Wall Street’s rare-metal rumour mill began on a freezing January morning at Zurich Airport, where cargo handlers wrestled two-ton pallets of 99.5% pure gold onto a chartered 747 bound for New York.

Their destination was a COMEX vault in the city, where warehouse rules hinge not on purity but bar dimensions. The gold came from London vaults, cast in 400-ounce formats that satisfied one market’s conventions but failed another’s.

Before it could settle futures contracts in the U.S., the metal had to pass through Swiss furnaces, where it was liquefied and reshaped into 100-ounce or kilobar form.

Each freshly poured block triggered a new customs declaration on arrival, flagged under HS code 7115900530, “finished metal shapes of gold.” There was no change in ownership, no added value, just reformatting in motion.

However, customs recorded the full market value each time. Gold poured from London to Zurich, then from Zurich to JFK, accumulating dollar signs at every checkpoint. Meanwhile, traders chased the price wedge as COMEX futures stood $40 to $50 above London spot, enough spread to cover refinery costs and freight and still lock in tidy returns.

Within weeks, those shipments, refined in Switzerland from London’s smaller “good-delivery” bars into the chunky 100-ounce format, swelled to a jaw-dropping $29 billion a month, a scale the Atlanta Fed’s economists quietly admit they had never seen in three and a half decades of trade data.

“The US gold market has been trading at a premium to the London market since the election result in late 2024,” the London Bullion Market Association told Reuters, noting a more-than-$50 futures premium that pulled bullion across the Atlantic like a monetary magnet.

That premium, fuelled by traders front-running President Trump’s mooted tariff barrage, created a juicy futures-versus-spot arbitrage. Traders could buy cheaper London metal, pay Swiss refiners to recast it, and still pocket profits once the bars were eligible for COMEX delivery.

However, once the White House formally exempted precious metals on 3 April, the Comex–London premium collapsed to $20/oz, and the incentive to keep air-freighting bullion vanished.

Atlanta, meanwhile, endured its own vibe shift.

The Fed district’s vaunted GDPNow “now-cast” model, updated only hours after every data release, suddenly skidded from modest-growth territory to a recession-screaming -3.1% in late February.

Barron’s later called the plunge “a red flag” and reported that GDPNow’s standard run briefly printed -3.7%, then ticked up to around -2.8%, far below rival nowcasts and consensus economists.

Let me put this delicately: the model was duped by the bullion bonanza.

However, Atlanta has missed the mechanical glitch. Gold bars are classified by the Bureau of Economic Analysis (BEA) as “non-monetary gold.” Purchases count as imports, which are subtracted from GDP, even though the metal often sits inert in vaults rather than coursing through factories.

The January–February spike left gross imports $22 billion above the Q4 average. Annualised, that gap tops $265 billion. The Fed’s Pat Higgins wrote that this was enough to hit the GDPNow print by 3.6 percentage points.

On 6 March, the Atlanta team bolted a “gold-adjustment” onto the codebase, literally yanking bullion flows out of the net-exports equation. “The model is forecasting smaller, but still slightly negative, first-quarter real GDP growth,” Higgins explained in an internal blog post as he promised to replace the old version on 30 April.

In one stroke, GDPNow lurched from doom-laden 2-ish prints to a far tamer 0.1 percent, a 250-basis-point facelift with the click of a Git commit.

The first estimate for Q1 GDP eventually came out at 0.3% and was later revised to 0.2%. GDPNow’s forecast for Q2 now sits at a much healthier 2% using the new gold-adjusted model.

But why so much metal, so suddenly?

Swiss customs tallied 192.9 tonnes heading west in January alone, thirteen-year highs, after traders feared that a White House “reciprocal tariff” might entangle precious metals despite later carve-outs. Stories of London vault liquidity tightening, together with the COMEX premium, turbo-charged the flow. The LBMA insists stocks remain “strong”, yet market participants whisper about thin spot liquidity, forcing spreads wider and tempting more arbitrage.

The BEA itself was not fooled, as the official advance estimate showed that Q1 GDP fell only 0.3%, which is hardly catastrophic because statisticians have already stripped “valuables” like gold and silver from domestic investment.

Imports still clobbered growth, subtracting almost five full percentage points, but that drag was partly optical, a ledger quirk rather than a real-economy crash. Higgins conceded that inventory data is patchy for the farm and utilities sectors, so the first print could be revised once those beans are counted.

What matters for Bitcoiners?

Absurdity is a word.

In 2025, a trillion-dollar economy’s growth estimate was nearly wrecked by the physical reshaping of hunks of metal, because one country prefers 400-ounce gold bars while another insists on 100-ounce blocks.

Entire pallets of bullion had to be flown from London to Switzerland, melted down, recast to spec, and re-exported to the U.S., not to make jewelry or electronics, but simply to satisfy warehouse eligibility rules for COMEX delivery. All to arbitrage a $50 pricing wedge that existed, largely, because someone floated a new tariff draft. It’s like discovering that GDP turned negative because the shipping containers were the wrong shape.

Compared to Bitcoin, a digital bearer asset with no weight, no borders, and no refinery bottlenecks, this is kinda of embarrassing.

BTC can be transmitted globally in ten minutes or less, 24/7, with final settlement guaranteed. No customs declarations, no harmonised system codes, no “balance-of-payments” reclassifications.

You can’t tariff Bitcoin. You can tariff gold imports.

You don’t need to melt anything to fit it into a specific vault; you just need a valid script and a miner willing to confirm the block. It’s almost comical that while one monetary asset requires furnaces and cargo planes to move between markets, the other crosses continents with a QR code.

Looking forward, the same trade-war jitters that drove bullion stateside remain unresolved, and Higgins warns the absence of another gold wave could whipsaw Q2 nowcasts in the opposite direction.

Should bullion flows normalise, GDPNow might overstate growth as imports retreat (which is interesting given that GDPNow currently stands at 2%). Conversely, a fresh premium could again punch the model below the waterline.

Either way, the Atlanta Fed’s willingness to hot-patch its algorithm highlights a larger lesson: data science is only as good as the metadata you feed it.

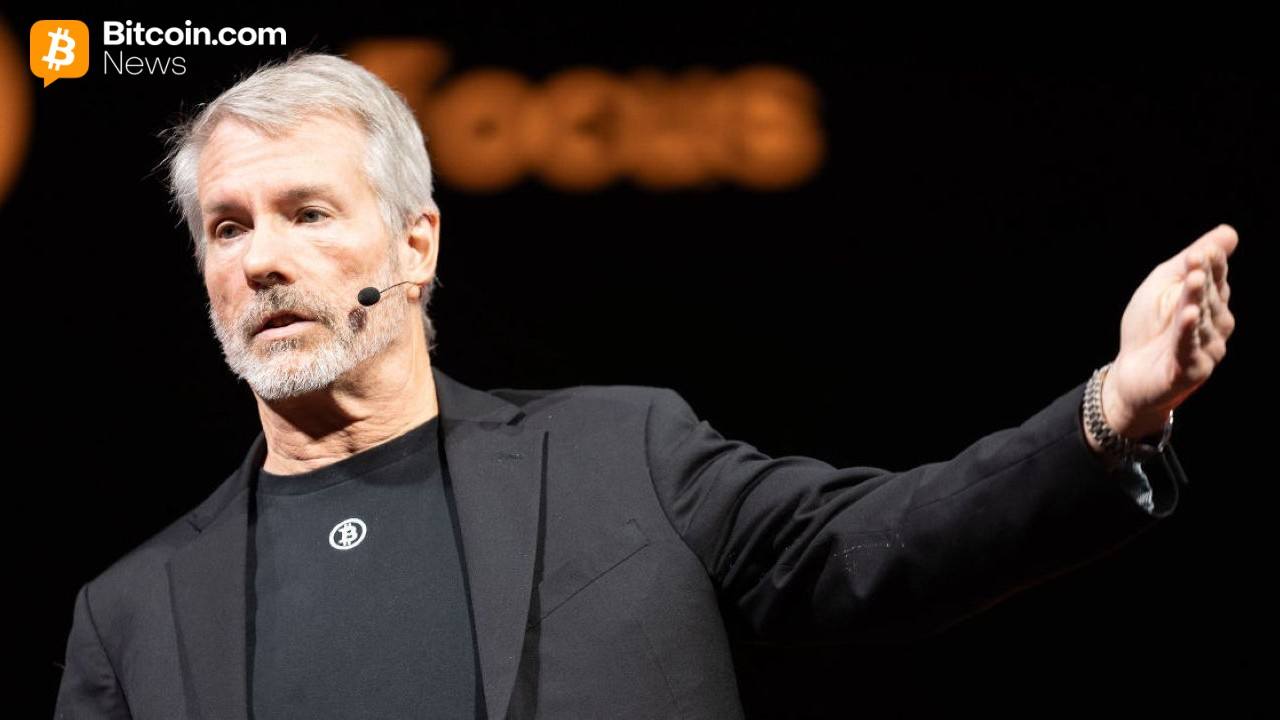

Mentioned in this article