Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

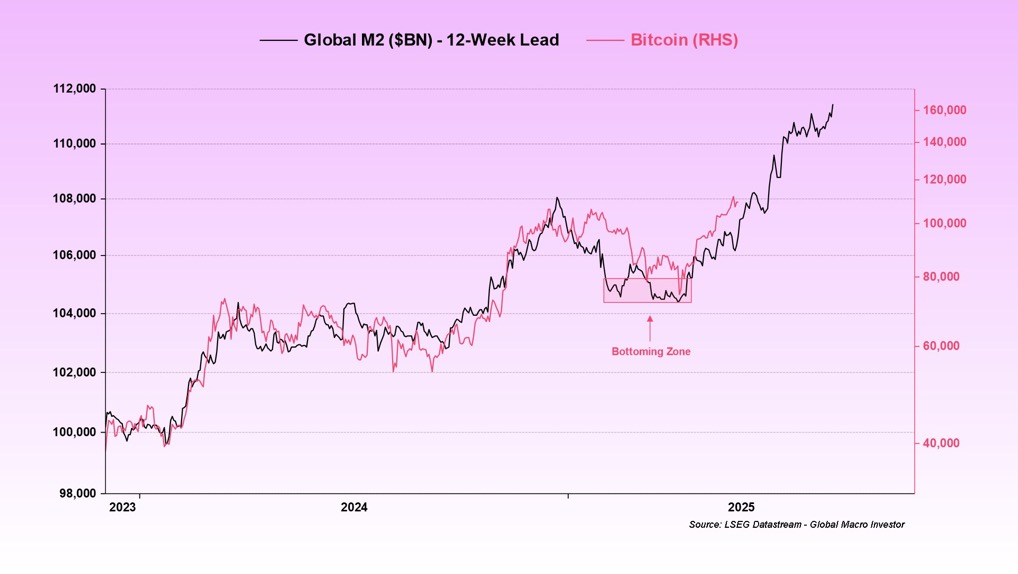

Bill Barhydt, the founder and chief executive of crypto-banking platform Abra, set Crypto-X alight over the weekend by reposting a collage of global M2-versus-Bitcoin charts first popularised by macro investor Raoul Pal and researcher Julien Bittel. “I’ve seen over a dozen posts with different versions of the global liquidity M2 vs Bitcoin price chart – I’ve attached several here. Credit @RaoulGMI and his colleague @BittelJulien for discovering the trend,” he wrote.

“Most of these charts predict a dip over the coming days to around $100 k and then a move to new ATH of $130 k in August/September … Or this could all be horseshit. Whatever.”

Will Bitcoin Follow M2?

Expanding on the macro backdrop, Barhydt argued that “global liquidity needs to rise significantly in the coming months. Bitcoin remains the mother of all liquidity (re: debasement) sponges.” He framed the asset’s reflexivity in stark terms: as fiat supply grows, Bitcoin absorbs the monetary excess, and the resulting gains “will most likely spill over into other L1 platforms and then ultimately speculative alts – the proverbial alt season.”

Related Reading

Even so, he cautioned traders against complacency. “Watch your leverage, touch grass and please please be civil,” Barhydt advised, noting that the anticipated pull-back could be a gentle pause or a swift capitulation toward $95,000 before any summer rally materialises.

When a follower fretted that the model might already be overcrowded, Barhydt dismissed the idea that positioning had reached critical mass: “I’ve thought about that but we’re talking about trillions of dollars and billions of people. There might be thousands of people focused on this but not more. Even then retail writ large isn’t focused on crypto right now.”

Related Reading

A second critic complained that the liquidity data “is not collected on a timeframe that would predict daily moves.” Barhydt concurred, replying: “I completely agree. Hence the ‘whatever’ reference. It’s macro directional on a weekly scale at best. But in that regard it’s been a very good tool.”

The liquidity-first thesis still has heavyweight backers. Pal recently told Real Vision subscribers that “liquidity is the single most important driver of all asset prices,” estimating that rising world-money supply accounts for up to 90% of Bitcoin price action, while Bittel’s latest update pegs global M2 near a record $111 trillion – a level he says leaves Bitcoin “still going higher.”

Whether those macro tailwinds propel Bitcoin to the $130,000 target or prove, in Barhydt’s own words, to be “horseshit” will depend on how briskly central banks resume balance-sheet expansion and how aggressively traders deploy leverage in the weeks ahead. For now, Barhydt’s call serves as both roadmap and reality check: the next swing could be explosive, but the model is only as good as the liquidity it tracks.

At press time, BTC traded at $104,625.

Featured image created with DALL.E, chart from TradingView.com