Reports have disclosed that crypto entrepreneur and Tron founder Justin Sun moved a sizable amount of Ethereum into a liquid-staking service this week.

According to on-chain data, about 45,000 ETH — worth roughly $154.5 million at the time — was shifted from the lending protocol Aave into the Lido Finance staking pool.

The transfer was public and traceable on the blockchain. It drew quick attention because of its scale and timing.

Sun’s Public Wallets Grow

The funds had been sitting on Aave before the move. They were then deposited into Lido, which issues staked-ETH tokens that let holders keep a form of liquidity while their ETH is staked.

Based on reports, Sun’s public wallets now show around $534 million in ETH holdings. That figure has reportedly surpassed his holdings in TRON’s native token, TRX, which are estimated near $519 million.

Market watchers say the swap signals a shift in how some big holders are allocating capital.

JUSTIN SUN JUST STAKED OVER $150M OF ETH [ARKHAM INSIGHTS]

Justin Sun just withdrew $154.5M of ETH (45,000 ETH) from AAVE and deposited it to Lido Staking. He currently holds $534M of ETH in his public wallets, even more than he holds in TRX ($519M).

We found this through… pic.twitter.com/rwU3H5uIKu

— Arkham (@arkham) November 5, 2025

Bigger Stakes, Bigger Questions

Analysts reacted fast. Some see the action as a vote of confidence in ETH’s yield options and protocol security. Others raised the point that large sums routed into single liquid-staking providers can add to centralization risks on the network.

Price remains unpredictable. Also, staking carries its own risks — smart contract bugs, validator downtime, and slashing events are possibilities that investors must weigh.

Market Context And Price Action

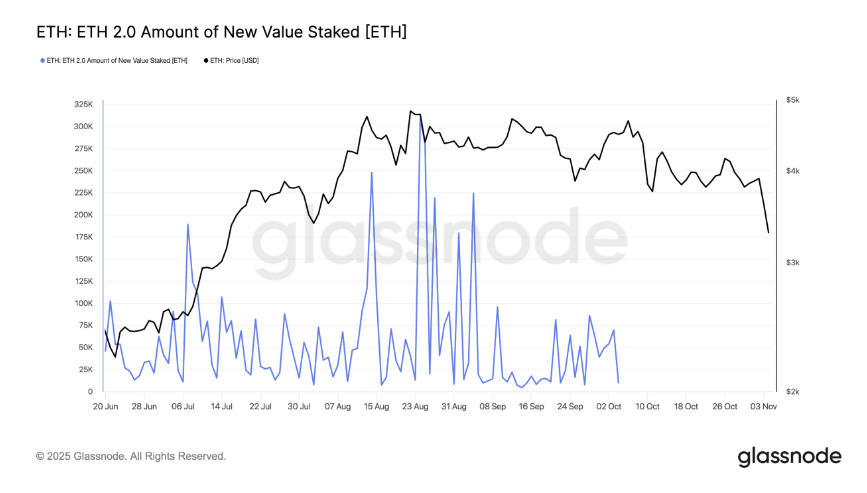

Based on reports, ETH was trading near $3,389 when this movement was noted. The token had slipped about 12% in the previous week, which makes big staking flows more visible because large buys or internal transfers stand out against falling prices.

In the broader crypto landscape, institutional and whale moves into staking have been increasing over the past months.

Lido remains one of the largest liquid-staking providers, and its market share is watched closely by both traders and protocol researchers.

Signals Versus Motive

Actions by the Tron boss Sun could be long-term, aimed at yield, or at a broader portfolio shuffle.

There is something notable in the transfer, but it is only a piece to a bigger picture— including holdings, trading, and trends beyond the broader indirect markets.

Featured image from Unsplash, chart from TradingView