President Trump has asked Congress to pass “one big, beautiful bill” to cut taxes by hundreds of billions of dollars, but on the other hand, Trump has imposed significantly higher taxes by placing tariffs on more than 70 percent of US imports. Even without further escalation of tariffs, the policies already in effect threaten to offset the benefits of the promised tax cuts.

As of April 2025, President Trump has imposed tariffs on nearly all US trade partners and additional product-specific tariffs, with few exceptions. The tariffs currently in effect include 20 percent on all imports from China and an additional 125 percent on certain imports from China, 25 percent on non-USMCA goods from Mexico and Canada (10 percent on non-USMCA Canadian energy and potash), 10 percent on most imports from nearly all other trading partners, and 25 percent on steel, aluminum, autos, and auto parts.

Meanwhile, Congress is considering a taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities.

bill that will, in some form, extend the expiring tax cuts from the 2017 Tax Cuts and Jobs Act (TCJA) and potentially include additional tax cuts for individuals based on Trump’s campaign pledges.

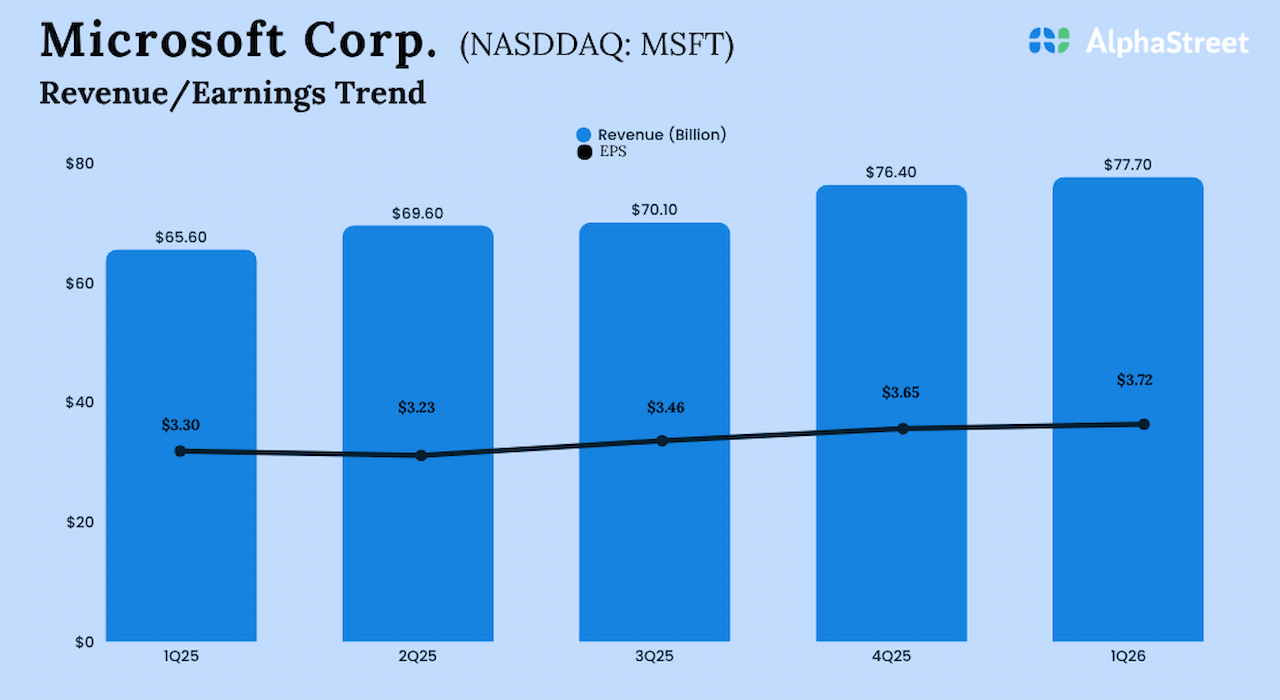

If the tariffs are left in place permanently, and if the expiring individual income taxAn individual income tax (or personal income tax) is levied on the wages, salaries, investments, or other forms of income an individual or household earns. The U.S. imposes a progressive income tax where rates increase with income. The Federal Income Tax was established in 1913 with the ratification of the 16th Amendment. Though barely 100 years old, individual income taxes are the largest source of tax revenue in the U.S.

changes are extended, the policy combination would reduce long-run GDP by more than 0.3 percent and reduce federal tax revenue by nearly $1.6 trillion. In other words, the combination is a tax cut that worsens economic growth, and that’s before considering foreign retaliation to US-imposed tariffs. Note: The tariffTariffs are taxes imposed by one country on goods imported from another country. Tariffs are trade barriers that raise prices, reduce available quantities of goods and services for US businesses and consumers, and create an economic burden on foreign exporters.

effects estimated here are not directly comparable to our tariff tracker, which incorporates scheduled increases in tariffs and models the tariffs independent of potential tax policy changes.

Summary Effects of TCJA Individual Permanence and US-Imposed Tariffs

Source: Tax Foundation General Equilibrium Model, April 2025.

Though taxpayers would, on average, receive a tax cut given the net reduction in taxes, tariffs would offset more than half of the benefit of the tax cuts overall, and up to two-thirds of the benefit for lower- and middle-income taxpayers.

Distributional Effects of TCJA Individual Permanence and US-Imposed Tariffs

Note: Market income includes adjusted gross income (AGI) plus 1) tax-exempt interest, 2) non-taxable social security income, 3) the employer share of payroll taxes, 4) imputed corporate tax liability, 5) employer-sponsored health insurance and other fringe benefits, 6) taxpayers’ imputed contributions to defined-contribution pension plans. Market income levels are adjusted for the number of exemptions reported on each return to make tax units more comparable. The 2026 income break points by percentile are: 20%-$17,735; 40%-$38,572; 60%-$73,905; 80%-$130,661; 90%-$188,849; 95%-$266,968; 99%-$611,194. Tax Units with negative market income and non-filers are excluded from the percentile groups but included in the totals. Estimates are stacked after making individual TCJA provisions permanent.

Source: Tax Foundation General Equilibrium Model, April 2025.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe

Share this article