Join Our Telegram channel to stay up to date on breaking news coverage

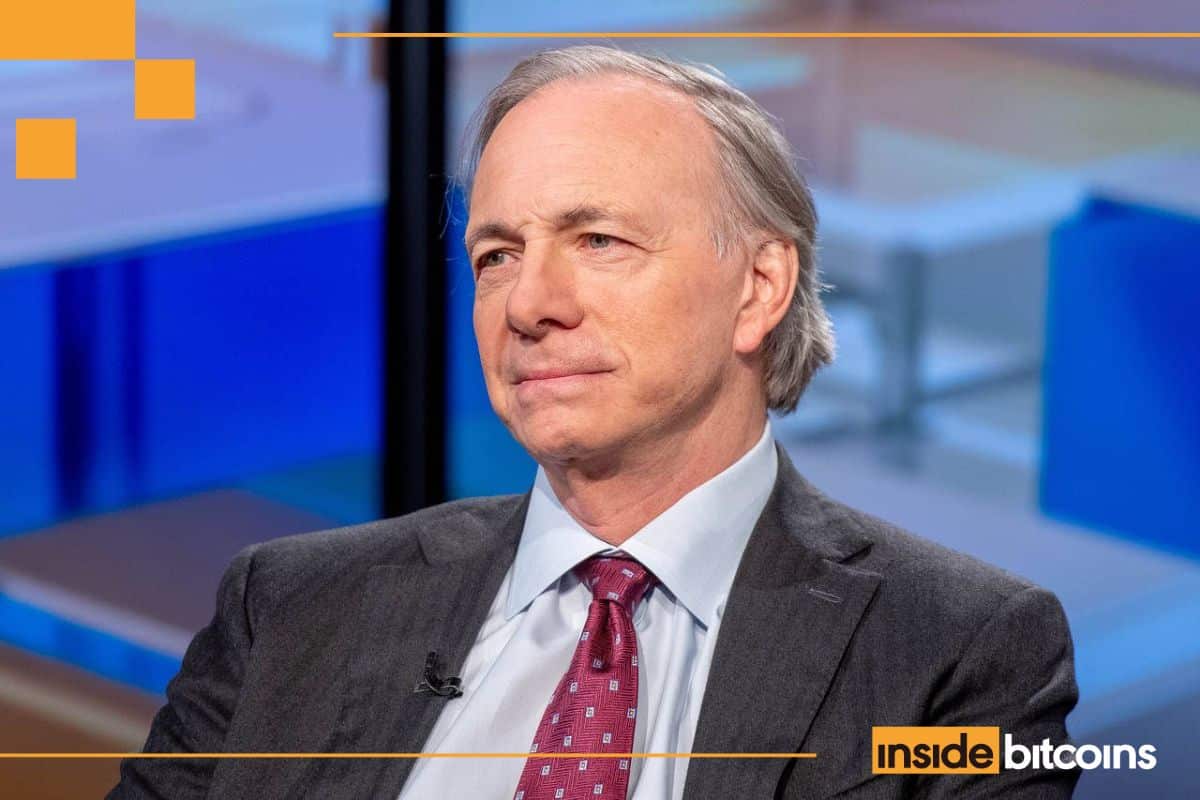

Ray Dalio warned that the US could face a debt-induced “heart-attack” within three years as soaring debt weakens the dollar, and called crypto an “attractive alternative currency.”

He compared the US’s financial condition to the cumulative toll of years of excesses, like overeating fatty foods and smoking for a lifetime.

“The great excesses projected under the new budget will probably trigger a debt-induced heart-attack in the relatively near future — I’d say three years, give or take a year or two,’’ the billionaire investor and Bridgewater Associates founder said in an interview with the Financial Times, later shared on X.

“Crypto is now an alternative currency that has its supply limited,” Dalio said. “So, all things being equal, if the supply of dollar money rises and/or the demand for it falls, that would likely make crypto an attractive alternative currency.”

He added that most fiat currencies, especially those with large debts, will have problems being effective storeholds of wealth and will go down in value relative to hard currencies, noting that similar situations occurred between 1930 and 1940, and again between 1970 and 1980.

Crypto Deregulation Not The Real Threat To The Dollar’s Reserve Status

Dalio said that deregulation of crypto in the US under Donald Trump is not a threat to the greenback’s status as a reserve currency.

The real risk to reserve currency governments’ is their spiralling debt, which diminishes their appeal as a reserve currency and pushes investors to alternative options, which is a key reason gold and crypto prices have soared, he said.

Gold recently reached a new all-time high (ATH) above $3,508 per ounce.

Monthly chart for the gold price (Source: TradingView)

Meanwhile, crypto market leaders Bitcoin (BTC) and Ethereum (ETH) also both recently achieved new record peaks. BTC achieved its new ATH of $124,457.12 on Aug. 14, while ETH reached a new high at $4,953.73 on Aug. 24.

The exposure that stablecoins have to US Treasuries also doesn’t pose a systemic risk, he said, but a fall in the purchasing power of Treasuries is ”a real risk.”

US National Debt Spirals

While gold, BTC and ETH all hit fresh ATHs this year, the US national debt continues to soar and also recently reached record levels.

In August, the US national debt topped $37 trillion for the first time. According to data from usdebtclock.org, the national debt has since continued to rise and stands at more than $37.31 trillion as of 5:11 a.m. EST.

Dalio said during the interview that the “worsened condition is due to years of excesses.” He added that the new budget will likely lead to “a debt-induced heart-attack” for the financial system, estimating that it will happen in about three years “give or take a year or two.”

“If the debt and debt service expenditures grow faster than the incomes, they build up like plaque that squeezes out other spending,” he said.

He went on to say that it’s easy to see that happening soon, noting that the US government’s debt service payments are now around $1 trillion a year in interest and “are increasing at a fast rate.”

It’s not just the US, global bonds are also under renewed pressure due to inflation concerns and governments’ large fiscal deficits.

While US 30-year Treasuries are nearing 5%, UK 30-year bonds have soared to their highest levels since 1998. Meanwhile, Japan’s 20-year bonds have also surged to their highest levels this century, and Australian 10-year yields have reached their highest levels since July.

Wrong.

Treasury yields are surging in the US today with the 30Y Note Yield back at 5%.

These are the same levels seen in 2008, amidst the biggest financial crisis in US history.

Interest rates are literally rising as the market prepares for rate cuts to begin. pic.twitter.com/XoYm9k2U6I

— The Kobeissi Letter (@KobeissiLetter) September 2, 2025

The increasing bond supply is correlated to an uptick in government borrowing, signaling that those governments are spending more money than they collect in taxes. To cover this gap between tax income and spending, governments issue bonds, but investors are now demanding higher yields to absorb all of the additional debt.

Related Articles:

Best Wallet – Diversify Your Crypto Portfolio

Easy to Use, Feature-Driven Crypto Wallet

Get Early Access to Upcoming Token ICOs

Multi-Chain, Multi-Wallet, Non-Custodial

Now On App Store, Google Play

Stake To Earn Native Token $BEST

250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage