According to the Treasury Department’s monthly report for September, the budget deficit turned positive last month, with tax receipts coming in at $197 billion above federal outlays. This sizable one-month surplus was due to a large month-to-month drop in federal spending for the month. Contrary to what some protectionists and Trump advocates have claimed, however, the surplus was not significantly driven by tariff revenues.

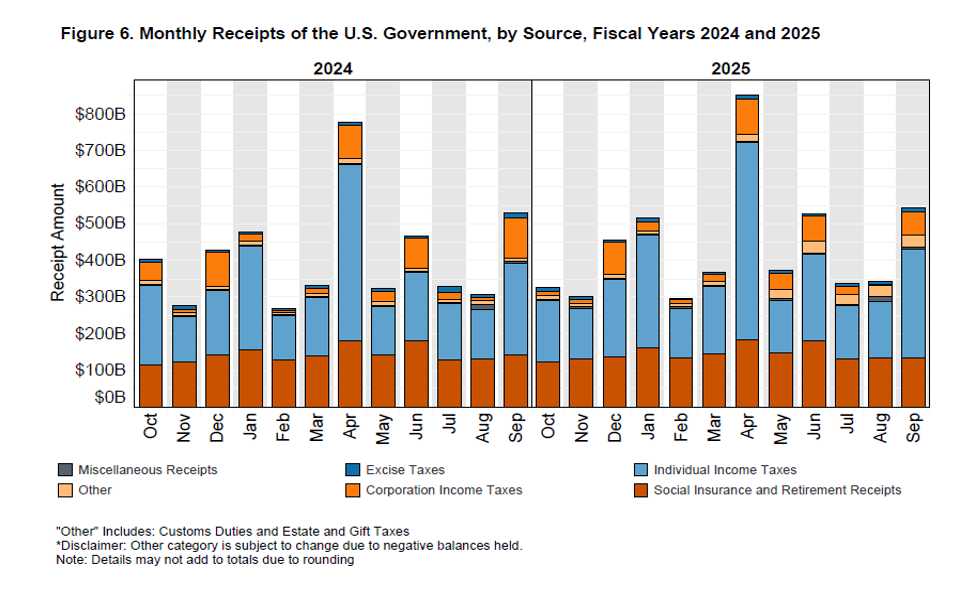

According to the report, total tax receipts for September amounted to $543 billion, a month-to-month increase of 57 percent, or $199 billion. In increase in receipts from August to September is an expected seasonal change, and tax revenue has increased from August to September in every year for more than a decade. Indeed, last months’ increase in revenue was not even particularly large. Over the past decade, the August-September increase in tax revenue has been larger in every year—except 2017 and 2018—compared to this year’s increase:

In other words, there’s nothing about recent revenue growth that’s remarkable.

In recent months, however, Trump and administration spokesmen have repeatedly made grandiose claims about tariff revenue. Early in his administration, for example, Trump claimed that tariff revenue would replace the income tax. It is now abundantly clear that the income tax is not going anywhere. As I showed earlier this year here on mises.org, tariff revenue is only a tiny part of total federal revenue. There is virtually no way to increase tariff revenue to a point that Trump would even be able to fund his military spending, let alone the popular welfare programs—like Social Security and Medicare—that Trump has pledged to not cut.

Nonetheless, the administration has been crowing about how tariff revenue increased to $31 billion during August and September, as if this would put any sort of significant dent in fiscal policy. For example, September’s tariff “haul” of $31 billion amounts to a mere 5.7 percent of all revenue ($543 bln) for the month. Looking at the Treasury’s revenue report, we can see that the true sources of the increase in September revenue were individual income taxes and corporate income taxes. Tariff revenues are so insignificant in the graph that they have been included under “other.”

Source: Treasury Dept.

Of course, an ordinary person could be forgiven for thinking that tariff revenue is enormous. In August, for example, Trump repeatedly claimed that tariff revenue totaled trillions of dollars. Forbes reports:

“Without tariffs, and all of the TRILLIONS OF DOLLARS we have already taken in, our Country would be completely destroyed, and our military power would be instantly obliterated,” Trump wrote on Truth Social.

Trump claimed earlier this month that “trillions of dollars are being taken in on tariffs” and his levies have “not caused inflation, or any other problems for America, other than massive amounts of CASH pouring into our Treasury’s coffers.”

In truth, since Trump took office, total tariff revenues have totaled about $120 billion or only 12 percent of a single trillion. It’s a long way from “TRILLIONS.”

So, when bragging about increased tax revenue in September and August, trump is really bragging about fleecing Americans of hundreds of billions of dollars collected through income taxes.

It’s not true that only foreigners pay tariffs, but, for the sake of argument, let’s say it is true. Even then, the overwhelming majority of tax revenue would still be coming from corporate and individual income taxes—assuming that Trump continues with his current policy of making no sustained spending cuts. Some Trump supporters may claim that tariffs are increasing and so will soon “replace” income taxes, but even if tariff revenue quadruples into fiscal year 2026, tariffs will still come up more than $3 trillion short of replacing income taxes. So, given everything we know about Trump’s big-spending fiscal policy, there is virtually no chance of the income tax going away. Trump needs that revenue to pander to Medicare recipients, to fund corporate welfare queens like Raytheon, and to lavish Israeli war criminals with American tax dollars.

Nor will tariff revenues do much to eliminate federal deficits. A monthly tariff revenue total of $30 billion—or even $50 billion—is a long way from erasing monthly deficits.

While it’s true that September’s surplus was unusually large, this can be attributed to a surprisingly big drop in federal outlays for the month. According to the Treasury report, total outlays dropped from $689 billion in August to $345 billion in September. Total outlays usually fall from August to September, with spending falling during the period during seven of the past ten years. Nonetheless, this September’s drop was a big one, with federal spending falling by 49.8 percent dung the period. The only comparable year in the past decade was 2018 when spending fell by 48.2 percent from August to September.

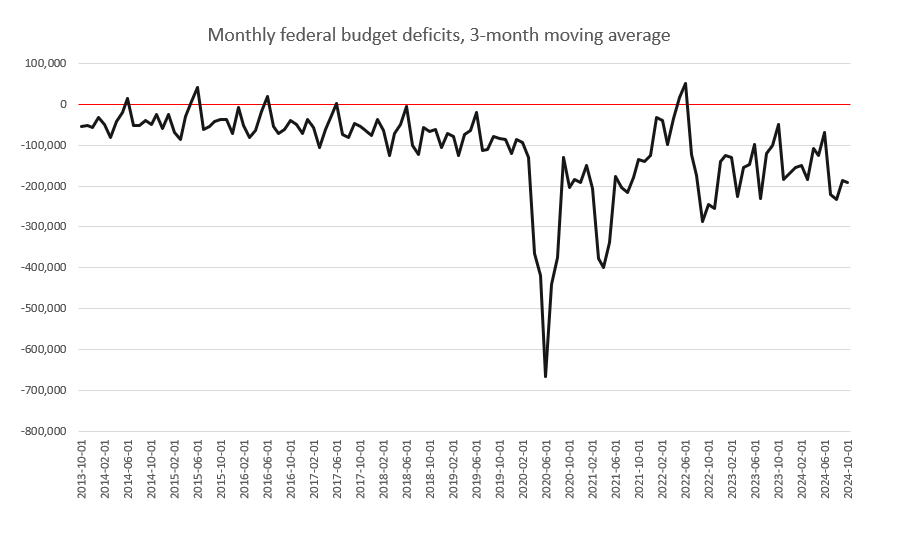

This is a good thing, of course, although it’s unlikely to be the start of any significant change in trend. Unfortunately, federal spending tends to increase from September to October, and September’s drop off in spending is likely to be an outlier. (I’d be happy to be proven wrong on this.)

Moreover, tax revenue tends to fall from September to October, so we’re likely looking at another sizable deficit for October. If that happens, Septembers surplus will be nothing more than blip in the trend in deficits. After all, the three-month moving average in monthly deficits shows the trend is getting worse, not better:

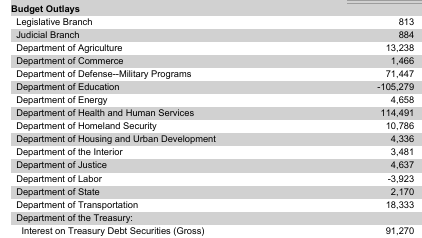

These deficits will continue to drive ever larger amounts of federal debt, and this itself will drive more federal spending on interest. For example, the September Treasury report also shows that more than $91 billion of the month’s $543 billion in revenue was spent on “interest on Treasury debt securities.” In other words, nearly one dollar for every six dollars collected in taxes goes just to pay debt service. That’s the largest single category of federal spending outside the major welfare programs like Social Security.

Year-to-date, total federal spending on interest on the national debt exceeded $1.22 trillion. That’s up from $1.13 trillion during the same period of last year. Debt service is rapidly consuming ever larger amounts of the federal budget. Contrary to what Americans have long told themselves, the federal debt does come with a cost.

The only good news in this monthly Treasury report is the fact that spending went down last month. Meanwhile, federal revenue went up substantially—with most of it coming from income taxes. But, unless something changes significantly in terms of military spending and big programs like Medicare, etc., the Treasury will quickly return to running big deficits.