Quick Facts:

1️⃣ Representative Troy Downing (R-Mont.) introduced a bill codifying Trump’s Executive Order 14330.

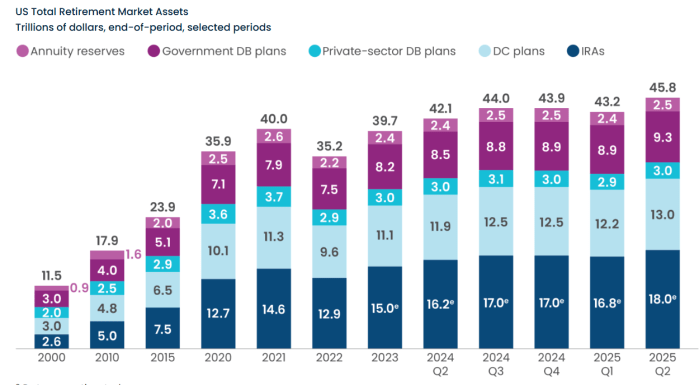

2️⃣ The executive order opens the $12T 401(k) market to crypto investors.

3️⃣ Both the executive order and the bill are infrastructure plays, setting up other projects like Bitcoin Hyper ($HYPER) for long-term growth.

Did you hear about US President Donald Trump’s move to open the $12T 401(k) retirement market to crypto?

When the news broke weeks ago, there was the usual doubt about what the exact outcome would be. Now we’re one step closer to finding out; U.S. Republicans are pushing legislation to enshrine in law President Trump’s executive order that allows crypto exposure in 401(k) plans.

The trickle-down impact would extend beyond $BTC and $ETH, opening the door for key infrastructure projects, such as Bitcoin Hyper ($HYPER), to gain momentum.

From Executive Order to Federal Law

Earlier this year, Trump issued Executive Order 14330, instructing the Department of Labor to permit ‘alternative assets,’ including digital assets, in retirement plans if fiduciaries deem them appropriate.

And defined contribution plans – mostly 401(k)s – account for $13T of that market.

However, even executive orders from Donald Trump lack permanence; they can be overturned or modified by future administrations. To address that, Representative Troy Downing has introduced the Retirement Investment Choice Act, a one-page bill that would give Trump’s guidelines the ‘force and effect of law.’

If enacted, this bill would permanently bind the retirement rule into federal statute.

Under the original executive order, the Labor Department has 180 days to propose rule changes that would allow plan sponsors to include cryptocurrencies and other alternative assets.

However, it’s not all easy-going. Real-world challenges, including the ongoing government shutdown, could delay the process.

Meanwhile, nine members of Congress have urged the SEC to accelerate implementation, pointing out that it’s not simply about the size of the 401(k) market cap; nearly 90M investors currently lack access to alternative assets under existing rules.

Open the Capital Floodgates for Crypto

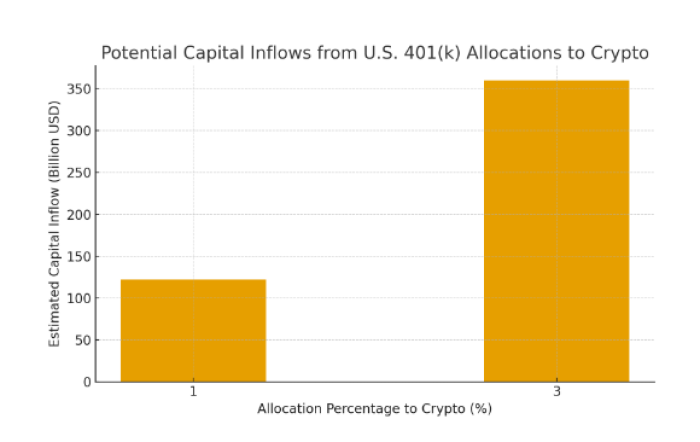

The implications for capital flows into digital assets are eye-watering. If even just 1 % of U.S. 401(k) assets were allocated to crypto, analysts estimate it could funnel $122B into crypto markets. That figure climbs to approximately $360B if allocations reach 3%.

It’s not like there isn’t already an institutional appetite: BlackRock’s IBIT spot Bitcoin ETF just passed the $100B AUM mark and shows little sign of slowing down. The total AUM of the $BTC ETF sits around $160B, with impressive growth over the past year.

What Crypto 401(k)s Mean for Altcoins

The best options to buy focus not just on short-term plays, but on long-term infrastructure. That’s exactly the kind of approach that fits hand-in-glove with Trump’s executive order and the new bill.

By incorporating crypto into retirement accounts, the financial industry could simultaneously boost the development and stability of digital assets. The move could achieve:

Broader institutional legitimization: Including crypto in retirement portfolios could shift perceptions, reducing the stigma associated with volatility and risk.

Greater capital dispersion: As ETFs covering altcoins become available (from Bitcoin to Ethereum and Solana), investors should diversify, supporting a wider range of protocols.

Reduced correlation to speculative markets: Retirement allocations tend to be longer-term and more stable, which could cushion crypto markets from extreme short-term swings.

Viewed that way, Trump’s executive order and Downing’s proposed bill are actually infrastructure plays, setting the stage for crypto to enter its next growth phase.

That’s where Bitcoin Hyper ($HYPER) comes in, bringing its own upgrade to Bitcoin’s limited architecture.

Bitcoin Hyper ($HYPER) – Whale Buys Boost Infrastructure Play, Raise $23.7M for Bitcoin Layer 2

Bitcoin is big, bad, and the poster child for crypto.

Too bad it’s not exactly what the original white paper intended.

Satoshi entitled the whitepaper a ‘Peer-to-Peer Electronic Cash System.’ While Bitcoin has succeeded wildly as a store of value, it hasn’t performed as well as an actual payment system.

That’s partly because Bitcoin is secure, stable, and slow. A low throughput and limited TPS (averaging 7) pales in comparison to Visa’s 65K TPS, or even the several thousand TPS offered by Solana.

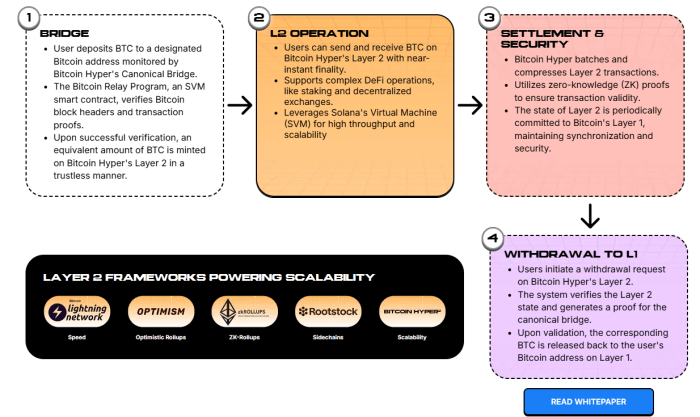

Bitcoin Hyper ($HYPER) addresses these weaknesses by utilizing a canonical bridge to the Solana Virtual Machine, thereby combining Bitcoin’s stability with Solana’s flexibility.

The resulting hybrid architecture utilizes the bridge to wrap $BTC onto the Bitcoin Hyper Layer 2, where it can be used for everything from DeFi to microtransactions, thanks to the SVM’s vastly higher throughput and lower fees.

What is Bitcoin Hyper? It’s the upgrade Bitcoin needed, and there’s an immense amount of buzz around the project with whale buys pouring in:

Our own price prediction thinks the token has a legitimate chance to move from $0.013115 to $0.32 by the end of the year. If 2339% gains sound decent to you, learn how to buy Bitcoin Hyper.

Visit the $HYPER presale page to learn more.

In the meantime, while the path from bill introduction to law is uncertain, the momentum is clear: political actors are aligning behind bringing digital assets into mainstream retirement investing.

Should the Retirement Investment Choice Act pass, the steady trickle of crypto adoption could become a flood, reshaping capital flows, investor behavior, and the very architecture of crypto markets – just like Bitcoin Hyper aims to do with Bitcoin.

As always, do your own research. This isn’t financial advice.

Authored by Bogdan Patru for Bitcoinist – https://bitcoinist.com/trump-crypto-401ks-are-here-bitcoin-hyper-can-benefit

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.