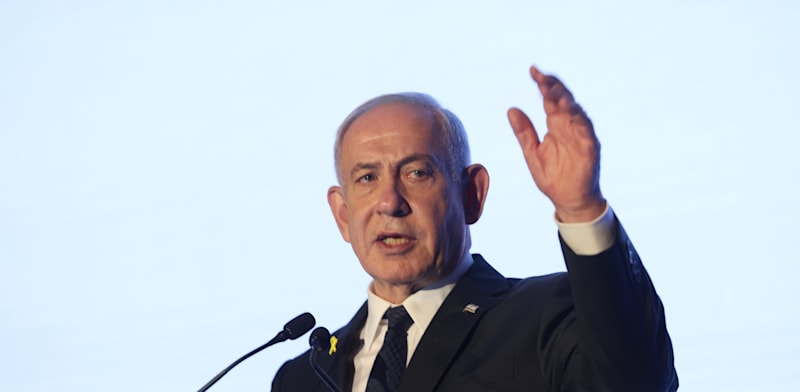

Prime Minister Benjamin Netanyahu’s remarks yesterday, that, because of its diplomatic isolation, Israel would have to “adapt to an economy with characteristics of autarky” and become a “super Sparta” struck many with dismay. Senior economists, including some who have worked closely with Netanyahu, are wondering what to make of such an extraordinary statement.

“A statement like this in the twenty-first century amounts to saying that we’ll go back to the Stone Age,” Prof. Manuel Trajtenberg told “Globes.” “The Israeli economy is very simple,” he says, “We sell brains to the world, and we buy all the rest. Autarky means that you sell Jewish brains to one another, and produce all the rest.

“There is no way that the Israeli economy in its present format can exist if we go in the direction of reducing economic ties with the world. We’re talking about the essence of the Israeli economy,” Trajtenberg says. “The upshot will be not just a dramatic fall in the standard of living, but in our ability to maintain an army, security, and of course all our social services.”

Trajtenberg is a visiting senior researcher at the Institute for National Strategic Studies, of which he was the executive director from 2021 to 2024. He was the first chairperson of the National Economic Council at the Prime Minister’s Office, and he chaired the Committee for Social and Economic Change appointed by Netanyahu following the mass social protests of 2011. “Everyone of us should look around at the things we have in our homes and elsewhere, and think about where they came from, and thanks to what,” he says. “Everything you hold in your hand has a long supply chain behind it. Do you want to cut it off? What will be left for us here?”

“We already know how to conduct an autarkic economy”

Amir Ayal, owner and chairperson of Infinity-Ayalim Investment Group, sees things differently. “’Autarky’ sounds like isolation, but I see in it strength and resilience. The world remains the same world. If we are capable of being independent, we can withstand any situation.”

Ayal says demand from the Israeli economy will be higher than supply. Referring to the fact that the leading indices on the Tel Aviv Stock Exchange switched from gains to losses following Netanyahu’s speech, he says, “Netanyahu didn’t frighten the market, he only reversed the direction of trading. In the past we have seen sharp falls, but not this time. I think that the word ‘autarky’ goes too far. We won’t become an autarkic economy so fast, because we both consume and produce. The Israeli economy exports goods that others won’t stop wanting – water, energy, weapons, technologies, and food technologies.

RELATED ARTICLES

Israel Business Forum slams Netanyahu’s “Sparta speech”

Netanyahu: Amid isolation we must be self-sufficient in arms

Spain cancels 700m Elbit artillery deal – report

“We are already independent in the most important things – water and energy – thanks to desalination and the natural gas. We are capable of being an autarkic economy already in these respects. In food, we both produce and import.”

On the changes happening around the world, Ayal says, “I’m not hurrying to write off the ‘old Europe.’ We have seen the large demonstration in Britain this week. The British won’t give up easily, but in other countries in Western Europe the situation is almost inevitable. In Belgium and Scandinavia it’s almost over.

“Western Europe will never be the same again, whereas Eastern Europe, which prevented Islamist immigration, is drawing closer to us. In arms, if the Spanish for example don’t want our products, let them make do with inferior ones.

“Israel has always had supporters and alliances, because it represents Western civilization in the region. There will always be demand for Israeli weaponry, for Israeli gas, for high-tech and agritech. Don’t write off the industries that Israel has developed. Businesses here can’t keep up with the demand. There’s no need to get anxious about specific cancellations. In investment, we buy when we’re depressed and sell when we’re euphoric. Each person will decide what he wants.”

“The diplomatic isolation isn’t new”

A former senior Ministry of Finance official tries to fathom what made Netanyahu express himself the way he did. “My analysis is psychological,” he says. “Netanyahu is losing control, but he has to appear as though he is still in control. So he talks as though he is consciously planning to turn Israel into an autarkic economy, and not as though the world is pushing us into a corner.”

Profit Finance chief economist and deputy CEO Amir Kahanovich adds a market perspective. “The process of diplomatic isolation that Israel is experiencing is not something new for the markets or for investors, but a process that has continued since October 7. It’s important to notice that this process is not really across the board, and in the main is confined to culture, academic institutions, and the arms trade, which is what Netanyahu was chiefly referring to.”

Kahanovich is not pessimistic about the impact of isolation on other sectors. “In other areas of business we are not seeing a significant institutionalized impact, and it’s not likely that the ‘Sparta’ scenario will manifest itself there,” he says. “Even if we take the extreme case of Turkey’s conduct towards Israel, we are seeing businesses finding loopholes and ways around it, and economic activity continues.

“Certainly as long as the US stands by us, it’s hard to see a scenario of material damage to business, when the US can be bypass route for any deal. It’s therefore reasonable to assume that any decline in the local market or the shekel because of what was said will be corrected when companies’ results speak for themselves. It’s not that Israel is the safest place in the world in which to invest, but for all that it does offer real potential for continued sharp rises when we reach the stage of a settlement. The conclusion again and again is – diversification.”

In responding to Netanyahu’s remarks, Ron Tomer, president of the Manufacturers’ Association of Israel, began by agreeing with him. “The prime minister stated in public what we feel and have been warning about. The Israeli brand, of creativity, demand, and success, has been badly damaged around the world.” He then changed his tone. “An autarkic economy will be a disaster for Israel and will affect the quality of life of every citizen,” he said. “Exports are Israel’s main growth engine, and giving up on them means giving up on our future in Israel.”

Tomer recommended the government to reverse direction. “Instead of shrinking into ourselves, we should strengthen our exporting capability, expand trade agreements, and give industrialists confidence and certainty for the long term. Only that way will we be able to ensure our citizens’ standard of living and also the economic and military strength of the country.”

Published by Globes, Israel business news – en.globes.co.il – on September 16, 2025.

© Copyright of Globes Publisher Itonut (1983) Ltd., 2025.