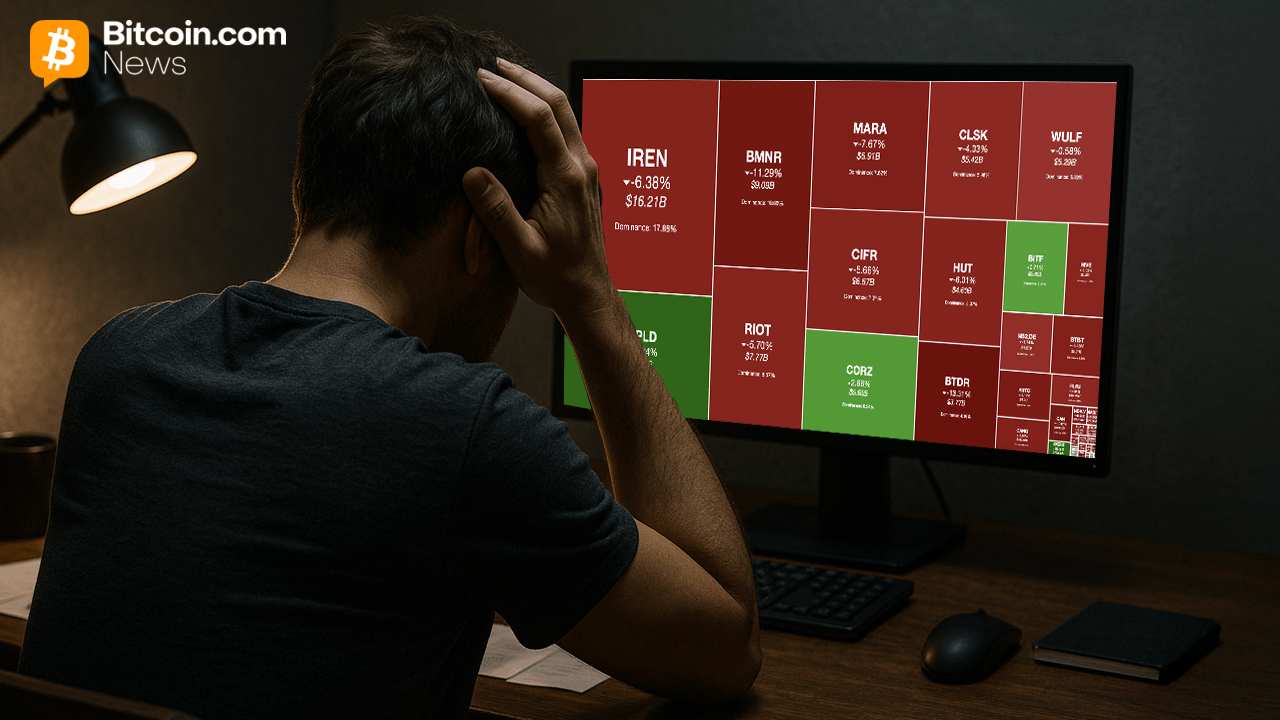

Market sell-offs can sting, but they also create opportunities to make more money when stocks rebound. However, it’s important to focus on buying shares of proven companies with a record of growth that still offer great long-term prospects.

Three Fool.com contributors recently were asked to provide details on discounted stocks to buy right now. Shares of Shopify (NASDAQ: SHOP), RH (NYSE: RH), and Roblox (NYSE: RBLX) are all trading between 51% and 77% off their previous peak. Here’s why these stocks could deliver excellent returns from here.

Jennifer Saibil (Shopify): I’ve been telling investors for years to wait for a better entry point to buy Shopify stock. Well, that day has finally come.

Shopify isn’t a consumer-facing business, so unless you’re an investor or you own a small, online business, you might not even be familiar with it. It’s the largest e-commerce software company in the U.S., and it’s growing internationally. That means it sells e-commerce services to small, and, increasingly, large businesses. Its core product is a full, e-commerce-equipped website that gets small businesses up and running and taking orders. But it’s expanded into offering a large assortment of services targeting businesses of all sizes, both online and offline, and it’s growing quickly.

Revenue increased 26% in 2024, and since it offloaded an ill-fated logistics business a few years ago that was weighing on the bottom line, growth has become profitable now, too. Operating income increased 61% in 2024, and free cash flow was up 37%, with a 22% margin.

E-commerce keeps growing as a percentage of retail sales, and as the dominant player in its space in the U.S., Shopify is well-positioned to benefit from organic industry growth. According to Statista, e-commerce is expected to reach more than 21% of total global retail sales by 2029, up from over 17% last year. But as it moves more into physical retail and offers a full omnichannel program, it has an even wider market opportunity.

And now, for the all-important valuation piece that’s been stopping me from giving Shopify a more wholehearted recommendation these past few years. Even down 51% from its all-time high and 23% year to date, Shopify stock trades at a forward one-year P/E ratio of 55, which no one would call cheap — but it’s a lot cheaper than it was before, and it’s near its lowest level in five years.

No one knows where tariffs are going to lead the U.S. economy, but Shopify stock isn’t likely to stay low forever; it’s already moving back up, for now at least, and you can still buy shares of this brilliant stock on the dip.

Jeremy Bowman (RH): Retail stocks have gotten crushed by the tariff-driven sell-off, and RH, the high-end home furnishings maker formerly known as Restoration Hardware, has been one of the hardest hit.

RH had the misfortune of reporting fourth-quarter earnings while President Donald Trump was announcing the new tariffs, and the stock tumbled more than 40% the following day on a combination of a weak fourth-quarter earnings report and disappointing guidance.

After that plunge, RH stock is now down 77% from its pandemic-era peak and 62% from levels earlier this year when investors were much more optimistic about the economy. The stock is even trading below where it was in 2019 in the months leading up to the pandemic.

The sell-off in RH stock does make sense in some ways. The company relies on imports for roughly 85% of its products, though it does have a factory in the U.S., and it was already struggling with a weak housing market prior to the tariff disruption. Additionally, as a high-end retailer, the company is more sensitive to the economic cycle and things like the stock market.

However, RH also seems more resilient than investors might think and to reassure the market, management updated its free-cash-flow guidance to call for free cash flow of $250 million to $350 million for 2025, meaning the stock trades at just 9 times expected free cash flow this year. Additionally, CEO Gary Friedman noted that the company has a strong inventory position with over a $1 billion inventory, representing about four months’ worth of sales.

RH has a history of making aggressive buybacks when the stock is down so it could take advantage of the sell-off that way, and the brand should emerge from any downturn just as strong as it is today.

While the stock is risky right now, it has a lot of upside over the longer term, and could easily double or triple from where it trades now.

John Ballard (Roblox): Roblox is a popular digital platform where people come to play and interact in games and other experiences. It has delivered strong growth in users and revenue, but its digital-based business makes it a stock worth considering amid the concerns over tariffs. At the current $55 share price, the stock is 59% off its all-time highs and about 4.4% year to date.

Digital entertainment companies are relatively resilient to the impact of tariffs, since they don’t make physical goods that are imported into the U.S. The main risk for Roblox would be weak consumer spending from a recession, but its free-to-play platform would still allow Roblox to maintain a large and growing user base.

Over the long term, a growing installed base of players would translate to higher revenue and profits. Roblox monetizes its users with ads and sales of virtual currency (Robux) that players use to spend on premium content. Roblox’s 2024 revenue surged 29% year over year, with daily active users up 21%.

Since the end of 2022, daily active users have increased from 59 million to 85 million. Management’s long-term goal is to grow the platform to 1 billion users. With $3.6 billion in annual revenue and a $34 billion market cap, Roblox should be a more valuable business in another decade. This is a great opportunity to buy shares on sale.

Before you buy stock in Shopify, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Shopify wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004… if you invested $1,000 at the time of our recommendation, you’d have $496,779!* Or when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $659,306!*

Now, it’s worth noting Stock Advisor’s total average return is 787% — a market-crushing outperformance compared to 152% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of April 5, 2025

Jennifer Saibil has no position in any of the stocks mentioned. Jeremy Bowman has positions in RH and Shopify. John Ballard has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Roblox and Shopify. The Motley Fool recommends RH. The Motley Fool has a disclosure policy.

3 Brilliant Stocks Down 51% to 77% to Buy Right Now was originally published by The Motley Fool