The company’s shares are proposed to list on both BSE and NSE, with allotment expected on September 1 and tentative listing on September 3.

Vikran Engineering raised Rs 232 crore from anchor investors ahead of the IPO. The company had earlier secured backing from The Wealth Company (via India Inflection Opportunity Fund) and investors Ashish Kacholia and Mukul Aggarwal through a pre-IPO placement.

Vikran Engineering IPO price band

At the upper end of the price band (Rs 97), the issue is valued at 22x FY25 earnings and 4x book value, which analysts consider fairly priced compared with listed peers trading at much higher multiples.

About the Company

Incorporated in 2008 and headquartered in Thane, Vikran Engineering is a fast-growing EPC (Engineering, Procurement and Construction) player. It provides turnkey solutions across power transmission and distribution, water infrastructure, railway electrification, metro projects, and renewable energy.The company follows an asset-light model, leasing most of its equipment instead of owning heavy assets, which ensures better scalability and financial flexibility. With operations spanning 22 states and more than 190 project sites, Vikran Engineering has developed strong execution capabilities.

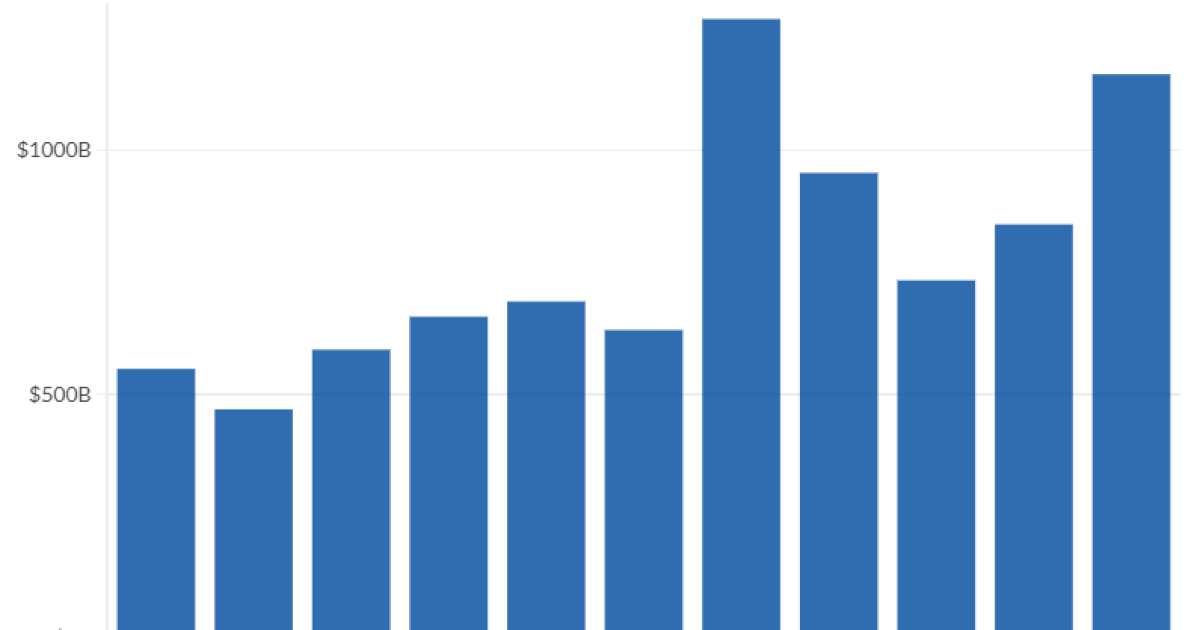

Financial Performance

The company has delivered strong growth in recent years. Revenue rose from Rs 524 crore in FY23 to Rs 916 crore in FY25, a CAGR of 32%. Profit after tax grew at a 35% CAGR over the same period, from Rs 43 crore in FY23 to Rs 78 crore in FY25.For FY25, it reported revenue of Rs 1,354.7 crore and PAT of Rs 77.8 crore. EBITDA stood at Rs 160.2 crore with margins of 11.8%.

Should You Subscribe?

Both Reliance Securities and Canara Bank Securities recommend subscribing to the issue. Reliance Securities highlighted Vikran Engineering’s strong execution track record, alignment with government infrastructure push, and asset-light business model that enhances efficiency and scalability.

Canara Bank noted rapid growth in order execution, and experienced promoters. However, it flagged risks such as stretched working capital cycles and a recent ban from railway electrification projects by the Railways’ vigilance wing, which could weigh on order flows.

Objects of the IPO

The company plans to utilise the proceeds mainly for funding working capital requirements (Rs 541 crore) and for general corporate purposes.