Published on December 9th, 2025 by Bob Ciura

There’s a beauty to simplicity.

And investing doesn’t get much simpler than buying and holding high quality dividend growth stocks for the long run.

Long-term dividend growth stock investing combines the primary reason most people invest – passive income – with the tried-and-true wisdom that underlies successful investing.

For a company to pay rising dividends year-after-year for decades, it must have favorable long-term economic characteristics and a reasonably competent and honest management team.

As a result, we recommend income investors purchase high dividend stocks.

You can download your free full list of all high dividend stocks (along with important financial metrics such as dividend yield and payout ratio) by clicking on the link below:

However, not all high-yield stocks make equally good investments.

This article will discuss 10 high dividend stocks with yields above 5%, that also have long histories of raising their dividends each year, even during recessions.

These 10 dividend stocks have all raised their payouts for at least 25 consecutive years. This means they have demonstrated the underlying business strength to continue raising dividends for the long run.

Table Of Contents

The 10 high dividend stocks are listed by payout ratio, in ascending order.

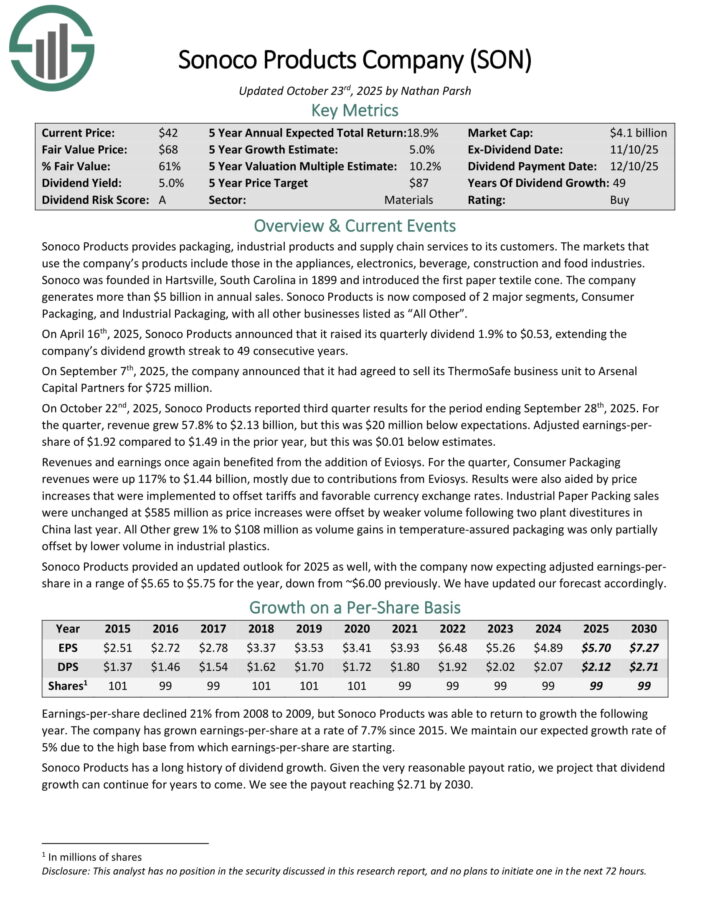

High Dividend Stock For The Long Run: Sonoco Products (SON)

Sonoco Products provides packaging, industrial products and supply chain services to its customers. The markets that use the company’s products include those in the appliances, electronics, beverage, construction and food industries.

The company generates more than $5 billion in annual sales. Sonoco Products is now composed of 2 major segments, Consumer Packaging, and Industrial Packaging, with all other businesses listed as “All Other”.

On October 22nd, 2025, Sonoco Products reported third quarter results for the period ending September 28th, 2025. For the quarter, revenue grew 57.8% to $2.13 billion, but this was $20 million below expectations. Adjusted earnings-per-share of $1.92 compared to $1.49 in the prior year, but this was $0.01 below estimates.

Revenues and earnings once again benefited from the addition of Eviosys. For the quarter, Consumer Packaging revenues were up 117% to $1.44 billion, mostly due to contributions from Eviosys. Results were also aided by price increases that were implemented to offset tariffs and favorable currency exchange rates.

Industrial Paper Packing sales were unchanged at $585 million as price increases were offset by weaker volume following two plant divestitures in China last year. All Other grew 1% to $108 million as volume gains in temperature-assured packaging was only partially offset by lower volume in industrial plastics.

Sonoco Products provided an updated outlook for 2025 as well, with the company now expecting adjusted earnings-per-share in a range of $5.65 to $5.75 for the year, down from ~$6.00 previously.

Click here to download our most recent Sure Analysis report on SON (preview of page 1 of 3 shown below):

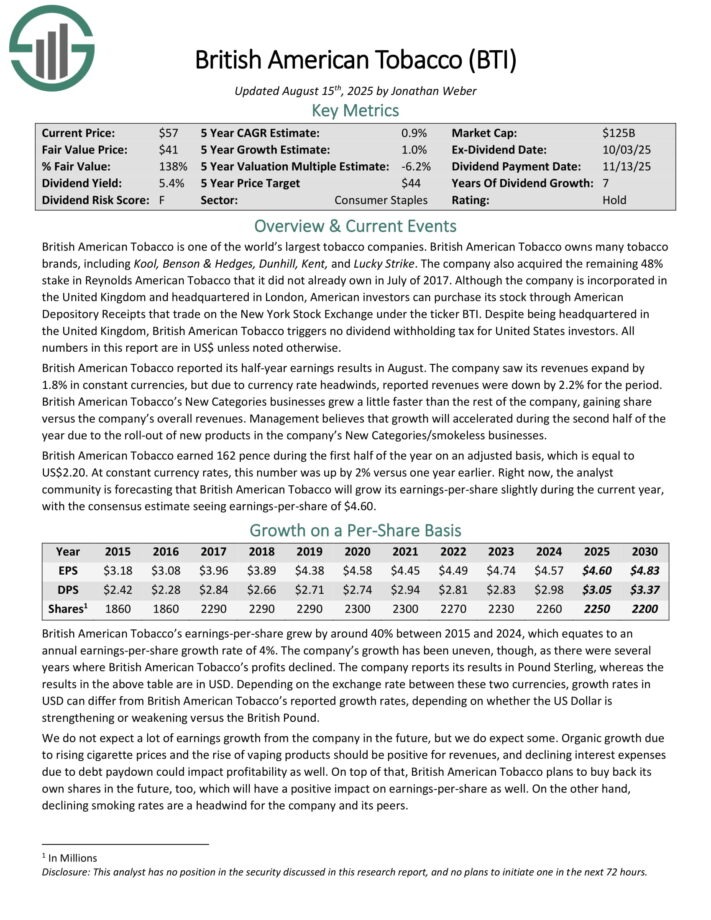

High Dividend Stock For The Long Run: British American Tobacco plc (BTI)

British American Tobacco is one of the largest tobacco companies in the world. It owns the following tobacco brands, among others: Kool, Benson & Hedges, Dunhill, Kent, and Lucky Strike.

British American Tobacco reported its half-year earnings results in August. The company saw its revenues expand by 1.8% in constant currencies, but due to currency rate headwinds, reported revenues were down by 2.2% for the period.

British American Tobacco’s New Categories businesses grew a little faster than the rest of the company, gaining share versus the company’s overall revenues. Management believes that growth will accelerated during the second half of the year due to the roll-out of new products in the company’s New Categories/smokeless businesses.

British American Tobacco earned 162 pence during the first half of the year on an adjusted basis, which is equal to US$2.20. At constant currency rates, this number was up by 2% versus one year earlier.

Organic growth due to rising cigarette prices and the rise of vaping products should be positive for revenues, and declining interest expenses due to debt paydown could impact profitability as well. On top of that, British American Tobacco plans to buy back its own shares in the future which will have a positive impact on earnings-per-share as well.

Click here to download our most recent Sure Analysis report on BTI (preview of page 1 of 3 shown below):

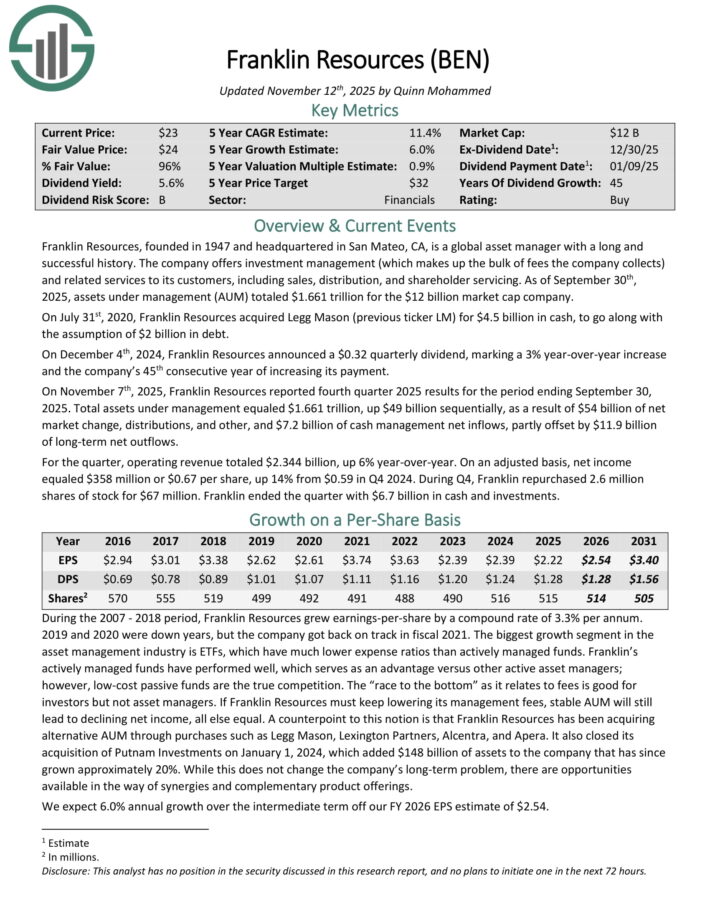

High Dividend Stock For The Long Run: Franklin Resources (BEN)

Franklin Resources offers investment management (which makes up the bulk of fees the company collects) and related services to its customers, including sales, distribution, and shareholder servicing.

As of September 30th, 2025, assets under management (AUM) totaled $1.661 trillion. On July 31st, 2020, Franklin Resources acquired Legg Mason (previous ticker LM) for $4.5 billion in cash, to go along with the assumption of $2 billion in debt.

On November 7th, 2025, Franklin Resources reported fourth quarter 2025 results. Total assets under management equaled $1.661 trillion, up $49 billion sequentially, as a result of $54 billion of net market change, distributions, and other, and $7.2 billion of cash management net inflows, partly offset by $11.9 billion of long-term net outflows.

For the quarter, operating revenue totaled $2.344 billion, up 6% year-over-year. On an adjusted basis, net income equaled $358 million or $0.67 per share, up 14% from $0.59 in Q4 2024. During Q4, Franklin repurchased 2.6 million shares of stock for $67 million.

Click here to download our most recent Sure Analysis report on BEN (preview of page 1 of 3 shown below):

High Dividend Stock For The Long Run: Enbridge Inc. (ENB)

Enbridge is an oil & gas company that operates the following segments: Liquids Pipelines, Gas Distributions, Energy Services, Gas Transmission & Midstream, and Green Power & Transmission.

Enbridge reported its third quarter earnings results in November. The company generated revenues of CAD$14.6 billion during the period, which was down 2% compared to the previous year’s quarter, and which pencils out to US$10.5 billion.

During the quarter, Enbridge grew its adjusted EBITDA by 2% year over year, to CAD$4.3 billion, up from CAD$4.2 billion during the previous year’s quarter.

During the third quarter, Enbridge was able to generate distributable cash flows of CAD$2.6 billion, which equates to US$1.9 billion, or US$0.87 on a per-share basis.

While distributable cash flows in 2024 were down in US Dollars, that was due to currency rate movements – results were higher in Canadian Dollars. The same holds true for Enbridge’s dividend, which was increased by 3% in Canadian Dollars, to CAD$0.9424 at the beginning of the current year.

Enbridge is forecasting distributable cash flows in a range of CAD$5.50 – CAD$5.90 per share for the current year. Using current exchange rates, this equates to USD$4.08 at the midpoint of the guidance range, which would be up 6% versus 2024.

Click here to download our most recent Sure Analysis report on ENB (preview of page 1 of 3 shown below):

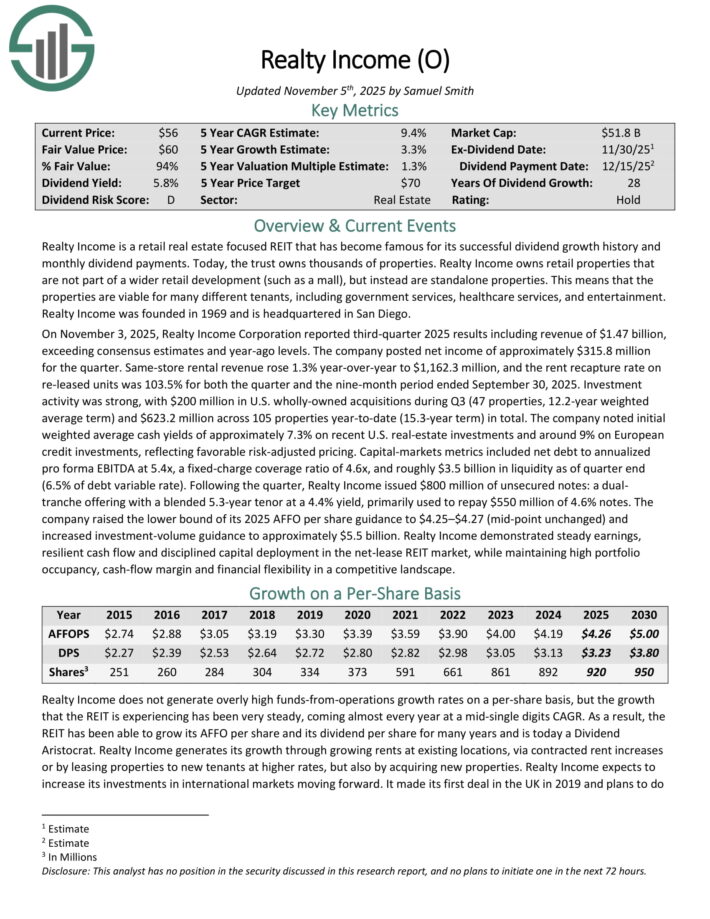

High Dividend Stock For The Long Run: Realty Income (O)

Realty Income is a retail real estate focused REIT that has become famous for its successful dividend growth history and monthly dividend payments. Today, the trust owns thousands of properties.

Realty Income owns retail properties that are not part of a wider retail development (such as a mall), but instead are standalone properties. This means that the properties are viable for many different tenants, including government services, healthcare services, and entertainment.

On November 3, 2025, Realty Income Corporation reported third-quarter 2025 results including revenue of $1.47 billion, exceeding consensus estimates and year-ago levels.

The company posted net income of approximately $315.8 million for the quarter. Same-store rental revenue rose 1.3% year-over-year to $1,162.3 million, and the rent recapture rate on re-leased units was 103.5% for both the quarter and the nine-month period ended September 30, 2025.

Investment activity was strong, with $200 million in U.S. wholly-owned acquisitions during Q3 (47 properties, 12.2-year weighted average term) and $623.2 million across 105 properties year-to-date (15.3-year term) in total.

The company raised the lower bound of its 2025 AFFO per share guidance to $4.25–$4.27 (mid-point unchanged) and increased investment-volume guidance to approximately $5.5 billion.

Click here to download our most recent Sure Analysis report on O (preview of page 1 of 3 shown below):

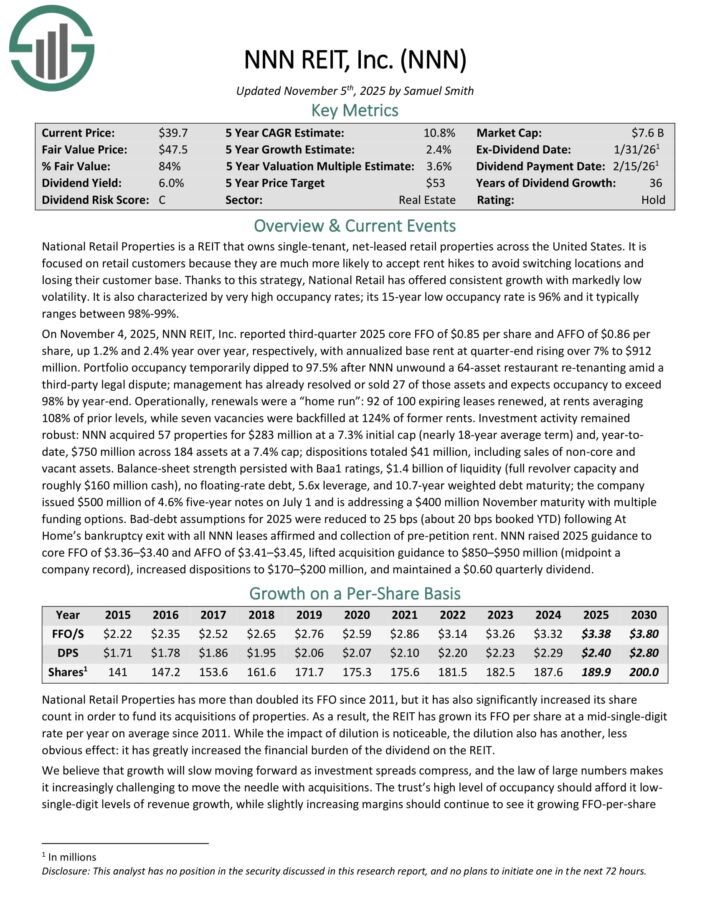

High Dividend Stock For The Long Run: NNN REIT (NNN)

National Retail Properties is a REIT that owns single-tenant, net-leased retail properties across the United States.

National Retail has offered consistent growth with markedly low volatility. It is also characterized by very high occupancy rates; its 15-year low occupancy rate is 96% and it typically ranges between 98%-99%.

On November 4, 2025, NNN REIT reported third-quarter 2025 core FFO of $0.85 per share and AFFO of $0.86 per share, up 1.2% and 2.4% year over year, respectively, with annualized base rent at quarter-end rising over 7% to $912 million.

Portfolio occupancy temporarily dipped to 97.5% after NNN unwound a 64-asset restaurant re-tenanting amidthird-party legal dispute; management has already resolved or sold 27 of those assets and expects occupancy to exceed 98% by year-end.

Operationally, renewals were a “home run”: 92 of 100 expiring leases renewed, at rents averaging 108% of prior levels, while seven vacancies were back-filled at 124% of former rents.

Investment activity remained robust: NNN acquired 57 properties for $283 million at a 7.3% initial cap (nearly 18-year average term) and, year-to-date, $750 million across 184 assets at a 7.4% cap.

Click here to download our most recent Sure Analysis report on NNN (preview of page 1 of 3 shown below):

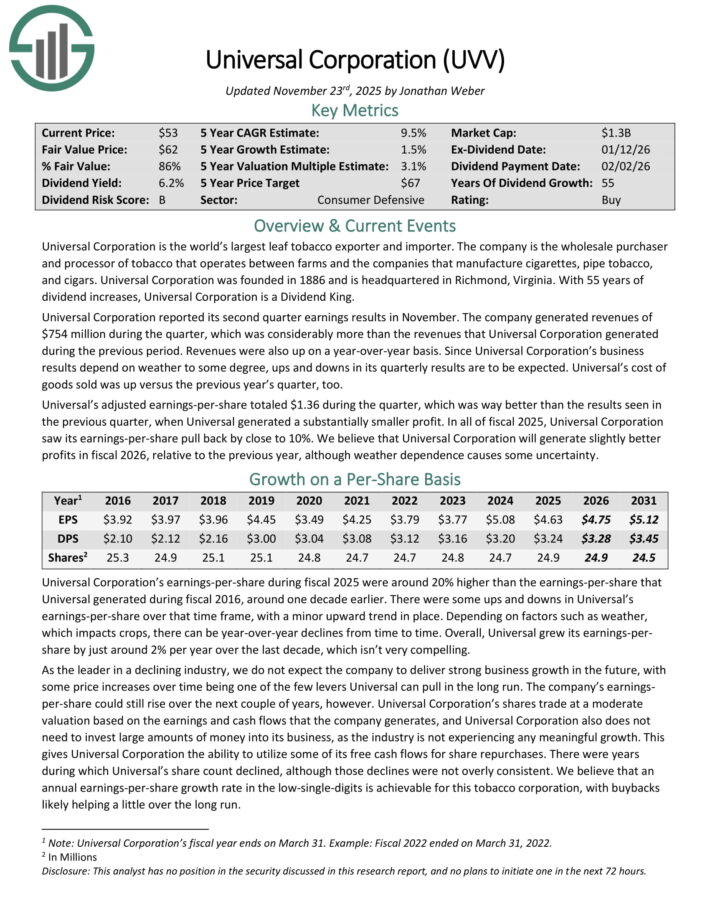

High Dividend Stock For The Long Run: Universal Corp. (UVV)

Universal Corporation is the world’s largest leaf tobacco exporter and importer. The company is the wholesale purchaser and processor of tobacco that operates between farms and the companies that manufacture cigarettes, pipe tobacco, and cigars.

Universal Corporation was founded in 1886 and is headquartered in Richmond, Virginia. With 55 years of dividend increases, Universal Corporation is a Dividend King.

Universal Corporation reported its second quarter earnings results in November. The company generated revenue of $754 million during the quarter, which was considerably more than the revenues that Universal Corporation generated during the previous period.

Revenues were also up on a year-over-year basis. Since Universal Corporation’s business results depend on weather to some degree, ups and downs in its quarterly results are to be expected. Universal’s cost of goods sold was up versus the previous year’s quarter.

Universal’s adjusted earnings-per-share totaled $1.36 during the quarter. In fiscal 2025, Universal Corporation saw its earnings-per-share pull back by close to 10%.

Click here to download our most recent Sure Analysis report on UVV (preview of page 1 of 3 shown below):

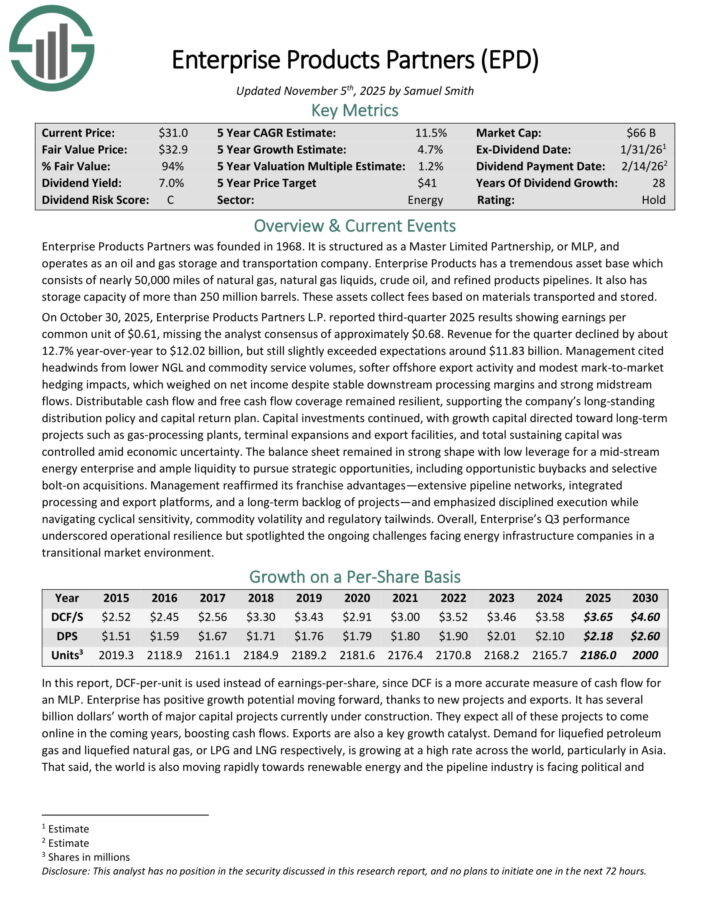

High Dividend Stock For The Long Run: Enterprise Products Partners LP (EPD)

Enterprise Products Partners was founded in 1968. It is structured as a Master Limited Partnership, or MLP, and operates as an oil and gas storage and transportation company.

Enterprise Products has a tremendous asset base which consists of nearly 50,000 miles of natural gas, natural gas liquids, crude oil, and refined products pipelines. It also has storage capacity of more than 250 million barrels. These assets collect fees based on materials transported and stored.

On October 30, 2025, Enterprise Products Partners L.P. reported third-quarter 2025 results showing earnings per common unit of $0.61, missing the analyst consensus of approximately $0.68. Revenue for the quarter declined by about 12.7% year-over-year to $12.02 billion, but still slightly exceeded expectations around $11.83 billion.

Management cited headwinds from lower NGL and commodity service volumes, softer offshore export activity and modest mark-to-market hedging impacts, which weighed on net income despite stable downstream processing margins and strong midstream flows.

Click here to download our most recent Sure Analysis report on EPD (preview of page 1 of 3 shown below):

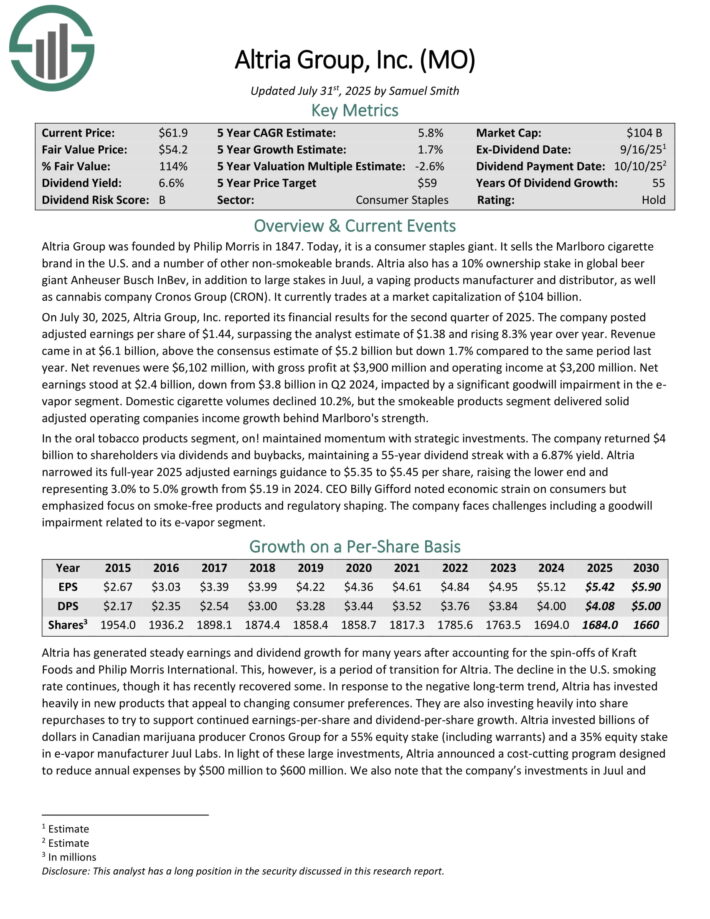

High Dividend Stock For The Long Run: Altria Group (MO)

Altria is a tobacco stock that sells cigarettes, chewing tobacco, cigars, e-cigarettes, and more under a variety of brands, including Marlboro, Skoal, and Copenhagen, among others.

This is a period of transition for Altria. The decline in the U.S. smoking rate continues. In response, Altria has invested heavily in new products that appeal to changing consumer preferences, as the smoke-free category continues to grow.

The company also has a 35% investment stake in e-cigarette maker JUUL, and a 45% stake in the Canadian cannabis producer Cronos Group (CRON).

On July 30, 2025, Altria Group, Inc. reported its financial results for the second quarter of 2025. The company posted adjusted earnings per share of $1.44, surpassing the analyst estimate of $1.38 and rising 8.3% year over year.

Revenue came in at $6.1 billion, above the consensus estimate of $5.2 billion but down 1.7% compared to the same period last year. Net revenues were $6,102 million, with gross profit at $3,900 million and operating income at $3,200 million.

Net earnings stood at $2.4 billion, down from $3.8 billion in Q2 2024, impacted by a significant goodwill impairment in the e-vapor segment.

Domestic cigarette volumes declined 10.2%, but the smokeable products segment delivered solid adjusted operating companies income growth behind Marlboro’s strength.

Click here to download our most recent Sure Analysis report on Altria (preview of page 1 of 3 shown below):

High Dividend Stock For The Long Run: Universal Health Realty Income Trust (UHT)

Universal Health Realty Income Trust operates as a real estate investment trust (REIT), specializing in the healthcare sector. The trust owns healthcare and human service-related facilities.

Its property portfolio includes acute care hospitals, medical office buildings, rehabilitation hospitals, behavioral healthcare facilities, sub-acute care facilities and childcare centers. Universal Health’s portfolio consists of 76 properties located in 21 states.

On October 27, 2025, Universal Health Realty Income Trust (UHT) reported third quarter 2025 net income of $4.0 million, or $0.29 per diluted share, unchanged from the same quarter in 2024.

Results included a one-time $275,000 gain ($0.02 per share) from a settlement and release agreement related to one of its medical office buildings, partially offset by a $256,000 decrease in aggregate property income, which included $900,000 of nonrecurring depreciation expense.

Funds from operations (FFO) rose to $12.2 million, or $0.88 per diluted share, up from $11.3 million, or $0.82 per share, in the prior year period.

Click here to download our most recent Sure Analysis report on UHT (preview of page 1 of 3 shown below):

Additional Reading

If you are interested in finding other high-yield securities, the following Sure Dividend resources will be useful:

High-Yield Individual Security Research

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].