Yves here. We’ve pointed out extremely cheery economic messaging on the front page of the Wall Street Journal over the past week, based heavily on stock market performance plus anecdata. This was the lead story a day ago:

From its text:

The set of turbulent recent events, which also has included the administration’s aggressive deportation program and the U.S. bombing of Iran’s nuclear sites, has failed either to dent or improve the public’s overall view of the president. Some 46% approve of his job performance—unchanged from April—with 52% disapproving.

The poll shows why the near-unshakeable backing of Trump’s Republican base is so valuable to him. With 88% of GOP voters approving of his job performance—and 66% strongly approving—he has been able to retain political potency in Congress and among much of the electorate when voters overall are dissatisfied with the country’s direction and disapprove of the president’s handling of the economy, inflation, tariffs and other aspects of his agenda.

Contrast this cheery take with a story a day ago in The Hill, Polls turn sour on Trump as he hits new lows with independents:

Trump saw some of his lowest approval ratings of his second term over the past week, with his net approval in the Decision Desk HQ (DDHQ) average falling to more than 9 points underwater. He’s seen declines, in particular, among independents and on his handling of certain key issues like immigration.

At the same time, he’s trying to tame an ongoing headache stemming from the controversial case of the financier and convicted sex offender.

While his numbers certainly haven’t bottomed out, they indicate to a tough moment for Trump after a series of major victories in recent months.

Lee Miringoff, the director of the Marist University Institute for Public Opinion, said Trump’s quickly shifting political fortunes are part of his skill at “keeping the focus moving all the time,” which requires redirecting people’s attention to his benefit.

“But you do take a cost that your victories are short-lived, and the net effect is there’s still an awful lot that people feel has not been accomplished and that he hasn’t fulfilled a lot of campaign promises, even though some of it clearly was written and spoken of during the campaign,” he added…

Some polls have been better for Trump, with an Emerson College Polling survey only showing him 1 point underwater, but multiple major pollsters have found him trending in the wrong direction recently, including Morning Consult, YouGov/The Economist and Gallup.

The Gallup poll could particularly be a warning sign for Trump and the GOP, with 37 percent of respondents saying they approve of his job performance, down from 40 percent last month and 43 percent in May…

Democratic strategist Joe Caiazzo said the numbers are evidence that any grace period Trump enjoyed has ended…

He pointed to continued inflation amid Trump’s tariff policy, along with the public witnessing major raids from Immigration and Customs Enforcement (ICE) agents detaining people at places like schools, hospitals and churches.

And from a post last week on the declining caliber of US economic statistics, more on the heavy economic hopium messaging from the Journal:

In a bit of serendipity, the Wall Street Journal is giving a big dose of what supposed economic stories based on feelings look like. Two days ago, its lead item was The U.S. Economy Is Regaining Its Swagger. The argument at the top of the piece:

Consumer sentiment collapsed. The S&P 500 stock index fell by 19% between February and April. The world held its breath and waited for the bottom to drop out.

But that didn’t happen. Now businesses and consumers are regaining their swagger, and evidence is mounting that those who held back are starting to splurge again.

The stock market is reaching record highs. The University of Michigan’s consumer sentiment index, which tumbled in April to its lowest reading in almost three years, has begun climbing again. Retail sales are up more than economists had forecast, and sky-high inflation hasn’t materialized—at least not yet.

First, given that Trump was elected to a significant degree on a tide of voter upset about high inflation versus lackluster growth does not even remotely amount to “swagger” that can is allegedly being regained.

Second, placing a lot of stock in this stock market is also misguided. Admittedly, as Keynes warned, it can and will stay irrational longer than shorts might remain solvent….

The very next day, the lead Journal story was more flagrant boosterism. From The Global Economy Is Powering Through a Historic Increase in Tariffs:

The global economy is sailing through this year’s historic increase in tariffs, displaying an unexpected trait: resilience.

Faced with extreme uncertainty, businesses and households have surprised economists with their ability to hedge, finding a short-term path through as they await clarity on where tariffs will end up.

Global producers brought forward purchases and rerouted goods destined for the U.S. through third-party countries that are subject to lower tariffs. For the most part, households and businesses have continued to spend and invest despite the uncertainty, analysts say.

The world economy grew at a 2.4% annual rate in the first half of this year, around its longer-term trend, according to JPMorgan.

Trade volumes are buoyant, stock markets on both sides of the Atlantic have rebounded to record highs and growth forecasts from Europe to Asia are being raised.

Lordie. In January, the IMF predicted global growth for 2025 and 2026 to come in at 3.3%. A mere 2.4% is a big miss, not something to brag about unless you are a market tout serving easily manipulated clients (as in most equity investors).

And the IMF revised its forecasts in April based on Trump’s tariff announcements….and had its new 2025 global forecast at 2.8%! In other words, the world economy is doing worse in the face of the Trump tariff shock, with his high and arbitrary Liberation Day levels, than experts expected. And let us further consider that the IMF had deemed its initial global growth estimate of 3.3% to be lackluster.

Now to the main event.

By Stephen Praeger. Originally published at Common Dreams

The White House says the U.S. is in the midst of an “economic boom” under President Donald Trump. But voters aren’t feeling it in their wallets.

Polling released by Gallup Thursday found the president’s approval rating at just 37%, the lowest point of his second term so far, with an all-time low approval rating of 29% among independents.

This precipitous decline has been helped along by sagging approval on the economy, which has historically been the issue where he gets the most support. After a high of 42% in February, approval for his handling of the economy is likewise down to just 37%.

An uptick in inflation seen over the past month has exacerbated the cost of living crisis Trump promised to abate on the campaign trail.

A poll released Friday by Data for Progress found that, “Only 30% of likely voters report having enough income to be able to comfortably provide for their household’s needs, while a plurality of voters (43%) say they have enough income but money is tight, and 20% say they do not make enough to provide for all household members’ needs.”

(Graphic: Data for Progress)

“As his approval tanks, President Trump has finally lost voters on the one issue where they’ve historically trusted him: the economy,” said Lindsay Owens, the executive director of the Groundwork Collaborative. “Not only has Trump shirked his promise to lower prices, he’s made the situation substantially worse as his tax and tariff policies have landed a double blow to household budgets.”

According to data from Indeed, cited by Forbes, 43% of Americans have seen their wages lagging behind the cost of living over the past year. The jobs feeling the worst crunch are those “at the low-to-middle end of the pay spectrum.”

Trump has imposed the highest tariffs on imported goods since the Great Depression. After months of relative quiet, they began to make their impact felt this past month, with consumer prices up 2.7% from the previous year, compared with just 2.4% in May.

While rising rent costs were the top driver of inflation in June, prices for clothing, toys, and consumer appliances all rose, as did food and energy.

The president was elected on promises to tackle the cost of living. But now 70% say that he is not focused enough on lowering prices, according to polling released Sunday by CBS News. Meanwhile, 61% say Trump is focusing too much on his tariff policy, which remains broadly unpopular.

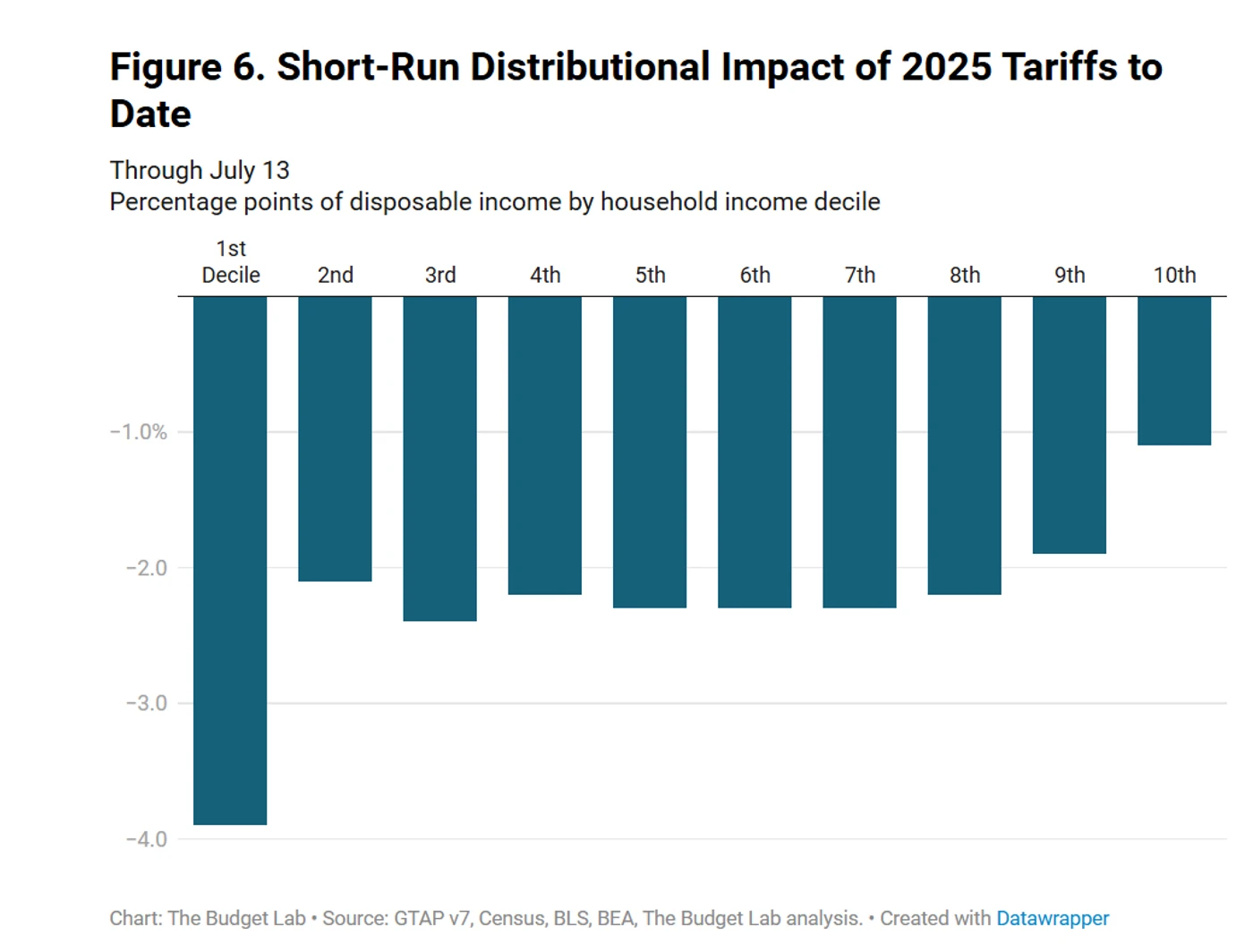

Yale’s Budget Lab estimates that it would cost the average household $2,770 worth of disposable income per year if tariffs stayed at their current rate indefinitely, with the worst impact—especially in the short term—on the poorest Americans.

(Graphic: Yale Budget Lab)

But they are set to grow more intense beginning on August 1, when Trump has said he’ll roll out new levies on imports from some of America’s top trading partners, including Canada, the European Union, Mexico, Brazil, and South Korea.

According to economists who spoke with Vox, the worst effects are likely yet to come. Preston Caldwell, chief U.S. economist for Morningstar, said inflation would likely peak in 2026 rather than 2025.

“Companies have started paying tariffs on their imported goods, but as far as the goods that are being sold in stores right now, those are primarily being drawn from the inventory of goods that were brought in before the tariffs,” Caldwell said. “So most companies are still not really having to recognize the loss of tariffs yet to a great degree.”

“The more that it becomes clear that tariffs are here for at least the foreseeable future,” he continued, “the more that they are going to have to eventually adjust to this new reality, which will entail increasing their prices.”

Owens said that will likely translate to even fiercer backlash against Trump.

“Working families,” she said, “know exactly who to blame as they pay higher prices on everything from groceries and electricity bills to school supplies and appliances.”