Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

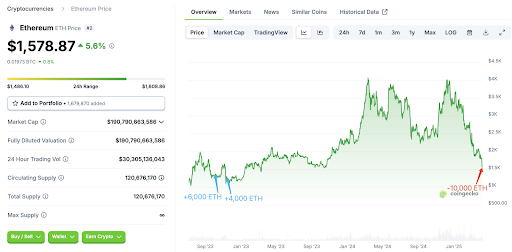

An Ethereum whale has dumped its ETH holdings after holding them for over two years, even through a bull market. This capitulation from the ETH whale suggests it might be a good time to offload the leading altcoin, with a further crash in the coming weeks a possibility.

Ethereum Whale Dumps 10,000 ETH After 900 Days

In an X post, on-chain analytics platform Lookonchain revealed that an Ethereum whale finally capitulated after holding for over 900 days, selling all their 10,000 ETH for $15.71 million. This whale had originally bought 10,000 ETH for $12.95 million at an average price of $1,295 on October 4 and November 14, 2022.

Related Reading

The Ethereum whale didn’t sell any of their ETH holdings, even when the leading altcoin broke through $4,000 twice in 2024. However, the whale has now capitulated with the Ethereum price below $1,500, nearing their average entry price of $1,295. The investor sold the coins for a $2.75 million profit, while their unrealized profit was $27.6 million at its peak.

This Ethereum whale isn’t the only one who is capitulating. As Bitcoinist reported, ETH whales have dumped over 500,000 coins in the space of 48 hours. This development is thanks to Ethereum’s massive crash, with the leading altcoin at risk of dropping lower. This decline is part of a broader crypto market crash, which has occurred due to Donald Trump’s tariffs.

Trump’s tariffs have led to a major trade war with China, which has promised not to back down, further sparking concerns among investors. As such, the Ethereum price looks more likely to suffer a further crash in the meantime, which explains why these Ethereum whales are capitulating to cut their losses.

Donald Trump’s World Liberty Financial Also Capitulating?

Donald Trump’s World Liberty Financial (WLFI), an Ethereum whale, looks to be feeling the heat and might have already started capitulating. Citing Arkham Intelligence’s data, Lookonchain revealed that a wallet possibly linked to WLFI sold 5,471 ETH for $8.01 million at the price of $1,465, representing a loss for the whale in question.

Related Reading

World Liberty Financial had previously bought 67,498 ETH for $210 million at an average price of $3,259. The crypto firm is now sitting on an unrealized loss of $125 million, seeing as the Ethereum price has declined by over 50% since their purchases.

Crypto analyst Ali Martinez predicts that the Ethereum price will crash further in the short term, indicating that Ethereum whales like WLFI could witness more unrealized loss on their ETH holdings. Martinez stated that $1,200 could be where the leading altcoin finds its footing.

At the time of writing, the Ethereum price is trading at around $1,400, down over 8% in the last 24 hours, according to data from CoinMarketCap.

Featured image from Unsplash, chart from Tradingview.com