Discover why 86% of firms are falling dangerously behind the curve and learn what firms of all sizes can do to reverse course.

Highlights

Accounting firms without a clear AI strategy face significant disadvantages

Implementing an integrated automation platform is essential for modern firms to remain competitive

UltraTax CS, SurePrep, and SafeSend resolve these challenges with end-to-end automation

The writing is on the wall for tax and accounting firms: AI and automation aren’t optional anymore. The latest technology is imperative to survive and thrive.

Yet according to Thomson Reuters’ Future of Professionals Report 2025, only 14% of firms have visible AI strategies. While many firms continue to struggle with mounting pressures, those 14% of firms with visible AI strategies are already seeing 3.1 times more ROI.

The gap is widening every day. Here are the top 8 ways firms are currently failing without AI-powered automation and losing ground to firms that have been embracing change.

Jump to ↓

8. You’re missing the AI revolution that’s actively reshaping your industry

7. You’re vulnerable to client communication and security risks

6. You’re always behind on regulatory changes

5. You’re losing talent to forward-thinking firms

4. Your team lacks time for strategic value-add work

3. You can’t scale beyond your current capacity

2. Your data is scattered across incompatible systems

1. Your best people are burning out on mundane tasks

Your brand-new workflow manual: Meet automation, integration, and AI

8. You’re missing the AI revolution that’s actively reshaping your industry

The Failure: 86% of firms lack visible AI strategies. Early adopters have already transformed their operations. It’s now a widely accepted belief that AI will play a central role in all future tax technologies.

The Reality Check: The firms investing in AI today will have insurmountable competitive advantages tomorrow.

The Fix: SurePrep 1040SCAN uses AI-powered document recognition and data extraction technology, reducing workload compression and increasing overall workflow efficiency for firms of all sizes.

7. You’re vulnerable to client communication and security risks

The Failure: Manual processes often involve emailing sensitive financial data, storing information in unsecured spreadsheets, and lacking proper audit trails. Poor client communication creates friction and delays.

The Reality Check: A single data breach or compliance failure can mean significant fines and reputation damage, while poor client experience drives business away.

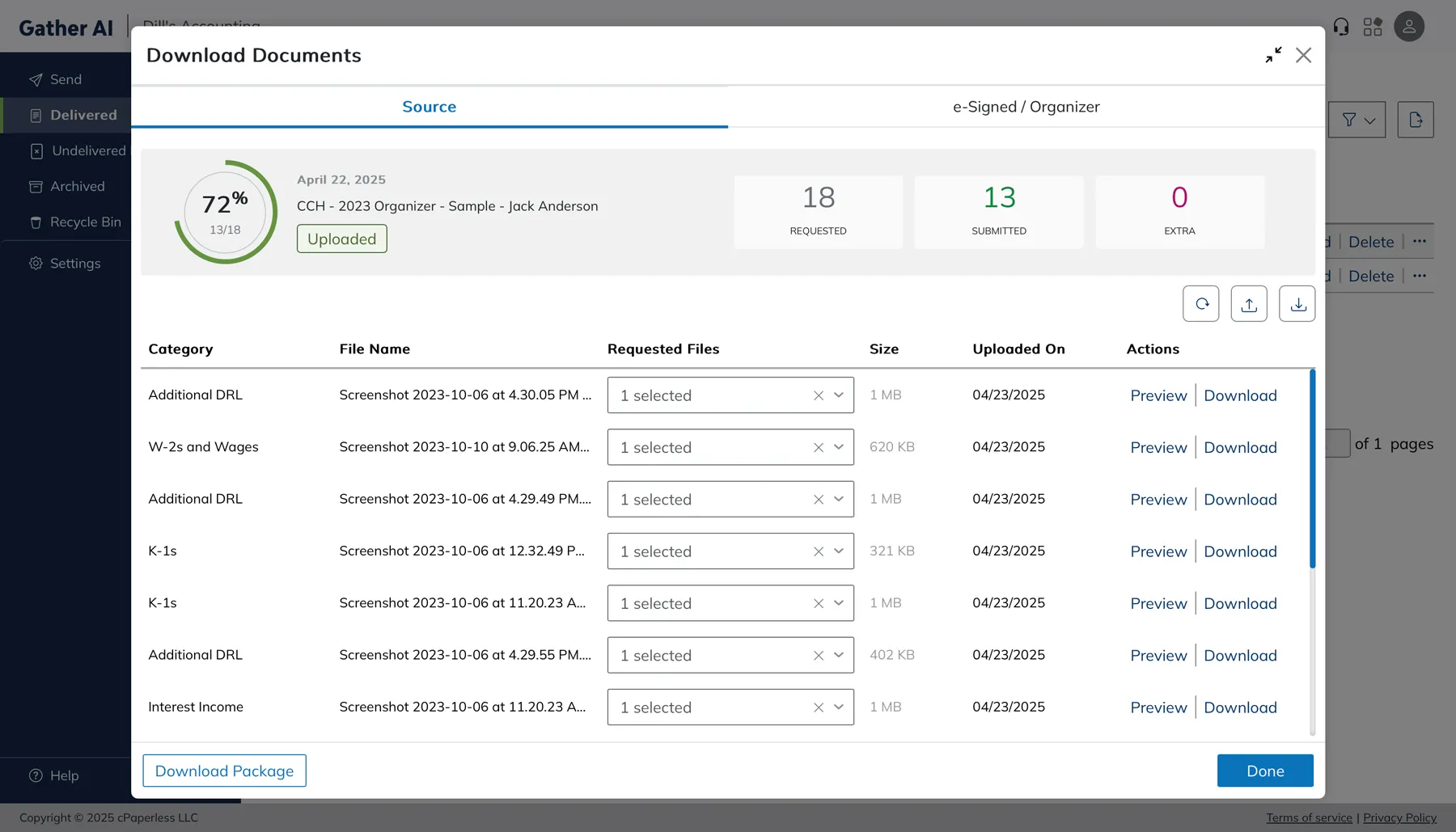

The Fix: SafeSend Gather provides bank-level security for document collection and client communication, integrating with your existing tax software to eliminate unsecured email exchanges. Enterprise-grade automation platforms provide complete audit trails and controlled access to sensitive data.

6. You’re always behind on regulatory changes

The Failure: Tax regulations evolve constantly (e.g., OBBBA, TCJA, state-specific changes). Manual tracking and implementation create dangerous lag times.

The Reality Check: Regulatory compliance isn’t just about avoiding penalties — it’s about maintaining your license to operate in key jurisdictions.

The Fix: UltraTax CS updates forms, calculations, and diagnostics to reflect the latest federal and state tax law changes. There’s also an ability to apply automatic updates. That means you stay confidently compliant, remaining in control while enjoying the support of intelligent tools that help you file accurately and efficiently.

5. You’re losing talent to forward-thinking firms

The Failure: The talent shortage in tax is real. And manual processes accelerate burnout.

The Reality Check: Top talent gravitates toward firms offering modern tools and strategic work, not Excel-heavy manual tasks.

The Fix: UltraTax CS provides intuitive workflows and automated calculations that reduce preparation time and increase accuracy, while modern automation tools improve job satisfaction and help attract and retain quality professionals.

4. Your team lacks time for strategic value-add work

The Failure: Many firms don’t have the resources for planning or investigating new technologies. They’re trapped in a reactive cycle from busy season to busy season.

The Reality Check: Strategic tax planning and advisory services command higher margins and stronger client relationships than annual tax services.

The Fix: 1040SCAN’s patented auto-verification technology enables firms to reduce or eliminate data entry, freeing up preparers for higher-value activities (e.g., tax strategy, planning, advisory services) that drive real business value.

3. You can’t scale beyond your current capacity

The Failure: Staffing constraints are dictating growth potential. Fewer CPAs and financial professionals are available in the market, making it especially hard for small firms to compete with larger firms for talent.

The Reality Check: While you say “no” to growth opportunities, firms that have deployed more automation are scaling without proportional headcount increases.

The Fix: UltraTax CS handles comprehensive federal, state, and local tax preparation across all entity types (e.g., 1040 individual, 1120 corporate, 1065 partnership, 1041 estates and trusts). Is your firm mainly focused on 1040s and 1041s? The purpose-built automation of 1040SCAN recognizes 4–7 times as many documents as competing solutions, which reduces time spent on data entry.

2. Your data is scattered across incompatible systems

The Failure: Today’s tax technology can drive efficiency across the tax workflow. But many solutions don’t integrate with each other.

The Reality Check: Disconnected systems create data silos, manual reconciliation nightmares, and compliance blind spots.

The Fix: UltraTax CS integrates with 1040SCAN for automated document processing, while SafeSend Gather connects with your tax software to streamline client communication and document collection.

1. Your best people are burning out on mundane tasks

The Failure: Tax professionals spend countless hours on repetitive manual work (e.g., data entry, workpaper preparation, depreciation calculations, reconciliations). One owner of a small firm told us: “We have to bend to the will of the software.”

The Reality Check: While your senior staff burn midnight oil on data entry, competitors are leveraging their expertise for strategic advisory work that commands premium rates.

The Fix: 1040SCAN eliminates manual data entry by automatically extracting information from client documents and seamlessly integrating with UltraTax CS. Combined with UltraTax CS’s cross-return data sharing capabilities, your team enters data once and it populates across all relevant forms and schedules, freeing senior staff for high-value analysis and advisory services.

Your brand-new workflow manual: Meet automation, integration, and AI

The tax and accounting industry has fundamentally changed. Real-time reporting requirements, increasing complexity, talent shortages, and competitive pressure have created an environment where manual processes are no longer viable.

As our research shows, the most successful tax firms share three characteristics:

They automate routine tasks with integrated, AI-powered solutions like 1040SCAN to free resources for strategic work.

They integrate their tech stack with advanced software like UltraTax CS to eliminate data silos and manual handoffs.

They embrace modern client communication tools like SafeSend Gather to improve the client experience.

Manual processes are hard. And they cost you much more than you think (e.g., time, money, effort, reputation, talent). Stop watching competitors pull further ahead while you’re stuck in a manual cycle. It’s time to upgrade your tax workflow with fully integrated automation.

Ready to start leading?

Thomson Reuters has an integrated automation platform that addresses every failure point outlined above. From UltraTax CS’s comprehensive tax preparation capabilities to 1040SCAN’s AI-powered document processing and SafeSend Gather’s secure client communication, we help tax and accounting firms transform from cost centers to strategic value drivers.

Discover how top tax and accounting firms are using automation to redefine their workflows.

UltraTax CS

Professional tax preparation software to reduce your workflow time and increase your productivity

Learn more ↗

SurePrep

Save over 90 minutes per 1040 return with best-in-class automation and streamlined preparation

Learn more ↗

SafeSend

The entire client experience in one user-friendly platform

Learn more ↗