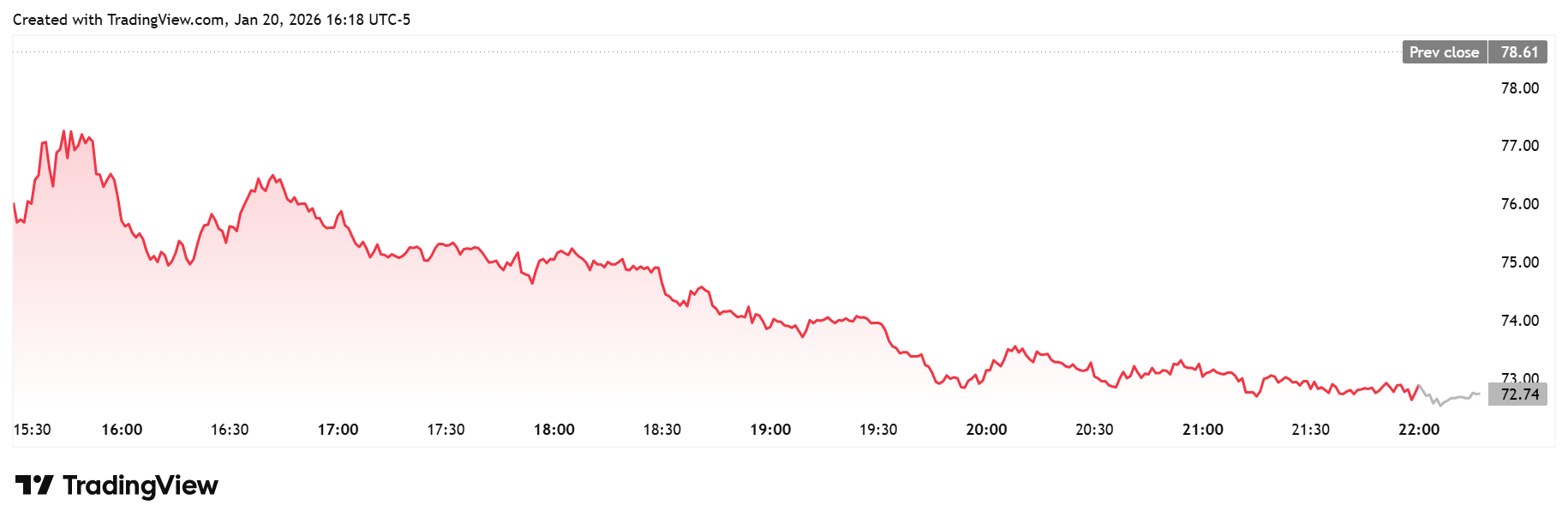

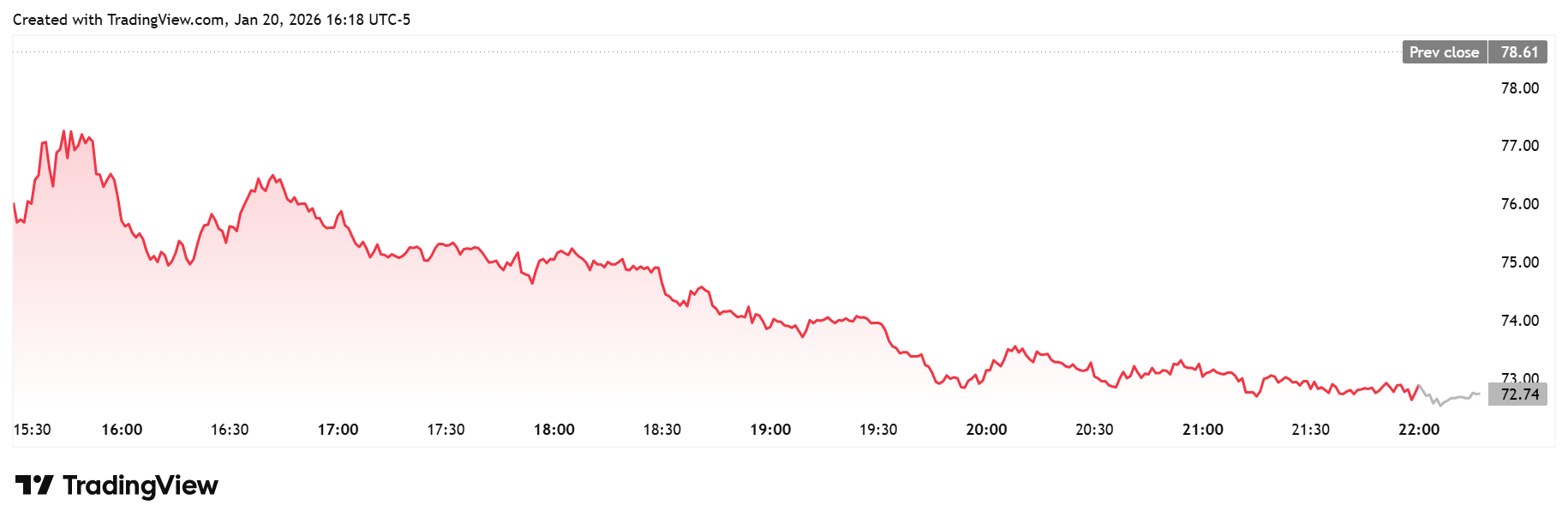

Stocks of crypto companies fell as much as 10% on Tuesday as investors pulled out of risk assets amid a resurgence in tariff talks and rising tensions in the Japanese bond market. The combination of these factors caused a sell-off in key crypto stocks.

Crypto Stocks Plunge With MSTR, COIN, Hood, CRCL Leading The Way

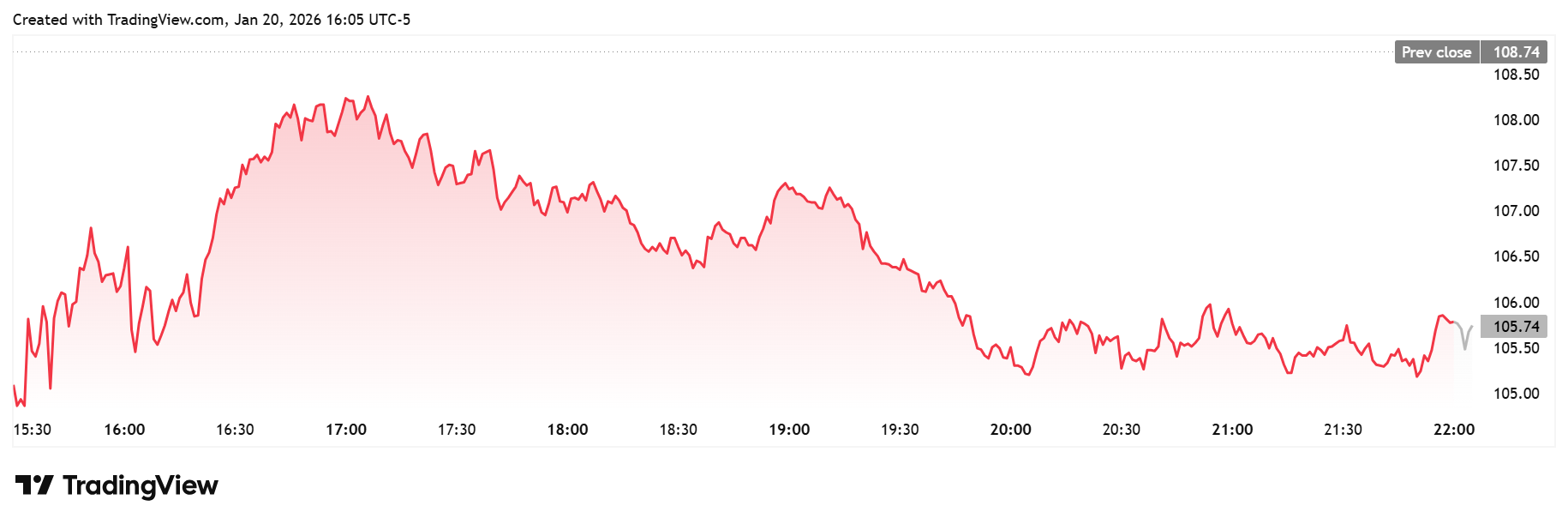

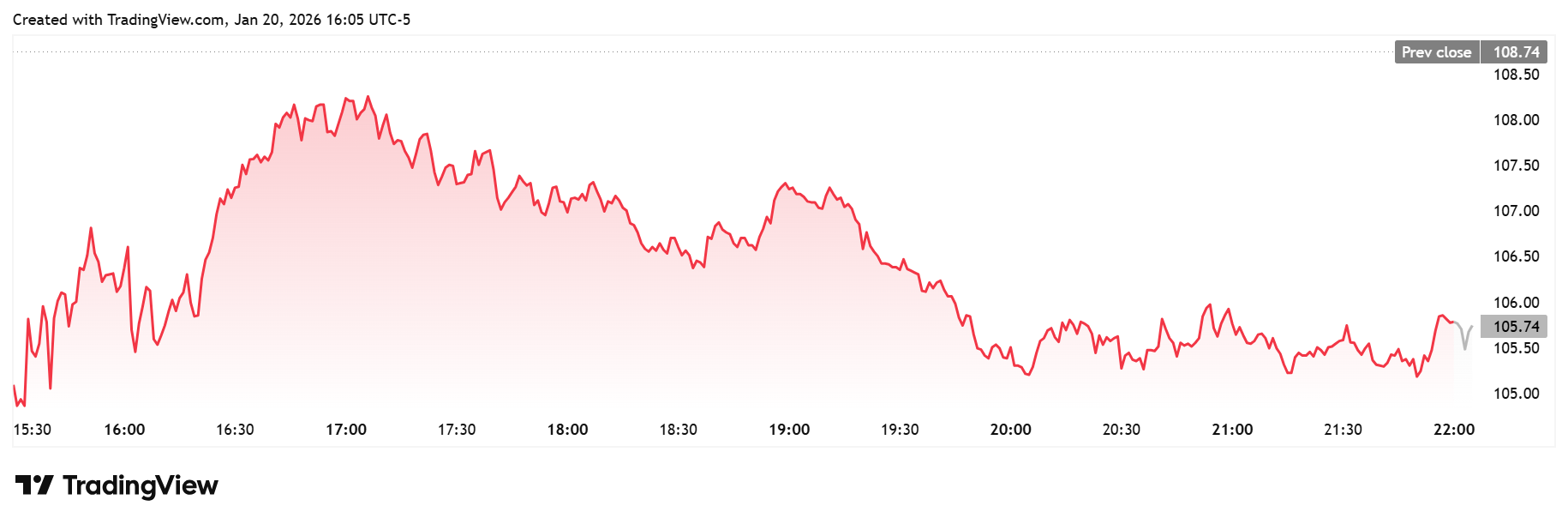

MSTR stock took a nearly 8% hit, worse than many other crypto stocks. The share is sensitive to the price movements of the leading digital asset and the wider crypto market. The stock also declined amid tariff uncertainties, which led to heavy selling pressure in the crypto market.

The Strategy stock is also known to share a direct correlation with Bitcoin, which crashed below $90,000 today. Meanwhile, the decline in the crypto stock comes amid Strategy’s latest BTC purchase, which saw the company cross the 700,000 milestone.

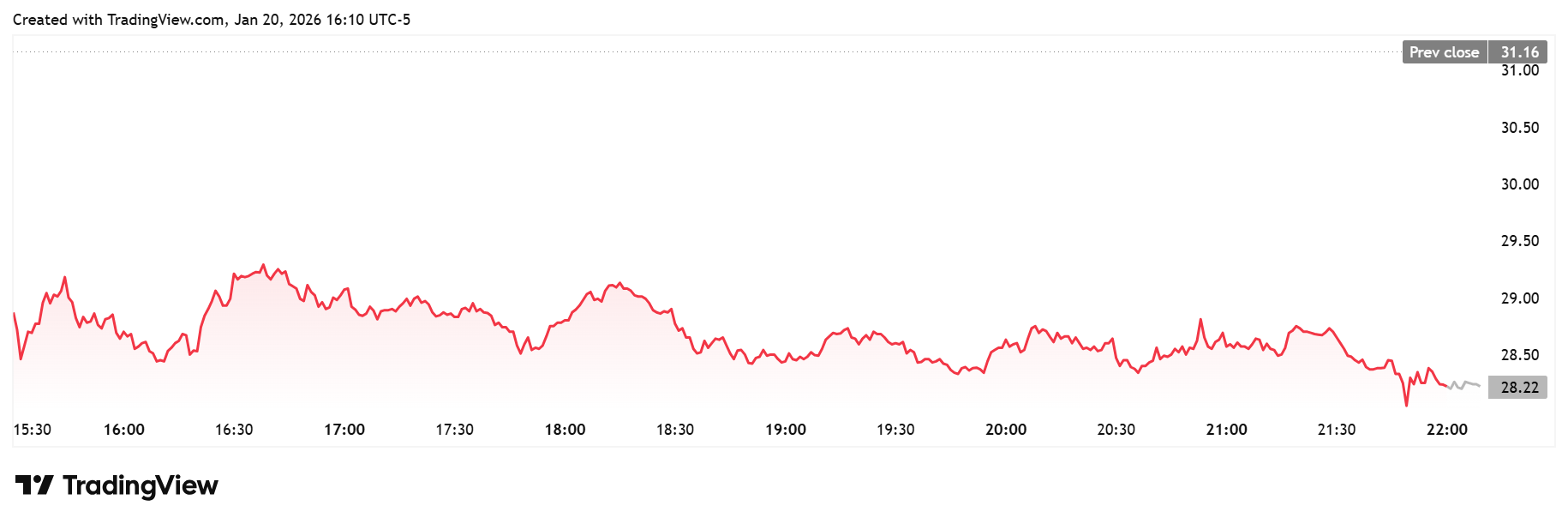

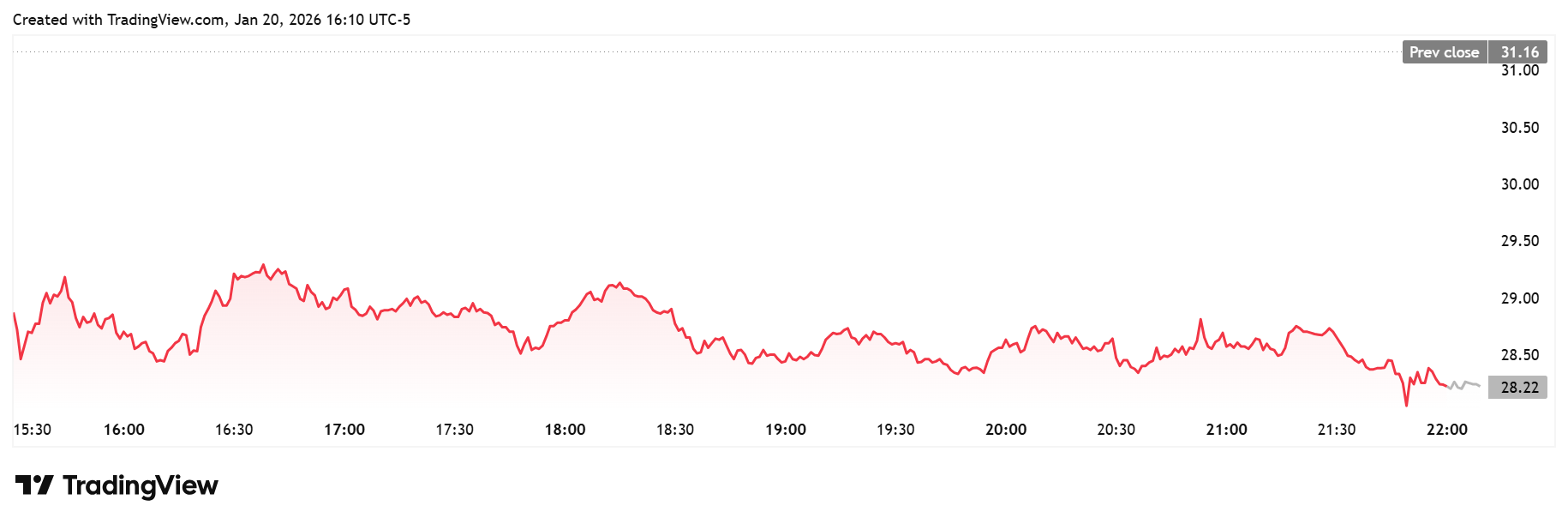

Furthermore, Coinbase shares declined over 5% on the day amid the sell-off in the crypto market. The COIN stock began its decline last week after the CLARITY Act markup was postponed. The top crypto exchange was at the centre of that development, withdrawing its support for the bill over provisions, including the distribution of stablecoin yields.

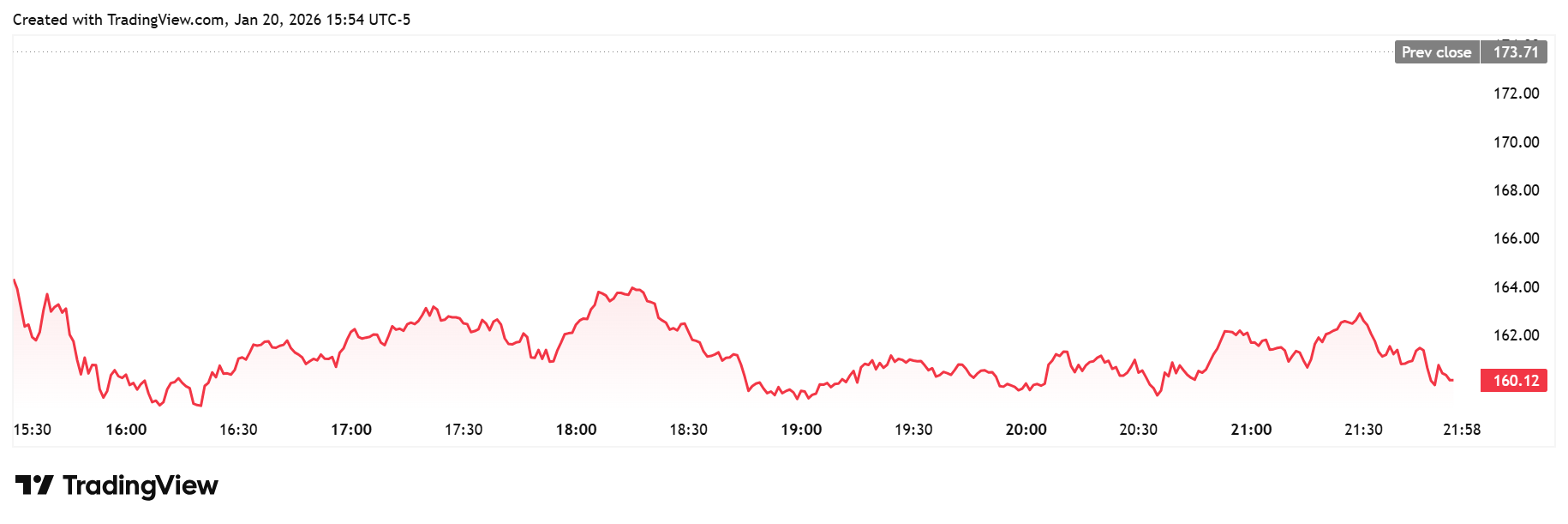

The HOOD stock had also suffered a similar fate to the COIN stock, declining last week. The crypto stock dropped over 2% and is now down over 8% year-to-date (YTD).

BitMine’s BMNR stock, just like MSTR, was among the crypto stocks that suffered the largest losses. The stock dropped almost 10% today amid BitMine’s announcement of another weekly Ethereum purchase.

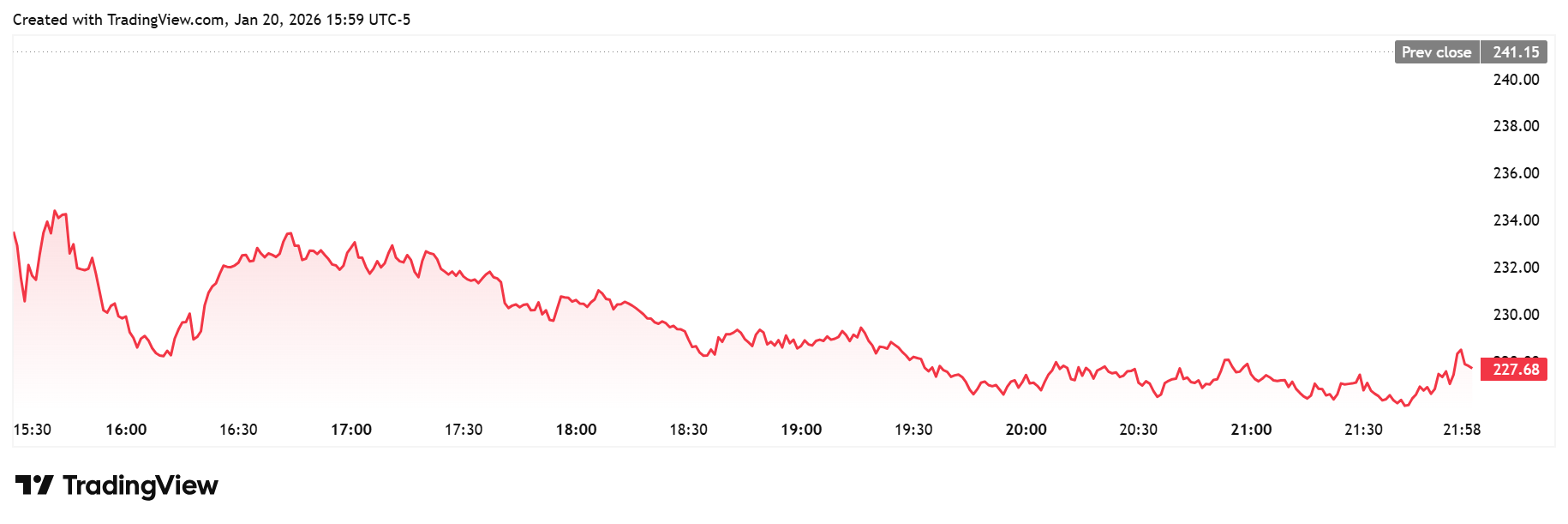

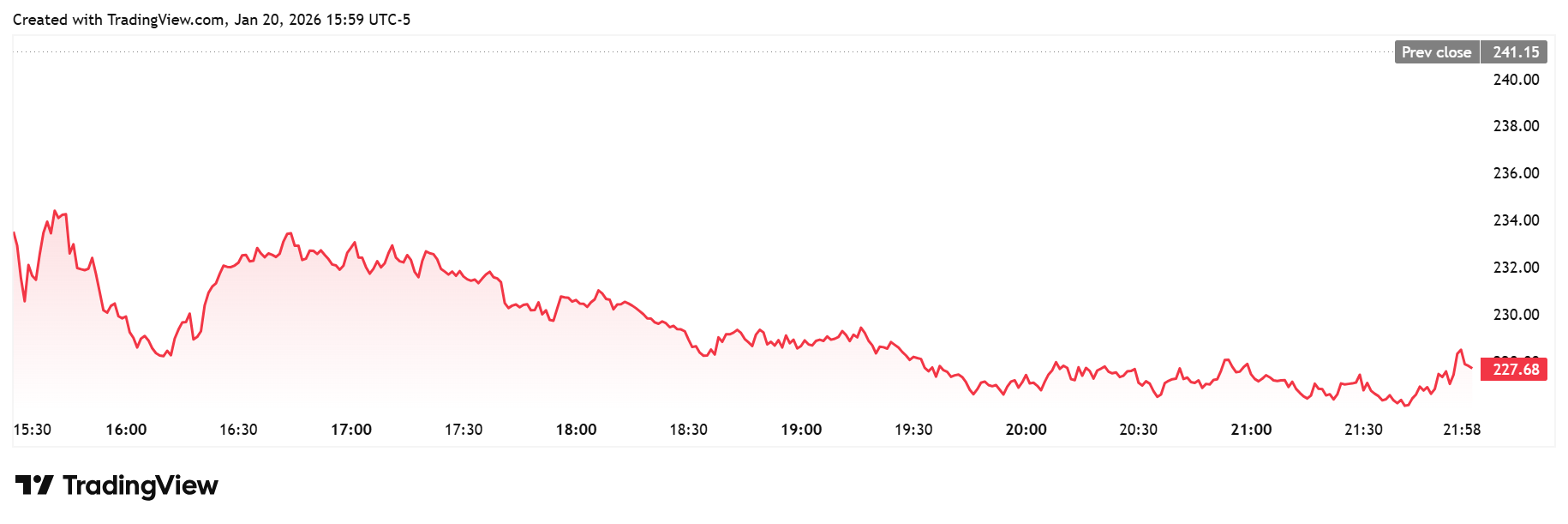

The Circle stock was another crypto stock that suffered a significant loss today. The stock dropped almost 8% on the day and is now down over 10% year-to-date (YTD). The stock has notably shed most of its gains from its successful U.S. IPO last year, down over 63% in the last six months.

Risk-Off Hype is Revived by Tariff Threat

Fresh tariff threats from the U.S. also affected financial markets worldwide, amid fears of weaker economic growth and higher inflation. These fears heightened when Trump threatened to impose 200% tariffs on France, leading to increased trade tensions.

These situations usually cause investors to withdraw their capital from risky assets, such as the crypto industry and crypto stocks.

The tension across global markets increased as long-term Japanese government bond yields rose. This comes amid concerns about the government’s increased fiscal spending. Meanwhile, the Bank of Japan (BOJ) is also considering further rate hikes, which could spark a collapse in the Yen carry trade.

James Lavish, a macro investor, highlighted the rise in Japan’s 40-year bond yield to multi-year highs by posting a chart on X. He also explained that a rise in Japan’s bond yields could lead to tighter liquidity in global markets. Hence, this would put downward pressure on risk asset classes like crypto and its equities.

Investors monitor the Japanese bond market because it is a key component of the global liquidity environment. It is worth noting that the U.S. stock market suffered a significant sell-off today, which also affected crypto stocks. The S&P 500 dropped over 25 today and is now down YTD.