The Philippines is often described as a country afflicted by a succession of internal conflicts: colonial rebellion, communist insurgency, separatist war, Islamist terrorism. This framing obscures a deeper continuity. What the Philippines has experienced instead is a persistent condition of disruptive warfare, shaped and sustained by its incorporation into U.S. grand strategy beginning in 1898. From that point forward, internal conflict was no longer treated primarily as a political failure to be resolved, but as a security condition to be managed so long as the country’s strategic alignment and utility were preserved. The result has been more than a century of instability that is neither accidental nor episodic, but structurally conditioned by the Philippines’ role as an American strategic asset.

Before the Pivot: Spanish Rule and Incomplete Integration

Spanish colonization of the Philippines, beginning in the sixteenth century, never produced a fully integrated polity. Governance was uneven, extraction-heavy, and reliant on local intermediaries rather than durable institutions. Large portions of the archipelago—most notably Muslim-majority Mindanao—were never fully subdued or incorporated. Resistance was chronic, authority fragmented, and political cohesion shallow.

This history matters not because Spanish rule was uniquely brutal or incompetent, but because it left behind a fragmented political landscape. Spain created instability, but it did not systematize it. Rebellion existed, but it was episodic and local, not yet institutionalized as a permanent security condition. That would change decisively at the end of the nineteenth century.

1898: From Colony to Chess Piece

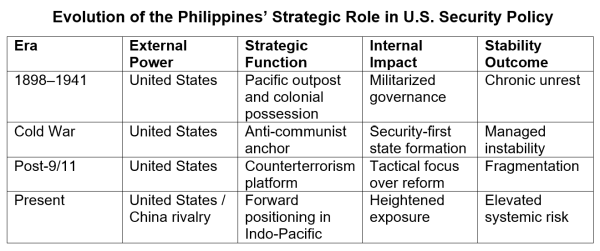

In 1898, following the Spanish–American War, the Philippines became an American possession. More importantly, it became an American strategic position. From Washington’s perspective, the archipelago was no longer merely a former colony with governance problems; it was a Pacific outpost, a gateway to Asia, and a symbol of emerging U.S. power.

This strategic recasting altered the logic of governance. The Philippine–American War that followed was not merely a war of conquest; it was an early exercise in modern counterinsurgency. Pacification, intelligence gathering, population control, and the professionalization of security forces became central governing tools. Internal violence was reframed not as a political failure demanding integration and reform, but as a technical problem requiring management.

By 1902, organized resistance to U.S. rule had been decisively suppressed. The campaign combined intelligence-driven targeting, population control, and punitive force in ways that demonstrated the feasibility of defeating insurgency without resolving its underlying political causes. While costly and brutal, it restored order sufficient for strategic purposes. In doing so, it established a precedent: counterinsurgency could be treated as a technical and organizational problem rather than a political one. That lesson would echo, with unfortunate consequences, through later U.S. military doctrine.

The Philippines thus entered the American security system not as a sovereign project to be completed, but as a position to be held. This strategic recasting did not occur in a vacuum. At the turn of the twentieth century, American thinking about power was heavily influenced by the naval theories of Alfred Thayer Mahan, who argued that national greatness depended on command of the seas, forward bases, and control of key maritime routes. In this framework, the Philippines’ value lay not in its political cohesion or social development, but in its position astride the Western Pacific.

The archipelago was conceived less as a nation to be integrated than as a platform to be held. That strategic logic did not require internal stability—only that disorder remain manageable. From the outset, then, the Philippines entered U.S. grand strategy as a positional asset, with its internal conflicts subordinated to external imperatives.

The Japanese Gambit

The Japanese conquest of the Philippines during World War II underscored the strategic logic that had already shaped American policy. Japan did not seize the archipelago because of its internal politics or social structure, but because of its position astride key maritime routes and its value as a forward operating platform. The rapid collapse of U.S. defenses in 1941 revealed a fundamental reality: in great-power conflict, the Philippines’ internal stability was strategically irrelevant. What mattered was denial, access, and control. The war thus confirmed the Philippines’ role not as a sovereign state to be defended for its own sake, but as a positional asset whose fate would be determined by external strategic competition.

The lesson drawn by the United States from this experience was not that Philippine political cohesion should be prioritized, but that strategic alignment and access had to be secured under all conditions. When the United States returned after the war, it did so with a security posture designed to prevent strategic loss rather than to complete political integration.

Permanent Counterinsurgency as Normality

In the postwar era, counterinsurgency hardened into a governing norm. Philippine security institutions were shaped around containment rather than resolution. Stability came to mean the suppression of threats below a tolerable threshold, not the elimination of the structural drivers that produced them.

This approach proved durable. Insurgencies could be weakened, fragmented, or temporarily suppressed without being resolved. Security forces became tactically proficient. External assistance flowed steadily. The state survived, elections were held, and formal sovereignty was preserved.

What never emerged was a political settlement capable of integrating peripheral regions, addressing land inequality, or dissolving the incentive structures that perpetuated rebellion. Low-grade conflict became sustainable. In this sense, disorder was not a failure of the system; it was the equilibrium the system produced.

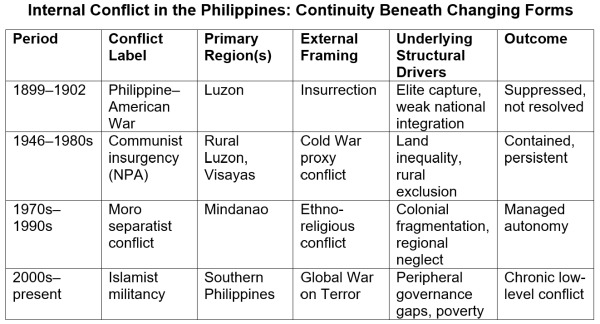

Recurring Insurgency

The persistence of internal conflict in the Philippines has often been obscured by its changing ideological labels. Communist insurgency, Moro separatism, and Islamist militancy have each been treated as distinct problems requiring distinct responses. In practice, these movements emerged from the same conflict ecology: peripheral neglect, weak political integration, elite capture, and security-first governance.

Ideology shifted; structure did not. Armed groups fragmented, reconstituted, and rebranded. The New People’s Army waxed and waned. Moro movements split, negotiated, and rearmed. Islamist branding supplied a new vocabulary for an old pattern. Each iteration justified renewed security assistance while deferring the political and economic reforms necessary for durable resolution.

Persistent insurgency did not serve a deliberate American purpose, but it produced consequences aligned with U.S. strategic interests. So long as internal conflict remained containable, it sustained security cooperation, reinforced institutional dependence, and ensured strategic alignment without requiring deep political transformation. Instability was not sought, but it was tolerated, managed, and ultimately normalized.

Advising Without Resolving

The American role throughout this period has been consistent. Training missions, advisory deployments, intelligence cooperation, and joint exercises have enhanced the tactical competence of Philippine forces. Measured narrowly, many of these efforts succeeded. Measured strategically, they did not. Metrics focused on operations rather than outcomes. Kill and capture rates substituted for political integration. Professionalization reinforced dependency. Each new phase of assistance optimized the system for continued management rather than transformation. This pattern is familiar across U.S. security partnerships. What distinguishes the Philippines is not failure, but longevity: more than a century of security engagement without structural resolution.

The closure of major U.S. bases in the early 1990s briefly appeared to mark a strategic departure. The Philippines asserted sovereignty, rejected permanent basing, and sought greater autonomy from American military influence. Yet the underlying security relationship remained intact. Internal conflict persisted, defense capacity remained limited, and reliance on external support quietly continued through advisory missions, access agreements, and intermittent cooperation. When regional competition intensified, the strategic logic reasserted itself with little friction. The episode demonstrated that the Philippines could distance itself from the form of U.S. military presence but not its function within American grand strategy.

This continuity was formalized in 2014 under the Enhanced Defense Cooperation Agreement (EDCA), which allows U.S. forces rotational access to designated Philippine military facilities, permits prepositioning of equipment, and authorizes the construction of temporary infrastructure. EDCA does not reestablish permanent U.S. bases, but it preserves the functional equivalent of rapid access and surge capability. In a crisis, this framework would allow substantial U.S. military assets to be positioned in the Philippines without the political or legal delays associated with renegotiating basing rights. The distinction between access and basing is therefore largely administrative rather than strategic.

The Chess Game Resumes

As competition between the United States and China intensifies, the Philippines’ geographic position has regained prominence, increasing its strategic value once again. Basing access, maritime route proximity, and forward positioning have elevated the archipelago’s external significance within the evolving Indo-Pacific security environment. U.S. security cooperation has increasingly emphasized access, interoperability, and presence, placing the Philippines closer to the front line of disputes over maritime boundaries and regional control.

What has not changed is the country’s internal fragility. Peripheral regions remain underdeveloped. Infrastructure is vulnerable. Defense capacity is limited. The very conditions that once made managed instability tolerable—containable conflict, external security support, and deferred reform—now amplify exposure under conditions of great-power competition. Strategic importance does not confer protection; it increases risk. A state with limited defense autonomy and persistent internal insecurity has fewer credible options for strategic nonalignment. In such conditions, alignment with a potential belligerent often reflects constraint rather than preference. A country valued primarily for its position becomes more, not less, vulnerable as rivalry among major powers intensifies.

The Sacrificial Piece

The danger of being treated as a strategic chess piece is not merely that one is manipulated, but that one may eventually be sacrificed. In a serious regional conflict, devastation of the Philippines would not require invasion or occupation. Precision strikes, infrastructure paralysis, and economic disruption would be sufficient to render the Philippines unusable to both sides. Such an outcome would not be an accident or a tragic miscalculation. It would be the possible consequence of a century-long pattern in which the Philippines’ primary value lay in its strategic position, not its stability. Managed instability is tolerable until escalation to war renders management irrelevant.

The Philippines’ misfortune is not that it has suffered too many wars. It is that it has been positioned, repeatedly, as a place where disruption could be absorbed in service of big power strategies. When a nation is treated as a chess piece long enough, its welfare becomes secondary, and its sacrifice becomes a strategic option.