Published on August 18th, 2025 by Bob Ciura

Buy and hold investing is all about purchasing stocks that are built to last. In order for a company to maintain its competitive advantages over a long period of time, it must have a strong business model.

In turn, the strongest businesses can pay dividends, and continue to raise their dividends each year, even during recessions.

For this reason, we steer dividend growth investors toward high-quality stocks such as the Dividend Kings.

The Dividend Kings are the best-of-the-best in dividend longevity.

What is a Dividend King? A stock with 50 or more consecutive years of dividend increases.

You can see the full downloadable spreadsheet of all 55 Dividend Kings (along with important financial metrics such as dividend yields, payout ratios, and price-to-earnings ratios) by clicking on the link below:

This article will rank 10 Dividend Kings with the highest dividend growth rates. The following list of stocks have all raised their dividends for over 50 consecutive years, and have exhibited excellent dividend growth.

As a result, they are likely to continue raising their dividends at a high rate for many years to come.

Table of Contents

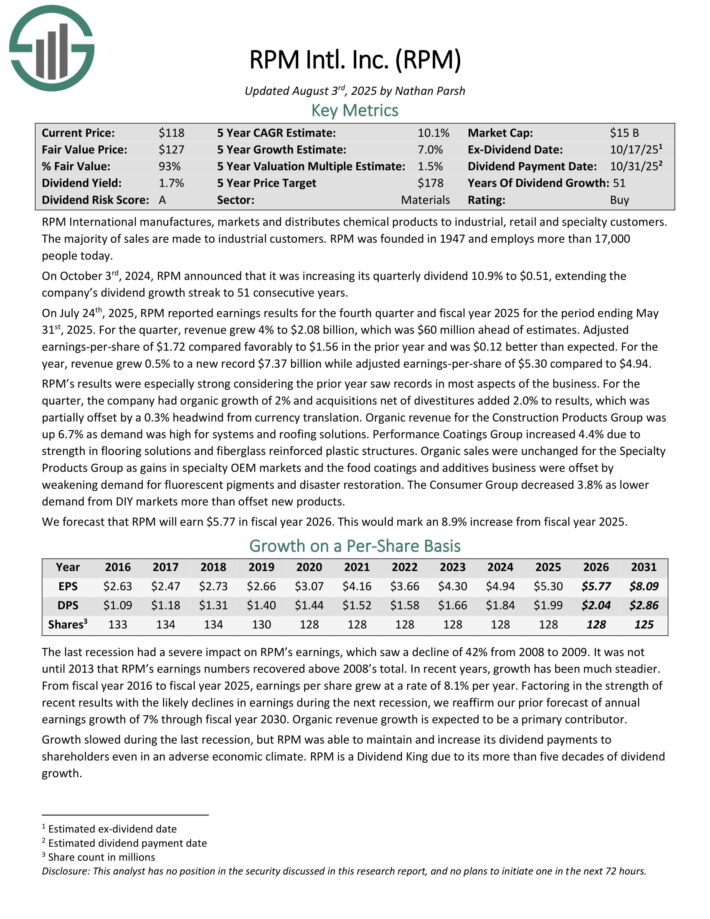

Buy and Hold Dividend King #10: RPM International (RPM)

RPM International manufactures, markets and distributes chemical products to industrial, retail and specialty customers. The majority of sales are made to industrial customers.

On July 24th, 2025, RPM reported earnings results for the fourth quarter and fiscal year 2025 for the period ending May 31st, 2025. For the quarter, revenue grew 4% to $2.08 billion, which was $60 million ahead of estimates. Adjusted earnings-per-share of $1.72 compared favorably to $1.56 in the prior year and was $0.12 better than expected.

For the year, revenue grew 0.5% to a new record $7.37 billion while adjusted earnings-per-share of $5.30 compared to $4.94. RPM’s results were especially strong considering the prior year saw records in most aspects of the business.

For the quarter, the company had organic growth of 2% and acquisitions net of divestitures added 2.0% to results, which was partially offset by a 0.3% headwind from currency translation.

Organic revenue for the Construction Products Group was up 6.7% as demand was high for systems and roofing solutions.

Click here to download our most recent Sure Analysis report on RPM (preview of page 1 of 3 shown below):

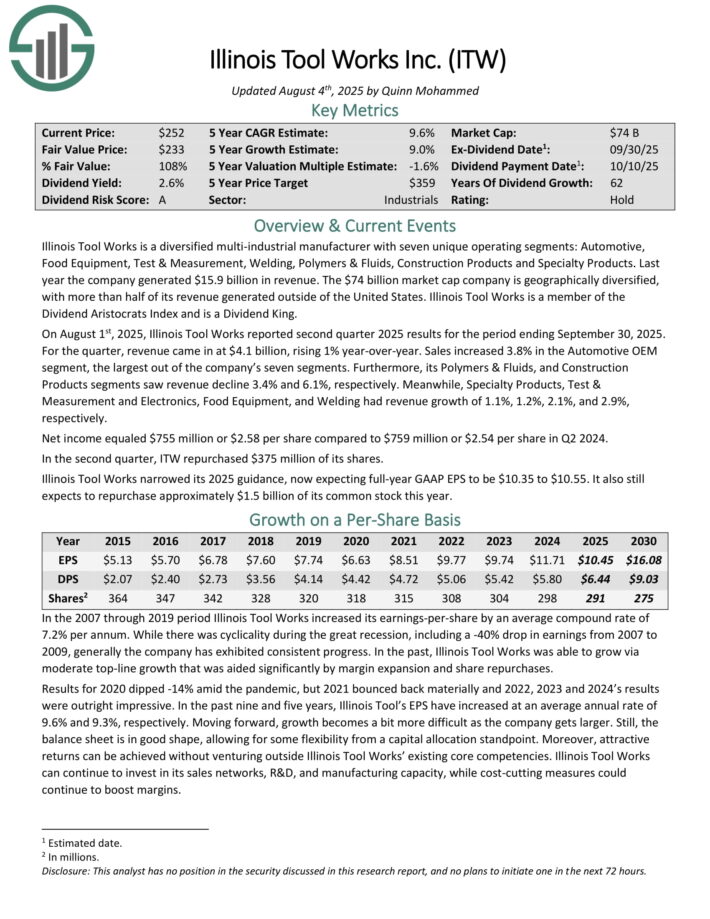

Buy and Hold Dividend King #9: Illinois Tool Works (ITW)

Illinois Tool Works is a diversified multi-industrial manufacturer with seven unique operating segments: Automotive, Food Equipment, Test & Measurement, Welding, Polymers & Fluids, Construction Products and Specialty Products.

Last year the company generated $15.9 billion in revenue.

On August 1st, 2025, Illinois Tool Works reported second quarter 2025 results. For the quarter, revenue came in at $4.1 billion, rising 1% year-over-year. Sales increased 3.8% in the Automotive OEM segment, the largest out of the company’s seven segments.

Furthermore, its Polymers & Fluids, and Construction Products segments saw revenue decline 3.4% and 6.1%, respectively.

Meanwhile, Specialty Products, Test & Measurement and Electronics, Food Equipment, and Welding had revenue growth of 1.1%, 1.2%, 2.1%, and 2.9%, respectively. Net income equaled $755 million or $2.58 per share compared to $759 million or $2.54 per share in Q2 2024.

Click here to download our most recent Sure Analysis report on ITW (preview of page 1 of 3 shown below):

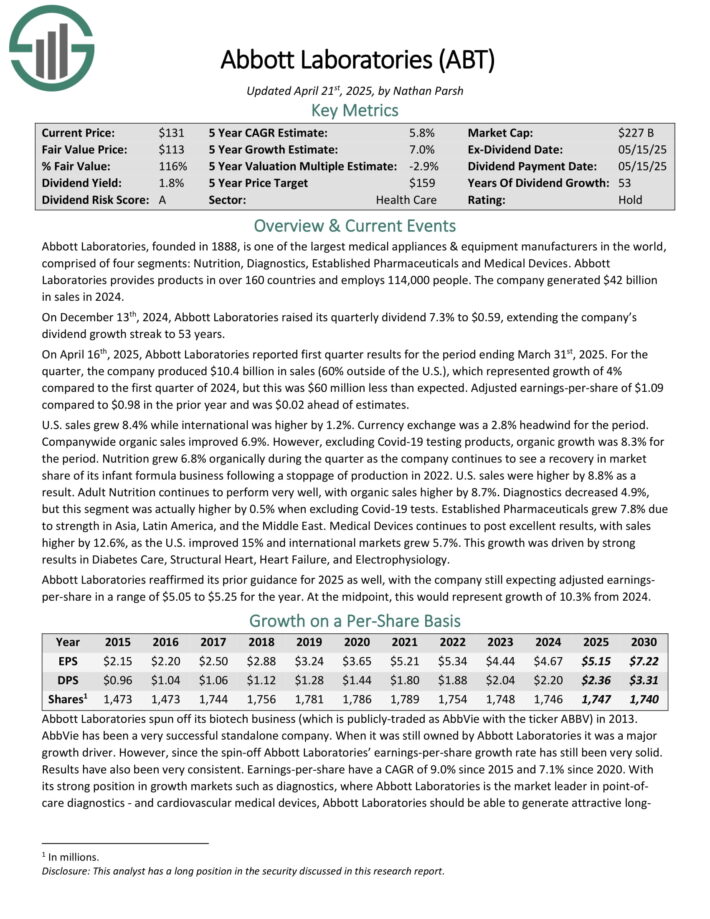

Buy and Hold Dividend King #8: Abbott Laboratories (ABT)

Abbott Laboratories, founded in 1888, is one of the largest medical appliances & equipment manufacturers in the world, comprised of four segments: Nutrition, Diagnostics, Established Pharmaceuticals and Medical Devices.

Abbott Laboratories provides products in over 160 countries and employs 114,000 people. The company generated $42 billion in sales in 2024.

On April 16th, 2025, Abbott Laboratories reported first quarter results for the period ending March 31st, 2025. For the quarter, the company produced $10.4 billion in sales (60% outside of the U.S.), which represented growth of 4% compared to the first quarter of 2024, but this was $60 million less than expected.

Adjusted earnings-per-share of $1.09 compared to $0.98 in the prior year and was $0.02 ahead of estimates.

U.S. sales grew 8.4% while international was higher by 1.2%. Currency exchange was a 2.8% headwind for the period. Company-wide organic sales improved 6.9%. However, excluding Covid-19 testing products, organic growth was 8.3% for the period.

Nutrition grew 6.8% organically during the quarter as the company continues to see a recovery in market share of its infant formula business following a stoppage of production in 2022. U.S. sales were higher by 8.8% as a result.

Click here to download our most recent Sure Analysis report on ABT (preview of page 1 of 3 shown below):

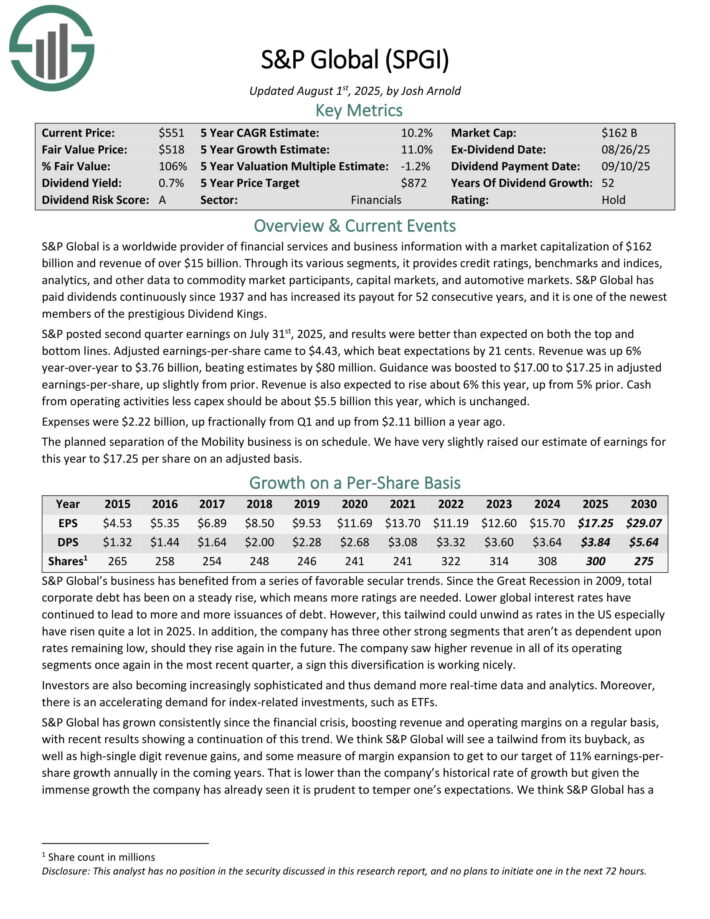

Buy and Hold Dividend King #7: S&P Global Inc. (SPGI)

S&P Global is a worldwide provider of financial services and business information with revenue of over $15 billion. Through its various segments, it provides credit ratings, benchmarks and indices, analytics, and other data to commodity market participants, capital markets, and automotive markets.

S&P Global has paid dividends continuously since 1937 and has increased its payout for 52 consecutive years.

S&P posted second quarter earnings on July 31st, 2025, and results were better than expected on both the top and bottom lines. Adjusted earnings-per-share came to $4.43, which beat expectations by 21 cents. Revenue was up 6% year-over-year to $3.76 billion, beating estimates by $80 million.

Guidance was boosted to $17.00 to $17.25 in adjusted earnings-per-share, up slightly from prior. Revenue is also expected to rise about 6% this year, up from 5% prior.

Cash from operating activities less capex should be about $5.5 billion this year, which is unchanged. Expenses were $2.22 billion, up fractionally from Q1 and up from $2.11 billion a year ago.

Click here to download our most recent Sure Analysis report on SPGI (preview of page 1 of 3 shown below):

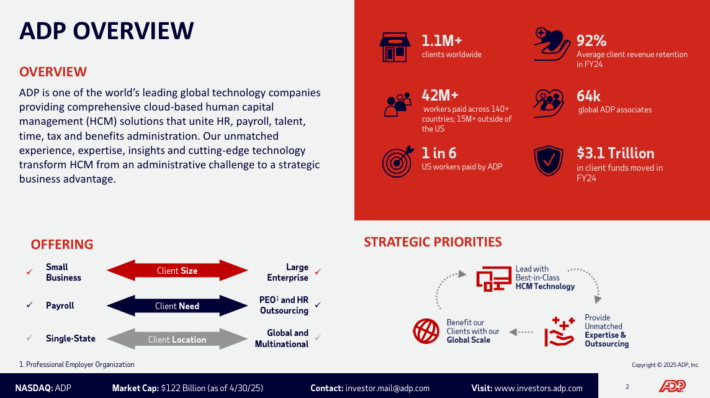

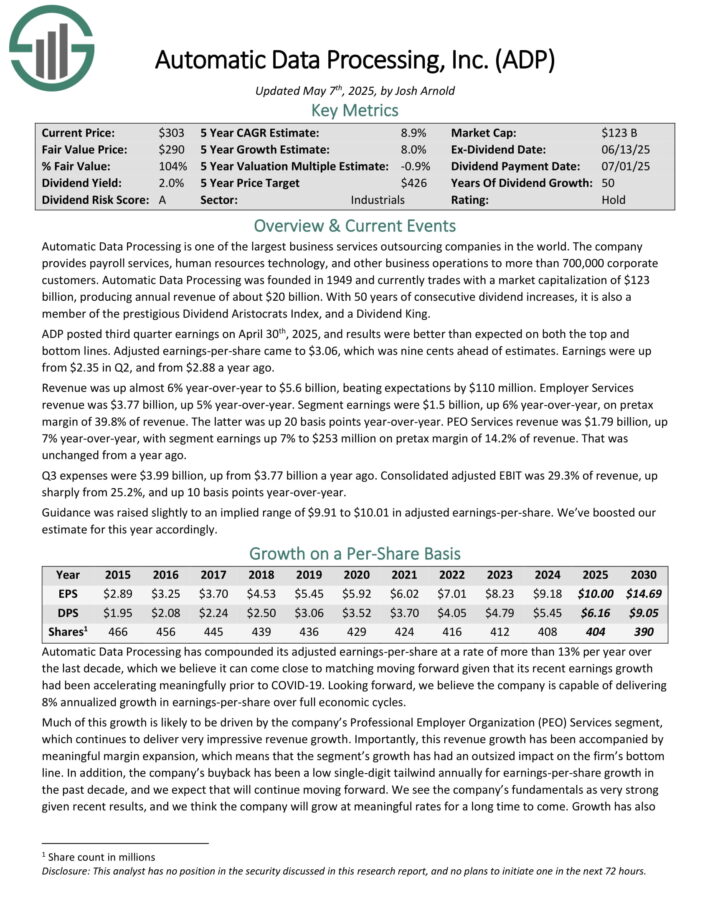

Buy and Hold Dividend King #6: Automatic Data Processing (ADP)

Automatic Data Processing is one of the largest business services outsourcing companies in the world. The company provides payroll services, human resources technology, and other business operations to more than 700,000 corporate customers. Automatic Data Processing produces annual revenue of about $20 billion.

Source: Investor Presentation

ADP posted third quarter earnings on April 30th, 2025, and results were better than expected on both the top and bottom lines. Adjusted earnings-per-share came to $3.06, which was nine cents ahead of estimates. Earnings were up from $2.35 in Q2, and from $2.88 a year ago.

Revenue was up almost 6% year-over-year to $5.6 billion, beating expectations by $110 million. Employer Services revenue was $3.77 billion, up 5% year-over-year. Segment earnings were $1.5 billion, up 6% year-over-year, on pretax margin of 39.8% of revenue. The latter was up 20 basis points year-over-year.

PEO Services revenue was $1.79 billion, up 7% year-over-year, with segment earnings up 7% to $253 million on pretax margin of 14.2% of revenue. That was unchanged from a year ago.

Click here to download our most recent Sure Analysis report on ADP (preview of page 1 of 3 shown below):

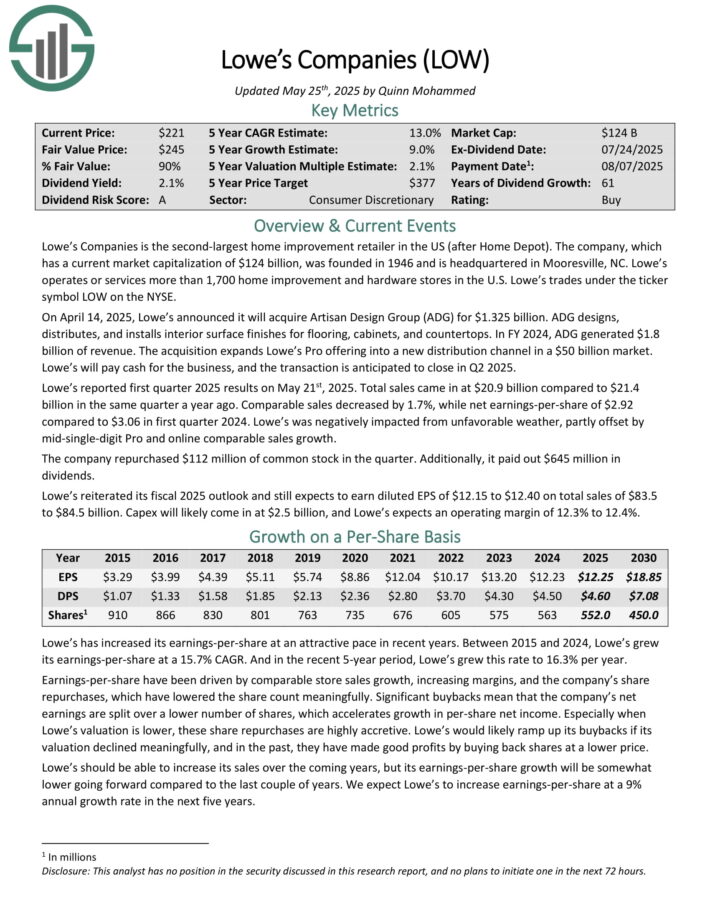

Buy and Hold Dividend King #5: Lowe’s Cos. Inc. (LOW)

Lowe’s Companies is the second-largest home improvement retailer in the US (after Home Depot). The company was founded in 1946 and is headquartered in Mooresville, NC.

Lowe’s operates or services more than 1,700 home improvement and hardware stores in the U.S.

On April 14, 2025, Lowe’s announced it will acquire Artisan Design Group (ADG) for $1.325 billion. ADG designs, distributes, and installs interior surface finishes for flooring, cabinets, and countertops.

In FY 2024, ADG generated $1.8 billion of revenue. The acquisition expands Lowe’s Pro offering into a new distribution channel in a $50 billion market. Lowe’s will pay cash for the business, and the transaction is anticipated to close in Q2 2025.

Lowe’s reported first quarter 2025 results on May 21st, 2025. Total sales came in at $20.9 billion compared to $21.4 billion in the same quarter a year ago. Comparable sales decreased by 1.7%, while net earnings-per-share of $2.92 compared to $3.06 in first quarter 2024.

Lowe’s was negatively impacted from unfavorable weather, partly offset by mid-single-digit Pro and online comparable sales growth.

The company repurchased $112 million of common stock in the quarter. Additionally, it paid out $645 million in dividends.

Lowe’s reiterated its fiscal 2025 outlook and still expects to earn diluted EPS of $12.15 to $12.40 on total sales of $83.5 to $84.5 billion.

Click here to download our most recent Sure Analysis report on LOW (preview of page 1 of 3 shown below):

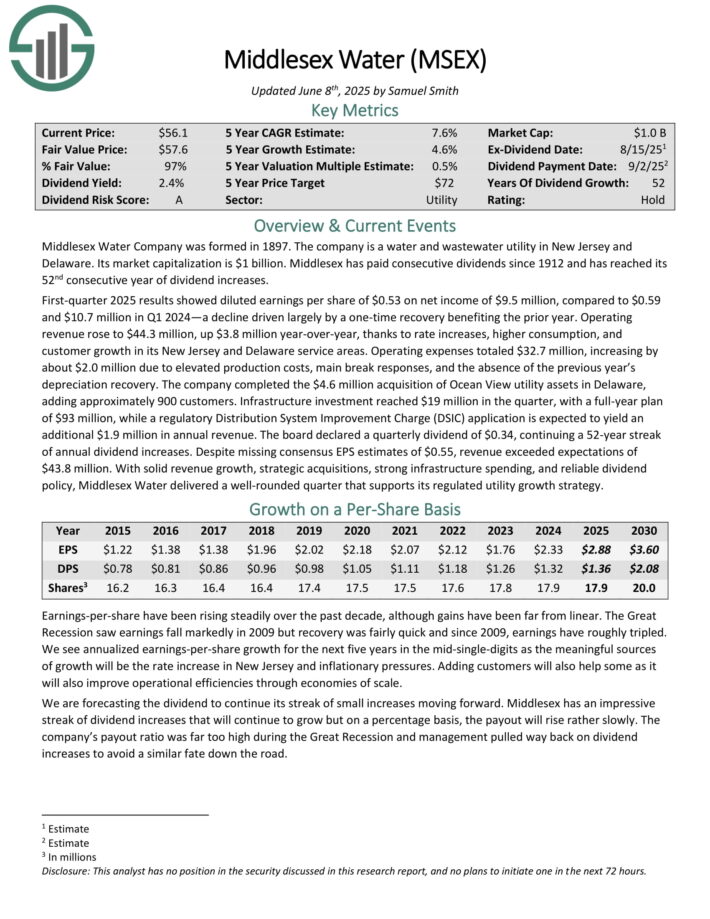

Buy and Hold Dividend King #4: Middlesex Water Co. (MSEX)

Middlesex Water Company was formed in 1897. The company is a water and wastewater utility in New Jersey and Delaware. Middlesex has paid consecutive dividends since 1912.

First-quarter 2025 results showed diluted earnings per share of $0.53 on net income of $9.5 million, compared to $0.59 and $10.7 million in Q1 2024—a decline driven largely by a one-time recovery benefiting the prior year.

Operating revenue rose to $44.3 million, up $3.8 million year-over-year, thanks to rate increases, higher consumption, and customer growth in its New Jersey and Delaware service areas.

The company completed the $4.6 million acquisition of Ocean View utility assets in Delaware, adding approximately 900 customers.

Infrastructure investment reached $19 million in the quarter, with a full-year plan of $93 million, while a regulatory Distribution System Improvement Charge (DSIC) application is expected to yield an additional $1.9 million in annual revenue.

The board declared a quarterly dividend of $0.34, continuing a 52-year streak of annual dividend increases.

Click here to download our most recent Sure Analysis report on MSEX (preview of page 1 of 3 shown below):

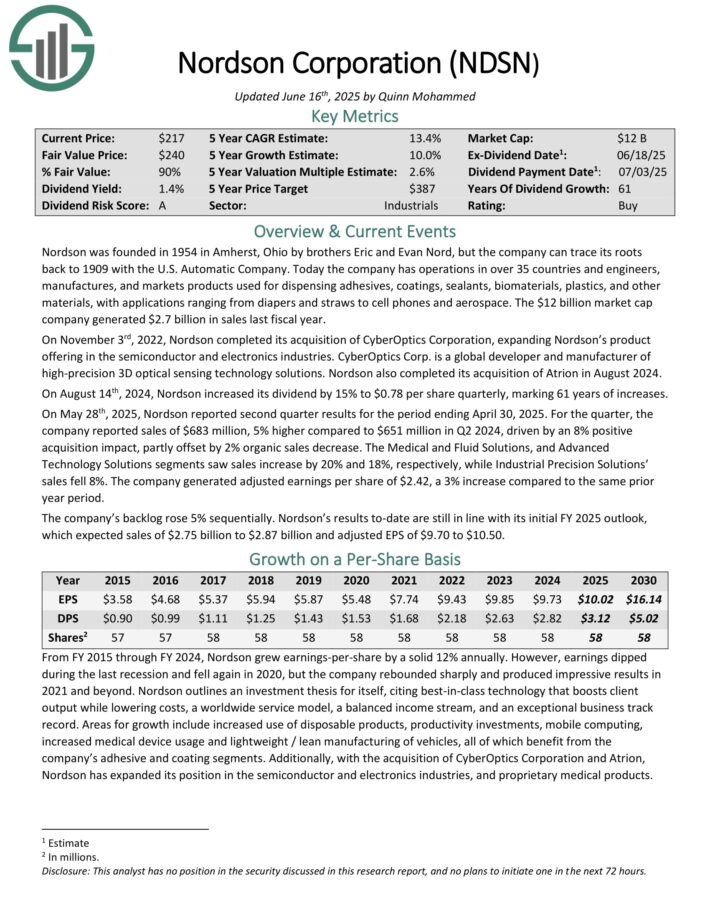

Buy and Hold Dividend King #3: Nordson Corp. (NDSN)

Nordson was founded in 1954. Today the company has operations in over 35 countries and engineers, manufactures, and markets products used for dispensing adhesives, coatings, sealants, biomaterials, plastics, and other materials, with applications ranging from diapers and straws to cell phones and aerospace.

The company generated $2.7 billion in sales last fiscal year.

On May 28th, 2025, Nordson reported second quarter results for the period ending April 30, 2025. For the quarter, the company reported sales of $683 million, 5% higher compared to $651 million in Q2 2024, driven by an 8% positive acquisition impact, partly offset by 2% organic sales decrease.

The Medical and Fluid Solutions, and Advanced Technology Solutions segments saw sales increase by 20% and 18%, respectively, while Industrial Precision Solutions sales fell 8%. The company generated adjusted earnings per share of $2.42, a 3% increase compared to the same prior year period.

The company’s backlog rose 5% sequentially.

Click here to download our most recent Sure Analysis report on NDSN (preview of page 1 of 3 shown below):

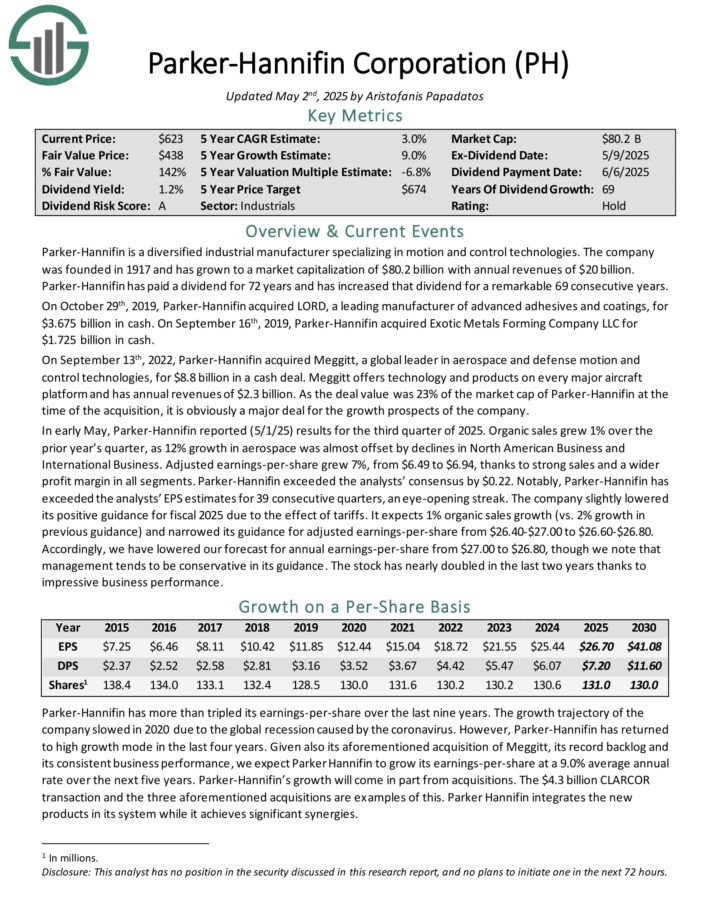

Buy and Hold Dividend King #2: Parker-Hannifin Corp. (PH)

Parker-Hannifin is a diversified industrial manufacturer specializing in motion and control technologies. The company generates annual revenues of $20 billion.

Parker-Hannifin has increased the dividend for 69 consecutive years.

Source: Investor Presentation

In early May, Parker-Hannifin reported (5/1/25) results for the third quarter of 2025. Organic sales grew 1% over the prior year’s quarter, as 12% growth in aerospace was almost offset by declines in North American Business and International Business.

Adjusted earnings-per-share grew 7%, from $6.49 to $6.94, thanks to strong sales and a wider profit margin in all segments.

Parker-Hannifin exceeded the analysts’ consensus by $0.22. Notably, Parker-Hannifin has exceeded the analysts’ EPS estimates for 39 consecutive quarters.

Click here to download our most recent Sure Analysis report on Parker-Hannifin (preview of page 1 of 3 shown below):

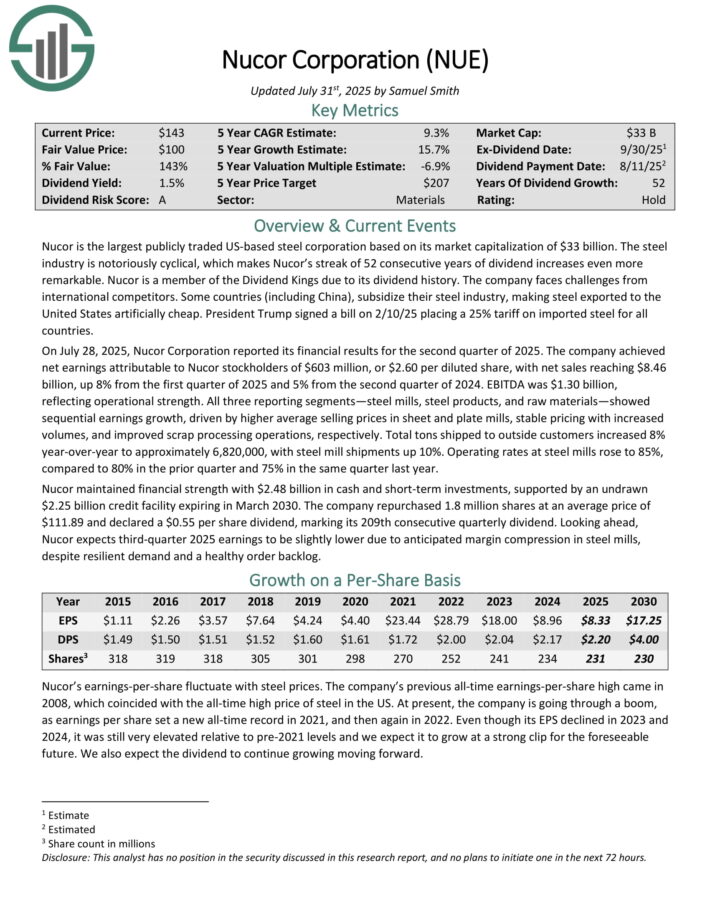

Buy and Hold Dividend King #1: Nucor Corp. (NUE)

Nucor is the largest publicly traded US-based steel corporation based on its market capitalization. The steel industry is notoriously cyclical, which makes Nucor’s streak of 52 consecutive years of dividend increases even more remarkable.

On July 28, 2025, Nucor Corporation reported its financial results for the second quarter of 2025. The company achieved net earnings attributable to Nucor stockholders of $2.60 per diluted share, with net sales reaching $8.46 billion, up 8% from the second quarter of 2024. EBITDA was $1.30 billion, reflecting operational strength.

All three reporting segments—steel mills, steel products, and raw materials—showed sequential earnings growth, driven by higher average selling prices in sheet and plate mills, stable pricing with increased volumes, and improved scrap processing operations, respectively.

Total tons shipped to outside customers increased 8% year-over-year to approximately 6,820,000, with steel mill shipments up 10%. Operating rates at steel mills rose to 85%, compared to 80% in the prior quarter and 75% in the same quarter last year.

Click here to download our most recent Sure Analysis report on NUE (preview of page 1 of 3 shown below):

Additional Reading

If you are interested in finding high-quality dividend growth stocks and/or other high-yield securities and income securities, the following Sure Dividend resources will be useful:

Other Sure Dividend Resources

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].