Published on June 30th, 2025 by Bob Ciura

Investors looking for the best stocks for the long run should consider dividend growth stocks.

More specifically, we believe stocks that can raise their dividends each year, regardless of the broader economic climate, are the best dividend stocks to buy and hold.

The Dividend Kings are the best-of-the-best in dividend longevity.

What is a Dividend King? A stock with 50 or more consecutive years of dividend increases.

You can see the full downloadable spreadsheet of all 55 Dividend Kings (along with important financial metrics such as dividend yields, payout ratios, and price-to-earnings ratios) by clicking on the link below:

The list includes 10 Dividend Kings with our highest Dividend Risk Score of ‘A’ in the Sure Analysis Research Database, that also have the highest dividend growth rates.

The stocks are sorted by dividend growth rate, in ascending order.

Table of Contents

Dividend King For The Long Run: RPM International (RPM)

Dividend Growth Rate: 7.0%

RPM International manufactures, markets and distributes chemical products to industrial, retail and specialty customers. The majority of sales are made to industrial customers.

On April 8th, 2025, RPM announced earnings results for the third quarter of fiscal year 2025 for the period ending February 28th, 2025. For the quarter, revenue declined 2.6% to $1.48 billion, which was $30 million less than expected.

Adjusted earnings-per-share of $0.35 compared unfavorably to $0.52 in the prior year and was $0.15 below estimates. RPM’s results were negatively impacted by weather as well as difficult comparison in the same period of fiscal year 2024.

Organic growth for the company declined 1.8% for the period and currency translation reduced results by 1.7%. This was partially offset by a 0.5% contribution from acquisitions.

Organic revenue for the Construction Products Group was down 1.7%, which follows a high single-digit improvement in the prior year. This segment was impacted by unfavorable weather conditions that limited construction and restoration activity.

Performance Coatings Group decreased 0.3% as gains in fiberglass and reinforced plastic structures was offset by modest declines due to challenging comparisons.

Click here to download our most recent Sure Analysis report on RPM (preview of page 1 of 3 shown below):

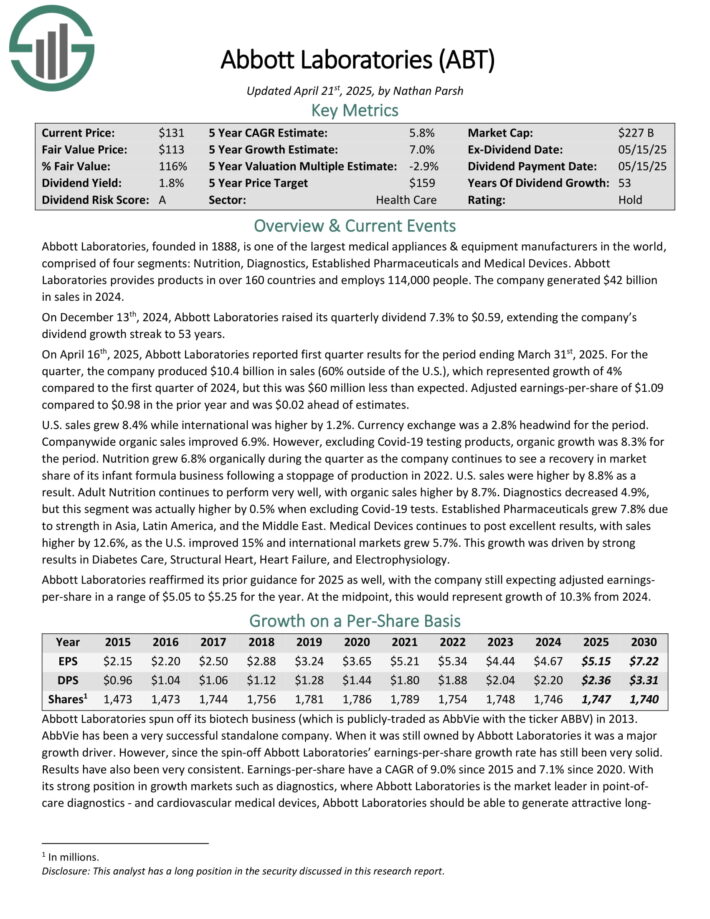

Dividend King For The Long Run: Abbott Laboratories (ABT)

Dividend Growth Rate: 7.0%

Abbott Laboratories, founded in 1888, is one of the largest medical appliances & equipment manufacturers in the world, comprised of four segments: Nutrition, Diagnostics, Established Pharmaceuticals and Medical Devices.

Abbott Laboratories provides products in over 160 countries and employs 114,000 people. The company generated $42 billion in sales in 2024.

On April 16th, 2025, Abbott Laboratories reported first quarter results for the period ending March 31st, 2025. For the quarter, the company produced $10.4 billion in sales (60% outside of the U.S.), which represented growth of 4% compared to the first quarter of 2024, but this was $60 million less than expected.

Adjusted earnings-per-share of $1.09 compared to $0.98 in the prior year and was $0.02 ahead of estimates.

U.S. sales grew 8.4% while international was higher by 1.2%. Currency exchange was a 2.8% headwind for the period. Company-wide organic sales improved 6.9%. However, excluding Covid-19 testing products, organic growth was 8.3% for the period.

Nutrition grew 6.8% organically during the quarter as the company continues to see a recovery in market share of its infant formula business following a stoppage of production in 2022. U.S. sales were higher by 8.8% as a result.

Click here to download our most recent Sure Analysis report on ABT (preview of page 1 of 3 shown below):

Dividend King For The Long Run: Illinois Tool Works (ITW)

Dividend Growth Rate: 7.0%

Illinois Tool Works is a diversified multi-industrial manufacturer with seven unique operating segments: Automotive, Food Equipment, Test & Measurement, Welding, Polymers & Fluids, Construction Products and Specialty Products.

Last year the company generated $15.9 billion in revenue. The company is geographically diversified, with more than half of its revenue generated outside of the United States.

On April 30th, 2025, Illinois Tool Works reported first quarter 2025 results for the period ending March 31st, 2025. For the quarter, revenue came in at $3.8 billion, shrinking 3.4% year-over-year. Sales declined 3.7% in the Automotive OEM segment, the largest out of the company’s seven segments.

In fact, every single one of ITW’s segments experienced revenue declines year-over-year. Food Equipment, Test & Measurement and Electronics, Welding, Polymers & Fluids, Construction Products and Specialty Products all saw revenue decline -0.7%, -6.3%, -0.9%, -0.8%, -9.2%, and -1.0% respectively.

Net income equaled $700 million or $2.38 per share compared to $819 million or $2.73 per share in Q1 2024. In the first quarter, ITW repurchased $375 million of its shares. Illinois Tool Works reaffirmed its 2025 guidance, still expecting full-year GAAP EPS to be $10.15 to $10.55.

Click here to download our most recent Sure Analysis report on ITW (preview of page 1 of 3 shown below):

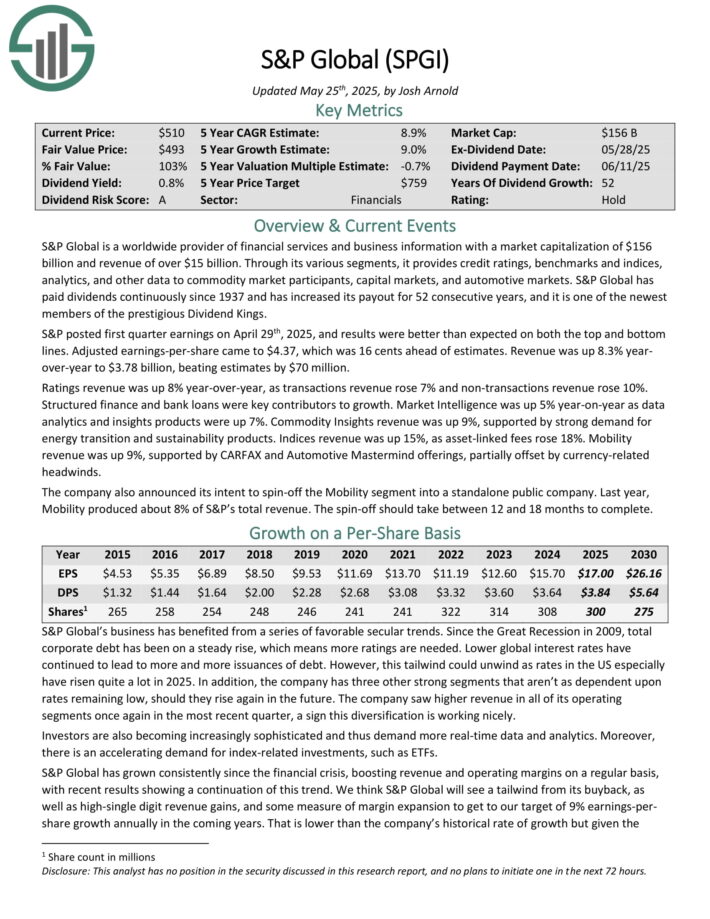

Dividend King For The Long Run: S&P Global (SPGI)

Dividend Growth Rate: 8.0%

S&P Global is a worldwide provider of financial services and business information and revenue of over $13 billion.

Through its various segments, it provides credit ratings, benchmarks and indices, analytics, and other data to commodity market participants, capital markets, and automotive markets.

S&P Global has paid dividends continuously since 1937 and has increased its payout for 51 consecutive years.

S&P posted first quarter earnings on April 29th, 2025, and results were better than expected on both the top and bottom lines. Adjusted earnings-per-share came to $4.37, which was 16 cents ahead of estimates. Revenue was up 8.3% year-over-year to $3.78 billion, beating estimates by $70 million.

Ratings revenue was up 8% year-over-year, as transactions revenue rose 7% and non-transactions revenue rose 10%. Structured finance and bank loans were key contributors to growth.

Market Intelligence was up 5% year-on-year as data analytics and insights products were up 7%. Commodity Insights revenue was up 9%, supported by strong demand for energy transition and sustainability products. Indices revenue was up 15%, as asset-linked fees rose 18%.

Mobility revenue was up 9%, supported by CARFAX and Automotive Mastermind offerings, partially offset by currency-related headwinds.

Click here to download our most recent Sure Analysis report on SPGI (preview of page 1 of 3 shown below):

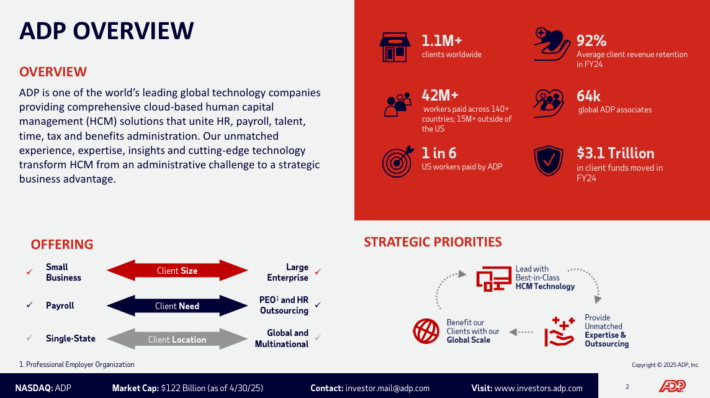

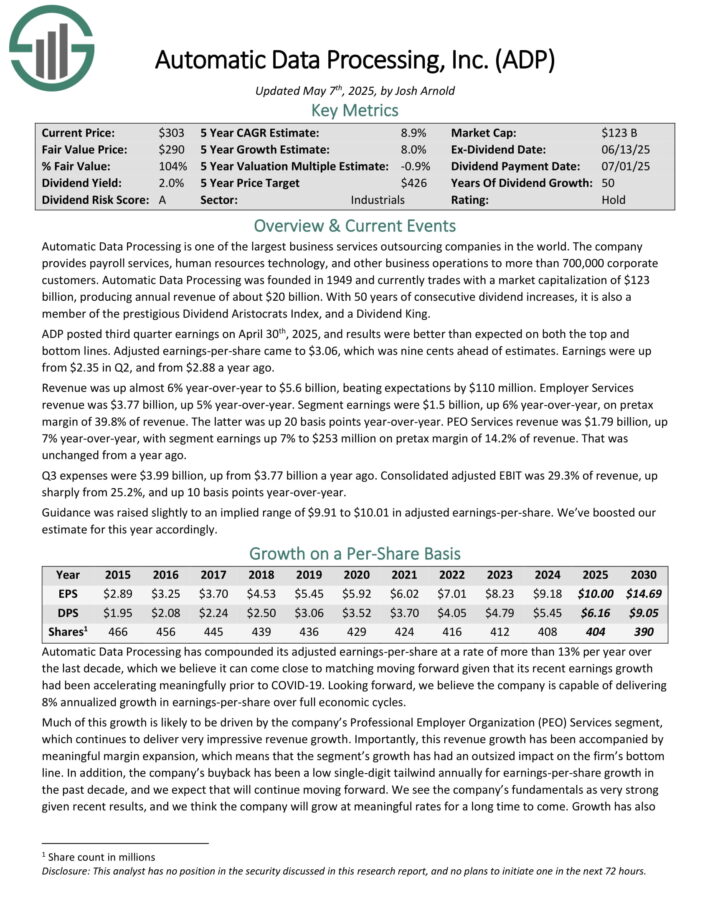

Dividend King For The Long Run: Automatic Data Processing (ADP)

Dividend Growth Rate: 8.0%

Automatic Data Processing is one of the largest business services outsourcing companies in the world. The company provides payroll services, human resources technology, and other business operations to more than 700,000 corporate customers. Automatic Data Processing produces annual revenue of about $20 billion.

Source: Investor Presentation

ADP posted third quarter earnings on April 30th, 2025, and results were better than expected on both the top and bottom lines. Adjusted earnings-per-share came to $3.06, which was nine cents ahead of estimates. Earnings were up from $2.35 in Q2, and from $2.88 a year ago.

Revenue was up almost 6% year-over-year to $5.6 billion, beating expectations by $110 million. Employer Services revenue was $3.77 billion, up 5% year-over-year. Segment earnings were $1.5 billion, up 6% year-over-year, on pretax margin of 39.8% of revenue. The latter was up 20 basis points year-over-year.

PEO Services revenue was $1.79 billion, up 7% year-over-year, with segment earnings up 7% to $253 million on pretax margin of 14.2% of revenue. That was unchanged from a year ago.

Click here to download our most recent Sure Analysis report on ADP (preview of page 1 of 3 shown below):

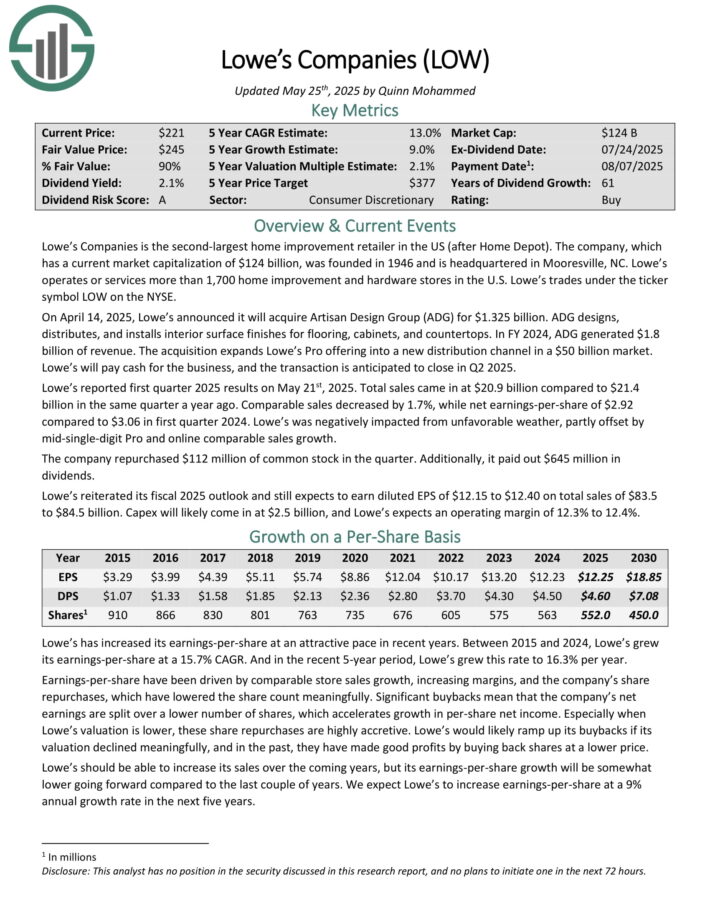

Dividend King For The Long Run: Lowe’s Companies (LOW)

Dividend Growth Rate: 8.1%

Lowe’s Companies is the second-largest home improvement retailer in the US (after Home Depot). The company was founded in 1946 and is headquartered in Mooresville, NC.

Lowe’s operates or services more than 1,700 home improvement and hardware stores in the U.S.

On April 14, 2025, Lowe’s announced it will acquire Artisan Design Group (ADG) for $1.325 billion. ADG designs, distributes, and installs interior surface finishes for flooring, cabinets, and countertops.

In FY 2024, ADG generated $1.8 billion of revenue. The acquisition expands Lowe’s Pro offering into a new distribution channel in a $50 billion market. Lowe’s will pay cash for the business, and the transaction is anticipated to close in Q2 2025.

Lowe’s reported first quarter 2025 results on May 21st, 2025. Total sales came in at $20.9 billion compared to $21.4 billion in the same quarter a year ago. Comparable sales decreased by 1.7%, while net earnings-per-share of $2.92 compared to $3.06 in first quarter 2024.

Lowe’s was negatively impacted from unfavorable weather, partly offset by mid-single-digit Pro and online comparable sales growth.

The company repurchased $112 million of common stock in the quarter. Additionally, it paid out $645 million in dividends.

Lowe’s reiterated its fiscal 2025 outlook and still expects to earn diluted EPS of $12.15 to $12.40 on total sales of $83.5 to $84.5 billion.

Click here to download our most recent Sure Analysis report on LOW (preview of page 1 of 3 shown below):

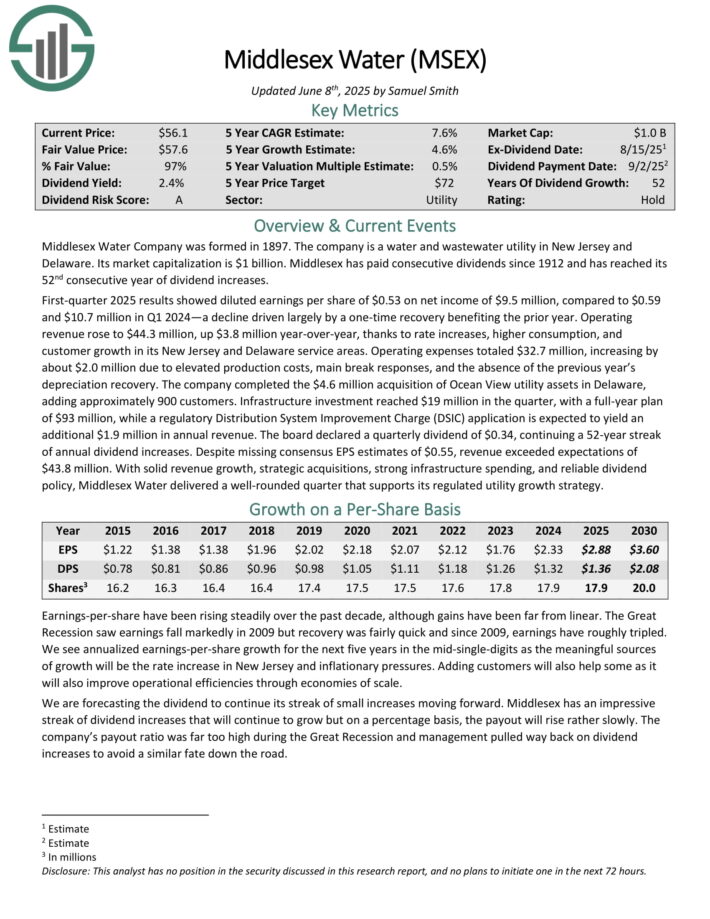

Dividend King For The Long Run: Middlesex Water Co. (MSEX)

Dividend Growth Rate: 8.9%

Middlesex Water Company was formed in 1897. The company is a water and wastewater utility in New Jersey and Delaware. Middlesex has paid consecutive dividends since 1912.

First-quarter 2025 results showed diluted earnings per share of $0.53 on net income of $9.5 million, compared to $0.59 and $10.7 million in Q1 2024—a decline driven largely by a one-time recovery benefiting the prior year.

Operating revenue rose to $44.3 million, up $3.8 million year-over-year, thanks to rate increases, higher consumption, and customer growth in its New Jersey and Delaware service areas.

The company completed the $4.6 million acquisition of Ocean View utility assets in Delaware, adding approximately 900 customers.

Infrastructure investment reached $19 million in the quarter, with a full-year plan of $93 million, while a regulatory Distribution System Improvement Charge (DSIC) application is expected to yield an additional $1.9 million in annual revenue.

The board declared a quarterly dividend of $0.34, continuing a 52-year streak of annual dividend increases.

Click here to download our most recent Sure Analysis report on MSEX (preview of page 1 of 3 shown below):

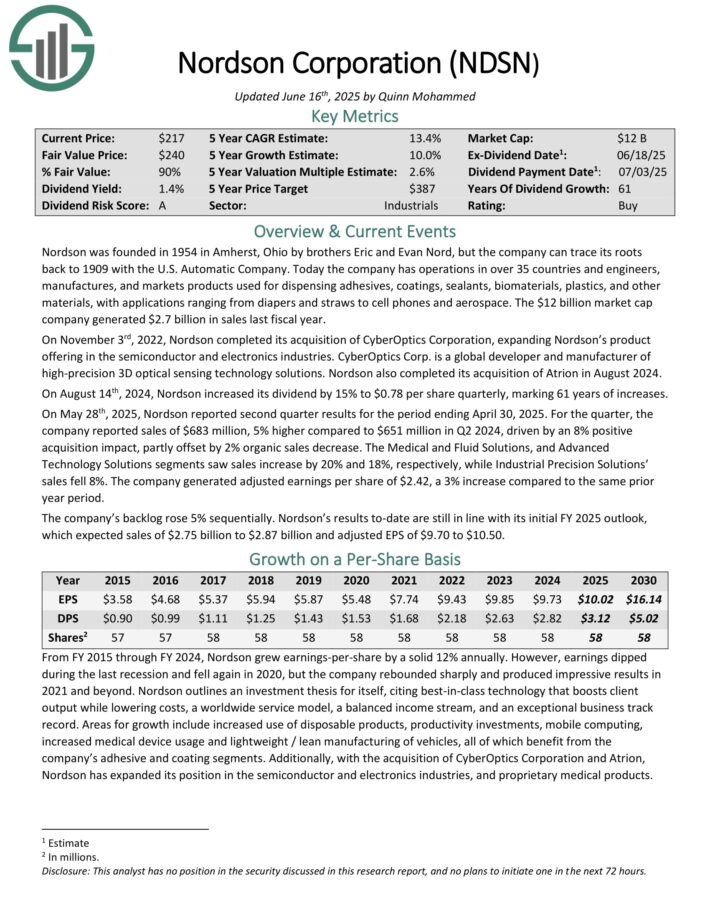

Dividend King For The Long Run: Nordson Corp. (NDSN)

Dividend Growth Rate: 10.0%

Nordson was founded in 1954. Today the company has operations in over 35 countries and engineers, manufactures, and markets products used for dispensing adhesives, coatings, sealants, biomaterials, plastics, and other materials, with applications ranging from diapers and straws to cell phones and aerospace.

The company generated $2.7 billion in sales last fiscal year.

On May 28th, 2025, Nordson reported second quarter results for the period ending April 30, 2025. For the quarter, the company reported sales of $683 million, 5% higher compared to $651 million in Q2 2024, driven by an 8% positive acquisition impact, partly offset by 2% organic sales decrease.

The Medical and Fluid Solutions, and Advanced Technology Solutions segments saw sales increase by 20% and 18%, respectively, while Industrial Precision Solutions sales fell 8%. The company generated adjusted earnings per share of $2.42, a 3% increase compared to the same prior year period.

The company’s backlog rose 5% sequentially.

Click here to download our most recent Sure Analysis report on NDSN (preview of page 1 of 3 shown below):

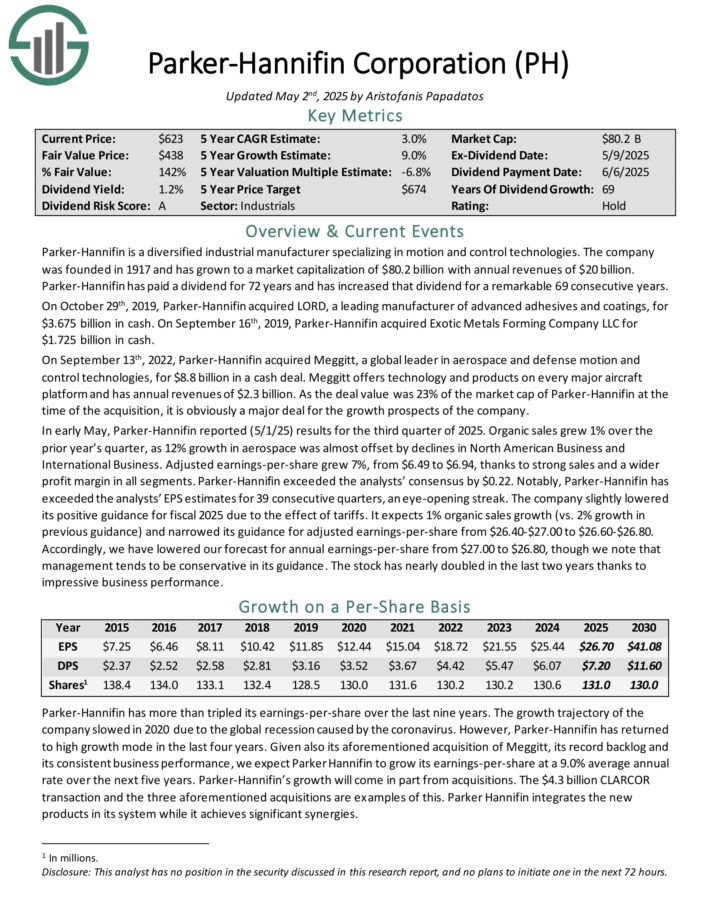

Dividend King For The Long Run: Parker-Hannifin Corp. (PH)

Parker-Hannifin is a diversified industrial manufacturer specializing in motion and control technologies. The company generates annual revenues of $20 billion.

Parker-Hannifin has increased the dividend for 69 consecutive years.

Source: Investor Presentation

In early May, Parker-Hannifin reported (5/1/25) results for the third quarter of 2025. Organic sales grew 1% over the prior year’s quarter, as 12% growth in aerospace was almost offset by declines in North American Business and International Business.

Adjusted earnings-per-share grew 7%, from $6.49 to $6.94, thanks to strong sales and a wider profit margin in all segments.

Parker-Hannifin exceeded the analysts’ consensus by $0.22. Notably, Parker-Hannifin has exceeded the analysts’ EPS estimates for 39 consecutive quarters.

Click here to download our most recent Sure Analysis report on Parker-Hannifin (preview of page 1 of 3 shown below):

Dividend King For The Long Run: Nucor Corp. (NUE)

Dividend Growth Rate: 12.7%

Nucor is the largest publicly traded US-based steel corporation based on its market capitalization. The steel industry is notoriously cyclical, which makes Nucor’s streak of 52 consecutive years of dividend increases even more remarkable.

On April 28, 2025, Nucor Corporation reported its financial results for the first quarter of 2025. The company posted net earnings attributable to stockholders of $156 million, or $0.67 per diluted share, a significant decrease from $845 million, or $3.46 per share, in the same quarter of the previous year.

Adjusted net earnings, excluding one-time charges related to facility closures and repurposing, were $179 million, or $0.77 per share, surpassing analyst expectations of $0.64 per share.

Net sales for the quarter were $7.83 billion, down 4% year-over-year but up 11% sequentially, driven by a 10% increase in total shipments to 6.83 million tons, despite a 12% decline in average sales price per ton compared to the first quarter of 2024.

Click here to download our most recent Sure Analysis report on NUE (preview of page 1 of 3 shown below):

Final Thoughts & Additional Reading

Screening to find the best Dividend Kings is not the only way to find high-quality dividend growth stocks to hold forever.

Sure Dividend maintains similar databases on the following useful universes of stocks:

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].