Dear real estate agents,

I have wanted to buy a house for a year or so now, but I held off because mortgage rates were high and I expected them to get lower. Right now, I can swing a 3% down payment and closing costs, but interest rates are still high. Should I go ahead and buy a house, or should I hold off another year and use that time to save for a larger down payment?

Thanks,

Buyer Biding Her Time

Metro Atlanta, Georgia

Read more: The best mortgage lenders for first-time home buyers

Dear Buyer Biding Her Time,

You’re right — national mortgage rates have hardly moved over the last year, even though many people thought they would decrease. Economists don’t expect home loan rates to plummet by this time next year, either.

However, everyone’s situation and local housing market are different. We have three real estate agents who have thoughts on whether it’s a good time for you to buy a house. Here’s what they have to say.

Note: Some answers have been edited for length and clarity.

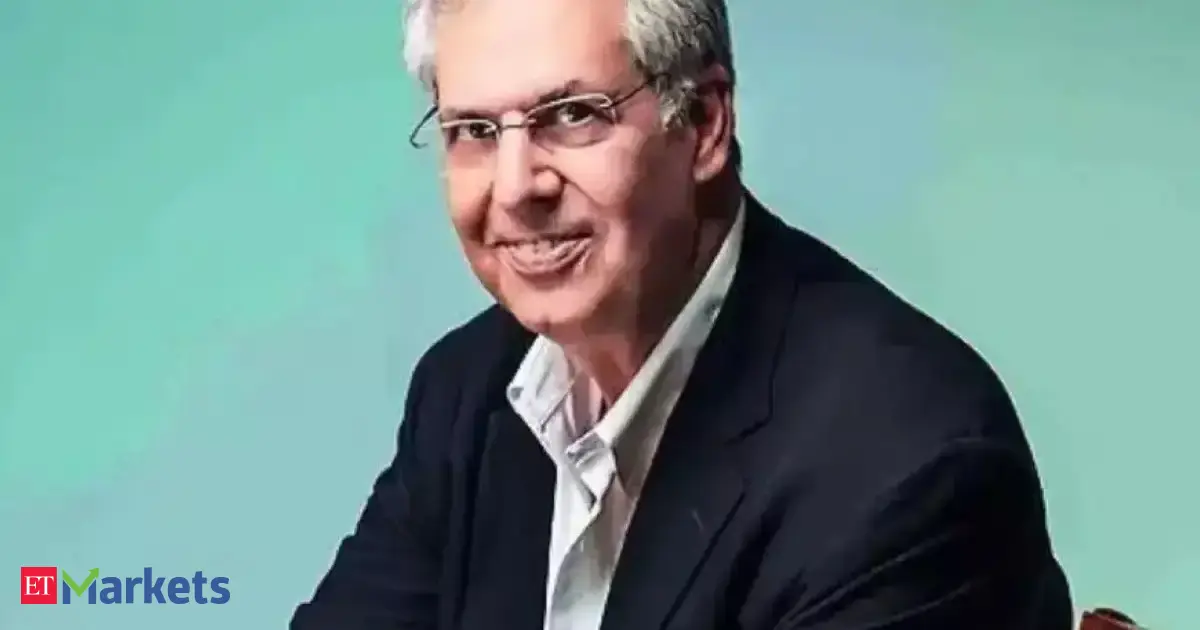

Our first tip is from Blake Blahut, a real estate agent with Realty ONE Inspiration Group in Orlando. Blahut pointed out that trying to time the real estate market usually turns out like attempting to time the stock market: futile. The future holds too many unknown factors that could negatively impact your plans.

“In my experience, waiting often leads to paying more for the home and still ending up with a higher rate than expected,” Blahut said.

Finding a home you like and can afford is typically more important than snagging a low mortgage rate. Remember, if rates drop substantially in a few years, you can refinance your mortgage to get a lower rate.

“Even if you saved a bit longer for a larger down payment, any benefit could be offset by home values continuing to rise, even modestly, in your market,” said Blahut. “Right now, you also have a unique chance to negotiate with sellers in a buyer’s market, and that won’t last forever.”

And remember, the sooner you buy, the sooner you begin building equity in your home and accumulating wealth.

Kathleen Myers, agent with RE/MAX in Portland, Ore., emphasized the importance of buying a house you can afford. Yes, mortgage rates factor into your monthly payments, but there are other factors to consider.

“While today’s rates are higher than a few years ago, the key question is whether you can comfortably afford the monthly payment on a home you love,” Myers said. “If the payment works for your budget, buying now makes sense.”

She also pointed out that once mortgage rates decrease, more people will probably want to buy. This means more competition, which typically leads to higher housing prices and bidding wars. By buying sooner rather than later, you could avoid this stressful and expensive situation.

“Ask your lender to put together a cost sheet for a home you are considering,” she said. “If the numbers work for your budget, I encourage you to go for it.”

Dig deeper: How much house can you afford? Use our home affordability calculator.

Are today’s mortgage rates stopping you from buying a house? Rosa Galarza, an agent with Kelly Properties in Nashville, suggested thinking outside the box and buying a new construction home. This could be a newly built property or one that is still in the construction process.

“This is like a secret weapon in today’s market,” Galarza said. “Many home builders have a ‘preferred lender’ they work with, and those lenders often offer special incentives you can’t find anywhere else. I’m talking about interest rates as low as 3.99% to 4.99%, along with closing costs paid for by the builder.”

This strategy could result in fewer closing costs and lower monthly payments, potentially saving you quite a bit of money.

Galarza said that you don’t necessarily need to think of this house as your “forever home.” You can enjoy low monthly payments now while you build equity, and if you find a place you like more in a few years, when market rates have decreased, you can use that equity to buy a house you love even more.

“Ask a real estate agent” is a monthly column. To submit a question to our panel of agents, fill out this Google Form.