecting adjusted EPS of $2.10 to $2.26 for the full fiscal year.

Additionally, the company reaffirms its expectation it can grow EPS on average 7% to 9% through 2025 from a base year of 2020. It also expects annual EPS growth of 7% to 9% from 2023 through 2027.

Click here to download our most recent Sure Analysis report on AES (preview of page 1 of 3 shown below):

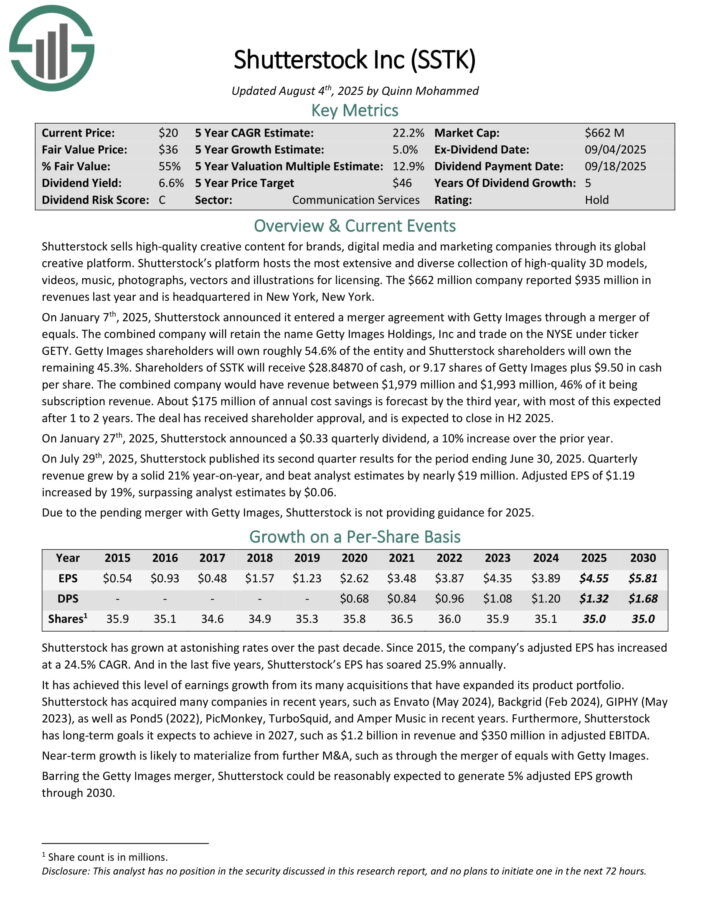

Low Payout Ratio High Dividend Stock #1: Shutterstock Inc. (SSTK)

Dividend Yield: 6.5%

Payout Ratio: 29.7%

Shutterstock sells high-quality creative content for brands, digital media and marketing companies through its global creative platform.

Its platform hosts the most extensive and diverse collection of high-quality 3D models, videos, music, photographs, vectors and illustrations for licensing. The company reported $935 million in revenues last year.

On January 7th, 2025, Shutterstock announced it entered a merger agreement with Getty Images through a merger of equals. The combined company will retain the name Getty Images Holdings, Inc and trade on the NYSE under ticker GETY.

Getty Images shareholders will own roughly 54.6% of the entity and Shutterstock shareholders will own the remaining 45.3%. Shareholders of SSTK will receive $28.84870 of cash, or 9.17 shares of Getty Images plus $9.50 in cash per share.

The combined company would have revenue between $1,979 million and $1,993 million, 46% of it being subscription revenue. About $175 million of annual cost savings is forecast by the third year, with most of this expected after 1 to 2 years.

On July 29th, 2025, Shutterstock published its second quarter results for the period ending June 30, 2025. Quarterly revenue grew by a solid 21% year-on-year, and beat analyst estimates by nearly $19 million. Adjusted EPS of $1.19 increased by 19%, surpassing analyst estimates by $0.06.

Click here to download our most recent Sure Analysis report on SSTK (preview of page 1 of 3 shown below):

Additional Reading

Investors looking for more of the safest dividend stocks may find the following resources useful:

The Dividend Aristocrats List: S&P 500 stocks with 25+ years of rising dividends.

The Dividend Kings List is even more exclusive than the Dividend Aristocrats. It is comprised of 56 stocks with 50+ years of consecutive dividend increases.

The High Yield Dividend Kings List is comprised of the 20 Dividend Kings with the highest current yields.

The Blue Chip Stocks List: stocks that qualify as Dividend Achievers, Dividend Aristocrats, and/or Dividend Kings

The High Dividend Stocks List: stocks that appeal to investors interested in the highest yields of 5% or more.

The Monthly Dividend Stocks List: stocks that pay dividends every month, for 12 dividend payments per year.

The Dividend Champions List: stocks that have increased their dividends for 25+ consecutive years.Note: Not all Dividend Champions are Dividend Aristocrats because Dividend Aristocrats have additional requirements like being in The S&P 500.

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].