Updated on April 24th, 2025 by Bob Ciura

Due to the surge of inflation to a 40-year high last year, the Federal Reserve raised interest rates at a rapid pace over the past two years to cool the economy.

But with inflation recently perking up again and the potential impact of tariffs, some economists now expect the Fed to lower interest rates once again, perhaps as soon as September.

Apartment REITs have proved resilient to recessions thanks to the essential nature of their business. They also widely have high dividend yields well above the S&P 500 Index average.

And, apartment REITs would benefit from falling interest rates, which would lower their cost of capital.

You can download our full REIT list, along with important metrics such as dividend yields and market caps, by clicking on the link below:

As a result, apartment REITs are interesting candidates for income investors.

This article will discuss the prospects of the top 10 apartment REITs in our Sure Analysis Research Database.

The following 10 apartment REITs are listed by five-year expected annual returns, in order of lowest to highest:

Table of Contents

You can instantly jump to any specific section of the article by using the links below:

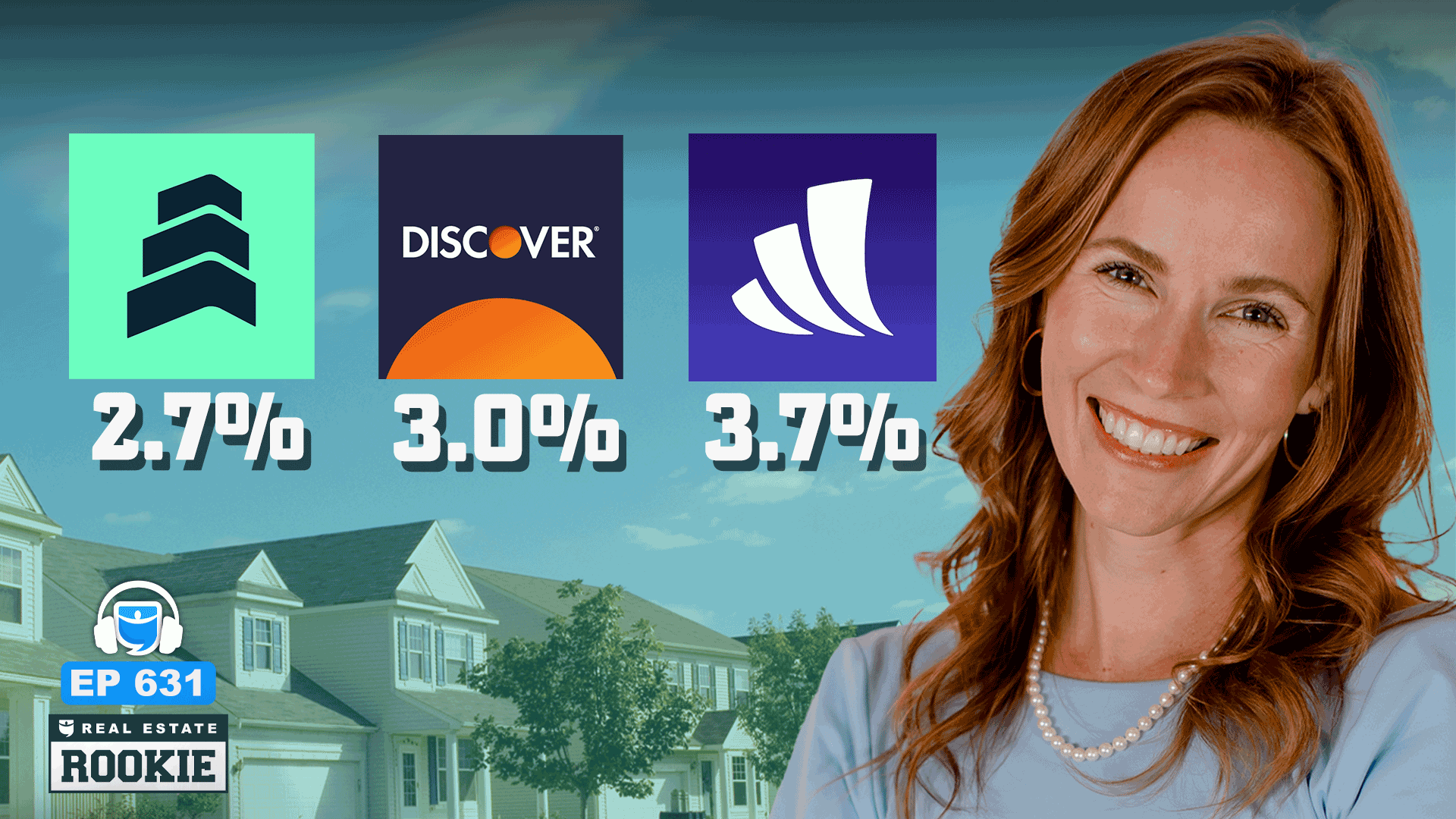

Apartment REITs #10: Essex Property Trust (ESS)

Annual Expected Returns: 5.3%

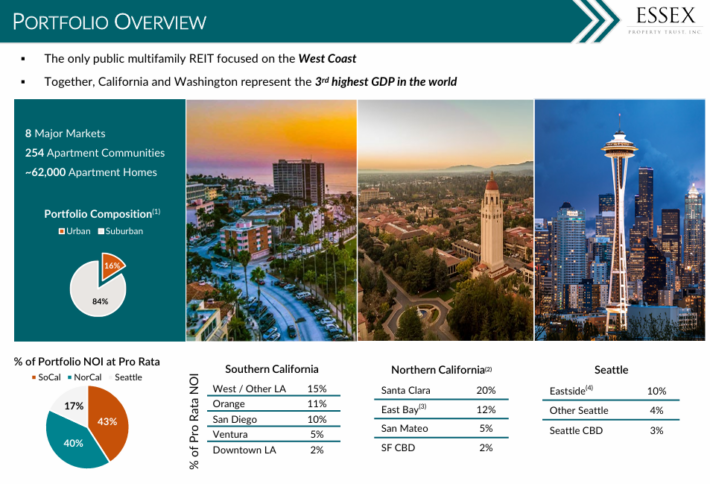

Essex Property Trust was founded in 1971. The trust invests in West Coast multi-family residential proprieties where it engages in development, redevelopment, management and acquisition of apartment communities and a few other select properties.

Essex has ownership interests in several hundred apartment communities consisting of over 60,000 apartment homes. The trust has about 1,800 employees and produces approximately $1.6 billion in annual revenue.

Essex is concentrated on the West Coast of the U.S., including cities like Seattle and San Francisco.

Source: Investor Presentation

Essex Property Trust reported strong fourth-quarter and full-year 2024 results, exceeding the high end of its original guidance with same-property revenue growth of 3.3% and core FFO growth of 3.8%.

The company attributed its performance to improving demand driven by return-to-office trends, migration patterns, and affordability relative to home ownership.

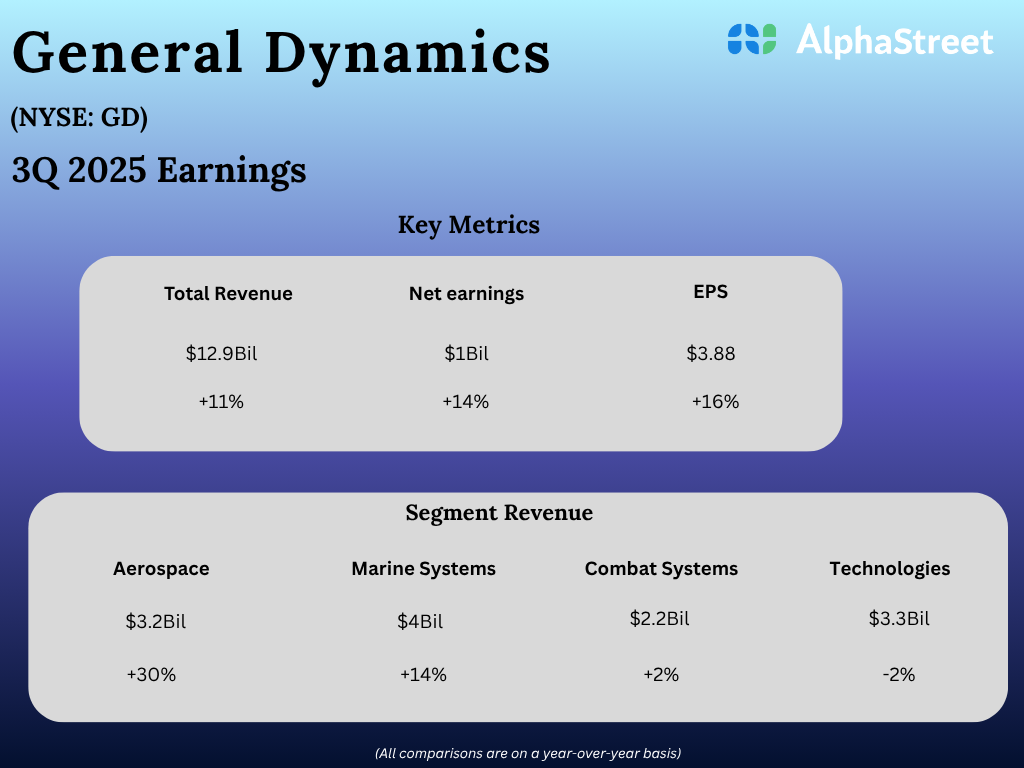

Click here to download our most recent Sure Analysis report on ESS (preview of page 1 of 3 shown below):

Apartment REITs #9: Camden Property Trust (CPT)

Annual Expected Returns: 5.8%

Founded in 1993 and headquartered in Houston, Texas, Camden Property Trust is one of the largest publicly traded multifamily real estate companies in the U.S.

The REIT owns, manages and develops multifamily apartment communities. It currently owns 172 properties that contain over 58,000 apartments.

On February 6th, 2025 Camden raised its dividend by 1.9% to a quarterly rate of $1.05, celebrating its 14th consecutive annual hike.

On the same day, the company reported its Q4 and full-year results for the period ending December 31st, 2024. For the quarter, the company reported property revenue of $386.3 million, relatively flat compared to Q4 2023.

While same property revenues rose 0.8%, same-store occupancy fell 20 basis points to 95.3%. Same-property expenses grew by 0.2% during the period, while same-property net operating income (NOI) grew 1.2%.

Click here to download our most recent Sure Analysis report on Camden Property Trust (CPT) (preview of page 1 of 3 shown below):

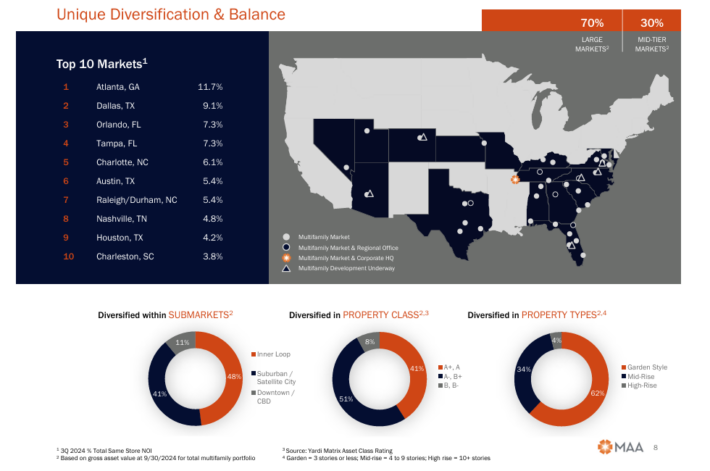

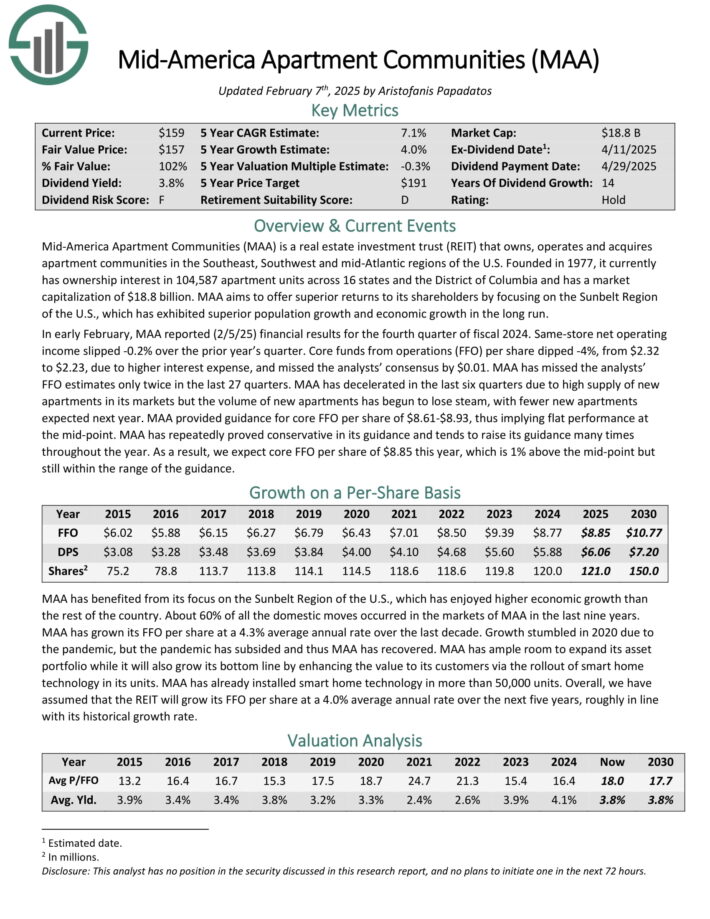

Apartment REITs #8: Mid-America Apartment Communities (MAA)

Annual Expected Returns: 7.1%

Mid-America Apartment Communities is a REIT that owns, operates and acquires apartment communities in the Southeast, Southwest and mid-Atlantic regions of the U.S.

It currently has ownership interest in ~102,000 apartment units across 16 states and the District of Columbia.

MAA is focused on the Sunbelt Region of the U.S., which has exhibited superior population growth and economic growth in the long run.

Source: Investor Presentation

In early February, MAA reported (2/5/25) financial results for the fourth quarter of fiscal 2024. Same-store net operating income slipped -0.2% over the prior year’s quarter.

Core funds from operations (FFO) per share dipped -4%, from $2.32 to $2.23, due to higher interest expense, and missed the analysts’ consensus by $0.01. MAA has missed the analysts’ FFO estimates only twice in the last 27 quarters.

MAA has decelerated in the last six quarters due to high supply of new apartments in its markets but the volume of new apartments has begun to lose steam, with fewer new apartments expected next year. MAA provided guidance for core FFO per share of $8.61-$8.93 for 2025.

Click here to download our most recent Sure Analysis report on Mid-America Apartment Communities (MAA) (preview of page 1 of 3 shown below):

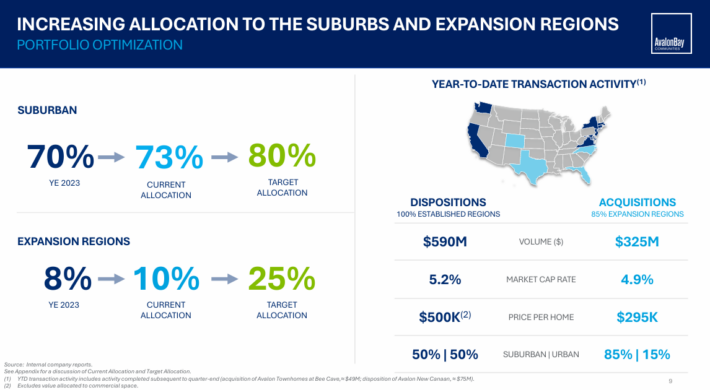

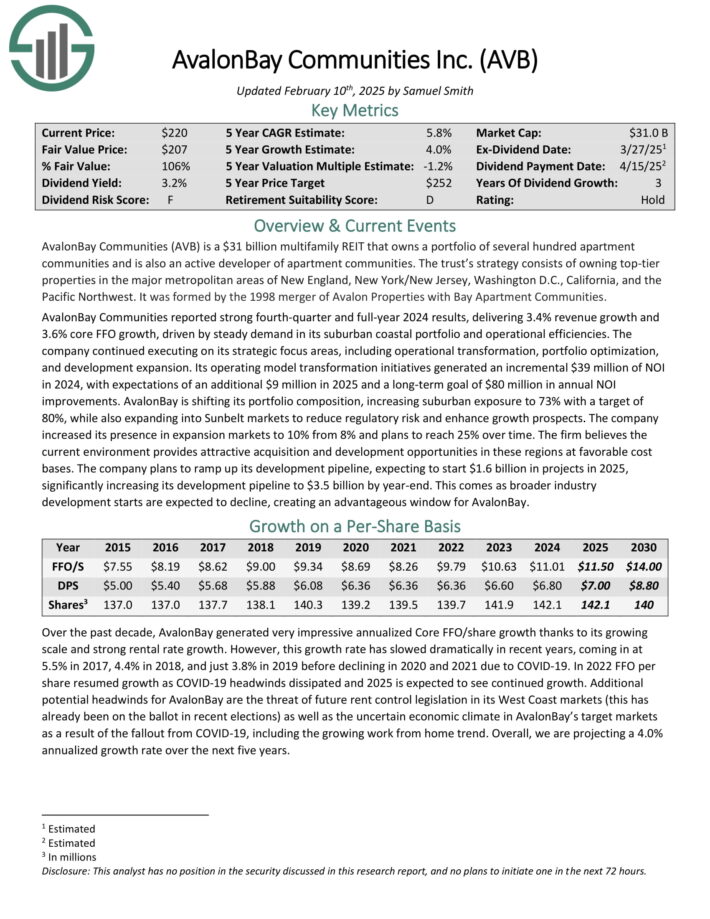

Apartment REITs #7: AvalonBay Communities (AVB)

Annual Expected Returns: 7.2%

AvalonBay Communities is a multifamily REIT that owns a portfolio of several hundred apartment communities and is also an active developer of apartment communities.

The strategy of the REIT involves owning top-tier properties in the major metropolitan areas of New England, New York/New Jersey, Washington D.C., California, and the Pacific Northwest.

Source: Investor Presentation

AvalonBay Communities reported strong fourth-quarter and full-year 2024 results, delivering 3.4% revenue growth and 3.6% core FFO growth, driven by steady demand in its suburban coastal portfolio and operational efficiencies.

The company continued executing on its strategic focus areas, including operational transformation, portfolio optimization, and development expansion.

Its operating model transformation initiatives generated an incremental $39 million of NOI in 2024, with expectations of an additional $9 million in 2025 and a long-term goal of $80 million in annual NOI improvements.

Click here to download our most recent Sure Analysis report on AvalonBay Communities (AVB) (preview of page 1 of 3 shown below):

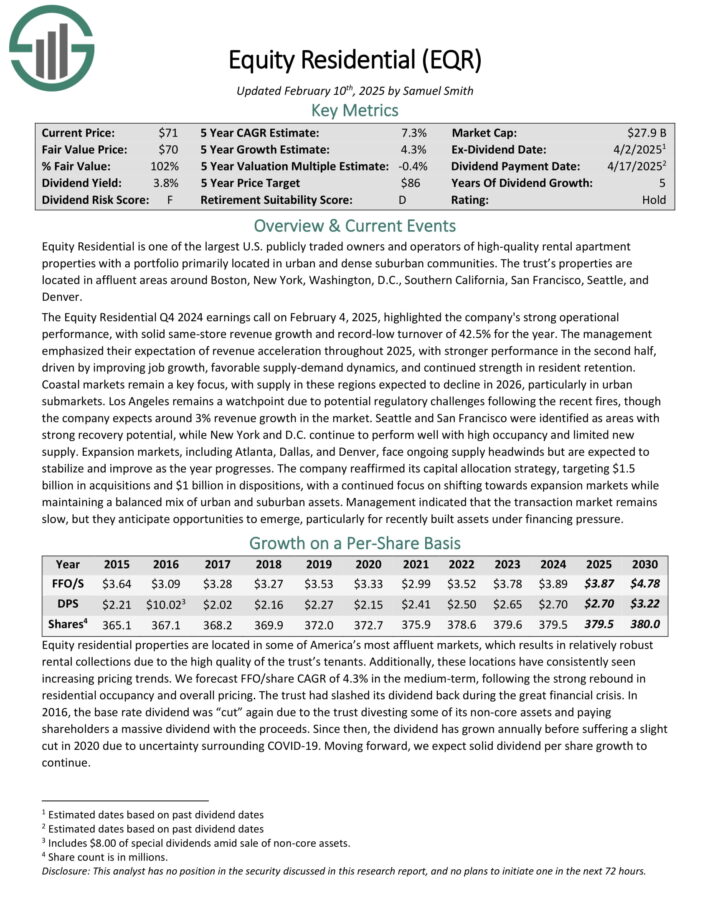

Apartment REITs #6: Equity Residential (EQR)

Annual Expected Returns: 7.9%

Equity Residential is one of the largest U.S. publicly-traded owners and operators of high-quality rental apartment properties with a portfolio primarily located in urban and dense suburban communities.

The properties of the trust are located in affluent areas around Boston, New York, Washington, D.C., Southern California, San Francisco, Seattle, and Denver.

Equity Residential greatly benefits from the favorable characteristics of its target group. Affluent renters are highly educated, well employed and earn high incomes.

As a result, they pay approximately 20% of their incomes on rent and hence they are not burdened by their rent. Thanks to their strong earnings potential, the REIT can easily grow its rent rates year after year.

The Equity Residential Q4 2024 earnings call on February 4, 2025, highlighted the company’s strong operational performance, with solid same-store revenue growth and record-low turnover of 42.5% for the year.

Management emphasized their expectation of revenue acceleration throughout 2025, with stronger performance in the second half, driven by improving job growth, favorable supply-demand dynamics, and continued strength in resident retention.

Coastal markets remain a key focus, with supply in these regions expected to decline in 2026, particularly in urban sub-markets.

Click here to download our most recent Sure Analysis report on Equity Residential (EQR) (preview of page 1 of 3 shown below):

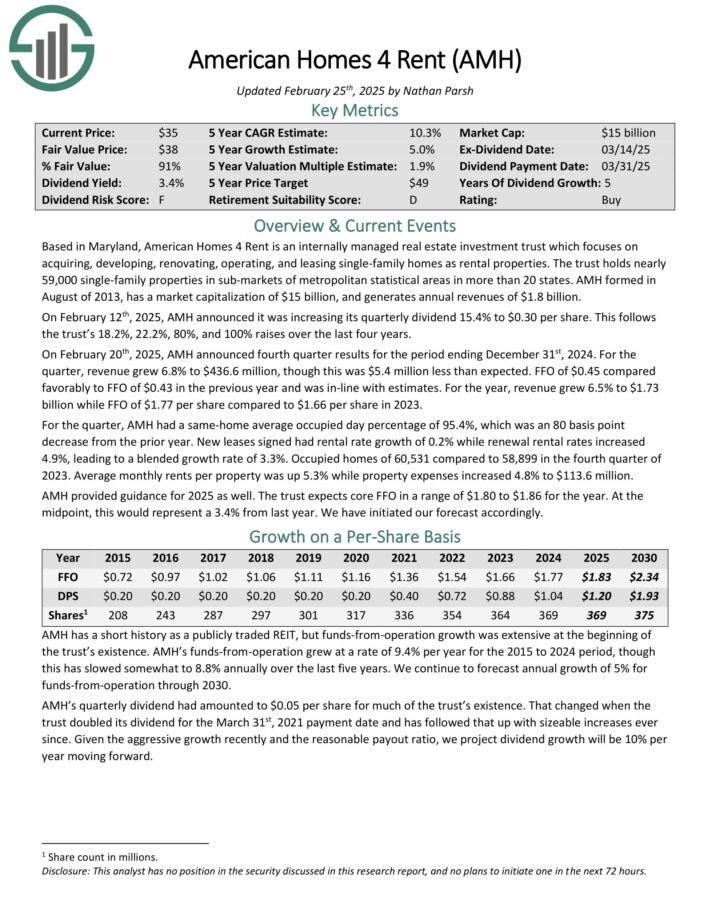

Apartment REITs #5: American Homes 4 Rent (AMH)

Annual Expected Returns: 8.9%

Based in Maryland, American Homes 4 Rent is an internally managed REIT that focuses on acquiring, developing, renovating, operating and leasing single-family homes as rental properties. AMH was formed in 2013 and has a market capitalization of $14 billion.

The REIT holds nearly 58,000 single-family properties in more than 30 sub-markets of metropolitan statistical areas in 21 states.

On February 12th, 2025, AMH announced it was increasing its quarterly dividend 15.4% to $0.30 per share.

On February 20th, 2025, AMH announced fourth quarter results for the period ending December 31st, 2024. For the quarter, revenue grew 6.8% to $436.6 million, though this was $5.4 million less than expected.

FFO of $0.45 compared favorably to FFO of $0.43 in the previous year and was in-line with estimates. For the year, revenue grew 6.5% to $1.73 billion while FFO of $1.77 per share compared to $1.66 per share in 2023.

Click here to download our most recent Sure Analysis report on American Homes 4 Rent (AMH) (preview of page 1 of 3 shown below):

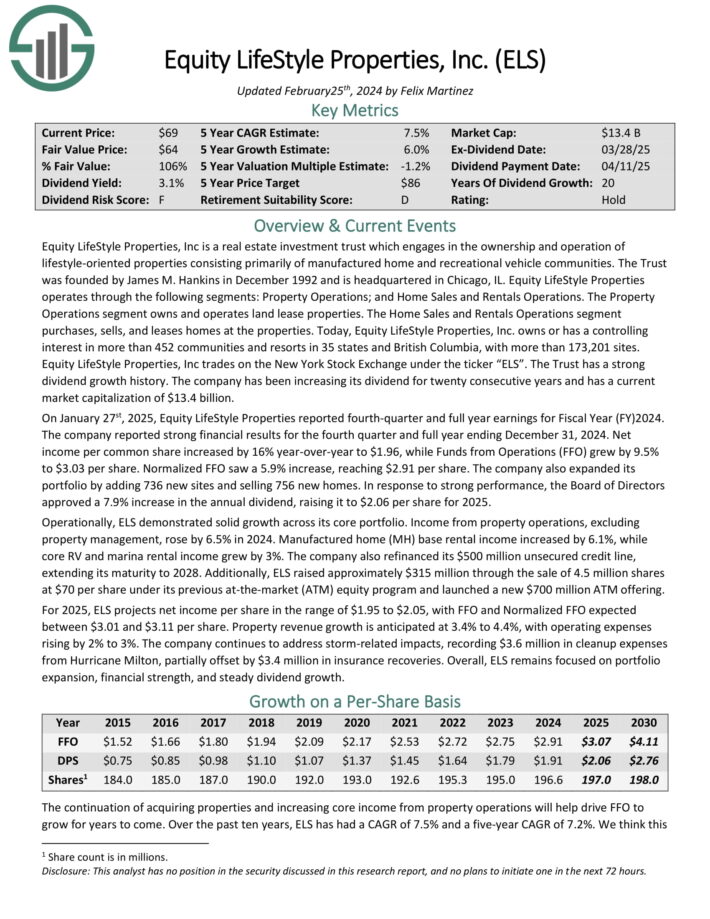

Apartment REITs #4: Equity LifeStyle Properties (ELS)

Annual Expected Returns: 9.3%

Equity LifeStyle Properties, Inc is a real estate investment trust which engages in the ownership and operation of lifestyle-oriented properties consisting primarily of manufactured home and recreational vehicle communities.

Equity LifeStyle Properties operates through the following segments: Property Operations; and Home Sales and Rentals Operations.

The Property Operations segment owns and operates land lease properties. The Home Sales and Rentals Operations segment purchases, sells, and leases homes at the properties.

Today, Equity LifeStyle Properties, Inc. owns or has a controlling interest in more than 400 communities and resorts in 33 states and British Columbia, with more than 165,000 sites.

On January 27st, 2025, Equity LifeStyle Properties reported fourth-quarter and full year earnings for Fiscal Year (FY)2024. Net income per common share increased by 16% year-over-year to $1.96, while Funds from Operations (FFO) grew by 9.5% to $3.03 per share.

Normalized FFO saw a 5.9% increase, reaching $2.91 per share. The company also expanded its portfolio by adding 736 new sites and selling 756 new homes.

In response to strong performance, the Board of Directors approved a 7.9% increase in the annual dividend, raising it to $2.06 per share for 2025.

Click here to download our most recent Sure Analysis report on ELS (preview of page 1 of 3 shown below):

Apartment REITs #3: UMH Properties (UMH)

Annual Expected Returns: 9.3%

UMH Properties is a REIT that is one of the largest manufactured housing landlords in the U.S. It was founded in 1968 and currently owns tens of thousands of developed sites and 135 communities located across the midwestern and northeastern U.S.

As manufactured homes are cheaper than conventional homes, UMH Properties has proved resilient to recessions.

Source: Investor Presentation

On February 25, 2025, UMH Properties, Inc. reported its financial results for the fourth quarter of 2024. The company achieved revenue of $61.87 million, surpassing the forecasted $58.47 million, indicating strong operational performance.

Normalized funds from operations (FFO) per share increased by 4% year-over-year to $0.24 for the quarter and 8% to $0.93 for the full year, reflecting robust demand in the manufactured housing sector.

Click here to download our most recent Sure Analysis report on UMH Properties (UMH) (preview of page 1 of 3 shown below):

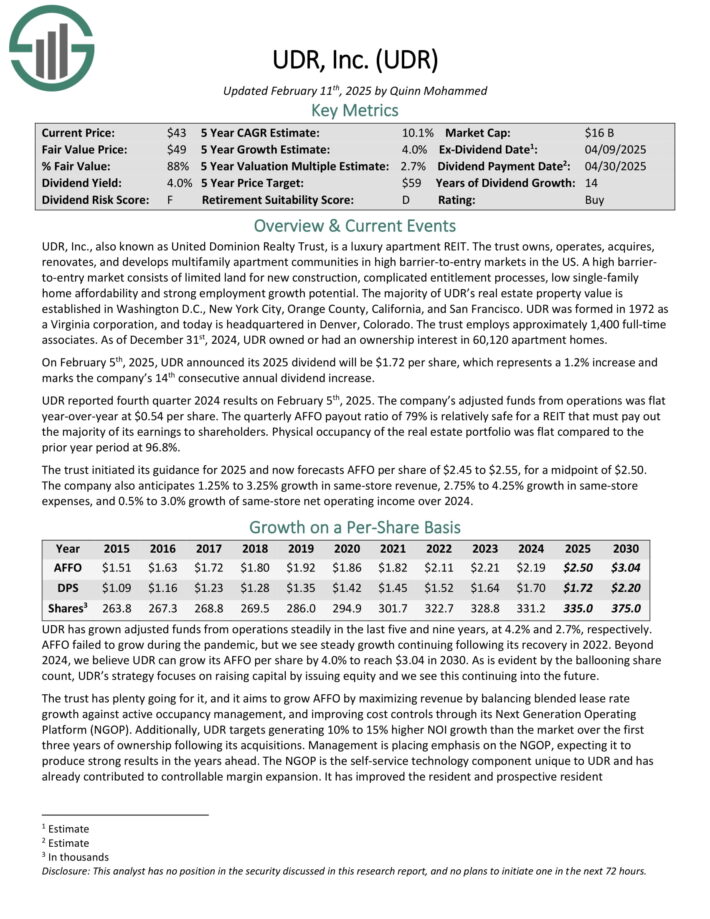

Apartment REITs #2: UDR, Inc. (UDR)

Annual Expected Returns: 10.7%

UDR, also known as United Dominion Realty Trust, is a luxury apartment REIT. The trust owns, operates, acquires, renovates, and develops multifamily apartment communities in high barrier-to-entry markets in the U.S.

A high barrier-to-entry market consists of limited land for new construction, complicated entitlement processes, low single-family home affordability and strong employment growth potential.

The majority of UDR’s real estate property value is established in Washington D.C., New York City, Orange County, California, and San Francisco.

Source: Investor Presentation

On February 5th, 2025, UDR announced its 2025 dividend will be $1.72 per share, which represents a 1.2% increase and marks the company’s 14th consecutive annual dividend increase.

UDR reported fourth quarter 2024 results on February 5th, 2025. The company’s adjusted funds from operations was flat year-over-year at $0.54 per share.

The quarterly AFFO payout ratio of 79% is relatively safe for a REIT that must pay out the majority of its earnings to shareholders. Physical occupancy of the real estate portfolio was flat compared to the prior year period at 96.8%.

The trust initiated its guidance for 2025 and now forecasts AFFO per share of $2.45 to $2.55.

Click here to download our most recent Sure Analysis report on UDR (preview of page 1 of 3 shown below):

Apartment REITs #1: American Assets Trust (AAT)

Annual Expected Returns: 17.3%

American Assets Trust is a REIT that was formed in 2011 as a successor of American Assets, a privately held company founded in 1967.

AAT has great experience in acquiring, improving and developing office, retail and residential properties throughout the U.S., primarily in Southern California, Northern California, Oregon, Washington and Hawaii.

Its office portfolio and its retail portfolio comprise of approximately 4.0 million and 3.1 million square feet, respectively. AAT also owns more than 2,000 multifamily units.

Source: Investor Presentation

In early February, AAT reported (2/4/25) financial results for the fourth quarter of fiscal 2024. Adjusted same-store net operating income grew 3% but funds from operations (FFO) per share dipped -4% over the prior year’s quarter due to higher interest expense.

Due to this headwind, AAT provided weak guidance for 2025, expecting FFO per share of $1.87 to $2.01.

Click here to download our most recent Sure Analysis report on American Assets Trust (AAT) (preview of page 1 of 3 shown below):

Final Thoughts

Many apartment REITs pass under the radar of the majority of investors due to their mundane business model.

However, some of these REITs have offered exceptionally high returns to their shareholders. In addition, apartment REITs have proved resilient to recessions, as the demand for housing remains strong even during rough economic periods.

The above 10 apartment REITs are interesting candidates for the portfolios of income-oriented investors, especially given the increasing risk of an upcoming recession.

If you are interested in finding high-quality dividend growth stocks and/or other high-yield securities and income securities, the following Sure Dividend resources will be useful:

High-Yield Individual Security Research

Other Sure Dividend Resources

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].