The US economy is starting 2026 with an uncomfortable split-screen scenario that is complicating the outlook for Bitcoin’s recovery towards $100,000.

While Wall Street credit pricing still looks calm, the “real economy” stress gauges are flashing late-cycle warning lights.

This disconnect matters for Bitcoin because its path to $100,000 is no longer just about crypto-native catalysts. It is increasingly about whether the next macro downdraft forces a liquidation phase that consumes the calendar year.

So, investors hoping for a straight line to six figures are facing a formidable obstacle: a consumer and corporate credit squeeze that threatens to drain liquidity from risk assets before the Federal Reserve can pivot to a rescue.

The consumer debt wall

The clearest red flag facing the market is the deteriorating state of the American consumer.

The New York Fed’s latest Household Debt and Credit report paints a grim picture of a populace leveraging up to maintain living standards. Total household debt rose to $18.8 trillion in the fourth quarter of 2025.

This represents an increase of $191 billion in a single quarter, leaving aggregate balances about $4.6 trillion above the pre-pandemic level.

The sheer volume of debt is concerning, but the quality of that debt is where the real alarm bells are ringing.

The report shows that 12.7% of credit-card balances were 90 or more days delinquent in the fourth quarter of 2025.

This marks a stark return to the elevated stress levels seen in the early 2010s, suggesting that the post-pandemic savings buffer has been fully eroded for a significant portion of the population.

When drilling down into the demographics, the signal becomes even harder to ignore.

In New York Fed charts tracking transitions into serious delinquency (defined as 90 or more days late) for credit cards, younger cohorts are performing notably worse than older ones.

The 18–29 and 30–39 age groups are running materially higher delinquency rates than households aged 40 and above.

This is not just a sobering credit statistic. It serves as a forward indicator for discretionary spending and employment sensitivity.

Younger borrowers are more exposed to rent inflation, rely on revolving credit to bridge gaps, and experience higher income volatility.

These are the exact demographics that drive retail crypto adoption, and their financial distress could accelerate a market downturn as layoffs spread.

Corporate distress accelerating

While households are feeling the pinch, corporate distress is also rising.

Official bankruptcy filings in the US rose 11% in the 12-month period ending December 31, 2025, according to data from the Administrative Office of the US Courts.

However, the more market-moving development is the accelerating pace of large corporate cases.

Bloomberg has reported that at least six major companies sought court protection each week over a three-week period beginning Jan. 10.

This represents an intensity of corporate failure not seen since the early pandemic months, suggesting that the “higher for longer” rate environment is finally breaking zombie companies that survived on cheap capital.

Distressed-market commentary has highlighted even more alarming figures. Some observers have noted that 18 companies with liabilities exceeding $50 million filed for bankruptcy over a three-week period.

While this tally is best treated as an unofficial tracker metric rather than a standardized government series, it aligns with the broader trend of deteriorating corporate health.

The liquidity trap

In light of these events, the question for crypto investors is why these traditional finance problems would stop Bitcoin from tagging $100,000 in 2026.

The answer lies in the mechanics of a crisis. The “deepening crisis” phase typically first hits Bitcoin in the least flattering way: as a high-beta liquidity asset.

When credit tightens and defaults rise, investors usually prioritize cash. They shorten duration and sell liquid, volatile positions to cover margin calls or build defensive buffers.

For crypto, that liquidation impulse now runs through a very specific, highly reactive funnel: Exchange-Traded Funds (ETFs) and other institutional products.

This dynamic is already visible in fund flows. Spot Bitcoin ETFs have seen net outflows of more than $600 million within the last two days alone, according to SoSo Value data.

Meanwhile, the selling pressure is not limited to a few days, as the 12 Bitcoin ETF products have recorded only two weeks of net inflows since the beginning of this year.

In a benign macro backdrop, that kind of persistent outflow can still be absorbed by the market.

However, that kind of consistent selling could become reflexive in a deteriorating macro backdrop.

In this case, redemptions pressure the price, price weakness triggers further de-risking models, and volatility itself becomes a reason for risk managers to reduce exposure further.

Policy paralysis

Meanwhile, Bitcoin bulls counter that crises eventually attract policy support, and the flagship digital asset has historically responded explosively when liquidity conditions turn favorable.

However, the timing for 2026 is complicated by the Federal Reserve not yet being in “panic mode.”

The central bank held the policy rate at a range of 3.5%–3.75% at its January meeting. While this is lower than the peak rates of previous years, it remains restrictive enough to pressure borrowers.

At the same time, the New York Fed has been conducting “reserve management” purchases. They are buying about $40 billion per month in Treasury bills and short-dated government bonds through mid-April.

These purchases are explicitly framed as technical operations rather than crisis-era quantitative easing.

If financial stress worsens materially, that technical line can blur quickly in markets’ minds. Still, the key for Bitcoin is timing.

The market often sells first and only rallies later when easing is unmistakable. If the Fed waits for credit spreads to blow out before cutting aggressively, Bitcoin could suffer a significant drawdown before the liquidity rescue arrives.

Downside targets and revised expectations

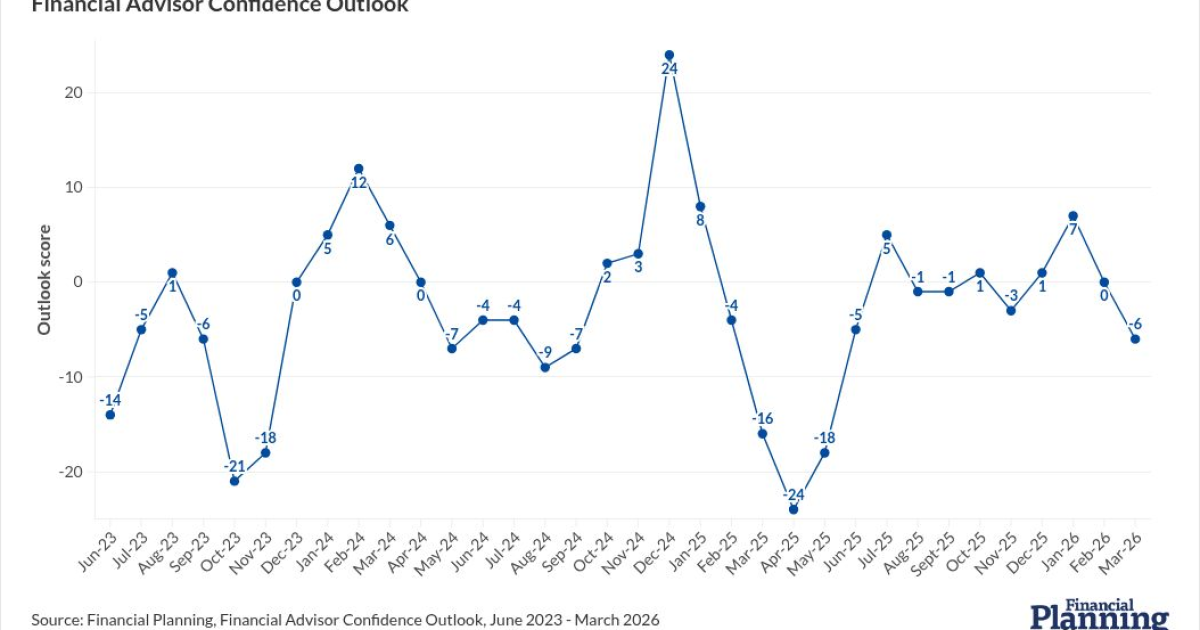

That timing risk is exactly why some major bank analysts are urging caution.

Standard Chartered’s Geoff Kendrick has warned that crypto could see “one final wave” of selling pressure first. He flagged downside risks toward $50,000 for BTC, while arguing that this level represents “buy zones” for a later recovery.

Notably, data from CryptoQuant indicate that Bitcoin’s ultimate bear-market bottom is around $55,000.

Meanwhile, Kendrick also cut his end-of-year BTC target to $100,000 (down from $150,000).

According to him, the message is not “perma-bearish,” but rather a recognition that the path to higher prices likely runs through a significant drawdown first.

Essentially, the narrative that BTC could reach $100,000 this year is weakened by a deepening US financial squeeze that is compressing the runway.

If Bitcoin spends the next few months digesting a macro-driven deleveraging phase, then the “reflation rally” window shifts later into 2026.

In this case, hitting $100,000 becomes less about whether BTC can rally and more about whether there is enough time left in the year to do so after the washout.

Three paths for Bitcoin’s $100,000 question

A clean way to frame the year ahead is a three-case scenario model that keeps the focus on timing.

ScenarioMacro setupFlow and positioning signalTypical BTC pathWhat it implies for $100,000 in 2026Base case (soft landing, messy credit)Delinquencies rise, but do not cascade into a jobs shock, corporate stress stays containedETF outflows stabilize after recent net negatives (ETF daily prints of -$276.3M on Feb. 11 and -$410.2M on Feb. 12 are not repeated)Wide range trading with sharper rallies and pullbacksLate-year coin flip rather than a base expectationHard landing (defaults → jobs → spreads)Corporate failures and consumer strain feed into unemployment, spreads widen from ~2.84%Forced selling dominates, CoinShares-style outflows remain heavy (recently $1.7B weekly)Downside first, BTC can plausibly test $50,000Unlikely to hit $100,000 in-calendar-year because the washout consumes timeFast pivot (stress forces easing)Data deteriorates quickly enough to trigger faster cuts from 3.5%–3.75% and more visible liquidity supportOutflows slow materially and then flip, ETF wrapper turns from a drag into support“Dump first, then rip,” often requires a capitulation lowPossible, but still timing-dependent, a rally may arrive later after a low is set

The base case is a soft landing with messy credit in which delinquencies rise but do not cascade into a jobs shock.

Here, corporate distress remains meaningful but contained and ETF flows stabilize after a period of outflows.

In that world, Bitcoin can trade in a wide range, and $100,000 becomes a late-year coin flip rather than a base expectation. The upside is possible, but it depends on the market regaining confidence before the calendar runs out.

The “hard landing” scenario involves corporate failures and consumer strain feeding into unemployment. Spreads would widen, and forced selling would dominate.

In that case, Bitcoin can plausibly reach the downside zone Kendrick flagged before any durable rally begins. A later recovery may still occur, but $100,000 in calendar year looks unlikely because the washout phase consumes the period when momentum would normally build.

The third scenario is a “fast pivot,” where data deteriorates quickly enough to trigger faster cuts and more visible liquidity support. That can produce a 2020-style sequence of a dump first, followed by a rip, but it still may require a capitulation low before the upside.

The bottom line is that macro stress can cut both ways. It can eventually justify easier policy and better liquidity conditions, which have historically supported Bitcoin.

However, that same stress can prevent Bitcoin from reaching $100,000 on schedule, as the first phase of a deepening squeeze is often the least favorable for crypto.

Unless policy support arrives early enough, and ETF flows flip back to sustained inflows, the path of least resistance in early 2026 looks more like downside and turbulence first.

So, a $100,000 print becomes less about whether Bitcoin can rally, and more about whether the market gets through the washout fast enough for the rally to fit inside the year.