Published on February 18th, 2026 by Bob Ciura

In the world of investing, volatility matters. Investors are reminded of this every time there is a downturn in the broader market and individual stocks that are more volatile than others experience enormous swings in price.

Volatility is a proxy for risk; more volatility generally means a riskier portfolio. The volatility of a security or portfolio against a benchmark is called Beta.

In short, Beta is measured via a formula that calculates the price risk of a security or portfolio against a benchmark, which is typically the broader market as measured by the S&P 500.

Here’s how to read stock betas:

A beta of 1.0 means the stock moves equally with the S&P 500

A beta of 2.0 means the stock moves twice as much as the S&P 500

A beta of 0.0 means the stocks moves don’t correlate with the S&P 500

A beta of -1.0 means the stock moves precisely opposite the S&P 500

At the same time, investors can focus on stocks with low volatility as measured by beta values, that also have high dividend yields.

This creates an attractive combination of stability and income.

With this in mind, we have created a spreadsheet of over 200 stocks with dividend yields of 5% or more…

You can download your free full list of all high dividend stocks with 5%+ yields (along with important financial metrics such as dividend yield and payout ratio) by clicking on the link below:

Why this matters is because investors can utilize beta to get a better understanding of a security’s volatility, and therefore its risk.

This article will discuss the 10 lowest-beta stocks in the S&P 500 Index, that also have high dividend yields above 5%.

The stocks are listed by annualized beta over the past five years, in ascending order.

Table Of Contents

The table of contents below provides for easy navigation of the article:

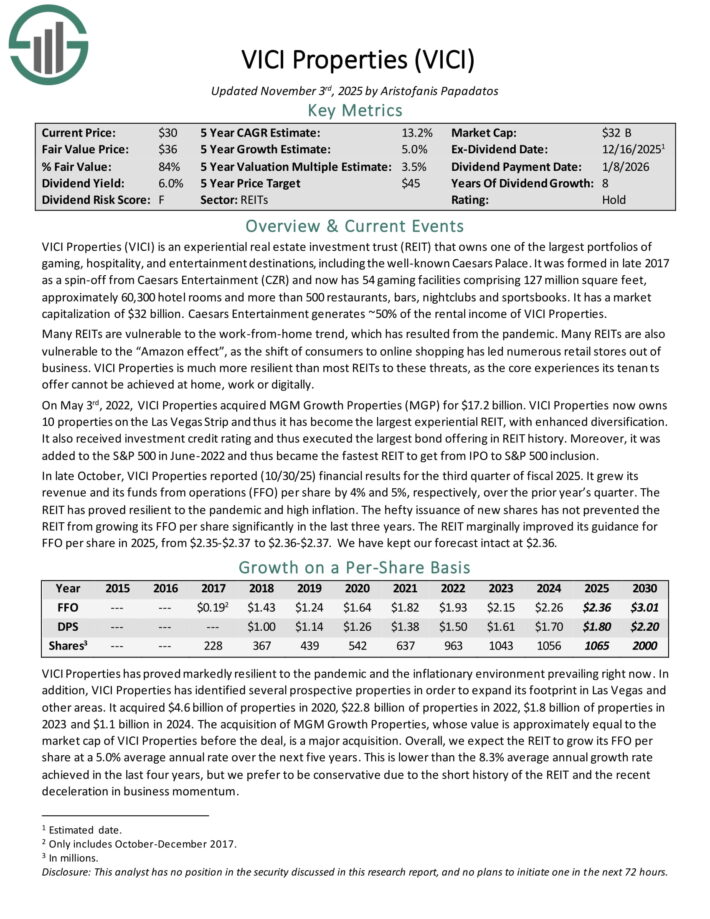

Low Beta High Dividend Stock #10: VICI Properties (VICI)

VICI Properties is an experiential real estate investment trust (REIT) that owns one of the largest portfolios of gaming, hospitality, and entertainment destinations, including the well-known Caesars Palace.

It now has 54 gaming facilities comprising 127 million square feet, approximately 60,300 hotel rooms and more than 500 restaurants, bars, nightclubs and sportsbooks.

Caesars Entertainment generates ~50% of the rental income of VICI Properties.

In late October, VICI Properties reported (10/30/25) financial results for the third quarter of fiscal 2025. It grew its revenue and its funds from operations (FFO) per share by 4% and 5%, respectively, over the prior year’s quarter.

The REIT has proved resilient to the pandemic and high inflation. The hefty issuance of new shares has not prevented the REIT from growing its FFO per share significantly in the last three years.

The REIT marginally improved its guidance for FFO per share in 2025, from $2.35-$2.37 to $2.36-$2.37.

Click here to download our most recent Sure Analysis report on VICI (preview of page 1 of 3 shown below):

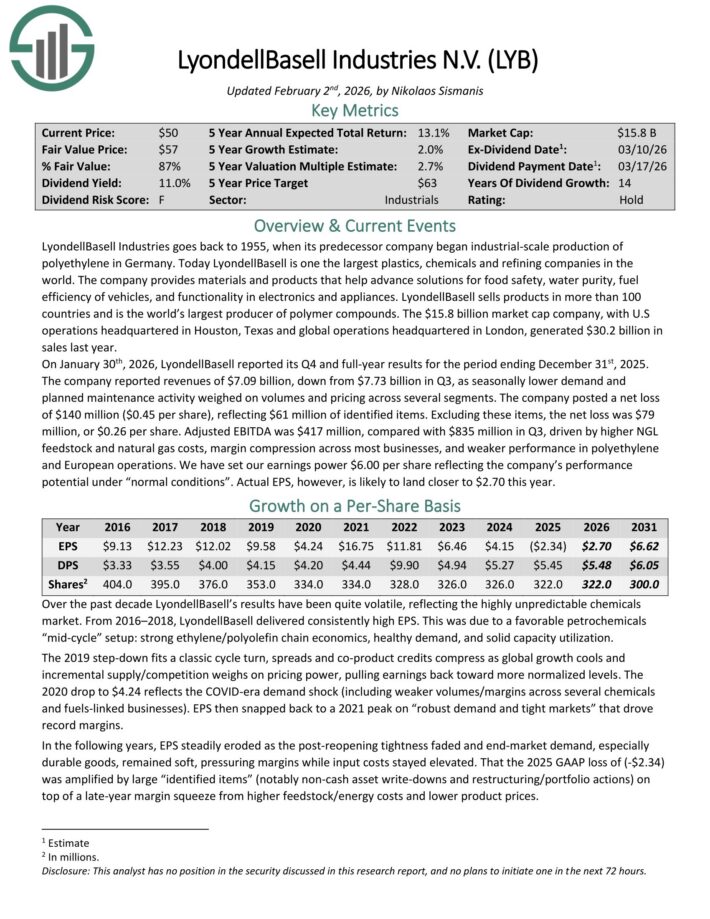

Low Beta High Dividend Stock #9: LyondellBasell Industries (LYB)

LyondellBasell Industries goes back to 1955, when its predecessor company began industrial-scale production of polyethylene in Germany.

Today LyondellBasell is one the largest plastics, chemicals and refining companies in the world. The company provides materials and products that help advance solutions for food safety, water purity, fuel efficiency of vehicles, and functionality in electronics and appliances.

LyondellBasell sells products in more than 100 countries and is the world’s largest producer of polymer compounds. The company, with U.S operations headquartered in Houston, Texas and global operations headquartered in London, generated $30.2 billion in sales last year.

On January 30th, 2026, LyondellBasell reported its Q4 and full-year results for the period ending December 31st, 2025. The company reported revenues of $7.09 billion, down from $7.73 billion in Q3, as seasonally lower demand andplanned maintenance activity weighed on volumes and pricing across several segments.

The company posted a net loss of $140 million ($0.45 per share), reflecting $61 million of identified items. Excluding these items, the net loss was $79 million, or $0.26 per share.

Adjusted EBITDA was $417 million, compared with $835 million in Q3, driven by higher NGL feedstock and natural gas costs, margin compression across most businesses, and weaker performance in polyethylene and European operations.

Click here to download our most recent Sure Analysis report on LYB (preview of page 1 of 3 shown below):

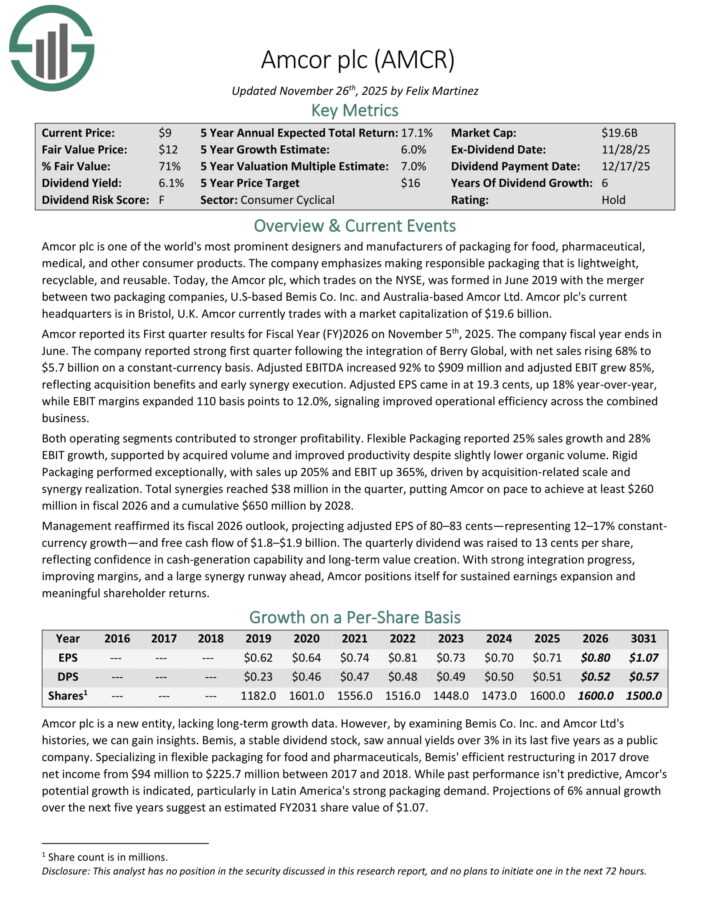

Low Beta High Dividend Stock #8: Amcor plc (AMCR)

Amcor plc is one of the world’s most prominent designers and manufacturers of packaging for food, pharmaceutical, medical, and other consumer products.

The company emphasizes making responsible packaging that is lightweight, recyclable, and reusable.

Amcor reported its First quarter results for Fiscal Year (FY) 2026 on November 5th, 2025. The company fiscal year ends in June.

The company reported strong first quarter following the integration of Berry Global, with net sales rising 68% to $5.7 billion on a constant-currency basis.

Adjusted EBITDA increased 92% to $909 million and adjusted EBIT grew 85%, reflecting acquisition benefits and early synergy execution.

Adjusted EPS came in at 19.3 cents, up 18% year-over-year, while EBIT margins expanded 110 basis points to 12.0%, signaling improved operational efficiency across the combined business.

Both operating segments contributed to stronger profitability. Flexible Packaging reported 25% sales growth and 28% EBIT growth, supported by acquired volume and improved productivity despite slightly lower organic volume.

Rigid Packaging performed exceptionally, with sales up 205% and EBIT up 365%, driven by acquisition-related scale and synergy realization.

Click here to download our most recent Sure Analysis report on AMCR (preview of page 1 of 3 shown below):

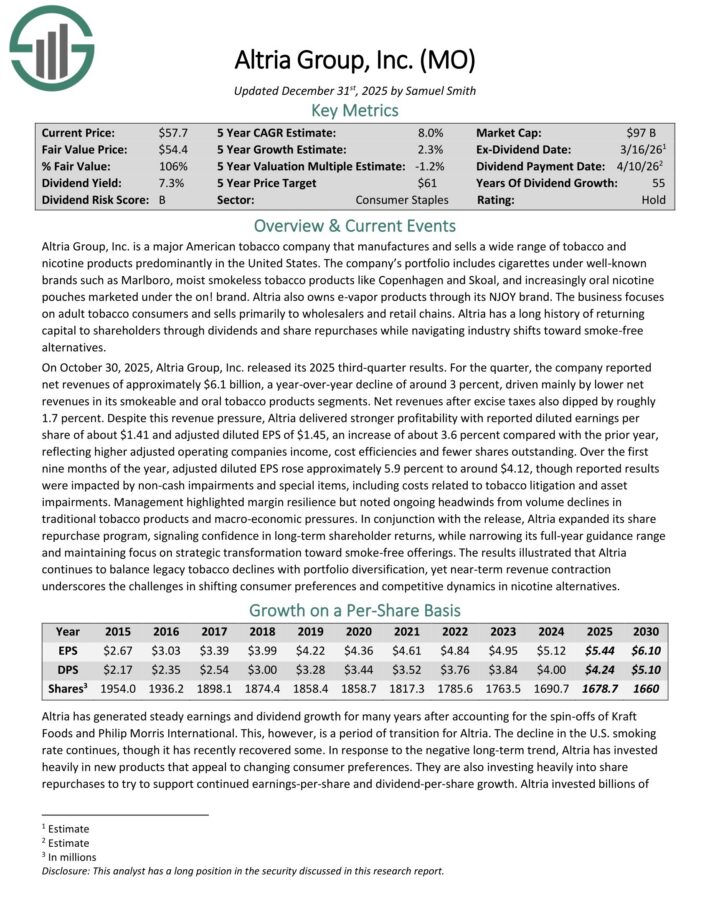

Low Beta High Dividend Stock #7: Altria Group (MO)

Altria is a tobacco stock that sells cigarettes, chewing tobacco, cigars, e-cigarettes, and more under a variety of brands, including Marlboro, Skoal, and Copenhagen, among others.

The decline in the U.S. smoking rate continues, though it has recently recovered some. In response to the negative long-term trend, Altria has invested heavily in new products that appeal to changing consumer preferences.

On October 30, 2025, Altria Group, Inc. released its 2025 third-quarter results. For the quarter, the company reported net revenues of approximately $6.1 billion, a year-over-year decline of around 3%, driven mainly by lower net revenues in its smokeable and oral tobacco products segments.

Net revenues after excise taxes also dipped by roughly 1.7%. Despite this revenue pressure, Altria delivered stronger profitability with reported diluted earnings per share of about $1.41 and adjusted diluted EPS of $1.45, an increase of about 3.6% compared with the prior year, reflecting higher adjusted operating companies income, cost efficiencies and fewer shares outstanding.

Click here to download our most recent Sure Analysis report on Altria (preview of page 1 of 3 shown below):

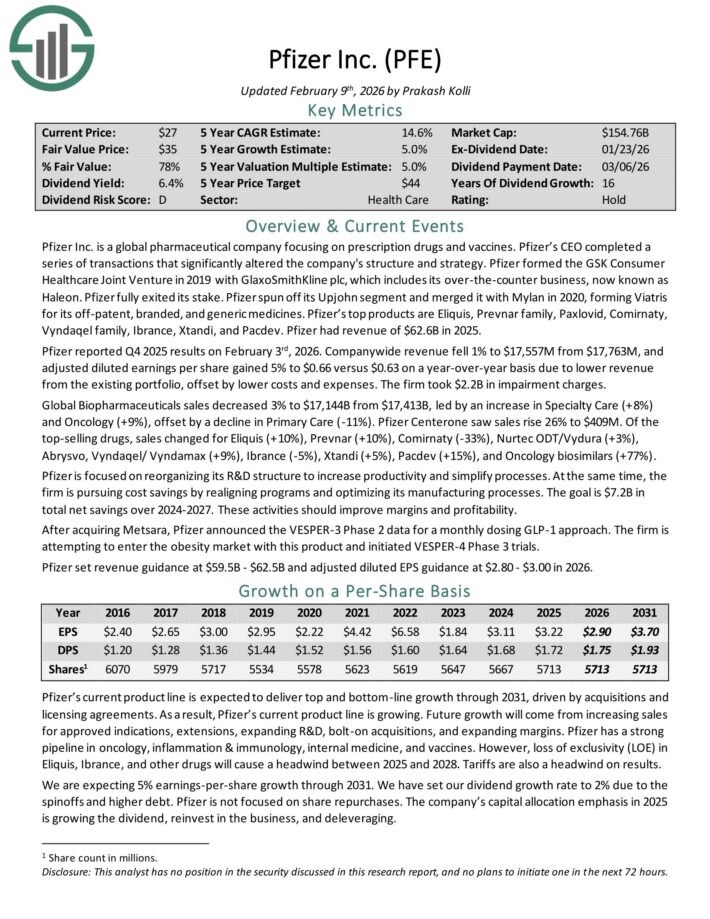

Low Beta High Dividend Stock #6: Pfizer Inc. (PFE)

Pfizer Inc. is a global pharmaceutical company focusing on prescription drugs and vaccines. Pfizer’s top products are Eliquis, Prevnar family, Paxlovid, Comirnaty, Vyndaqel family, Ibrance, Xtandi, and Pacdev.

Pfizer had revenue of $62.6B in 2025.

Pfizer reported Q4 2025 results on February 3rd, 2026. Company-wide revenue fell 1% and adjusted diluted earnings per share gained 5% to $0.66 versus $0.63 on a year-over-year basis due to lower revenue from the existing portfolio, offset by lower costs and expenses. The firm took $2.2B in impairment charges.

Global Biopharmaceuticals sales decreased 3% led by an increase in Specialty Care (+8%) and Oncology (+9%), offset by a decline in Primary Care (-11%). Centerone saw sales rise 26% to $409M.

Of the top-selling drugs, sales changed for Eliquis (+10%), Prevnar (+10%), Comirnaty (-33%), Nurtec ODT/Vydura (+3%), Abrysvo, Vyndaqel/ Vyndamax (+9%), Ibrance (-5%), Xtandi (+5%), Pacdev (+15%), and Oncology biosimilars (+77%).

Pfizer is focused on reorganizing its R&D structure to increase productivity and simplify processes.

At the same time, the firm is pursuing cost savings by realigning programs and optimizing its manufacturing processes. The goal is $7.2B in total net savings over 2024-2027. These activities should improve margins and profitability.

After acquiring Metsara, Pfizer announced the VESPER-3 Phase 2 data for a monthly dosing GLP-1 approach. The firm is attempting to enter the obesity market with this product and initiated VESPER-4 Phase 3 trials.

Pfizer set revenue guidance at $59.5B – $62.5B and adjusted diluted EPS guidance at $2.80 – $3.00 in 2026.

Click here to download our most recent Sure Analysis report on PFE (preview of page 1 of 3 shown below):

Low Beta High Dividend Stock #5: Verizon Communications (VZ)

Verizon Communications is one of the largest wireless carriers in the country. Wireless contributes three-quarters of all revenues, and broadband and cable services account for about a quarter of sales. The company’s network covers ~300 million people and 98% of the U.S.

On September 5th, 2025, Verizon announced that it was increasing its quarterly dividend 1.8% to $0.69 for the November 3rd, 2025 payment, extending the company’s dividend growth streak to 21 consecutive years.

On October 29th, 2025, Verizon reported third quarter results for the period ending September 30th, 2025. For the quarter, revenue grew 1.5% to $33.8 billion, but this was $470 million below estimates. Adjusted earnings-per-share of $1.21 compared favorably to $1.19 in the prior year and was $0.02 better than expected.

For the quarter, Verizon Consumer had postpaid phone net losses of 7,000, which compares to net additions of 18,000 in the same period of last year. However, wireless retail core prepaid net additions grew 47,000, marking the fifth consecutive quarter of positive subscriber growth.

Consumer wireless retail postpaid phone churn rate remains low at 0.91%. The Consumer segment grew 2.9% to $26.1 billion while consumer wireless service revenue increased 2.4% to $17.4 billion. Consumer wireless postpaid average revenue per account grew 2.0% to $147.91.

Broadband totaled 306K net new customers during the period, which marks 13 consecutive quarters of at least 300K net adds. The total fixed wireless customer base is almost 5.4 million. Verizon aims to have 8 to 9 million fixed wireless subscribers by 2028.

Wireless retail postpaid net additions were 110K for the period. Free cash flow was $15.8 billion for the first three quarters of the year, up from $14.5 billion for the same period in 2024.

Verizon reaffirmed prior guidance for 2025 as well, with the company still expecting wireless service revenue to grow 2% to 2.8% for the year. Verizon is also expected to produce adjusted EPS growth in a range of 1% to 3%.

Click here to download our most recent Sure Analysis report on VZ (preview of page 1 of 3 shown below):

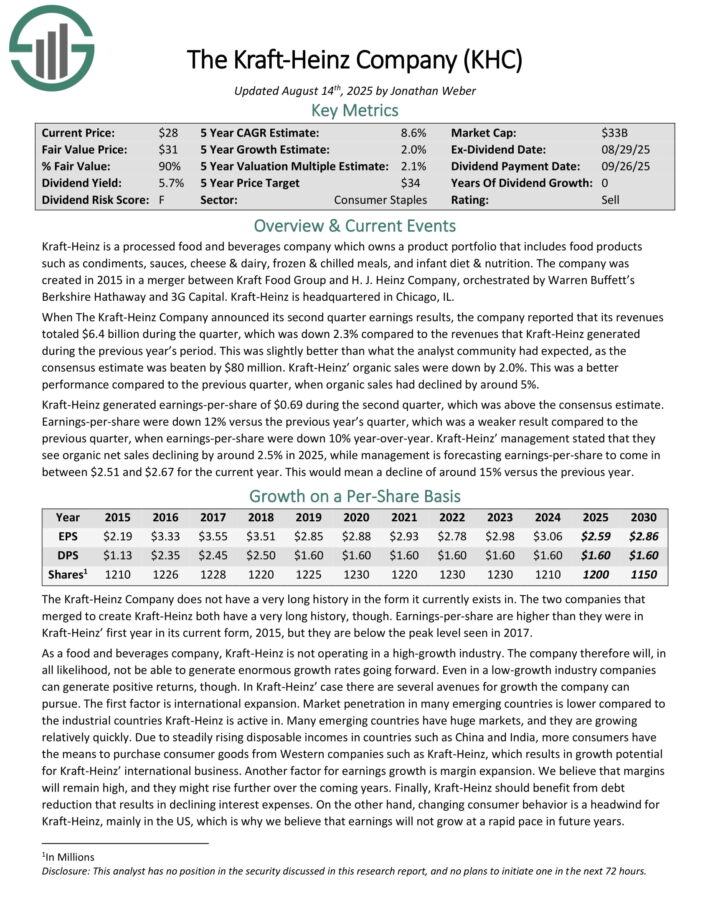

Low Beta High Dividend Stock #4: Kraft-Heinz (KHC)

Kraft-Heinz is a processed food and beverages company which owns a product portfolio that includes food products such as condiments, sauces, cheese & dairy, frozen & chilled meals, and infant diet & nutrition.

When The Kraft-Heinz Company announced its second quarter earnings results, the company reported that its revenues totaled $6.4 billion during the quarter, which was down 2.3% compared to the revenues that Kraft-Heinz generated during the previous year’s period.

This was slightly better than what the analyst community had expected, as the consensus estimate was beaten by $80 million. Kraft-Heinz’ organic sales were down by 2.0%. This was a better performance compared to the previous quarter, when organic sales had declined by around 5%.

Kraft-Heinz generated earnings-per-share of $0.69 during the second quarter, which was above the consensus estimate.

Earnings-per-share were down 12% versus the previous year’s quarter, which was a weaker result compared to the previous quarter, when earnings-per-share were down 10% year-over-year.

Click here to download our most recent Sure Analysis report on KHC (preview of page 1 of 3 shown below):

Low Beta High Dividend Stock #3: ConAgra Brands (CAG)

Conagra traces its roots back to Gilbert Van Camp’s new canned product – pork and beans – in 1861.

The company was incorporated as Nebraska Consolidated Mills in 1919, changed to ConAgra in 1971, ConAgra Foods in 1993, and has now become Conagra Brands, moving its headquarters from Omaha to Chicago and spinning off its Lamb Weston business in 2016. In 2018 Conagra acquired Pinnacle Foods.

The company has well-known brands like Slim Jim, Healthy Choice, Marie Callender’s, Orville Redenbacher’s, Reddi Whip, Birds Eye, Vlasic, Hunt’s, and PAM.

After paying the same $0.2125 quarterly payout for 13 consecutive quarters, Conagra increased its dividend 29.4% in 2020, 13.6% in 2021, 5.6% in 2022, and 6.1% in 2023 to $0.35 per quarter.

On July 10th, 2025, Conagra reported fourth quarter results for the period ending May 25, 2025. (Conagra’s fiscal year ends the last Sunday in May). For the quarter, net sales declined 4.3% year-over-year to $2.8 billion, the result of a 3.5% reduction in organic net sales, a 0.6% decline due to currency exchange, and a negative impact of -0.2% due to M&A.

Volume declined 2.5%. Adjusted EPS decreased 8% to $0.56, missing analyst estimates by $0.05. At fiscal year-end, the company had net debt of $8.0 billion, and a net leverage ratio of 3.6x.

Conagra provided its fiscal 2026 guidance, expecting organic net sales growth of (1)% to 1% compared to FY 2025. Adjusted operating margin is likely to come in between 11.0% to 11.5%, and adjusted EPS is expected to decline sharply from FY 2025 to $1.70 to $1.85.

Capex is expected to be $450 million, and interest expense is expected to equal $400 million. Furthermore, it expects its net leverage ratio to degrade further to 3.85x.

Click here to download our most recent Sure Analysis report on CAG (preview of page 1 of 3 shown below):

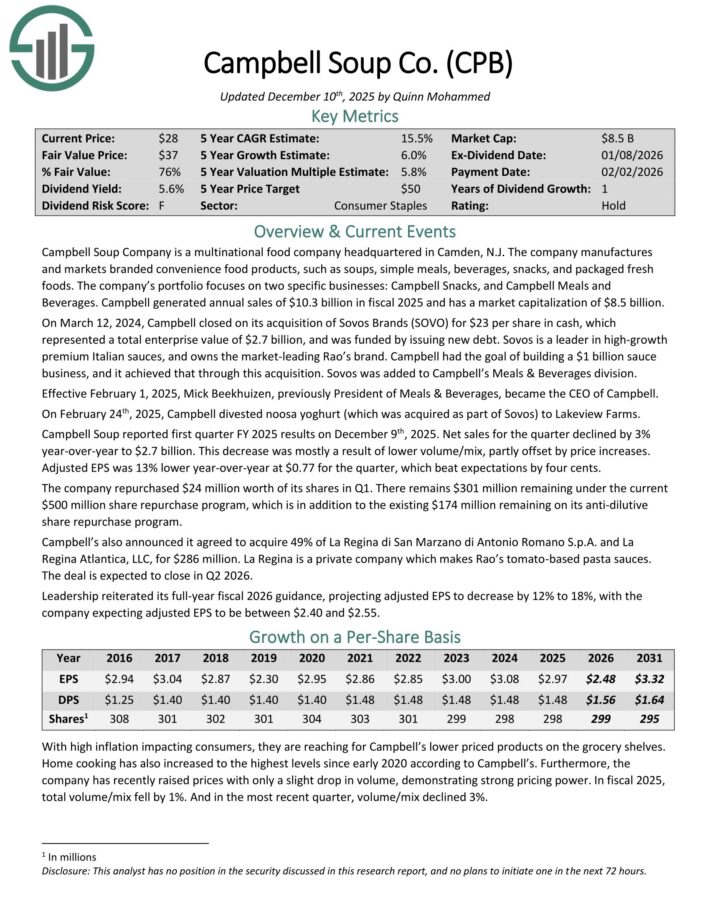

Low Beta High Dividend Stock #2: Campbell Soup (CPB)

Campbell Soup Company is a multinational food company headquartered in Camden, N.J. The company manufactures and markets branded convenience food products, such as soups, simple meals, beverages, snacks, and packaged fresh foods.

The company’s portfolio focuses on two specific businesses: Campbell Snacks, and Campbell Meals and Beverages. Campbell generated annual sales of $10.3 billion in fiscal 2025.

Campbell Soup reported first quarter FY 2025 results on December 9th, 2025. Net sales for the quarter declined by 3% year-over-year to $2.7 billion. This decrease was mostly a result of lower volume/mix, partly offset by price increases.

Adjusted EPS was 13% lower year-over-year at $0.77 for the quarter, which beat expectations by four cents. The company repurchased $24 million worth of its shares in Q1.

There remains $301 million remaining under the current $500 million share repurchase program, which is in addition to the existing $174 million remaining on its anti-dilutive share repurchase program.

Campbell’s also announced it agreed to acquire 49% of La Regina di San Marzano di Antonio Romano S.p.A. and La Regina Atlantica, LLC, for $286 million.

La Regina is a private company which makes Rao’s tomato-based pasta sauces. The deal is expected to close in Q2 2026.

Leadership reiterated its full-year fiscal 2026 guidance, projecting adjusted EPS to decrease by 12% to 18%, with the company expecting adjusted EPS to be between $2.40 and $2.55.

Click here to download our most recent Sure Analysis report on CPB (preview of page 1 of 3 shown below):

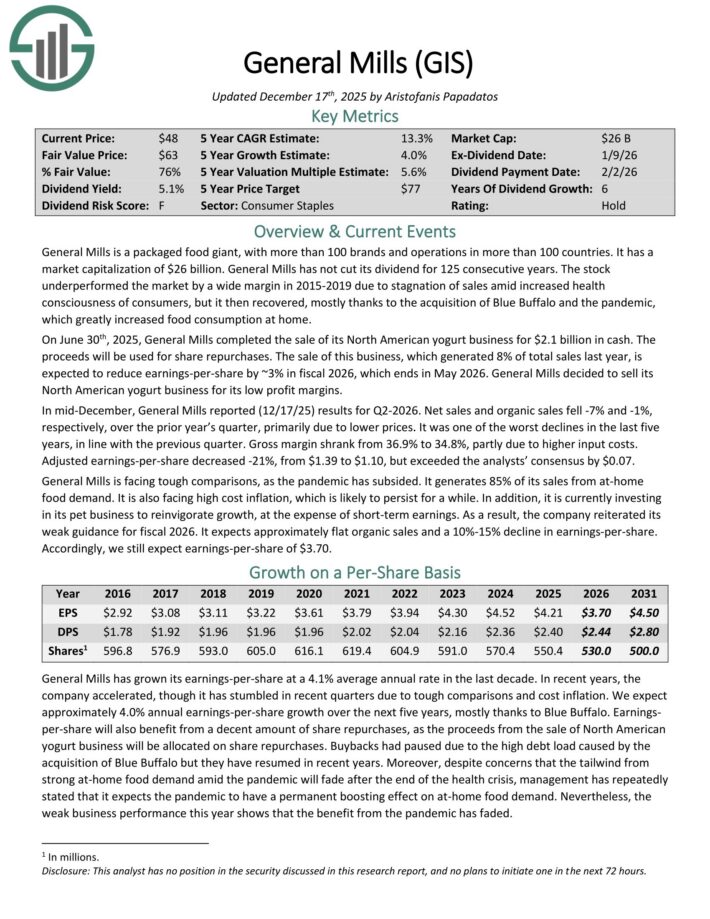

Low Beta High Dividend Stock #1: General Mills (GIS)

General Mills is a packaged food giant, with more than 100 brands and operations in more than 100 countries. It has a market capitalization of $26 billion. General Mills has not cut its dividend for 125 consecutive years.

On June 30th, 2025, General Mills completed the sale of its North American yogurt business for $2.1 billion in cash. The proceeds will be used for share repurchases.

The sale of this business, which generated 8% of total sales last year, is expected to reduce earnings-per-share by ~3% in fiscal 2026, which ends in May 2026. General Mills decided to sell its North American yogurt business for its low profit margins.

In mid-December, General Mills reported (12/17/25) results for Q2-2026. Net sales and organic sales fell -7% and -1%, respectively, over the prior year’s quarter, primarily due to lower prices.

It was one of the worst declines in the last five years, in line with the previous quarter. Gross margin shrank from 36.9% to 34.8%, partly due to higher input costs.

Adjusted earnings-per-share decreased -21%, from $1.39 to $1.10, but exceeded the analysts’ consensus by $0.07.

General Mills is facing tough comparisons, as the pandemic has subsided. It generates 85% of its sales from at-home food demand. It is also facing high cost inflation, which is likely to persist for a while.

In addition, it is currently investing in its pet business to reinvigorate growth, at the expense of short-term earnings.

As a result, the company reiterated its weak guidance for fiscal 2026. It expects approximately flat organic sales and a 10%-15% decline in earnings-per-share.

Click here to download our most recent Sure Analysis report on GIS (preview of page 1 of 3 shown below):

Additional Reading

If you are interested in finding high-quality dividend growth stocks and/or other high-yield securities and income securities, the following Sure Dividend resources will be useful:

High-Yield Individual Security Research

Other Sure Dividend Resources

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].