In an unpredictable economic landscape, ensuring your financial plan can withstand unforeseen downturns is crucial. Stress testing your financial plan involves simulating adverse economic scenarios to evaluate the resilience of your portfolio and overall strategy. This proactive approach helps identify vulnerabilities and allows for adjustments to safeguard your financial future.

Understanding Stress Testing

Stress testing is a risk management technique used to assess how a financial plan or institution might perform under severe but plausible adverse conditions. Originally employed by financial institutions to evaluate capital adequacy, individuals can also utilize stress testing to ensure their personal finances are robust enough to endure economic shocks.

Implementing Stress Testing in Personal Finance

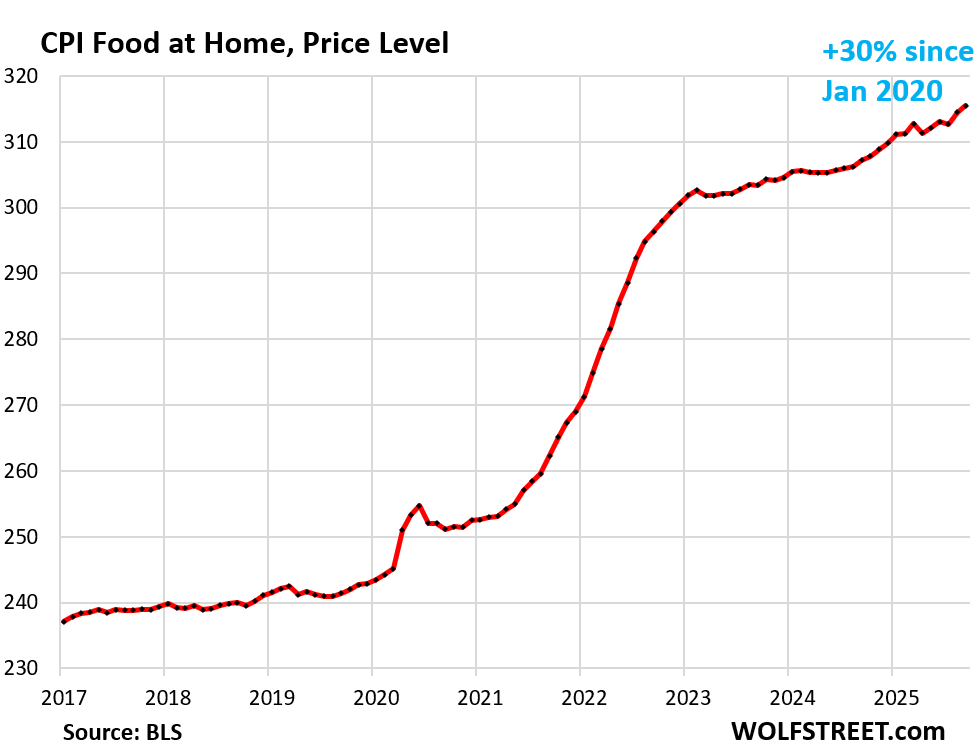

Scenario Planning: Begin by identifying potential economic downturns that could impact your finances, such as a recession, significant market correction, or a sudden increase in inflation. Consider how these scenarios might affect your income, investments, and expenses.

Assessing Asset Allocation: Evaluate your current investment portfolio to determine its diversification and risk exposure. A well-diversified portfolio can help mitigate losses during market volatility. Ensure your asset allocation aligns with your risk tolerance and long-term financial goals.

Evaluating Cash Flow and Emergency Funds: Analyze your cash flow to ensure you have sufficient liquidity to cover essential expenses during economic downturns. Maintaining an emergency fund equivalent to three to six months’ worth of living expenses can provide a buffer against income disruptions.

Reviewing Debt Levels: High debt levels can exacerbate financial stress during economic downturns. Assess your current liabilities and consider strategies to reduce debt, thereby decreasing your financial vulnerability.

Utilizing Financial Planning Tools: Employ tools like Monte Carlo simulations, which run thousands of different iterations against your retirement plan to provide a probability of success percentage. This analysis can help you understand the potential impact of various economic scenarios on your financial plan.

Incorporating Asset-Liability Optimization: Asset-liability optimization is an approach that considers both the assets and the expected liabilities of a financial plan. By integrating this method into your stress testing, you can more accurately assess your risk capacity. For example, understanding future spending obligations (liabilities) in relation to current investments (assets) can guide how much portfolio risk you can reasonably take on. This approach helps create a more tailored and sustainable investment strategy that is better aligned with long-term financial goals.

Building Resilience into Your Financial Plan

After identifying potential weaknesses through stress testing, take steps to enhance the resilience of your financial plan:

Adjust Asset Allocation: Rebalance your portfolio to ensure it remains aligned with your risk tolerance and investment horizon. This may involve shifting investments to more stable assets or diversifying into alternative investments.

Increase Savings Rate: Boosting your savings can provide additional financial cushioning during economic downturns. Consider automating savings to consistently build your financial reserves.

Secure Additional Income Streams: Diversifying your income sources can reduce reliance on a single revenue stream, thereby enhancing financial stability. This might include pursuing freelance work, rental income, or other side ventures.

Regular Plan Reviews: Periodically review and update your financial plan to account for changes in your personal circumstances and the economic environment. Regular reviews ensure your plan remains relevant and effective.

Revisiting Asset-Liability Optimization: Revisiting your asset-liability framework regularly can help maintain balance as conditions evolve. Adjusting portfolios to match updated liability forecasts ensures that the financial plan remains responsive to both expected and unexpected changes, making it a critical aspect of ongoing stress testing.

By proactively stress testing your financial plan, incorporating asset-liability optimization, and implementing strategies to address identified vulnerabilities, you can enhance your financial resilience and navigate economic uncertainties with greater confidence.

Article contributed by Matt Kline

Disclosure: Content should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the author as of the date of publication and are subject to change. All investment strategies have the potential for profit or loss. There can be no guarantee that investment goals will be achieved, and there can be no assurance that any specific investment or strategy will be profitable.

Herbein Financial Group is a joint venture between Northeast Financial Group, Inc. (“NEFG”) and Herbein Financial Group, LLC (“HFG”). Investment Management services are provided through NEFG while HFG will provide certain relationship services.

Advisory services provided by Herbein Financial Group, LLC. (“Herbein Financial Group”), an SEC registered investment adviser. Registration as an investment advisor does not constitute an endorsement of the firm by the Securities Exchange Commission or any other securities regulator and does not mean the advisor has attained a particular level of skill or ability. Herbein Financial Group, LLC. only transacts business in states where it is properly notice filed or excluded or exempted from notice filing requirements. Registration does not imply a certain level of skill or training. A copy of Herbein Financial Groups current Relationship Summary and written disclosure statement discussing its business operations, services, and fees is available upon request from Herbein Financial Group or by going to the SEC’s website (www.adviserinfo.gov).

This newsletter is provided for informational purposes only. This newsletter contains data from third party sources. Although Herbein Financial Group believes these sources to be reliable it makes no representations as to their accuracy or completeness. The information contained herein is based upon certain assumptions, theories and principles that do not completely or accurately reflect your specific circumstances. Information presented herein is subject to change without notice and should not be considered as a solicitation to buy or sell any security. Furthermore, this newsletter may contain certain forward-looking statements that indicate future possibilities. Due to known and unknown risks, other uncertainties and factors, actual results may differ materially. As such, there is no guarantee that any views and opinions expressed herein will come to pass.

Herbein Financial Group, LLC. is a Registered Investment Advisor registered with the Securities Exchange Commission. This report is for information purposes only and does not constitute a complete description of our services or performance. The information contained in this document is not a solicitation to sell securities or investment advisory services where such an offer would not be legal.

The information discussed is intended to serve as a basis for further discussion with your financial, legal, tax and/or accounting advisors. It is not a substitute for competent advice from these advisors. Herbein Financial Group, LLC. or its advisors are not authorized to practice law or provide legal, tax or accounting advice. If a numerical analysis is shown, the results are neither guarantees nor projections, and actual results may differ significantly. Any assumptions as to interest rates, rates of return, inflation, or other values are hypothetical and for illustrative purposes only. Rates of return shown are not indicative of any particular investment and will vary over time. Any reference to past performance is not indicative of future results and should not be taken as a guaranteed projection of actual returns from any recommended investment.