On-chain data shows a humongous amount of old Bitcoin saw revival in 2025. Here’s how the year stacks up against previous ones.

5+ Year Old Bitcoin Revived Supply Broke $52 Billion This Year

As explained by on-chain analyst Checkmate in a new post on X, 2025 has seen a large amount of old tokens come back to life. Coins are considered to be “old” when they are dormant (that is, not involved in any transaction on the blockchain) for at least 5 years.

There are different bands these old tokens can be further divided into. The youngest band is the 5 to 7 years range, containing buyers from the last two BTC cycles who are resolute enough to still not have sold their coins.

The middle band corresponds to an age of 7 to 10 years old. At this range, there is a real chance that coins entering the cohort are doing so by becoming lost, rather than through “HODLing.” Finally, there is the 10+ years band, reflecting the truly ancient BTC supply.

In 2025 so far, the three cohorts have made movements worth (from youngest to oldest): $22.7 billion, $16.2 billion, and $13.3 billion. In total, over $52 billion in old supply broke dormancy this year. Below is the chart shared by Checkmate that shows how previous years compared.

The data for the revived old BTC supply by year | Source: @_Checkmatey_ on X

As is visible in the graph, 2024 was the only year that surpassed this year in terms of total 5+ years old revived supply, although 2025 isn’t over yet so it may well surpass it by the end of December.

Interestingly, an old supply band that 2025 has already overtaken 2024 in this metric is the 10 years+ cohort. This means that this year Bitcoin saw the most amount of ancient supply come alive. The analyst has noted that $9.5 billion of these tokens have come from a single holder with 80,000 BTC.

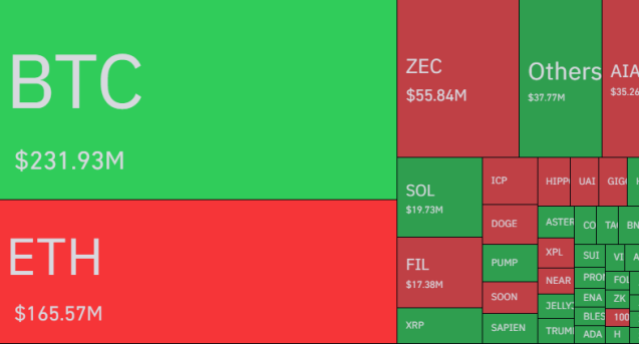

In some other news, a large amount of liquidations have hit the cryptocurrency derivatives market as a result of the volatility that Bitcoin and others have gone through.

As data from CoinGlass shows, $686 million in liquidations have taken place over the last 24 hours.

Looks like liquidations have tended toward long contracts | Source: CoinGlass

Long contracts have outweighed short ones in liquidations in this period, as a result of volatility being to a net downside. More specifically, the bullish flush has amounted to $363 million, while the bearish one to $318 million.

Short liquidations have still been of a significant amount since down isn’t the only way the market has gone. Bitcoin initially fell below $100,000, before recovering back to the current level.

The breakdown of the liquidations by symbol | Source: CoinGlass

In terms of the individual assets, BTC-related contracts contributed the most toward the squeeze with $231 million in liquidations, while Ethereum came second at $165 million.

BTC Price

At the time of writing, Bitcoin is floating around $101,500, down nearly 8% in the last seven days.

The trend in the price of the coin over the last five days | Source: BTCUSDT on TradingView

Featured image from Dall-E, CoinGlass.com, checkonchain.com, chart from TradingView.com

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.