Published on September 10th, 2025 by Bob Ciura

Income investors are likely familiar with the Dividend Aristocrats, which are some of the highest-quality stocks to buy and hold for the long term.

We recommend long-term investors focus on high-quality dividend stocks. To that end, we view the Dividend Aristocrats as among the best dividend stocks to buy-and-hold for the long run.

The Dividend Aristocrats have a long history of outperforming the market when it comes to risk-adjusted returns.

You can download the full Dividend Aristocrats list, along with important metrics like dividend yields and price-to-earnings ratios, by clicking on the link below:

Disclaimer: Sure Dividend is not affiliated with S&P Global in any way. S&P Global owns and maintains The Dividend Aristocrats Index. The information in this article and downloadable spreadsheet is based on Sure Dividend’s own review, summary, and analysis of the S&P 500 Dividend Aristocrats ETF (NOBL) and other sources, and is meant to help individual investors better understand this ETF and the index upon which it is based. None of the information in this article or spreadsheet is official data from S&P Global. Consult S&P Global for official information.

Even better, investors can buy quality dividend stocks when they are also undervalued, which could lead to high total returns in the coming years.

After all, the goal of rational investors is to maximize total return under a given set of constraints. Dividends can contribute a significant portion of a stock’s total return.

Stocks with low P/E ratios can offer attractive returns if their valuation multiples expand.

And when a low P/E stock also has a high dividend yield, investors get ‘paid to wait’ for the valuation multiple to increase.

This article will discuss the 10 cheapest Dividend Aristocrats now.

Table of Contents

The table of contents below allows for easy navigation. The stocks are listed by 5-year annual return from valuation, in ascending order.

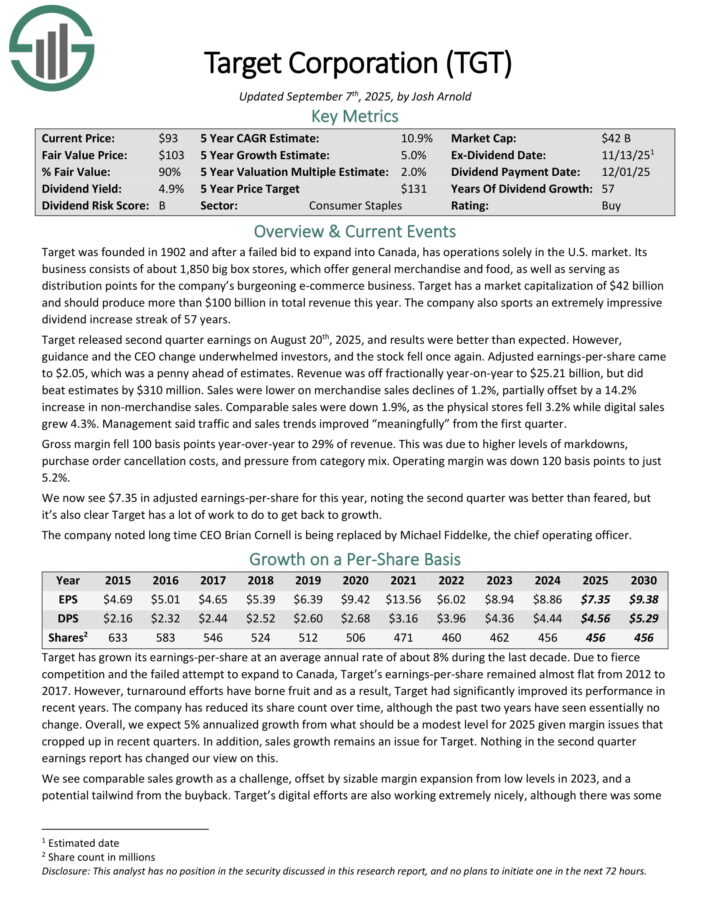

Cheapest Dividend Aristocrat #10: Target Corp. (TGT)

Annual Valuation Return: 2.5%

Target was founded in 1902 and now operates about 1,850 big box stores, which offer general merchandise and food, as well as serving as distribution points for the company’s e-commerce business.

Target released second quarter earnings on August 20th, 2025, and results were better than expected. However, guidance and the CEO change underwhelmed investors, and the stock fell once again.

Adjusted earnings-per-share came to $2.05, which was a penny ahead of estimates. Revenue was off fractionally year-on-year to $25.21 billion, but did beat estimates by $310 million. Sales were lower on merchandise sales declines of 1.2%, partially offset by a 14.2% increase in non-merchandise sales.

Comparable sales were down 1.9%, as the physical stores fell 3.2% while digital sales grew 4.3%. Management said traffic and sales trends improved “meaningfully” from the first quarter.

The company is investing heavily in its business in order to navigate through the changing landscape in the retail sector. The payout is now 62% of earnings for this year, which is elevated from historical levels, but the dividend remains well-covered.

Click here to download our most recent Sure Analysis report on TGT (preview of page 1 of 3 shown below):

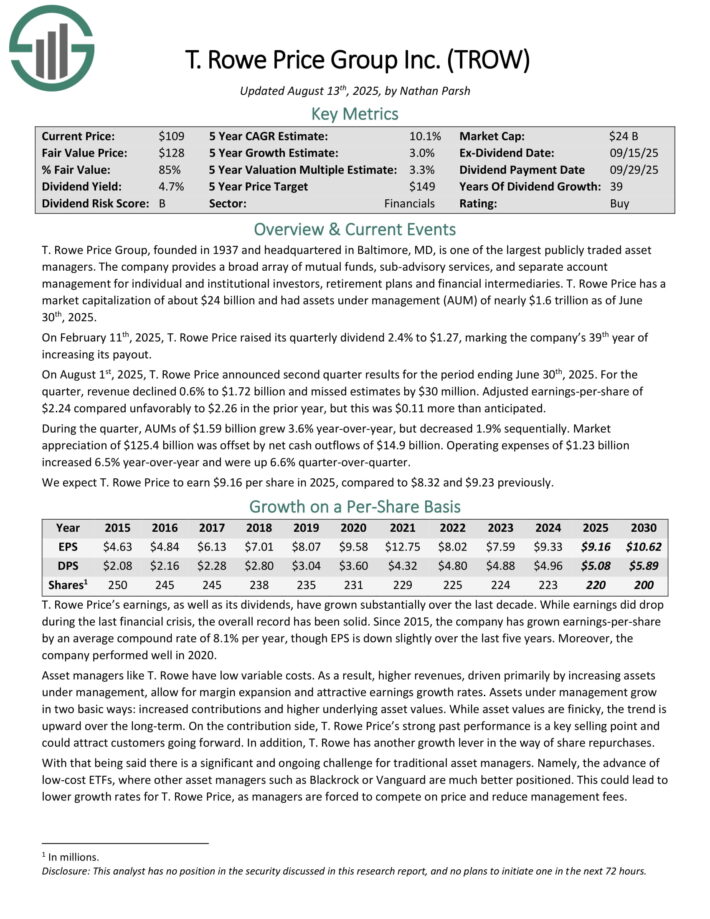

Cheapest Dividend Aristocrat #9: T. Rowe Price Group (TROW)

Annual Valuation Return: 3.7%

T. Rowe Price Group is one of the largest publicly traded asset managers. The company provides a broad array of mutual funds, sub-advisory services, and separate account management for individual and institutional investors, retirement plans and financial intermediaries.

T. Rowe Price had assets under management (AUM) of nearly $1.6 trillion as of June 30th, 2025.

On February 11th, 2025, T. Rowe Price raised its quarterly dividend 2.4% to $1.27, marking the company’s 39th year of increasing its payout.

On August 1st, 2025, T. Rowe Price announced second quarter results for the period ending June 30th, 2025. For the quarter, revenue declined 0.6% to $1.72 billion and missed estimates by $30 million.

Adjusted earnings-per-share of $2.24 compared unfavorably to $2.26 in the prior year, but this was $0.11 more than anticipated.

During the quarter, AUMs of $1.59 billion grew 3.6% year-over-year, but decreased 1.9% sequentially. Market appreciation of $125.4 billion was offset by net cash outflows of $14.9 billion.

Operating expenses of $1.23 billion increased 6.5% year-over-year and were up 6.6% quarter-over-quarter.

Click here to download our most recent Sure Analysis report on TROW (preview of page 1 of 3 shown below):

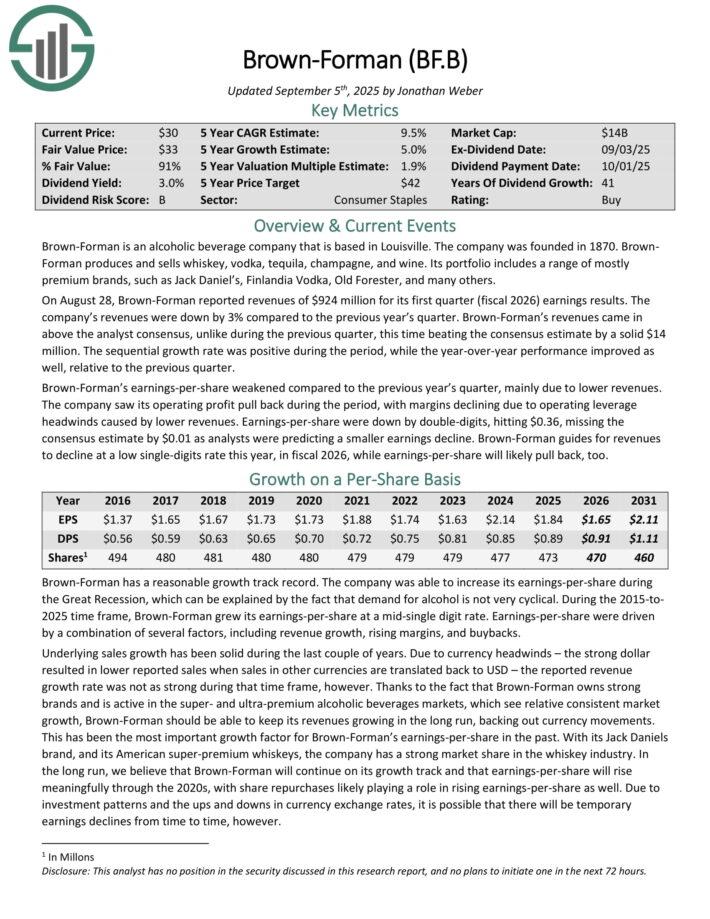

Cheapest Dividend Aristocrat #8: Brown-Forman Corp. (BF.B)

Annual Valuation Return: 3.9%

Brown-Forman is an alcoholic beverage company that is based in Louisville. The company was founded in 1870. It produces and sells whiskey, vodka, tequila, champagne, and wine.

Its portfolio includes a range of mostly premium brands, such as Jack Daniel’s, Finlandia Vodka, Old Forester, and many others.

On August 28, Brown-Forman reported revenues of $924 million for its first quarter (fiscal 2026) earnings results. The company’s revenues were down by 3% compared to the previous year’s quarter.

Revenues came in above the analyst consensus, unlike during the previous quarter, this time beating the consensus estimate by a solid $14 million. The sequential growth rate was positive during the period, while the year-over-year performance improved as well, relative to the previous quarter.

Brown-Forman’s earnings-per-share weakened compared to the previous year’s quarter, mainly due to lower revenues. The company saw its operating profit pull back during the period, with margins declining due to operating leverage headwinds caused by lower revenues.

Earnings-per-share were down by double-digits, hitting $0.36, missing the consensus estimate by $0.01 as analysts were predicting a smaller earnings decline.

Brown-Forman guides for revenues to decline at a low single-digits rate this year.

Click here to download our most recent Sure Analysis report on BF.B (preview of page 1 of 3 shown below):

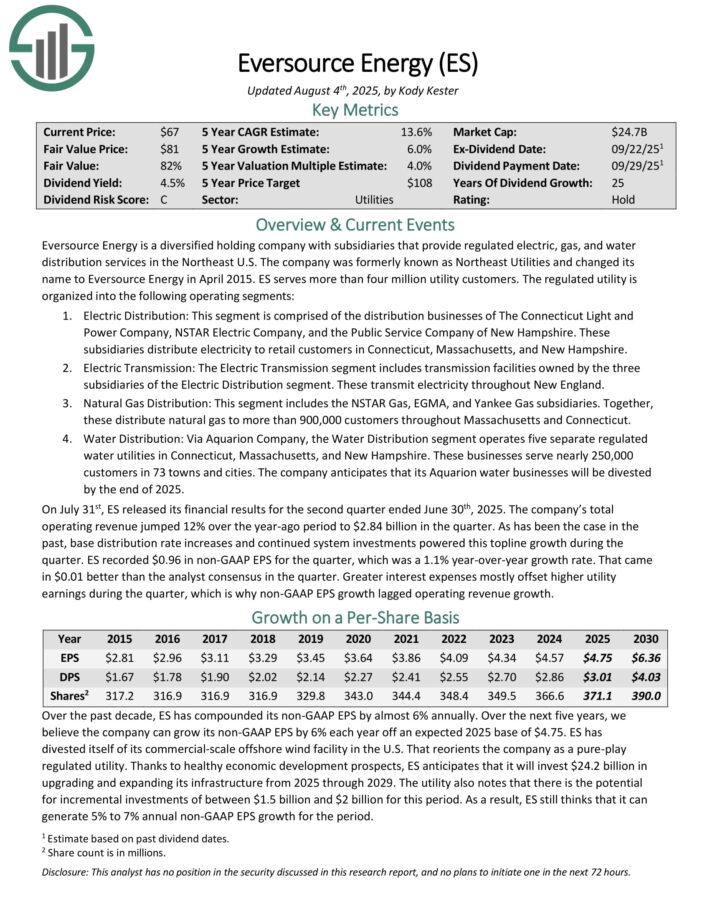

Cheapest Dividend Aristocrat #7: Eversource Energy (ES)

Annual Valuation Return: 5.0%

Eversource Energy is a diversified holding company with subsidiaries that provide regulated electric, gas, and water distribution service in the Northeast U.S.

The company’s utilities serve more than 4 million customers. Eversource has delivered steady growth to shareholders for many years.

On July 31st, ES released its financial results for the second quarter ended June 30th, 2025. The company’s total operating revenue jumped 12% over the year-ago period to $2.84 billion in the quarter.

As has been the case in the past, base distribution rate increases and continued system investments powered this top-line growth during the quarter.

ES recorded $0.96 in non-GAAP EPS for the quarter, which was a 1.1% year-over-year growth rate. That came in $0.01 better than the analyst consensus in the quarter.

Click here to download our most recent Sure Analysis report on ES (preview of page 1 of 3 shown below):

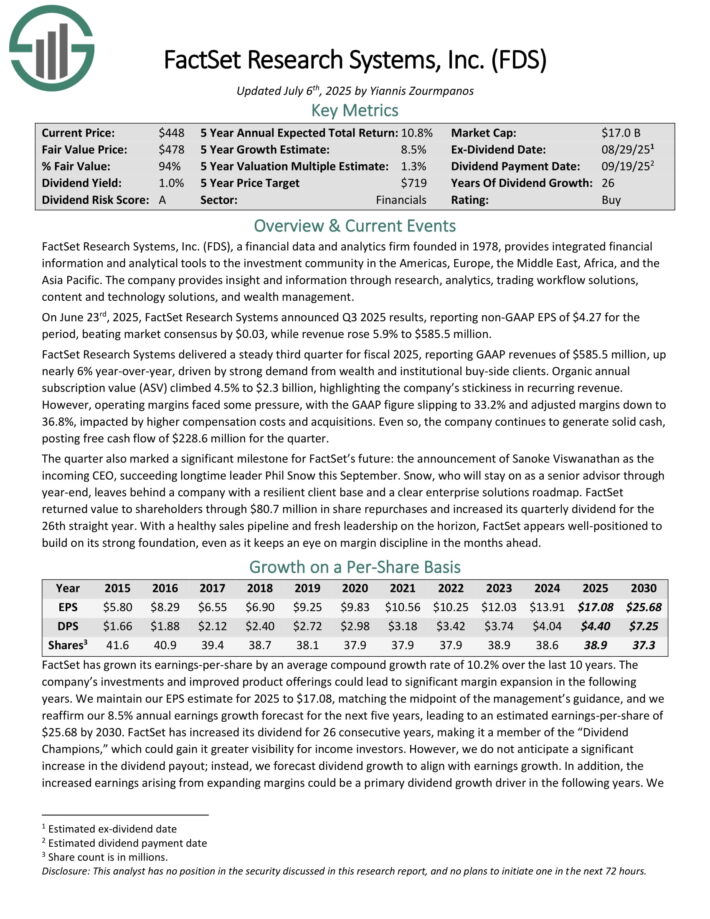

Cheapest Dividend Aristocrat #6: Factset Research Systems (FDS)

Annual Valuation Return: 5.1%

FactSet Research Systems, a financial data and analytics firm founded in 1978, provides integrated financial information and analytical tools to the investment community in the Americas, Europe, the Middle East, Africa, and Asia-Pacific.

The company provides insight and information through research, analytics, trading workflow solutions, content and technology solutions, and wealth management.

On June 23rd, 2025, FactSet Research Systems announced Q3 2025 results, reporting non-GAAP EPS of $4.27 for the period, beating market consensus by $0.03, while revenue rose 5.9% to $585.5 million.

It delivered a steady third quarter for fiscal 2025, reporting GAAP revenues of $585.5 million, up nearly 6% year-over-year, driven by strong demand from wealth and institutional buy-side clients.

Organic annual subscription value (ASV) climbed 4.5% to $2.3 billion, highlighting the company’s stickiness in recurring revenue.

However, operating margins faced some pressure, with the GAAP figure slipping to 33.2% and adjusted margins down to 36.8%, impacted by higher compensation costs and acquisitions.

Even so, the company continues to generate solid cash, posting free cash flow of $228.6 million for the quarter.

FactSet returned value to shareholders through $80.7 million in share repurchases and increased its quarterly dividend for the 26th straight year.

Click here to download our most recent Sure Analysis report on FDS (preview of page 1 of 3 shown below):

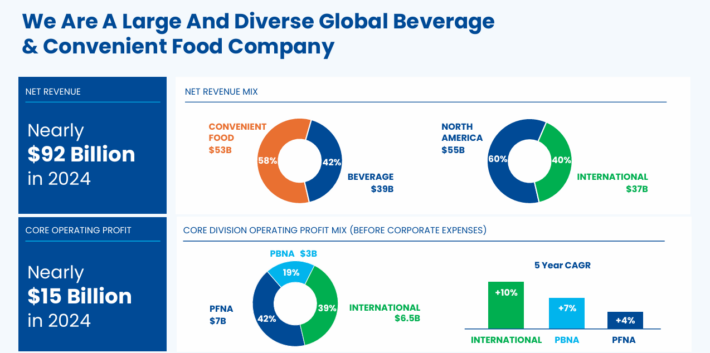

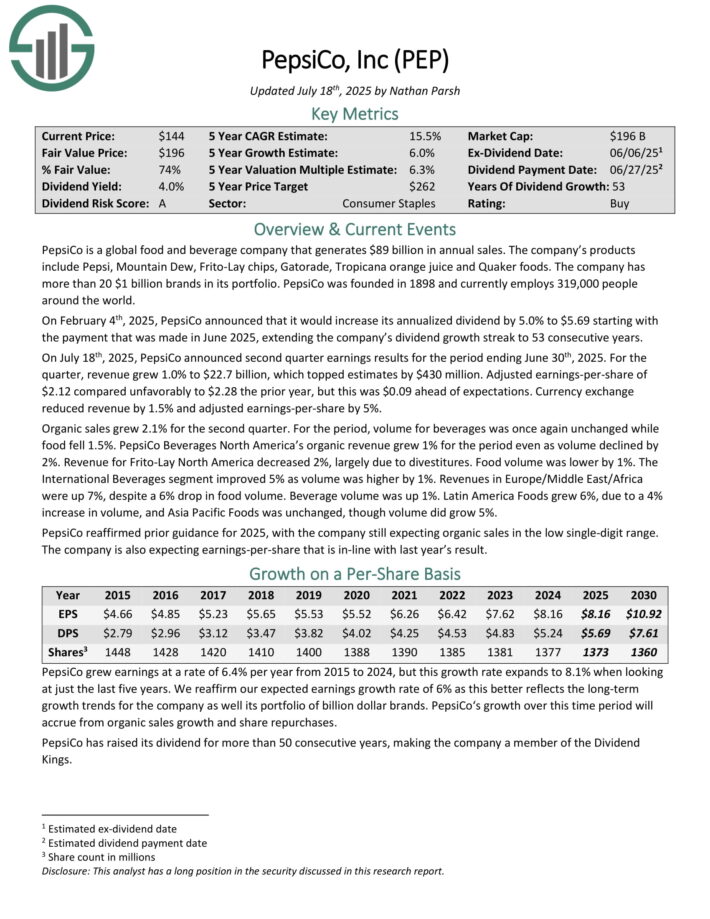

Cheapest Dividend Aristocrat #5: PepsiCo Inc. (PEP)

Annual Valuation Return: 6.5%

PepsiCo is a global food and beverage company. Its products include Pepsi, Mountain Dew, Frito-Lay chips, Gatorade, Tropicana orange juice and Quaker foods.

Its business is split roughly 60-40 in terms of food and beverage revenue. It is also balanced geographically between the U.S. and the rest of the world.

Source: Investor Presentation

On July 18th, 2025, PepsiCo announced second quarter earnings results for the period ending June 30th, 2025. For the quarter, revenue grew 1.0% to $22.7 billion, which topped estimates by $430 million.

Adjusted earnings-per-share of $2.12 compared unfavorably to $2.28 the prior year, but this was $0.09 ahead of expectations. Currency exchange reduced revenue by 1.5% and adjusted earnings-per-share by 5%.

Organic sales grew 2.1% for the second quarter. For the period, volume for beverages was once again unchanged while food fell 1.5%.

Click here to download our most recent Sure Analysis report on PEP (preview of page 1 of 3 shown below):

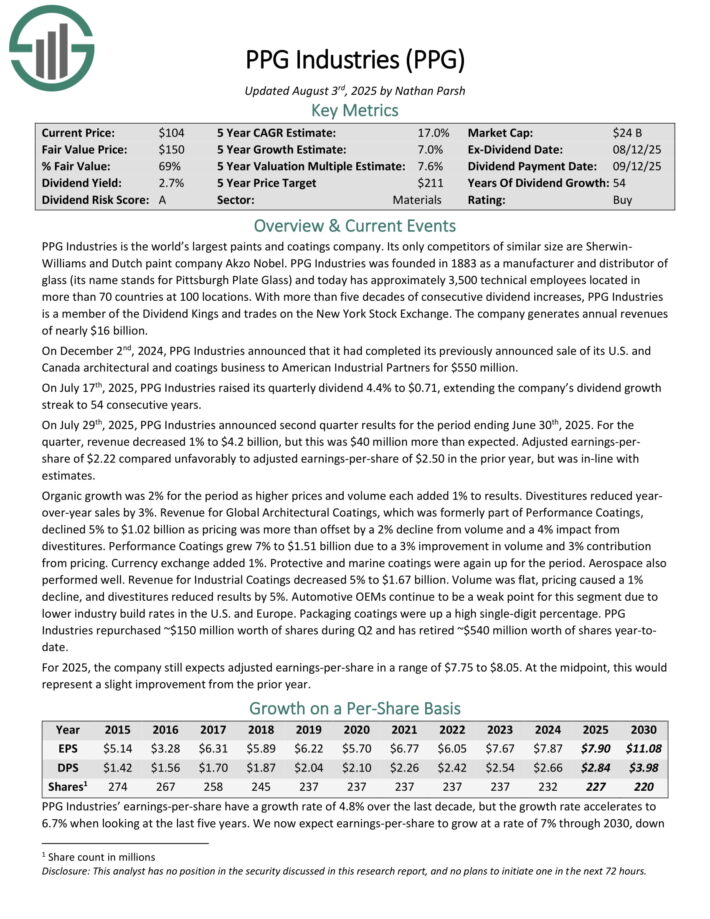

Cheapest Dividend Aristocrat #4: PPG Industries (PPG)

Annual Valuation Return: 6.5%

PPG Industries is the world’s largest paints and coatings company. Its only competitors of similar size are Sherwin-Williams and Dutch paint company Akzo Nobel.

PPG Industries was founded in 1883 as a manufacturer and distributor of glass (its name stands for Pittsburgh Plate Glass) and today has approximately 3,500 technical employees located in more than 70 countries at 100 locations.

On July 17th, 2025, PPG Industries raised its quarterly dividend 4.4% to $0.71, extending the company’s dividend growth streak to 54 consecutive years.

On July 29th, 2025, PPG Industries announced second-quarter results. For the quarter, revenue decreased 1% to $4.2 billion, but this was $40 million more than expected. Adjusted earnings-per-share of $2.22 compared unfavorably to adjusted earnings-per-share of $2.50 in the prior year, but was in-line with estimates.

Organic growth was 2% for the period as higher prices and volume each added 1% to results. Divestitures reduced year-over-year sales by 3%. Revenue for Global Architectural Coatings declined 5% to $1.02 billion as pricing was more than offset by a 2% decline from volume and a 4% impact from divestitures.

Performance Coatings grew 7% to $1.51 billion due to a 3% improvement in volume and 3% contribution from pricing. Currency exchange added 1%. Protective and marine coatings were again up for the period.

PPG Industries repurchased ~$150 million worth of shares during Q2 and has retired ~$540 million worth of shares year-to-date.

Click here to download our most recent Sure Analysis report on PPG (preview of page 1 of 3 shown below):

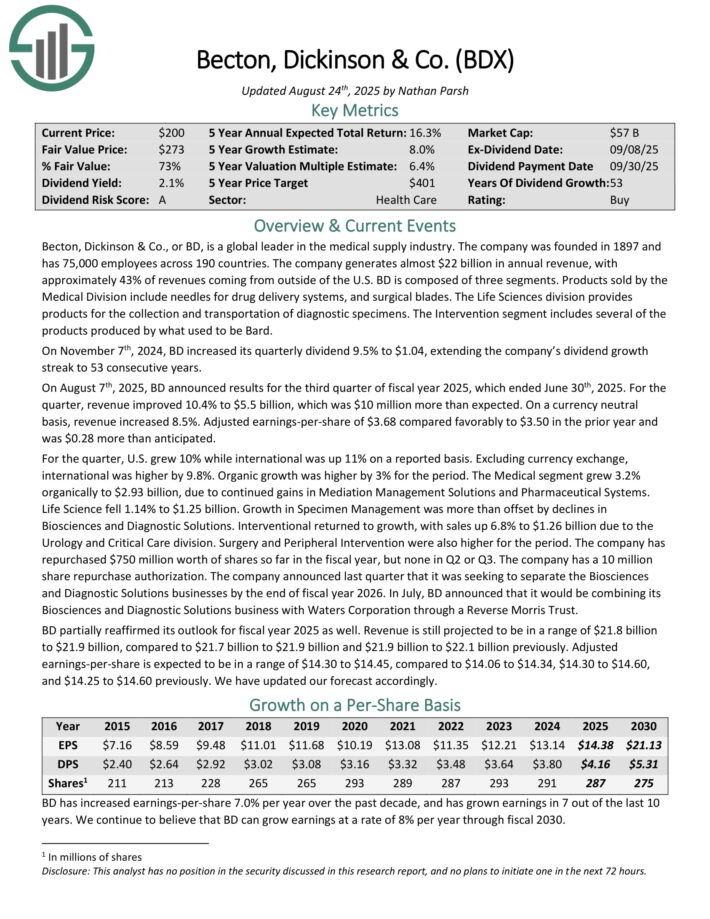

Cheapest Dividend Aristocrat #3: Becton Dickinson & Co. (BDX)

Annual Valuation Return: 7.5%

Becton, Dickinson & Co. is a global leader in the medical supply industry. The company was founded in 1897 and has 75,000 employees across 190 countries.

The company generates about $20 billion in annual revenue, with approximately 43% of revenues coming from outside of the U.S.

Becton, Dickinson & Co., or BD, is a global leader in the medical supply industry. The company generates almost $22 billion in annual revenue, with approximately 43% of revenues coming from outside of the U.S.

On August 7th, 2025, BD announced results for the third quarter of fiscal year 2025, which ended June 30th, 2025. For the quarter, revenue improved 10.4% to $5.5 billion, which was $10 million more than expected.

On a currency neutral basis, revenue increased 8.5%. Adjusted earnings-per-share of $3.68 compared favorably to $3.50 in the prior year and was $0.28 more than anticipated.

For the quarter, U.S. grew 10% while international was up 11% on a reported basis. Excluding currency exchange, international was higher by 9.8%. Organic growth was higher by 3% for the period.

BD partially reaffirmed its outlook for fiscal year 2025 as well. Revenue is still projected to be in a range of $21.8 billion to $21.9 billion, compared to $21.7 billion to $21.9 billion previously. Adjusted earnings-per-share is expected to be in a range of $14.30 to $14.45.

Click here to download our most recent Sure Analysis report on BDX (preview of page 1 of 3 shown below):

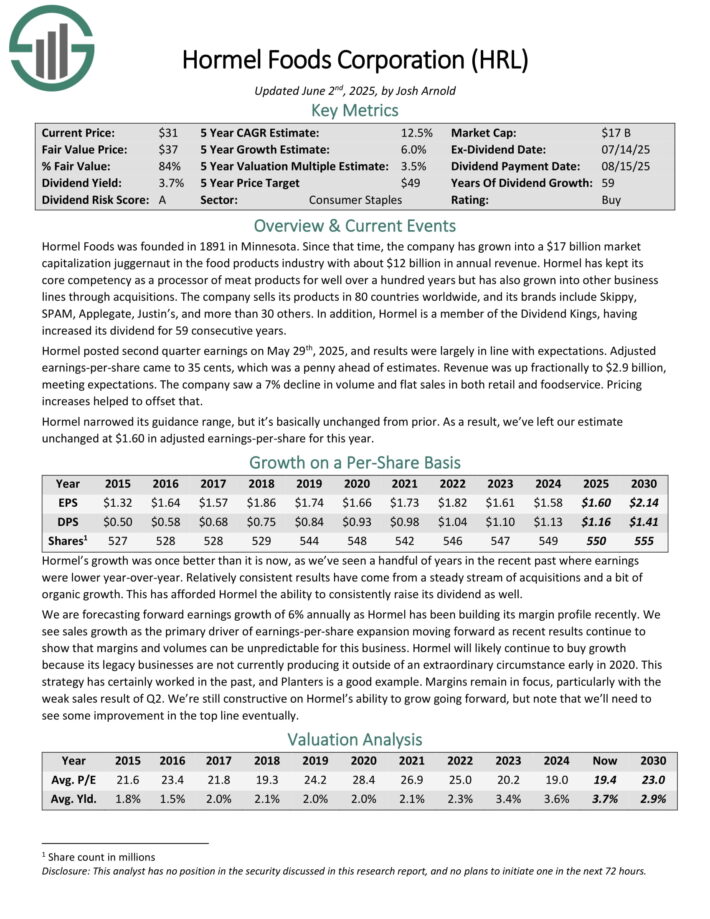

Cheapest Dividend Aristocrat #2: Hormel Foods (HRL)

Annual Valuation Return: 7.7%

Hormel Foods was founded back in 1891 in Minnesota. Since that time, the company has grown into a juggernaut in the food products industry with nearly $10 billion in annual revenue.

Hormel has kept with its core competency as a processor of meat products for well over a hundred years, but has also grown into other business lines through acquisitions.

Hormel has a large portfolio of category-leading brands. Just a few of its top brands include include Skippy, SPAM, Applegate, Justin’s, and more than 30 others.

The company has increased its dividend for 59 consecutive years.

Source: Investor Presentation

Hormel posted second quarter earnings on May 29th, 2025, and results were largely in line with expectations. Adjusted earnings-per-share came to 35 cents, which was a penny ahead of estimates.

Revenue was up fractionally to $2.9 billion, meeting expectations. The company saw a 7% decline in volume and flat sales in both retail and foodservice. Pricing increases helped to offset that.

Click here to download our most recent Sure Analysis report on HRL (preview of page 1 of 3 shown below):

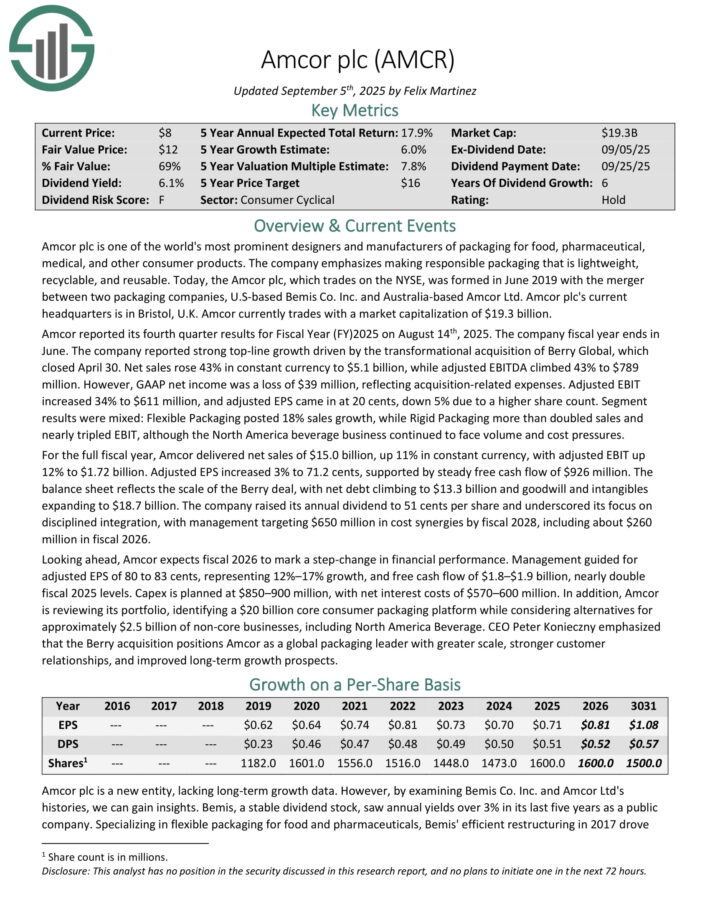

Cheapest Dividend Aristocrat #1: Amcor plc (AMCR)

Annual Valuation Return: 7.8%

Amcor plc is one of the world’s most prominent designers and manufacturers of packaging for food, pharmaceutical, medical, and other consumer products. The company emphasizes making responsible packaging that is lightweight, recyclable, and reusable.

Amcor reported its fourth quarter results for Fiscal Year 2025 on August 14th, 2025. The company fiscal year ends in June. The company reported strong top-line growth driven by the transformational acquisition of Berry Global, which closed April 30.

Net sales rose 43% in constant currency to $5.1 billion, while adjusted EBITDA climbed 43% to $789 million. However, GAAP net income was a loss of $39 million, reflecting acquisition-related expenses. Adjusted EBIT increased 34% to $611 million, and adjusted EPS came in at 20 cents, down 5% due to a higher share count.

Segment results were mixed: Flexible Packaging posted 18% sales growth, while Rigid Packaging more than doubled sales and nearly tripled EBIT, although the North America beverage business continued to face volume and cost pressures.

For the full fiscal year, Amcor delivered net sales of $15.0 billion, up 11% in constant currency, with adjusted EBIT up 12% to $1.72 billion. Adjusted EPS increased 3% to 71.2 cents, supported by steady free cash flow of $926 million.

The balance sheet reflects the scale of the Berry deal, with net debt climbing to $13.3 billion and goodwill and intangibles expanding to $18.7 billion.

The company raised its annual dividend to 51 cents per share and underscored its focus on disciplined integration, with management targeting $650 million in cost synergies by fiscal 2028, including about $260 million in fiscal 2026.

Click here to download our most recent Sure Analysis report on AMCR (preview of page 1 of 3 shown below):

Additional Reading

The following Sure Dividend databases contain the most reliable dividend growers in our investment universe:

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].