Published on November 18th, 2025 by Bob Ciura

Investors in the US should not overlook Canadian stocks, many of which have high dividend yields than their U.S. counterparts.

There are many Canadian dividend stocks that have significantly higher yields and lower valuations than comparable U.S. peers.

Canadian stocks also offer geographic diversification benefits, which could have appeal for investors looking to broaden their exposure outside the U.S.

This is also true when it comes to Real Estate Investment Trusts, or REITs. While REITs in the United States tend to get nearly all of the coverage in the financial media, there are many high-dividend REITs based in Canada.

You can see out list of 200+ REITs here.

You can download our full list of REITs, along with important metrics such as dividend yields and market capitalizations, by clicking on the link below:

The beauty of REITs for income investors is that they are required to distribute 90% of their taxable income to shareholders annually in the form of dividends. In return, REITs typically do not pay corporate taxes.

As a result, many of the 200+ REITs we track offer high dividend yields of 5%+.

Note: Canada imposes a 15% dividend withholding tax on U.S. investors. In many cases, investing in Canadian stocks through a U.S. retirement account waives the dividend withholding tax from Canada, but check with your tax preparer or accountant for more on this issue.

This article will rank the 10 highest-yielding Canadian REITs in the Sure Analysis Research Database.

Table of Contents

You can instantly jump to any specific section of the article by using the links below:

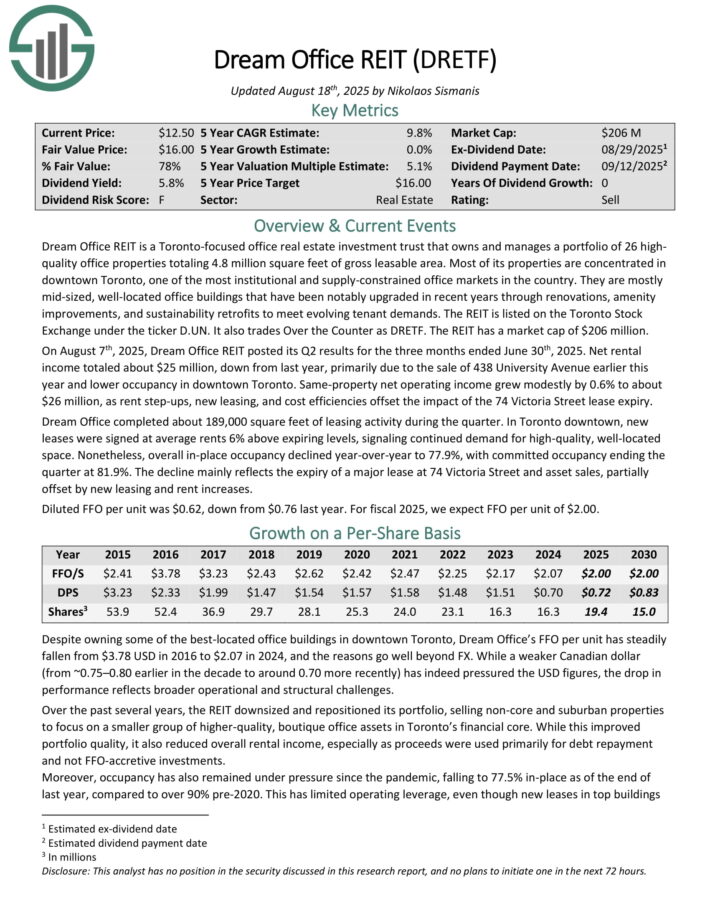

High-Yield REIT Canadian No. 10: Dream Office REIT (DRETF)

Dream Office REIT is a Toronto-focused office real estate investment trust that owns and manages a portfolio of 26 high-quality office properties totaling 4.8 million square feet of gross leasable area. Most of its properties are concentrated in downtown Toronto, one of the most institutional and supply-constrained office markets in the country.

They are mostly mid-sized, well-located office buildings that have been notably upgraded in recent years through renovations, amenity improvements, and sustainability retrofits to meet evolving tenant demands.

On August 7th, 2025, Dream Office REIT posted its Q2 results for the three months ended June 30th, 2025. Net rental income totaled about $25 million, down from last year, primarily due to the sale of 438 University Avenue earlier this year and lower occupancy in downtown Toronto.

Same-property net operating income grew modestly by 0.6% to about $26 million, as rent step-ups, new leasing, and cost efficiencies offset the impact of the 74 Victoria Street lease expiry.

Dream Office completed about 189,000 square feet of leasing activity during the quarter. In Toronto downtown, new leases were signed at average rents 6% above expiring levels, signaling continued demand for high-quality, well-located space.

Nonetheless, overall in-place occupancy declined year-over-year to 77.9%, with committed occupancy ending the quarter at 81.9%. The decline mainly reflects the expiry of a major lease at 74 Victoria Street and asset sales, partially offset by new leasing and rent increases. Diluted FFO per unit was $0.62, down from $0.76 last year.

Click here to download our most recent Sure Analysis report on DRETF (preview of page 1 of 3 shown below):

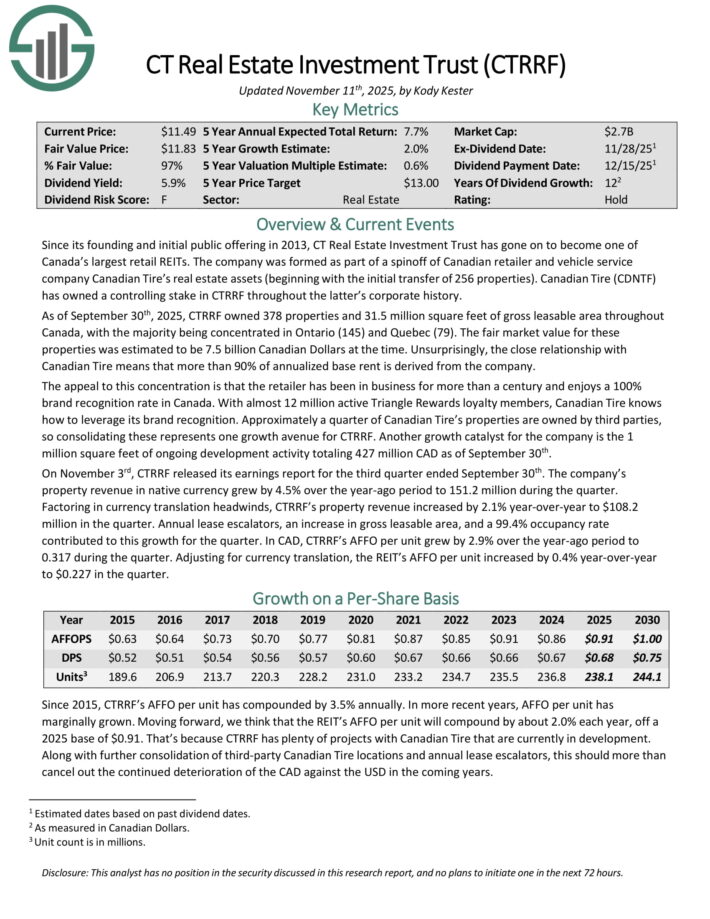

High-Yield Canadian REIT No. 9: CT Real Estate Investment Trust (CTRRF)

CT Real Estate Investment Trust is one of Canada’s largest retail REITs. As of September 30th, 2025, CTRRF owned 378 properties and 31.5 million square feet of gross leasable area throughout Canada, with the majority being concentrated in Ontario (145) and Quebec (79).

The fair market value for these properties was estimated to be 7.5 billion Canadian Dollars at the time.

On November 3rd, CTRRF released its earnings report for the third quarter ended September 30th. The company’s property revenue in native currency grew by 4.5% over the year-ago period to 151.2 million during the quarter.

Factoring in currency translation headwinds, CTRRF’s property revenue increased by 2.1% year-over-year to $108.2 million in the quarter. Annual lease escalators, an increase in gross leasable area, and a 99.4% occupancy rate contributed to this growth for the quarter.

In CAD, CTRRF’s AFFO per unit grew by 2.9% over the year-ago period. Adjusting for currency translation, the REIT’s AFFO per unit increased by 0.4% year-over-year to $0.227 in the quarter.

Click here to download our most recent Sure Analysis report on CTRRF (preview of page 1 of 3 shown below):

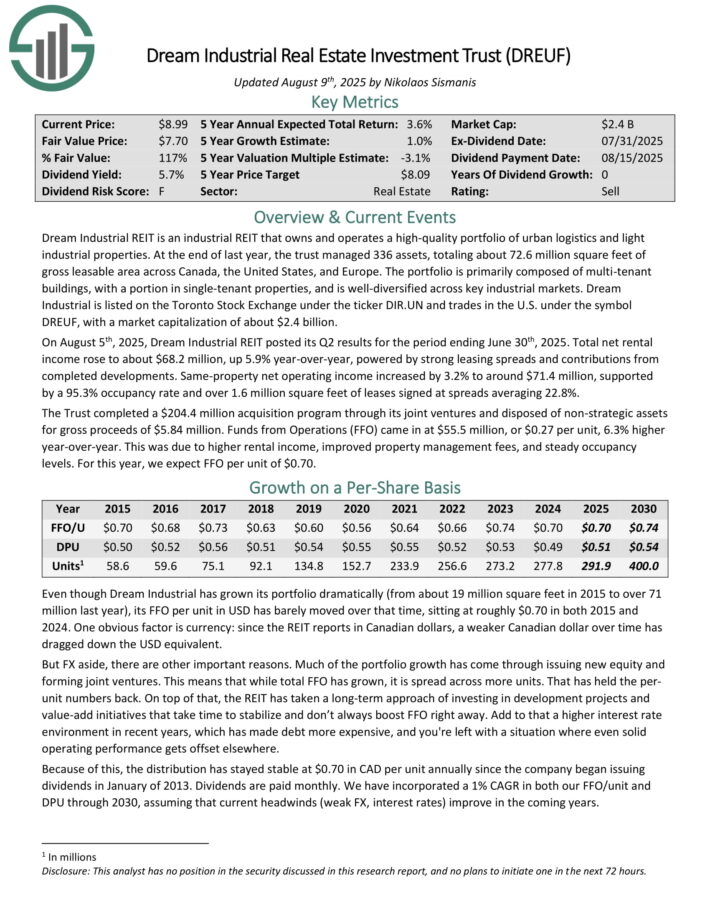

High-Yield Canadian REIT No. 8: Dream Industrial REIT (DREUF)

Dream Industrial REIT is an industrial REIT that owns and operates a high-quality portfolio of urban logistics and light industrial properties.

At the end of last year, the trust managed 336 assets, totaling about 72.6 million square feet of gross leasable area across Canada, the United States, and Europe.

The portfolio is primarily composed of multi-tenant buildings, with a portion in single-tenant properties, and is well-diversified across key industrial markets.

On August 5th, 2025, Dream Industrial REIT posted its Q2 results for the period ending June 30th, 2025. Total net rental income rose to about $68.2 million, up 5.9% year-over-year, powered by strong leasing spreads and contributions from completed developments.

Same-property net operating income increased by 3.2% to around $71.4 million, supported by a 95.3% occupancy rate and over 1.6 million square feet of leases signed at spreads averaging 22.8%.

The Trust completed a $204.4 million acquisition program through its joint ventures and disposed of non-strategic assets for gross proceeds of $5.84 million.

Funds from Operations (FFO) came in at $55.5 million, or $0.27 per unit, 6.3% higher year-over-year. This was due to higher rental income, improved property management fees, and steady occupancy levels.

Click here to download our most recent Sure Analysis report on DREUF (preview of page 1 of 3 shown below):

High-Yield Canadian REIT No. 7: H&R Real Estate Investment Trust (HRUFF)

H&R Real Estate Investment Trust holds a portfolio of 365 properties across Canada and the United States. The portfolio includes 26 residential properties with a total of 8,929 rental units, mainly focused on expanding its presence in the U.S. Sun Belt.

Moreover, the REIT owns 65 industrial properties in Canada and one in the U.S., totaling 8.3 million square feet of space. Additionally, H&R holds 16 office properties across North America, comprising 4.5 million square feet, and 27 retail properties in Canada along with 230 retail properties in the U.S., totaling 4.9 million square feet.

The company’s strategy these days focuses on residential and industrial assets, while reducing its exposure to office and retail sectors.

On August 12th, 2025, H&R Real Estate Investment Trust reported its Q2 results. The REIT posted total rental revenue of $106.0 million for the quarter, a decrease from $111.9 million in Q2 2024. This drop reflects the impact of property dispositions and shifting portfolio composition.

H&R’s Funds from Operations was $40.3 million, compared to $46.0 million in Q2 2024. The decline in FFO was driven by lower net operating income and the impact of asset sales. For the quarter, FFO per share was $0.14.

Click here to download our most recent Sure Analysis report on HRUFF (preview of page 1 of 3 shown below):

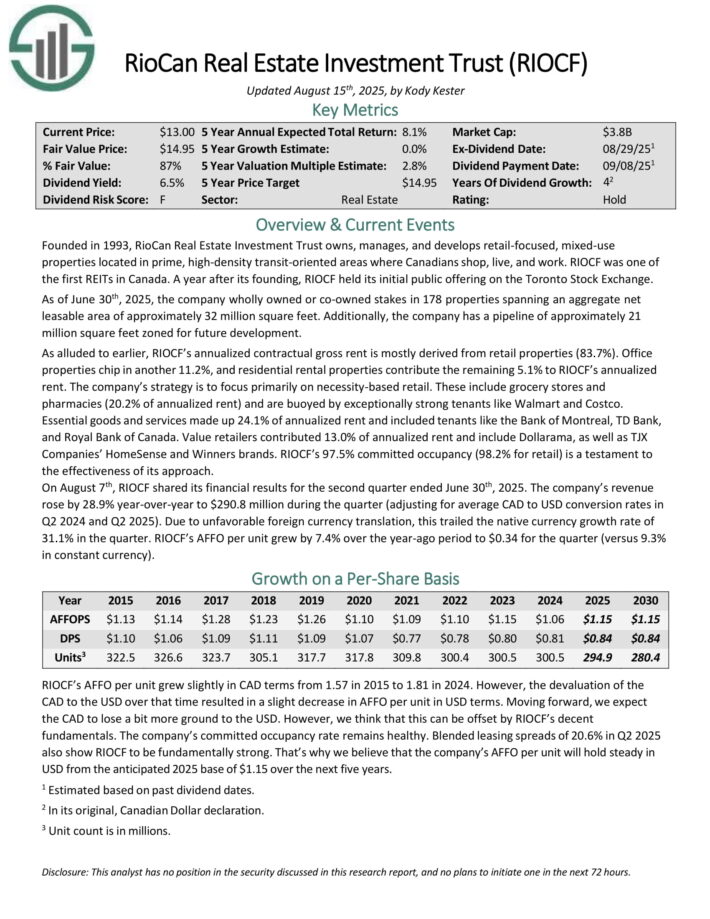

High-Yield Canadian REIT No. 6: RioCan Real Estate Investment Trust (RIOCF)

RioCan Real Estate Investment Trust owns, manages, and develops retail-focused, mixed-use properties located in prime, high-density transit-oriented areas where Canadians shop, live, and work.

As of June 30th, 2025, the company wholly owned or co-owned stakes in 178 properties spanning an aggregate net leasable area of approximately 32 million square feet. Additionally, the company has a pipeline of approximately 21 million square feet zoned for future development.

RIOCF’s annualized contractual gross rent is mostly derived from retail properties (83.7%). Office properties chip in another 11.2%, and residential rental properties contribute the remaining 5.1% to RIOCF’s annualized rent.

The company’s strategy is to focus primarily on necessity-based retail. These include grocery stores and pharmacies (20.0% of annualized rent) and are buoyed by exceptionally strong tenants like Walmart and Costco.

Essential goods and services made up 24.0% of annualized rent and included tenants like the Bank of Montreal, TD Bank, and Royal Bank of Canada. Value retailers contributed 13.0% of annualized rent and include Dollarama, as well as TJX Companies’ HomeSense and Winners brands.

On August 7th, RIOCF shared its financial results for the second quarter ended June 30th, 2025. The company’s revenue rose by 28.9% year-over-year to $290.8 million during the quarter (adjusting for average CAD to USD conversion rates in Q2 2024 and Q2 2025).

Due to unfavorable foreign currency translation, this trailed the native currency growth rate of 31.1% in the quarter. RIOCF’s AFFO per unit grew by 7.4% over the year-ago period to $0.34 for the quarter (versus 9.3% in constant currency).

Click here to download our most recent Sure Analysis report on RIOCF (preview of page 1 of 3 shown below):

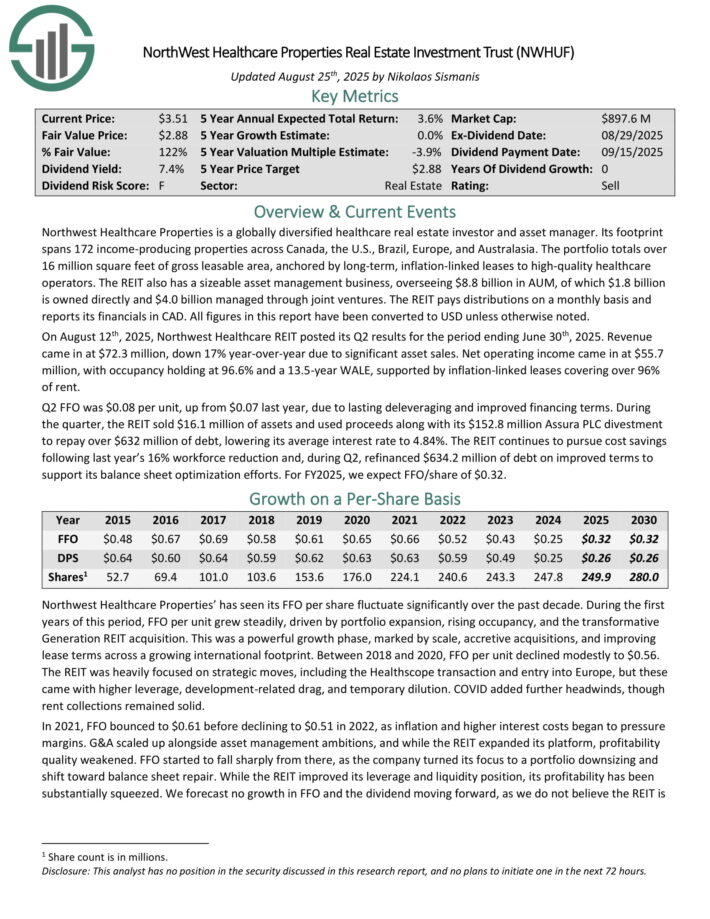

High-Yield Canadian REIT No. 5: NorthWest Healthcare Properties (NWHUF)

Northwest Healthcare Properties is a globally diversified healthcare real estate investor and asset manager. Its footprint spans 172 income-producing properties across Canada, the U.S., Brazil, Europe, and Australasia.

The portfolio totals over 16 million square feet of gross leasable area, anchored by long-term, inflation-linked leases to high-quality healthcare operators.

The REIT also has a sizeable asset management business, overseeing $8.8 billion in AUM, of which $1.8 billion is owned directly and $4.0 billion managed through joint ventures.

On August 12th, 2025, Northwest Healthcare REIT posted its Q2 results for the period ending June 30th, 2025. Revenue came in at $72.3 million, down 17% year-over-year due to significant asset sales.

Net operating income came in at $55.7 million, with occupancy holding at 96.6% and a 13.5-year WALE, supported by inflation-linked leases covering over 96% of rent.

Q2 FFO was $0.08 per unit, up from $0.07 last year, due to lasting deleveraging and improved financing terms. During the quarter, the REIT sold $16.1 million of assets and used proceeds along with its $152.8 million Assura PLC divestment to repay over $632 million of debt, lowering its average interest rate to 4.84%.

The REIT continues to pursue cost savings following last year’s 16% workforce reduction and, during Q2, refinanced $634.2 million of debt on improved terms to support its balance sheet optimization efforts.

Click here to download our most recent Sure Analysis report on NWHUF (preview of page 1 of 3 shown below):

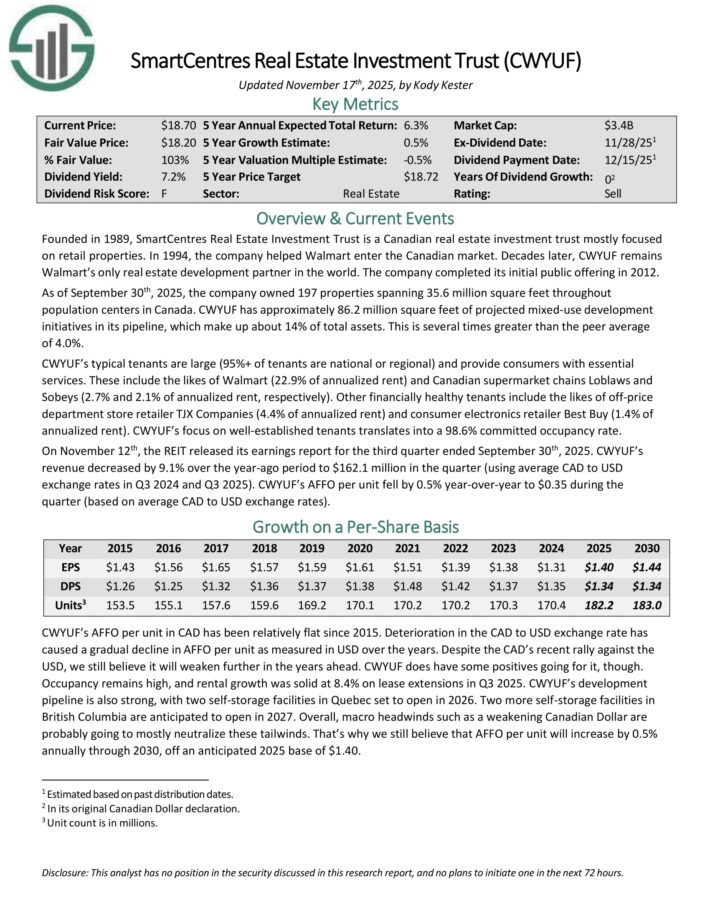

High-Yield Canadian REIT No. 4: SmartCentres Real Estate Investment Trust (CWYUF)

SmartCentres Real Estate Investment Trust is a Canadian real estate investment trust mostly focused on retail properties.

In 1994, the company helped Walmart enter the Canadian market. CWYUF remains Walmart’s only real estate development partner in the world.

As of September 30th, 2025, the company owned 197 properties spanning 35.6 million square feet throughout population centers in Canada.

CWYUF has approximately 86.2 million square feet of projected mixed-use development initiatives in its pipeline, which make up about 14% of total assets. This is several times greater than the peer average of 4.0%.

CWYUF’s typical tenants are large (95%+ of tenants are national or regional) and provide consumers with essential services. These include Walmart (22.9% of annualized rent) and Canadian supermarket chains Loblaws and Sobeys (2.7% and 2.1% of annualized rent, respectively).

Other financially healthy tenants include department store retailer TJX Companies (4.4% of annualized rent) and consumer electronics retailer Best Buy (1.4% of annualized rent).

CWYUF’s focus on well-established tenants translates into a 98.6% committed occupancy rate.

On November 12th, the REIT released its earnings report for the third quarter ended September 30th, 2025. CWYUF’s revenue decreased by 9.1% over the year-ago period to $162.1 million in the quarter (using average CAD to USD exchange rates in Q3 2024 and Q3 2025).

CWYUF’s AFFO per unit fell by 0.5% year-over-year to $0.35 during the quarter (based on average CAD to USD exchange rates).

Click here to download our most recent Sure Analysis report on CWYUF (preview of page 1 of 3 shown below):

High-Yield REIT Canadian No. 3: Slate Grocery REIT (SRRTF)

Slate Grocery REIT is a Toronto-based, yet U.S.-focused real estate investment trust focused on grocery-anchored retail centers. It owns 117 properties, totaling 15.4 million square feet and valued at about $2.4 billion.

Its portfolio is deeply rooted in necessity-based retail. Some of its top tenants include Kroger, Walmart, and Ahold Delhaize, while it boasts an anchor occupancy rate of 98.6%.

On August 6th, 2025, Slate Grocery REIT posted its Q2 results for the period ending June 30th, 2025. Total revenue grew 2.1% year-over-year to $53.4 million.

The growth was primarily driven by rental rate increases, strong leasing spreads, and contractual rent escalations, particularly on renewed leases that continue to reflect resilient demand for grocery-anchored retail.

Despite the revenue uplift, profitability was modestly pressured by higher general and administrative expenses as well as interest and finance costs.

FFO totaled $15.0 million, or $0.25 per unit, unchanged from a year ago. Leasing activity remained healthy, supporting a stable occupancy rate and reinforcing the REIT’s position in necessity-based retail.

Click here to download our most recent Sure Analysis report on SRRTF (preview of page 1 of 3 shown below):

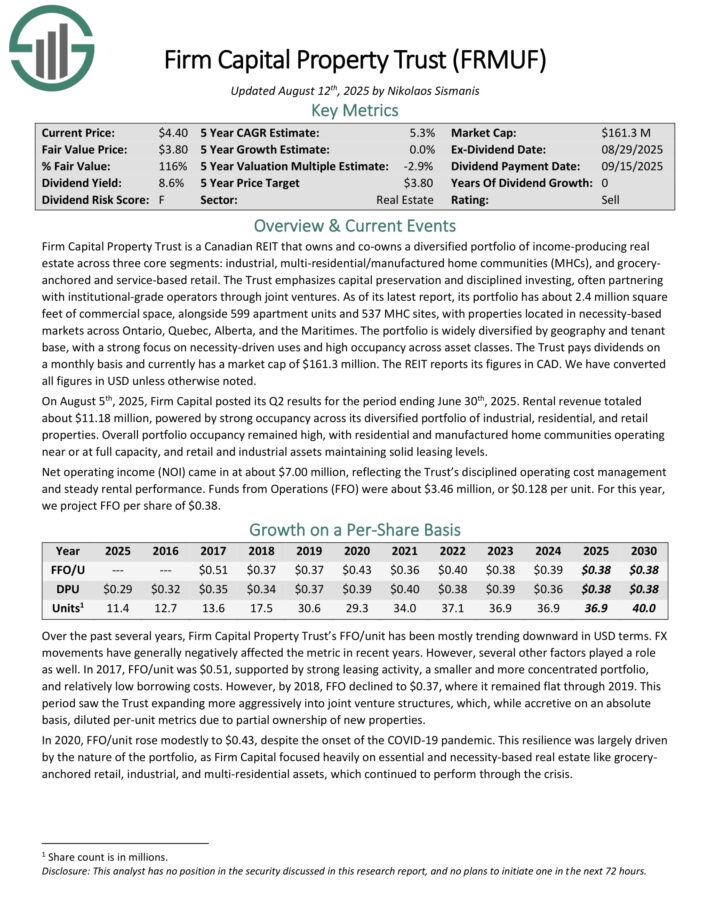

High-Yield Canadian REIT No. 2: Firm Capital Property Trust (FRMUF)

Firm Capital Property Trust is a Canadian REIT that owns and co-owns a diversified portfolio of income-producing real estate across three core segments: industrial, multi-residential/manufactured home communities (MHCs), and grocery anchored and service-based retail.

As of its latest report, its portfolio has about 2.4 million square feet of commercial space, alongside 599 apartment units and 537 MHC sites, with properties located in necessity-based markets across Ontario, Quebec, Alberta, and the Maritimes.

The portfolio is widely diversified by geography and tenant base, with a strong focus on necessity-driven uses and high occupancy across asset classes.

On August 5th, 2025, Firm Capital posted its Q2 results for the period ending June 30th, 2025. Rental revenue totaled about $11.18 million, powered by strong occupancy across its diversified portfolio of industrial, residential, and retail properties.

Overall portfolio occupancy remained high, with residential and manufactured home communities operating near or at full capacity, and retail and industrial assets maintaining solid leasing levels.

Net operating income (NOI) came in at about $7.00 million, reflecting the Trust’s disciplined operating cost management and steady rental performance. Funds from Operations (FFO) were about $3.46 million, or $0.128 per unit.

Click here to download our most recent Sure Analysis report on FRMUF (preview of page 1 of 3 shown below):

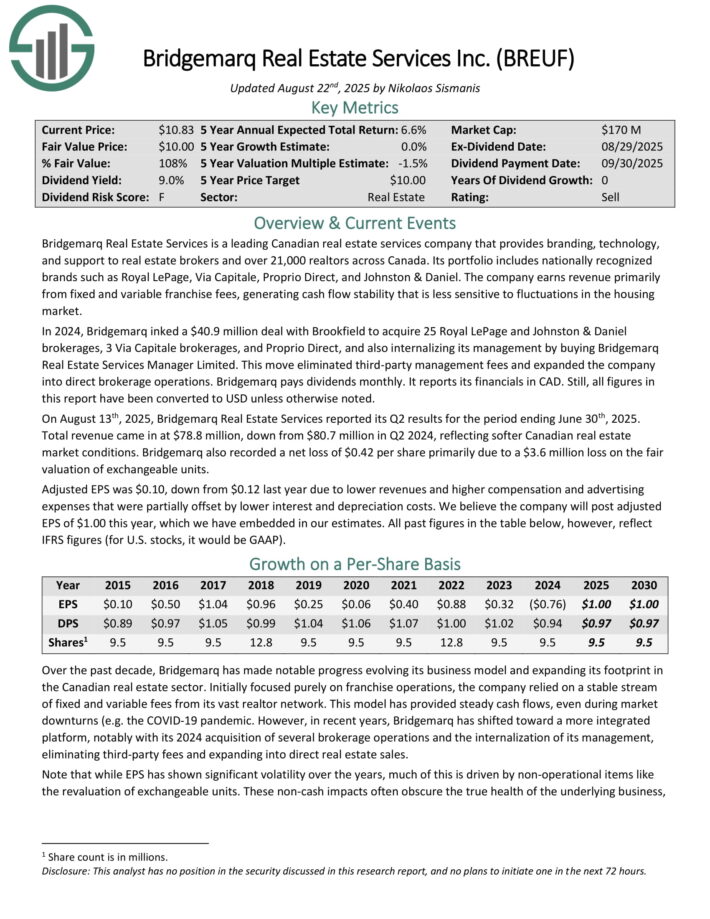

High-Yield Canadian REIT No. 1: Bridgemarq Real Estate Services (BREUF)

Bridgemarq Real Estate Services is a leading Canadian real estate services company that provides branding, technology, and support to real estate brokers and over 21,000 realtors across Canada. Its portfolio includes nationally recognized brands such as Royal LePage, Via Capitale, Proprio Direct, and Johnston & Daniel.

The company earns revenue primarily from fixed and variable franchise fees, generating cash flow stability that is less sensitive to fluctuations in the housing market.

On August 13th, 2025, Bridgemarq Real Estate Services reported its Q2 results. Total revenue came in at $78.8 million, down from $80.7 million in Q2 2024, reflecting softer Canadian real estate market conditions.

Bridgemarq also recorded a net loss of $0.42 per share primarily due to a $3.6 million loss on the fair valuation of exchangeable units.

Adjusted EPS was $0.10, down from $0.12 last year due to lower revenues and higher compensation and advertising expenses that were partially offset by lower interest and depreciation costs.

Click here to download our most recent Sure Analysis report on BREUF (preview of page 1 of 3 shown below):

High-Yield Individual Security Research

Other Sure Dividend Resources

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].