This entire impact of early monsoon, I mean if monsoons are late, it is a problem; when monsoons are early that is also not great. Do you think we should stop getting excited about the fact that monsoons have come early because ultimately, it is a weather pattern which has changed and it will have impact on vegetable prices, food prices, crop prices, crop sowing and this is May, I mean the June and July bacha hai abhi.Anshul Saigal: First of all, our demand has come down, but samosa demand has gone up. But power and also rains, we have been in the markets long enough to see that seasonality and these small events while they are good talking points in that year and that they are issues in the short term, but if we look beyond that short-term period, two or three-month period, then really it is the fundamentals of the markets which take over.

Good monsoons is by and large good for the country and, of course, there will be that odd issue in one sector or the other while monsoons are ahead of time, but by and large it should be good for the country.

And this year should be no different. If earnings growth continue in the same trend as the markets expect, which is that between FY25 and FY27 Nifty expectations are likely to be in the range of 12% to 13% CAGR earnings growth, if that continues, this market will have support and we also need to bear in mind that this market of course valuations are one aspect, but ownership of the market is the other aspect.

Ownership towards the last quarter of last year had gone up meaningfully. Markets were heavy. In the first quarter of this year, ownership has come down and markets are relatively light.

And so, valuations being reasonable, markets being relatively light, this is the good combination for markets to give reasonable returns going forward, that is what we anticipate from the current sort of setup. Tell me how are you stacking up both Zomato as well as Swiggy and especially Zomato given that the stock has as of yesterday already knocked off about 25 to 26 odd percent from its 52-week peak and now the weight reduction in ftse as well as msci definitely weighing heavy on it.Anshul Saigal: Actually, in our investment style we tend to not really chase stocks particularly if these stocks are expensive in valuations and secondly, if they are not making much money. Now despite this 26% kind of decline in the stock price, if you look at the market cap of the company, I forget what the last number was, but my guess is somewhere close to two lakh crores, that is not a very sort of small market cap which can give you tremendous upsides from current levels in our judgment and also the road to profitability is not very clear. There is, of course, that move which the company has indicated towards profitability and they have shown some progress on that, but whether that profitability justifies this this sort of a market cap, we are not very sure.

So, for us as an absolute return investor, we are not very excited by the current level of the company as also the market cap size and we find tremendous opportunity in the broader markets in that range of 5,000, 6,000, 10,000, 20,000 crore market cap companies which we anticipate can give very healthy returns, can double over a three-year period and hence that will peak our interest more and so that is just the sort of makeup of our investment style which is why we are not very excited by this space at the moment.

Also, help us with your take on the pharma pack as well because of late the sector seem to be consolidating a bit, CDMO as a space is the only outlier there. Help us understand that how are you looking at the numbers so far and what are the key triggers that you are watching out for.Anshul Saigal: Yes, you are right this is a space which has consolidated in recent times, and we are also actually quite positive on the CDMO space much more than we are on the generic pharma companies.

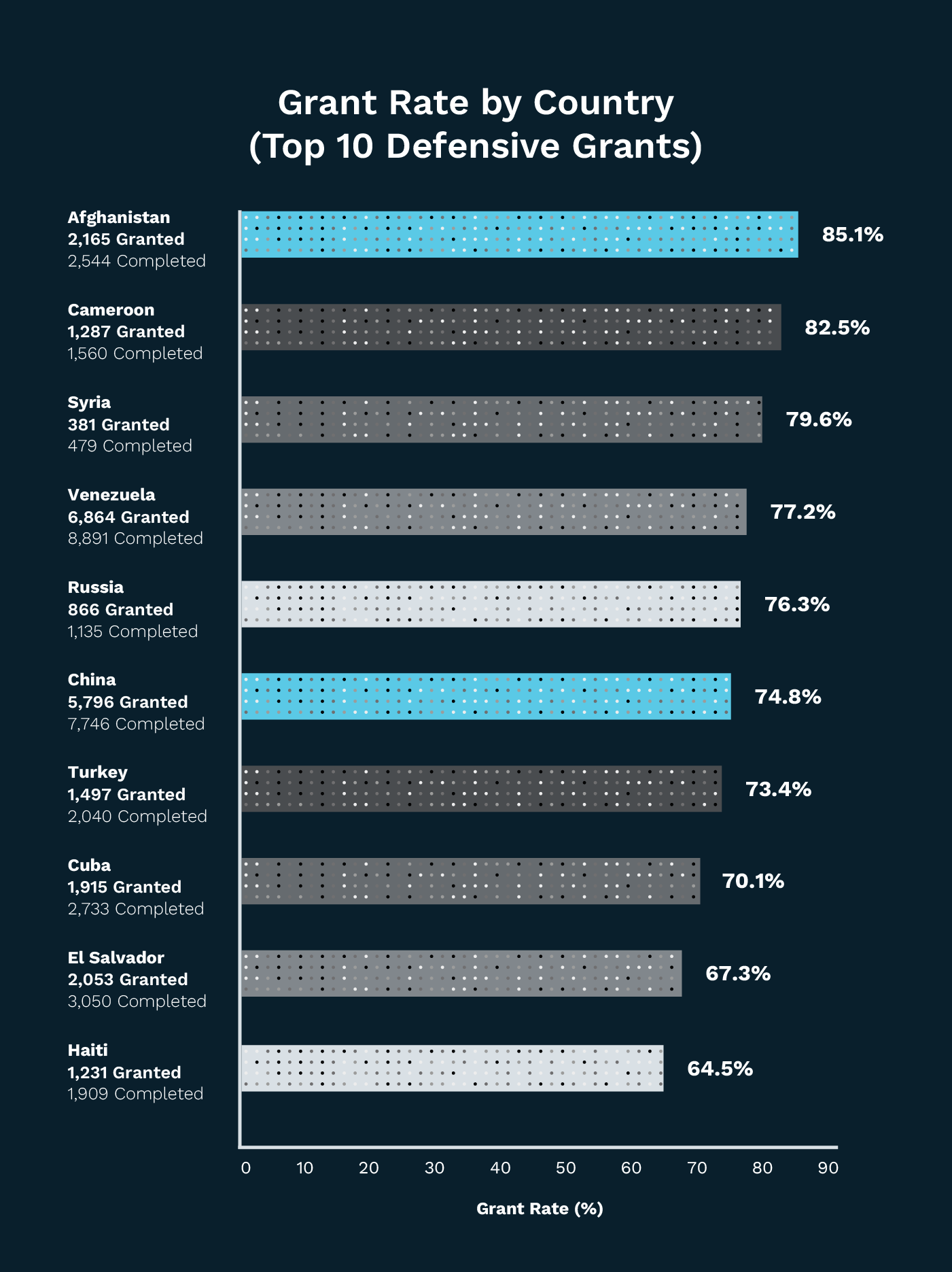

The reason being that India is currently at a 3% to 4% market share of a market which is $150 to $200 billion mostly catered to by countries outside of India, particularly China I think is about 50% to 60% market share in this space and our judgment is that even if a small portion of that China plus one anticipated move happens towards India, say three to four billion move from China which is clearly 50% of the market at this moment, we will be doubling our markets just by virtue of that small move away from China.

And if that happens, this space will have tremendous tailwinds, and our belief is that amongst various sectors India has tremendous chemistry capability as also manpower available to take advantage of this opportunity and we are likely to do that in the years ahead in the next three to five years.

So, CDMO looks very interesting for us. As regards generics pharma, we think that there is some uncertainty because of the tariff situation, as also the pharma headwinds in the US, we think that as a result there will be limited upside to multiples in this space and one would need to be slightly cautious on generic pharma, particularly exporters to the US. Domestic pharma has very nice dynamics almost FMCG sort of dynamics and that space could see tremendous interest. So, we think that domestic pharma and CDMO those are the pockets of opportunity at this moment.