Highlights

Uniswap is an EVM-centric non-custodial crypto trading platform. It is permissionless; anyone can trade on the platform and list new pairs by creating a liquidity pair.

Uniswap is one of the largest DeFi platforms, with a TVL of over $4.2 billion. It is available on more than 20 EVM-compatible crypto networks.

On Uniswap, you can spot trade crypto, earn by adding liquidity, and manage your portfolio through the Portfolio interface.

An average of $2 billion worth of crypto is traded on the Uniswap platform daily. Defillama estimates over $4.2 billion in locked assets on the DeFi protocol. Uniswap is arguably the most widely used DeFi protocol, with an average of 5 million monthly active users, according to Token Terminal.

Uniswap was launched on the Ethereum network in 2018, but has expanded its network coverage to over 40 EVM-compatible chains. For existing Unswap exchange users and crypto enthusiasts looking to utilize the platform, this article offers an in-depth review.

What is Uniswap DEX?

Uniswap is a multichain non-custodial crypto trading platform. It is an EVM-centric DEX, supporting over 20 EVM-compatible networks and any ERC20 token. Uniswap is permissionless; that is, usage is open to anyone connected to a supported network.

As a self-custody trading platform, Uniswap users maintain full control of their assets and wallet keys while using the platform. Registrations and KYC verifications are also not required to use the platform. Apart from trading on the platform, anyone can also create a liquidity pair and enable trading for any ERC20 standard token.

Uniswap is available globally; however, usage restrictions may apply in sanctioned regions like North Korea, Iran, Syria, and areas of Ukraine (Crimea, Donetsk, Luhansk).

What can you do on Uniswap DEX?

You can perform the following operations on Uniswap

1. Trade ERC-20 Standard Tokens

Uniswap is primarily a decentralized crypto trading platform. On the platform, you can swap your ERC20 token for other supported crypto assets. Note that a liquidity pool must exist for both tokens before your trade can be successful. You can use direct swaps or set limit orders to execute your trades at a set price.

2. Provide liquidity

You can also explore passive income through liquidity provision on Uniswap. Liquidity providers earn a significant portion of the trading fees paid by traders on Uniswap. Ensure that you understand liquidity farming concepts like Impermanent loss before committing your assets to the pools.

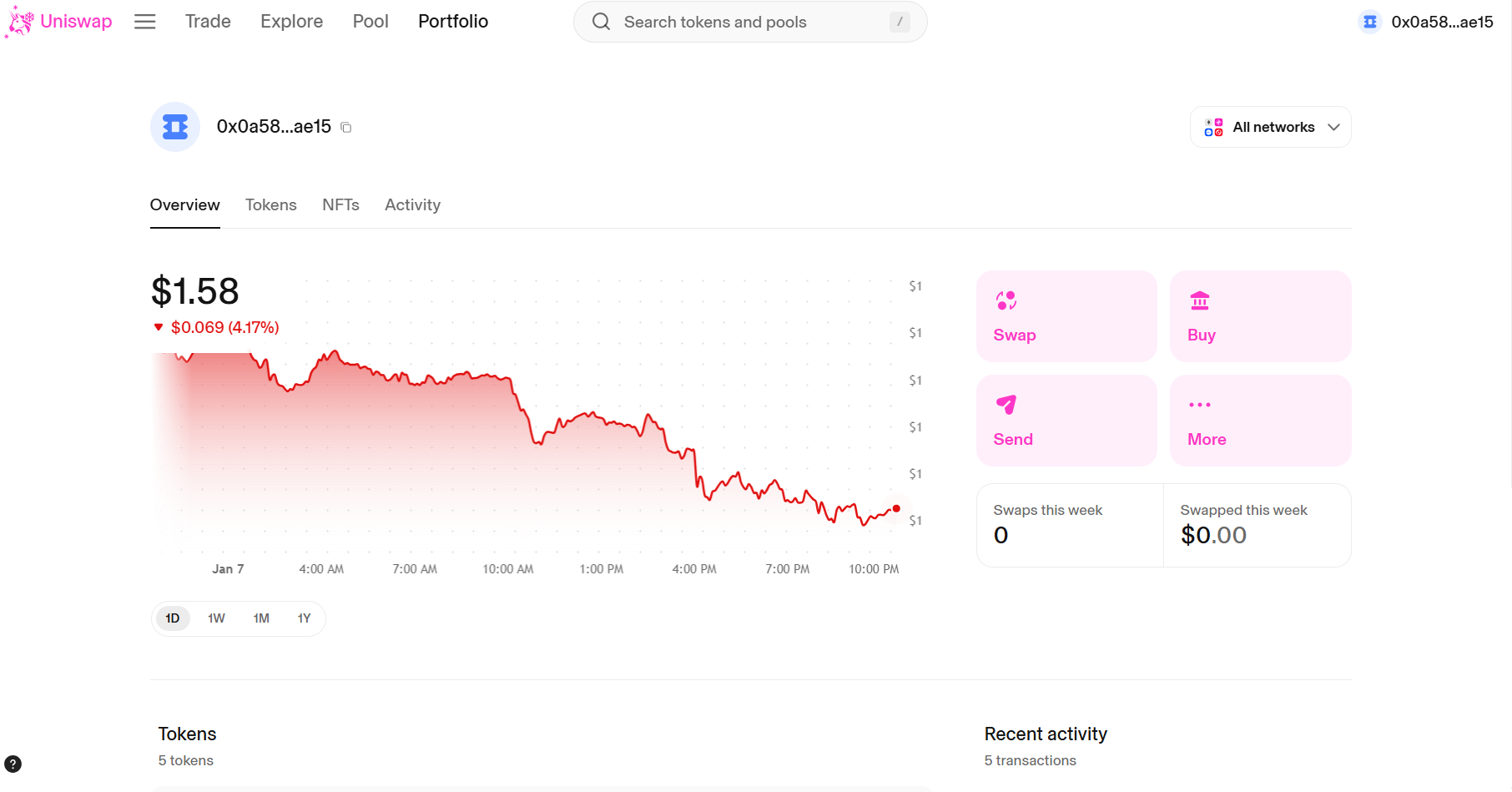

3. Track Your On-chain Portfolio

The portfolio feature on Uniswap provides a comprehensive overview of your wallet holdings and on-chain activity. You can track and manage your portfolio across multiple networks and leverage the provided data for your trading and investment strategy.

How does Uniswap Exchange Work?

Uniswap exchange is built to securely execute spot trades on the blockchain without keeping custody of the traders’ asset or their wallet keys. Every transaction is approved by the trader.

Here are the core systems that enable the Uniswap protocol to achieve this;

1. AMM DEX

Uniswap is an AMM DEX, the Automated Market Maker (AMM) is the protocol’s central trading engine. It executes users’ trade requests using resources in the liquidity pool. The liquidity pool is a smart contract that holds tokens in the trading pair.

After each trade, the AMM updates the price of each token in the pair using demand and supply data and decentralized oracles where required.

2. Concentrated Liquidity (Uniswap V3)

Uniswap implemented the Concentrated Liquidity feature in the third major protocol (V3). With the Concentrated liquidity feature, liquidity providers allocate the liquidity they provide to specific price ranges.

The allocated liquidity will only be available to the AMM or earn trading fees when the token trades at this price. Concentrated liquidity is designed to boost resource efficiency by enabling liquidity providers to channel resources to price levels where trading occurs most. This offers better passive income to LPs and lower slippage to traders.

3. UNI Token

UNI is the native token of the UNI protocol. It is used to govern the protocol through the Uniswap DAO. UNI holders vote on improvement proposals to decide the project’s direction.

Who is Uniswap Exchange Best Suited For?

Uniswap is best suited for beginners and anyone looking to quickly swap an asset ERC20 standard token for another. Liquidity on Uniswap is also relatively higher than most other decentralized swap protocols; therefore, it is also suited for high-volume swaps for popular pairs.

However, even with the limit order feature, the platform is not suited to traders who wish to leverage a full CEX-style trading interface and features.

Is it Safe to Use the Uniswap Platform?

Uniswap has a plausible security history; it hasn’t suffered any direct hacks since. It is considerably safe to use. However, indirect hacks may also affect users. Ensure to disconnect from the platform and revoke any approvals after use.

Is Uniswap Exchange Legitimate?

Yes, Uniswap is a legitimate crypto trading platform. It does not hold any operational license, as this is not required for a platform of its type.

What are the Factors to Consider before Using Uniswap?

Here are a few things to consider before trading on Uniswap

1. Liquidity

Liquidity on Uniswap may be lower than on Centralized exchanges. Check the liquidity and slippage on Uniswap (for the asset you wish to trade), and compare with CEX alternatives before swapping on the platform.

2. Trading Fees

Trading fees on Uniswap may be as high as 0.3% of the traded volume. This is significant, even for low-volume trades. Compared to centralized exchanges like Binance and Bybit, Uniswap is not exactly cost-efficient. You may consider this before trading on the platform.

3. The Asset You Wish to Trade

Uniswap supports ERC-20 standard tokens on networks where it is deployed. This limits its scope of market coverage. As a result, some tokens you wish to trade may not be available on the platform or have little liquidity. Verify these before connecting to the protocol.

4. Key Factors

Key Factors

Details

Trading Fees

V2: 0.3% flat trading fee

V3: 0.01% (on low volatility pair), 0.05%, 0.30% (standard), 1% (high volatility/exotic pairs).

Supported Assets

Supports any ERC20 token

Audited By

Spearbit, Certora, ChainSecurity, Spearbit, and Consensys Diligence.

Backed By

Andreessen Horowitz (a16z), Paradigm, Variant, SV Angel, Polychain Capital, and others

What is the Opinion of Crypto Community Members on Uniswap?

UNI’s latest fee switch proposal significantly improved the platform’s reputation, even though it is already an industry favorite. Most opinions about Uniswap are positive; however, a few posts on platforms like Reddit and X share some user dissatisfaction.

For instance, some Reddit discussions highlight concerns regarding transaction costs, while dialogue on X post explores the Foundation’s approach to protocol fee management. Much of the community conversation centers on navigating gas fees, the presence of unverified tokens, managing impermanent loss, and addressing failed transactions or liquidity-related price impact.

How Can I Start Trading on Uniswap Exchange?

To trade crypto on Uniswap Exchange

1. Visit the Uniswap Exchange platform, click Connect wallet on the interface, and follow the prompt to connect your wallet to the platform.

Depending on your wallet application, you may need to switch to the blockchain network where the tokens you want to trade are located.

2. Select the assets you wish to trade and a desired amount

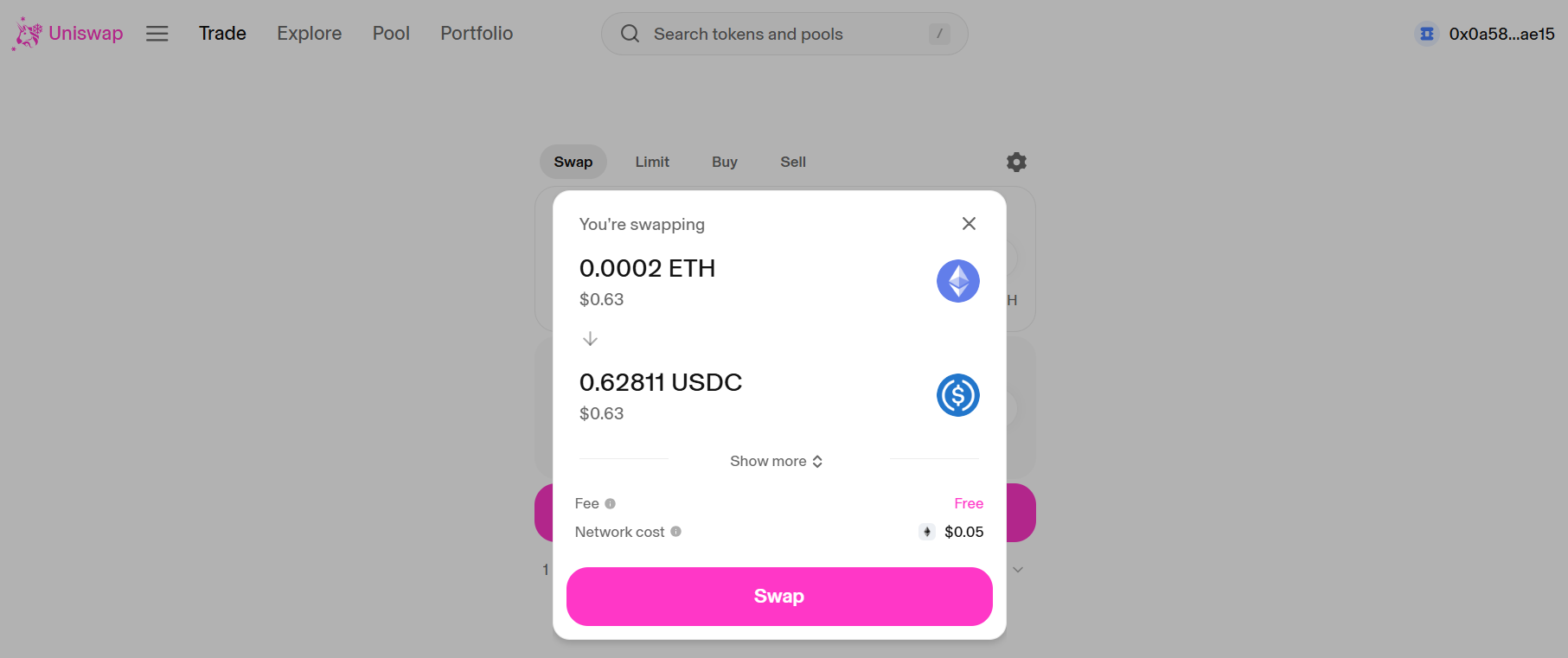

3. Click Review to proceed

4. Check the details of your trade.

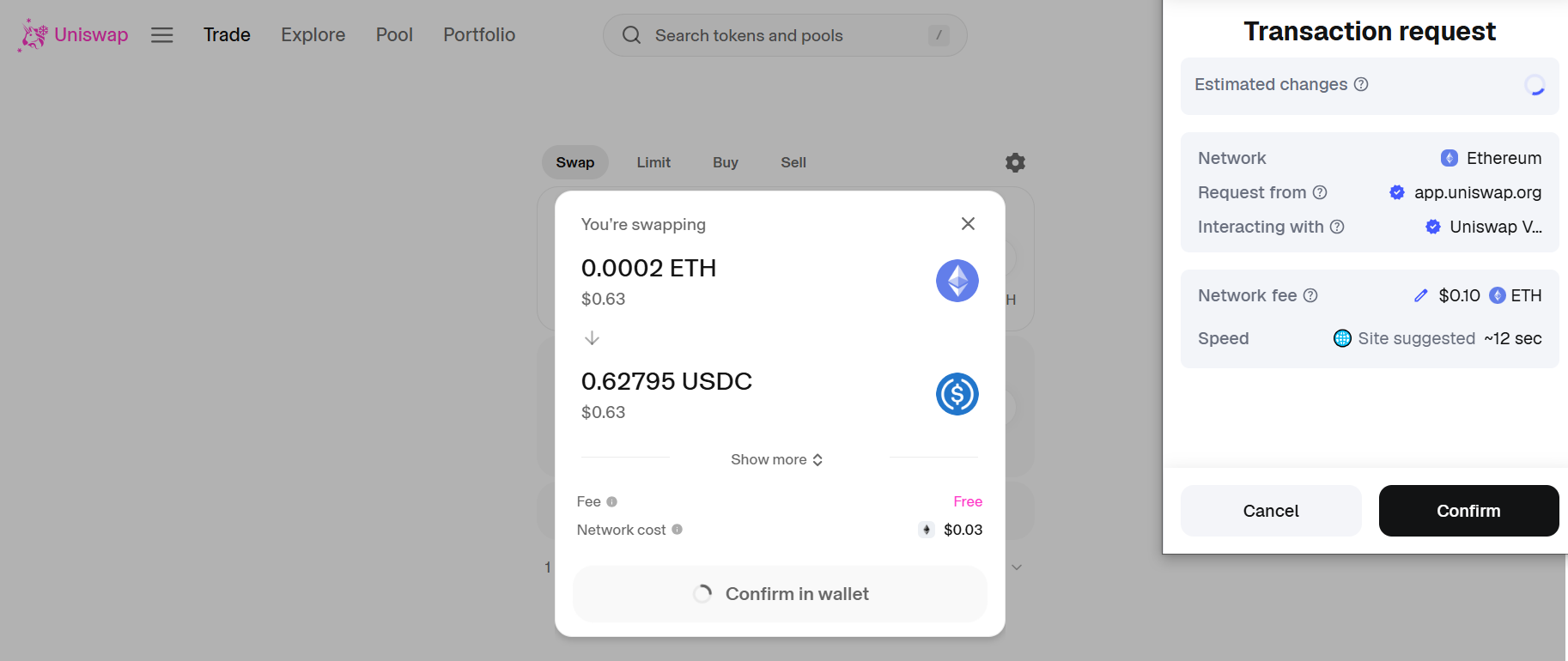

5. Click Swap to continue

6. Approve the transaction on your wallet to complete

The asset you purchased will arrive in your wallet when the transaction is confirmed on the blockchain.

Author Review Verdict on Uniswap Exchange

User interface: The Uniswap interface is intuitive. A simple interface and comprehensive text prompts make it easy to use for beginners and first-time users. Navigations are smooth and overall appealing.

User experience: We used the key features on Uniswap and found no significant UX issues. Swaps and liquidity provision went smoothly. The portfolio feature is also handy and provides accurate and precise data.

Security: Uniswap Exchange has not recorded any direct hack or data breach since it launched. The protocol has been audited by multiple independent and contracted audit firms. Uniswap Exchange has a high-level security standard.

Conclusion

Uniswap allows anyone to trade crypto without creating an exchange account or giving up custody of their assets. As investors increasingly pivot to self-custody alternatives, its relevance grows, and this is evident in the millions of investors who trade crypto on the platform.

Uniswap literally “cuts through the noise”; anyone can trade or list any ERC20 token on the exchange without paying any fee. Like the blockchain itself and other proper DeFi applications, it returns financial sovereignty to users via a platform that is devoid of administrative control.

Having said this, we recommend a basic understanding of DeFi operations before using Uniswap. Unlike centralized exchanges, assets lost due to erroneous transactions on Uniswap may be unrecoverable.

Disclaimer: This article is an independent review of the Uniswap exchange. It only educates readers and does not offer financial advice. Featured projects are not endorsed. Note that crypto investments carry significant risks.