Published on September 17th, 2025 by Bob Ciura

The idea behind value investing is to buy assets for less than they are worth. The larger the discrepancy between price and value, the bigger the margin of safety.

Value investing is simple to understand, but not easy to practice.

Stocks trading at a discount to their assets usually do so for a reason. They tend to be out of favor and surrounded by negative sentiment.

Unfortunately, undervalued stocks do not rebound just because you buy them. The market doesn’t care when you purchase a security.

Some value securities may rebound to fair value in a month, others may take years, or may never rebound at all. Waiting for your value stocks to appreciate can be fraught with both anxiety and disappointment.

Therefore, we recommend combining investing in undervalued securities with investing in securities that have high and growing yields.

We define stocks that have increased their dividends for 10+ years as blue-chip stocks.

You can download our free blue chip stocks list with important financial metrics such as dividend yields and price-to-earnings ratios, by clicking on the link below:

The combination of low valuations and high (and growing) yields could produce strong returns.

Instead of waiting for a stock to appreciate, you invest to collect the income the value stock is generating.

If it takes several years to recover, you will have created growing cash flows from the rising dividends on the stock. You get paid to wait when you purchase undervalued securities with high yields and growing dividends.

If the stock price recovers quickly, then you have quick capital appreciation.

If the stock price does not recover quickly, then you still benefit from a high starting yield on cost, and growing income rolling in quarterly.

This article will discuss the 10 blue-chip stocks with the highest projected return from valuation multiple expansion.

The 10 blue chip stocks are sorted by annual expected valuation return, in ascending order.

Table of Contents

The table of contents below allows for easy navigation.

Blue Chip #10: Novo Nordisk (NVO)

Annual Valuation Return: 8.6%

Novo Nordisk A/S ADR is a large global pharmaceutical company headquartered in Denmark. The company focuses on two core business segments: Diabetes & Obesity Care and Rare Diseases.

The Diabetes & Obesity Care segment manufactures insulin, related delivery systems, oral anti-diabetic products, and products to treat obesity.

The Rare Diseases segment manufactures products for hemophilia and other chronic diseases. Novo Nordisk derives ~92% of revenue from diabetes and obesity.

The company’s products are marketed in 170 countries but approximately 48% of net sales are from North America and the rest is international sales.1 Total revenue was nearly $40.7B in 2024.

Novo Nordisk reported solid H1 2025 results on August 6th, 2025. Company-wide sales were up 16% in Danish kroner to 154,944M ($24,300M) from 133,409 ($20,922M) and diluted earnings per share rose 23% to 12.49 DKK ($1.96) from 10.17 DKK ($1.59) on a year-over-year basis.

Diabetes & Obesity sales increased 16% to 145,406M DKK ($22,804M) driven by increases in Ozempic and Rybelsus (GLP-1), Wegovy (obesity), long-acting insulin, and fast-acting insulin, offset by lower sales for human insulin, Saxenda (obesity), Victoza (GLP-1), and flat premix insulin.

The Rare Disease segment sales rose 14% to 9,538M DKK ($1,496M) caused by rising rare blood and endocrine disorders drugs.

The firm is expanding its blockbuster GLP-1 and obesity drugs to other indications and dosing sizes. The company lowered its outlook to 8 – 14% sales growth and 10% – 16% operating profit growth in 2025.

Click here to download our most recent Sure Analysis report on NVO (preview of page 1 of 3 shown below):

Blue Chip #9: Sonoco Products (SON)

Annual Valuation Return: 8.8%

Sonoco Products provides packaging, industrial products and supply chain services to its customers. The markets that use the company’s products include those in the appliances, electronics, beverage, construction and food industries.

The company generates over $5 billion in annual sales. Sonoco Products is now composed of 2 major segments, Consumer Packaging, and Industrial Packaging, with all other businesses listed as “All Other”.

On April 16th, 2025, Sonoco Products raised its quarterly dividend 1.9% to $0.53, extending the company’s dividend growth streak to 49 consecutive years.

On July 23rd, 2025, Sonoco Products announced second quarter results for the period ending June 29th, 2025. For the quarter, revenue grew 17.9% to $1.91 billion, which was in-line with estimates. Adjusted earnings-per-share of $1.37 compared to $1.28 in the prior year, but was $0.08 less than expected.

Revenues and earnings benefited from the addition of Eviosys. For the quarter, Consumer Packaging revenues surged 110% to $1.23 billion, mostly due to contributions from Eviosys.

Volume growth was strong and favorable currency exchange rates also aided results. Industrial Paper Packing sales fell 2% to $588 million due to the impact of foreign currency exchange rates and lower volume following two plant divestitures in China last year.

Click here to download our most recent Sure Analysis report on Sonoco (SON) (preview of page 1 of 3 shown below):

Blue Chip #8: Flowers Foods (FLO)

Annual Valuation Return: 8.9%

Flowers Foods opened its first bakery in 1919 and has since become one of the largest producers of packaged bakery foods in the United States, operating 46 bakeries in 18 states.

Well-known brands include Wonder Bread, Home Pride, Nature’s Own, Dave’s Killer Bread, Tastykake and Canyon Bakehouse.

The company operates in two segments: Direct-Store-Delivery (DSD) and Warehouse Delivery, with ~85% of the company’s product being delivered directly to stores.

Fresh breads, buns, rolls, and tortillas make up about a three-fourths of the business, with sales channels for the company split between Supermarkets, Mass Merchandisers, Foodservice, and Convenience Store.

On May 22nd, 2025, Flower Foods increased its quarterly dividend 3.1% to $0.2475, extending the company’s dividend growth streak to 23 consecutive years.

On August 15th, 2025, Flowers Foods announced second quarter results for the period ending July 12th, 2025. For the quarter, revenue grew 0.8% to $1.24 billion, but missed estimates by $30 million. Adjusted earnings-per-share of $0.30 compared to $0.36 last year, but this was $0.01 more than expected.

For the quarter, Branded Retail sales improved 5% to $826.7 million as declines in pricing (-1.5%) and volumes (-1.3%) were offset by a strong contribution from Simple Mills (+7.8%).

Other sales decreased 4.8% to $416.1 million due to lower volumes and weaker pricing and mix. Materials, supplies, labor, and other production costs accounted for 51.2% of sales during the quarter, which was a 110 basis point increase from the prior year.

Flowers Foods provided an updated outlook for 2025 as well. Adjusted earnings-per-share are now expected to be in a range of $1.00 to $1.10 for the year.

Click here to download our most recent Sure Analysis report on FLO (preview of page 1 of 3 shown below):

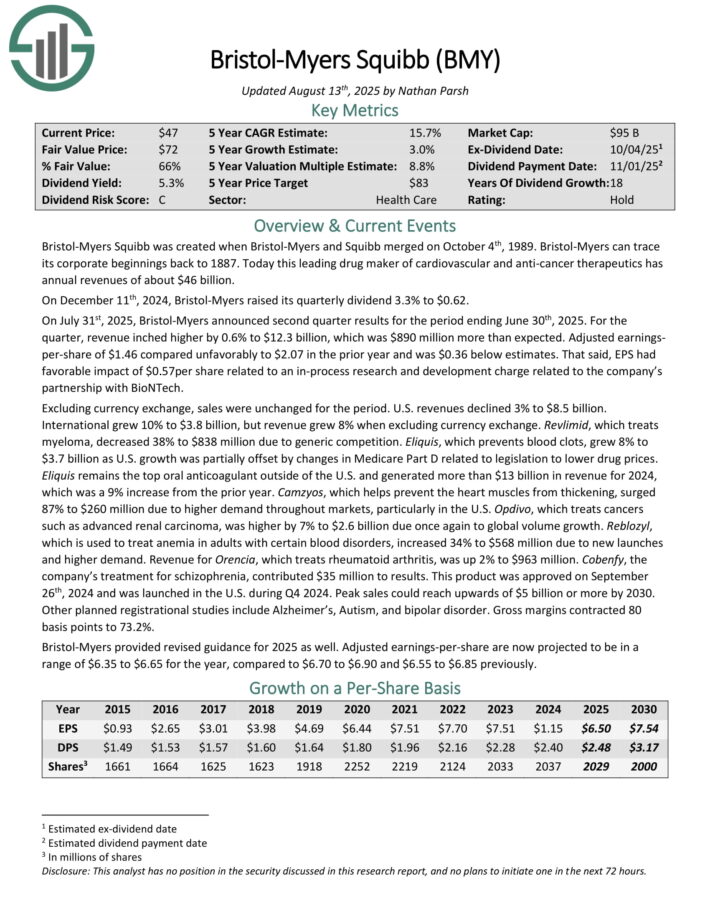

Blue Chip #7: Bristol-Myers Squibb (BMY)

Annual Valuation Return: 9.2%

Bristol-Myers Squibb is a leading drug maker of cardiovascular and anti-cancer therapeutics has annual revenues of about $46 billion.

On July 31st, 2025, Bristol-Myers announced second quarter results for the period ending June 30th, 2025. For the quarter, revenue inched higher by 0.6% to $12.3 billion, which was $890 million more than expected. Adjusted earnings-per-share of $1.46 compared unfavorably to $2.07 in the prior year and was $0.36 below estimates.

That said, EPS had favorable impact of $0.57per share related to an in-process research and development charge related to the company’s partnership with BioNTech.

U.S. revenues declined 3% to $8.5 billion. International grew 10% to $3.8 billion, but revenue grew 8% when excluding currency exchange. Eliquis, which prevents blood clots, grew 8% to $3.7 billion as U.S. growth was partially offset by changes in Medicare Part D related to legislation to lower drug prices.

Eliquis remains the top oral anticoagulant outside of the U.S. and generated more than $13 billion in revenue for 2024, which was a 9% increase from the prior year. Opdivo, which treats cancers such as advanced renal carcinoma, was higher by 7% to $2.6 billion due once again to global volume growth.

Bristol-Myers provided revised guidance for 2025 as well. Adjusted earnings-per-share are now projected to be in a range of $6.35 to $6.65 for the year.

Click here to download our most recent Sure Analysis report on BMY (preview of page 1 of 3 shown below):

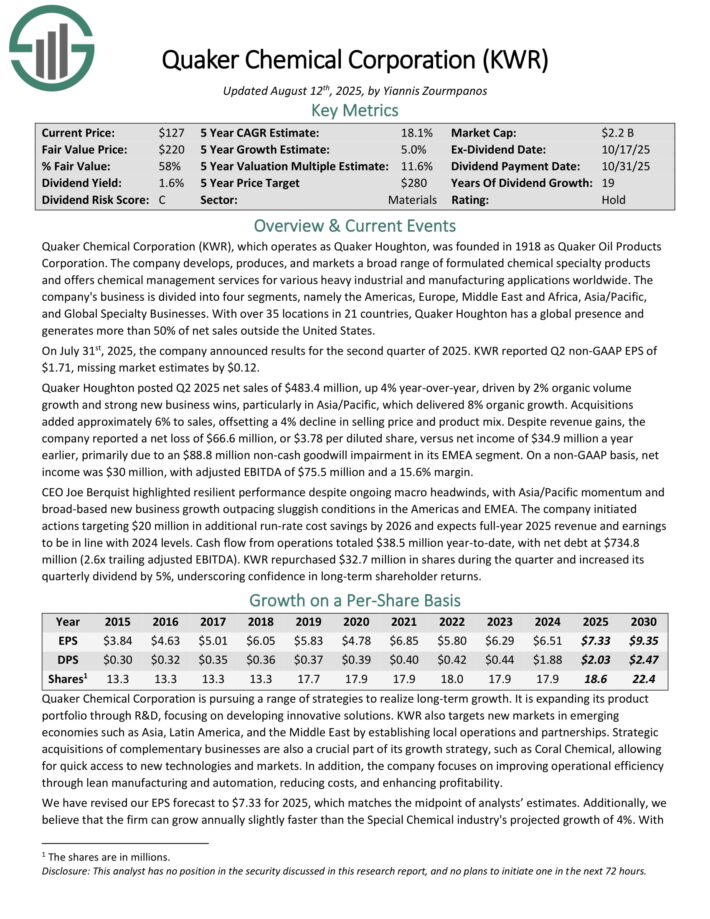

Blue Chip #6: Quaker Houghton (KWR)

Annual Valuation Return: 9.5%

Quaker Chemical Corporation, which operates as Quaker Houghton, was founded in 1918 as Quaker Oil Products Corporation.

The company develops, produces, and markets a broad range of formulated chemical specialty products and offers chemical management services for various heavy industrial and manufacturing applications worldwide.

The company’s business is divided into four segments, namely the Americas, Europe, Middle East and Africa, Asia/Pacific, and Global Specialty Businesses.

With over 35 locations in 21 countries, Quaker Houghton has a global presence and generates more than 50% of net sales outside the United States.

On July 31st, 2025, the company announced results for the second quarter of 2025. KWR reported Q2 non-GAAP EPS of $1.71, missing market estimates by $0.12.

Quaker Houghton posted Q2 2025 net sales of $483.4 million, up 4% year-over-year, driven by 2% organic volume growth and strong new business wins, particularly in Asia/Pacific, which delivered 8% organic growth.

Acquisitions added approximately 6% to sales, offsetting a 4% decline in selling price and product mix. Despite revenue gains, the company reported a net loss of $66.6 million, or $3.78 per diluted share, versus net income of $34.9 million a year earlier, primarily due to an $88.8 million non-cash goodwill impairment in its EMEA segment.

On a non-GAAP basis, net income was $30 million, with adjusted EBITDA of $75.5 million and a 15.6% margin.

KWR repurchased $32.7 million in shares during the quarter and increased its quarterly dividend by 5%.

Click here to download our most recent Sure Analysis report on KWR (preview of page 1 of 3 shown below):

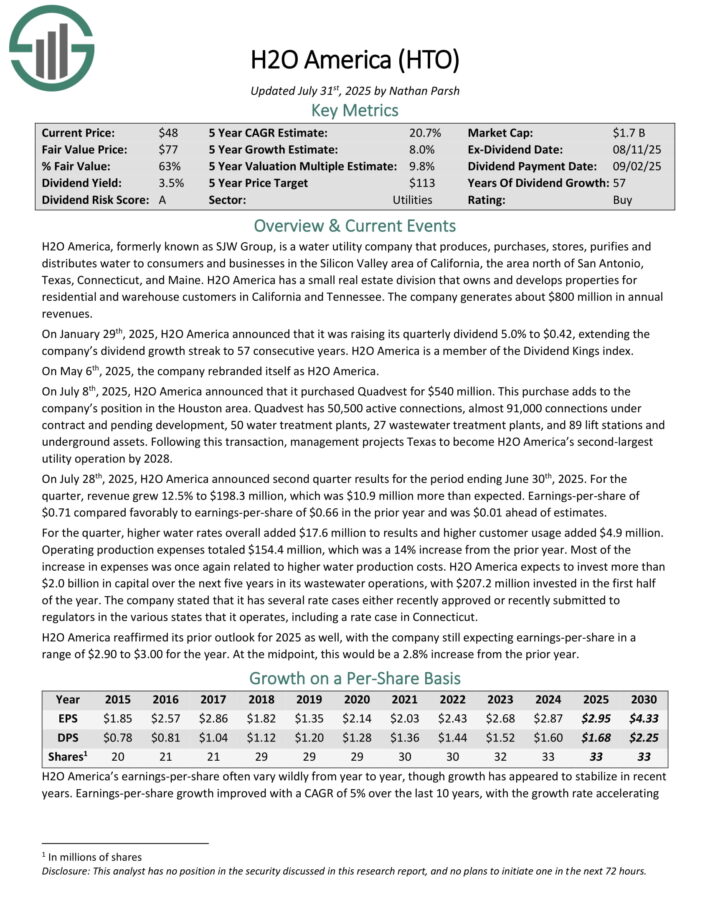

Blue Chip #5: H2O America (HTO)

Annual Valuation Return: 9.8%

H2O America, formerly known as SJW Group, is a water utility company that produces, purchases, stores, purifies and distributes water to consumers and businesses in the Silicon Valley area of California, the area north of San Antonio, Texas, Connecticut, and Maine.

It also has a small real estate division that owns and develops properties for residential and warehouse customers in California and Tennessee. The company generates about $670 million in annual revenues.

On July 8th, 2025, H2O America announced that it purchased Quadvest for $540 million. This purchase adds to the company’s position in the Houston area.

Quadvest has 50,500 active connections, almost 91,000 connections under contract and pending development, 50 water treatment plants, 27 wastewater treatment plants, and 89 lift stations and underground assets.

On July 28th, 2025, H2O America announced second quarter results for the period ending June 30th, 2025. For the quarter, revenue grew 12.5% to $198.3 million, which was $10.9 million more than expected.

Earnings-per-share of $0.71 compared favorably to earnings-per-share of $0.66 in the prior year and was $0.01 ahead of estimates.

For the quarter, higher water rates overall added $17.6 million to results and higher customer usage added $4.9 million. Operating production expenses totaled $154.4 million, which was a 14% increase from the prior year.

Click here to download our most recent Sure Analysis report on HTO (preview of page 1 of 3 shown below):

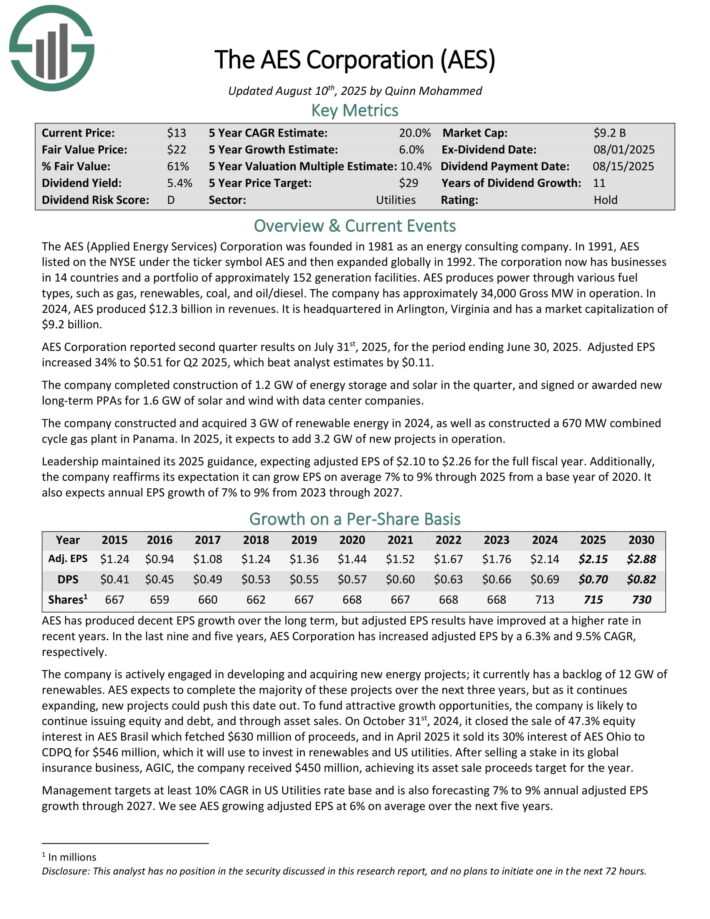

Blue Chip #4: AES Corp. (AES)

Annual Valuation Return: 11.5%

The AES (Applied Energy Services) Corporation has businesses in 14 countries and a portfolio of approximately 160 generation facilities. AES produces power through various fuel types, such as gas, renewables, coal, and oil/diesel.

The company has more than 36,000 Gross MW in operation. In 2024, AES produced $12.3 billion in revenues.

AES Corporation reported second quarter results on July 31st, 2025, for the period ending June 30, 2025. Adjusted EPS increased 34% to $0.51 for Q2 2025, which beat analyst estimates by $0.11.

The company completed construction of 1.2 GW of energy storage and solar in the quarter, and signed or awarded new long-term PPAs for 1.6 GW of solar and wind with data center companies.

The company constructed and acquired 3 GW of renewable energy in 2024, as well as constructed a 670 MW combined cycle gas plant in Panama. In 2025, it expects to add 3.2 GW of new projects in operation. Leadership maintained its 2025 guidance, expecting adjusted EPS of $2.10 to $2.26 for the full fiscal year.

Additionally, the company reaffirms its expectation it can grow EPS on average 7% to 9% through 2025 from a base year of 2020. It also expects annual EPS growth of 7% to 9% from 2023 through 2027.

Click here to download our most recent Sure Analysis report on AES (preview of page 1 of 3 shown below):

Blue Chip #3: Constellation Brands (STZ)

Annual Valuation Return: 12.3%

Constellation Brands was founded in 1945. The company produces and distributes alcoholic beverages including beer, wine, and spirits. It is the third largest beer company in the U.S., and imports and sells beer brands such as Corona, Modelo Especial (the #1 Beer in U.S.), Modelo Negra, and Pacifico.

In addition, Constellation has many wine brands including Robert Mondavi and Kim Crawford, as well as spirits brands including Casa Noble Tequila, and High West Whiskey. The company also has a stake in cannabis company Canopy Growth.

In June 2025, Constellation completed its divestiture of some of its wine and spirits brands to The Wine Group. The brands divested include Woodbridge, Meiomi, Robert Mondavi Private Selection, Cook’s, SIMI, and J. Roget sparkling wine, as well as its inventory, facilities, and vineyards. Constellation retained its high-end wine and spirits brands.

On July 1st, 2025, Constellation Brands reported first quarter fiscal 2026 results for the period ending May 31, 2025. For the quarter, the company recorded $2.52 billion in net sales, down 6% compared to the same prior year period. Beer sales fell 2% year-over-year, while wine and spirits sales plunged 28%.

Comparable earnings-per-share equaled $3.22 for the quarter, which was 10% lower compared to Q1 2025, and $0.07 behind analyst estimates.

In the first quarter, Constellation Brands repurchased $306 million of its shares and paid $182 million in dividends.

Click here to download our most recent Sure Analysis report on STZ (preview of page 1 of 3 shown below):

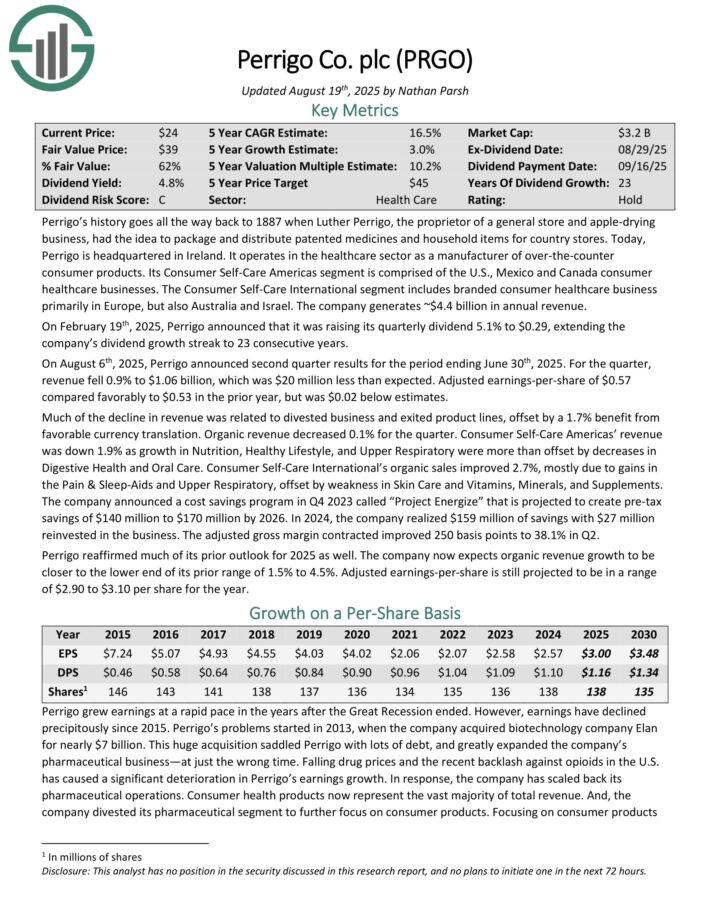

Blue Chip #2: Perrigo Company plc (PRGO)

Annual Valuation Return: 12.5%

Perrigo operates in the healthcare sector as a manufacturer of over-the-counter consumer products. Its Consumer Self-Care Americas segment is comprised of the U.S., Mexico and Canada consumer healthcare businesses. The Consumer Self-Care International segment includes branded consumer healthcare business primarily in Europe, but also Australia and Israel. The company generates ~$4.4 billion in annual revenue.

On August 6th, 2025, Perrigo announced second quarter results. For the quarter, revenue fell 0.9% to $1.06 billion, which was $20 million less than expected. Adjusted earnings-per-share of $0.57 compared favorably to $0.53 in the prior year, but was $0.02 below estimates.

Much of the decline in revenue was related to divested business and exited product lines, offset by a 1.7% benefit from favorable currency translation. Organic revenue decreased 0.1% for the quarter.

Consumer Self-Care Americas’ revenue was down 1.9% as growth in Nutrition, Healthy Lifestyle, and Upper Respiratory were more than offset by decreases in Digestive Health and Oral Care.

Consumer Self-Care International’s organic sales improved 2.7%, mostly due to gains in the Pain & Sleep-Aids and Upper Respiratory, offset by weakness in Skin Care and Vitamins, Minerals, and Supplements.

Perrigo reaffirmed much of its prior outlook for 2025 as well. The company now expects organic revenue growth to be closer to the lower end of its prior range of 1.5% to 4.5%.

Adjusted earnings-per-share is still projected to be in a range of $2.90 to $3.10 per share for the year.

Click here to download our most recent Sure Analysis report on PRGO (preview of page 1 of 3 shown below):

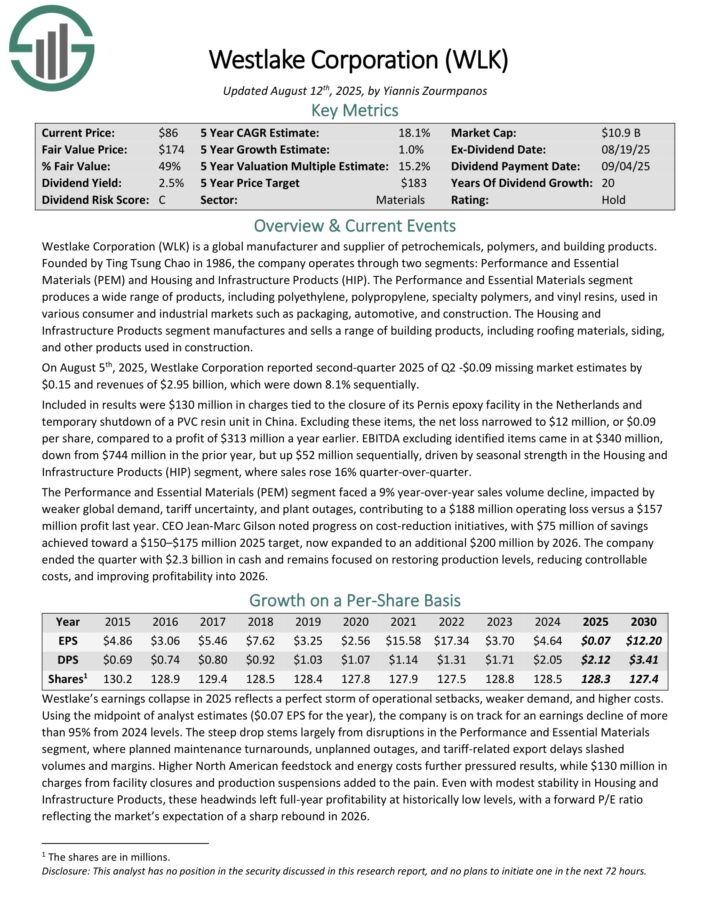

High Yield Blue Chip #1: Westlake Corporation (WLK)

Annual Valuation Return: 14.7%

Westlake Corporation is a global manufacturer and supplier of petrochemicals, polymers, and building products. Founded by Ting Tsung Chao in 1986, the company operates through two segments: Performance and Essential Materials (PEM) and Housing and Infrastructure Products (HIP).

The Performance and Essential Materials segment produces a wide range of products, including polyethylene, polypropylene, specialty polymers, and vinyl resins, used in various consumer and industrial markets such as packaging, automotive, and construction.

The Housing and Infrastructure Products segment manufactures and sells a range of building products, including roofing materials, siding, and other products used in construction.

On August 5th, 2025, Westlake Corporation reported second-quarter 2025 of Q2 -$0.09 missing market estimates by $0.15 and revenues of $2.95 billion, which were down 8.1% sequentially.

Included in results were $130 million in charges tied to the closure of its Pernis epoxy facility in the Netherlands and temporary shutdown of a PVC resin unit in China. Excluding these items, the net loss narrowed to $12 million, or $0.09 per share, compared to a profit of $313 million a year earlier.

EBITDA excluding identified items came in at $340 million, down from $744 million in the prior year, but up $52 million sequentially, driven by seasonal strength in the Housing and Infrastructure Products (HIP) segment, where sales rose 16% quarter-over-quarter.

The Performance and Essential Materials (PEM) segment faced a 9% year-over-year sales volume decline, impacted by weaker global demand, tariff uncertainty, and plant outages, contributing to a $188 million operating loss versus a $157 million profit last year.

Click here to download our most recent Sure Analysis report on WLK (preview of page 1 of 3 shown below):

Additional Reading

If you are interested in finding other high-yield securities, the following Sure Dividend resources may be useful:

High-Yield Individual Security Research

Other Sure Dividend Resources

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].