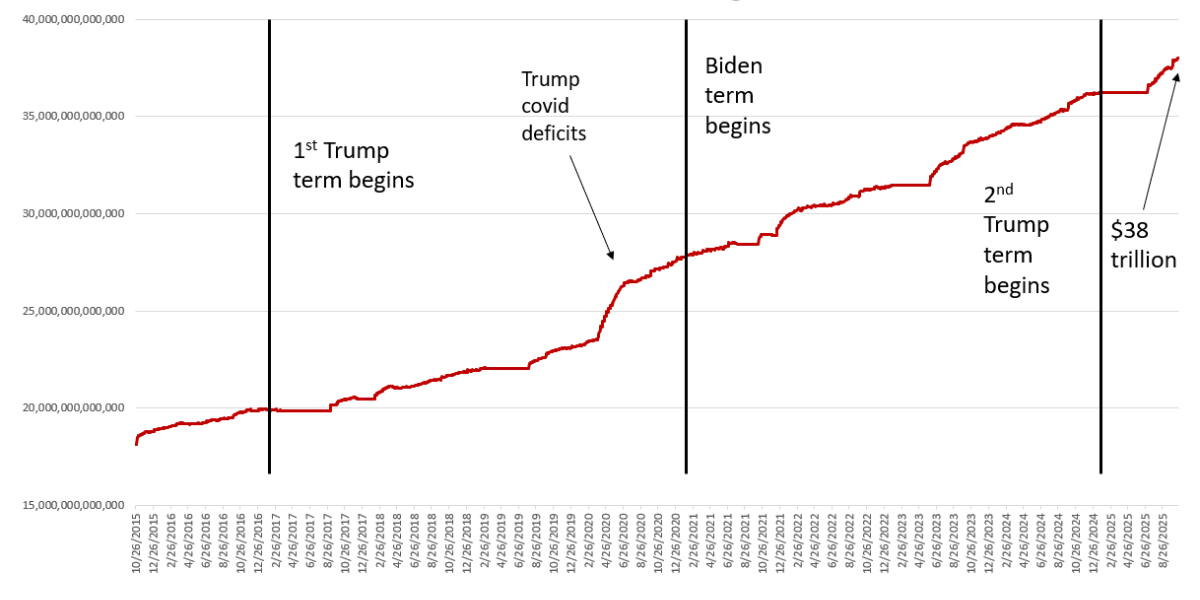

Last week, the US’s total federal debt surpassed $38 trillion. Federal debt now increases at a shocking rate, with the US’s debt increasing from $37 trillion to $38 trillion in just 73 days. It took nine months for the debt to increase from $36 to $37 trillion.

Since the covid lockdowns began in 2020—less than six years ago—the national debt has increased by $14 trillion, or 62 percent. In mid-2020 alone, under the Trump administration, the debt increased by three trillion from March to July of 2020.

Since Donald Trump was sworn in for his second term, the national debt has increased by $1.78 trillion. This is one of the largest increases in debt we’ve seen during this period (Jan 21-Oct 21). During the same period of the previous year—under the Biden administration—the debt increased by $1.70 trillion. 2020, of course, remains unrivaled in the enormous amounts of debt added when the Trump White House pushed for inflating the money supply by trillions of dollars to “stimulate” the economy during covid lockdowns and rising unemployment.

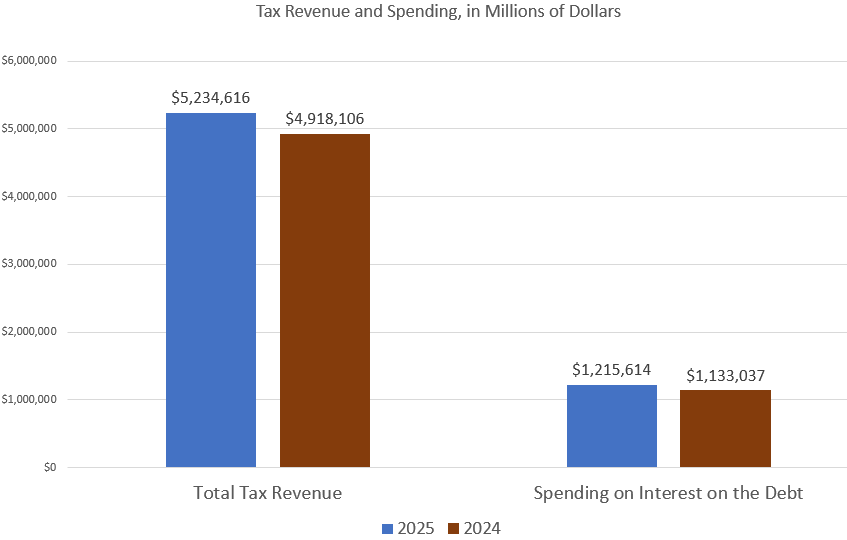

The true costs of the US regime’s debt-driven policy continue to rise. During the 2025 fiscal year, for example, the US spent nearly one quarter of all tax revenue just on paying interest on the debt. In other words, current taxpayers see a quarter of their tax dollars go to pay for decades of past deficit spending on lost wars, ever-growing welfare programs and bailouts for the banker class.

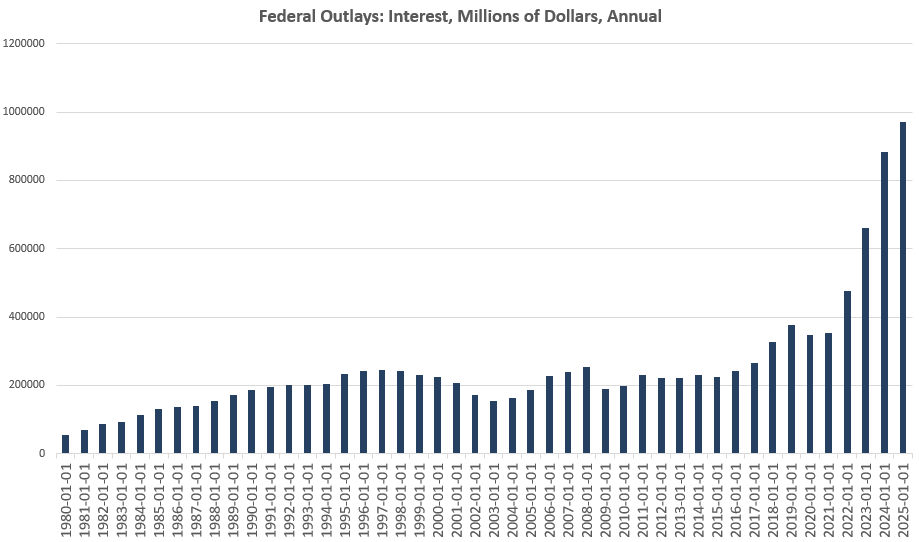

Rising debt payments for fiscal year 2025 continue an accelerating trend in interest costs. With FY 2025’s interest bill now topping $1.22 trillion, it’s up by 7.3 percent compared to the previous fiscal year.

Looking at calendar years up through 2024, we find that interest paid on the debt has soared to new highs, and is now one of the largest areas of federal spending. 2024 was the last calendar year with interest spending under a trillion dollars. 2025’s interest payments will easily exceed $1 trillion, meaning the US now spends more on interest than on the military, and interest payments are exceeded only by the rapidly growing welfare programs like Social Security and government healthcare benefits. As interest rates continue to inch upward, this will become an even larger burden on taxpayers.

Note: The views expressed on Mises.org are not necessarily those of the Mises Institute.