Strategies for tax and global trade professionals to manage tariffs.

Highlights

The Trump administration’s tariff strategy has created economic turbulence, with studies projecting negative impacts like reduced GDP growth, higher consumer prices, and increased household tax burdens.

For tax professionals, tariffs introduce significant compliance risks, particularly under UNICAP rules (IRC Sec. 263A).

Trade professionals must ensure precise product classification (HTS codes) and employ mitigation strategies like foreign trade zones (FTZs) to defer or reduce duties.

Tariffs remain firmly in the spotlight as one of several pressing issues facing businesses under the Trump administration. And, in recent months, President Trump has shifted his tariff strategy into higher gear, further fueling an already turbulent global trade environment.

Major trading partners and key U.S. allies — including the European Union (EU), Mexico, China, Brazil, Japan, India, and Canada — have faced significant tariff shifts as retaliation measures, legal challenges, and negotiation efforts increasingly define today’s tariff landscape.

Tax and trade professionals need to understand the broader economic impacts of tariffs to mitigate risks, manage costs, and navigate compliance. This article explores how tariffs are impacting the economy, addresses the tax and trade-specific considerations to keep in mind, and highlights the importance of an integrated tariff response strategy.

Jump to ↓

How tariffs are impacting the economy

General tariff impacts across tax and trade

Next steps for tax and trade leaders

How tariffs are impacting the economy

Under the Trump administration in 2025, the U.S. economy feels much like a roller coaster ride as businesses and consumers brace for unpredictable twists and turns fueled, in part, by trade policy shifts.

Amid sluggish economic growth, higher consumer prices, and economic uncertainty, the administration remains resolute in its position that President Trump’s tariff plan is an effective strategy to boost U.S.-based manufacturing, improve the trade balance, and, ultimately, increase federal government revenue.

However, analyses by both the Tax Foundation and the Peterson Institute for International Economics (PIIE) indicate that the tariffs under the Trump Administration are taking their toll on U.S. businesses and households.

Studies project that the imposed tariffs will reduce the U.S. growth rate by 0.23 percentage point in 2025 (0.62 percentage point in 2026), lead to an average tax increase per U.S. household of $1,300 in 2025 ($1,600 tax hike in 2026), and drive inflation roughly one percentage point higher. Although the rise in inflation may be temporary, PIIE suggests that U.S. price levels will remain elevated.

Additionally, the Tax Foundation estimates that, over the next decade, Trump’s imposed tariffs will “reduce US GDP by 0.8 percent, all before foreign retaliation.”

According to at least one survey, many Americans disapprove of Trump’s tariff policies. A Pew Research Center study conducted in August 2025 found that the majority of Americans believe the long-term effects of the administration’s tariff policies will be mostly negative for the country (55%) and for themselves and their families (also 55%).

The impacts are real, rippling through the economy, eroding consumers’ purchasing power, and resulting in new challenges for companies that rely on global supply chains. To help manage tax implications, offset higher costs, and reassess sourcing decisions, strategic planning is essential to navigate the impact of tariffs.

General tariff impacts across tax and trade

For both tax and trade leaders, tariffs can create a host of challenges. In today’s ever-changing environment, businesses are reevaluating how to navigate expensive tariffs while maintaining compliance.

Tax-specific considerations

For tax firms with clients involved in importing goods or those who rely on global supply chains, tariffs can have significant implications.

For instance, when a business client imports inventory or materials, the tariffs paid on those imports are not immediately deductible. Under the IRS’s uniform capitalization (UNICAP) rules of IRC Sec. 263A, those costs must be capitalized as part of the inventory’s total value.

If a client immediately expenses tariffs, they could end up underreporting inventory values and overstating the cost of goods sold (COGS). This results in an unexpected tax adjustment. To ensure compliance, it is important to track and allocate tariff-related costs properly.

Consider the following example: A business imports $200 million worth of goods and pays $15 million in tariffs over the course of the year. For internal accounting purposes, they record those tariff costs as expenses as they occur. However, by year-end, $2 million of those tariffs are tied to inventory that remains unsold and is still in the warehouse.

The company assumes the amount is immaterial and does not capitalize the $2 million in its GAAP financials. However, during tax preparation, the UNICAP rules are applied, which require that $2 million be added to the tax inventory.

The outcome:

The company’s COGS is reduced by $2 million for tax purposes.

Taxable income increases by the same amount.

The company’s tax bill is significantly higher than anticipated.

Consumer pricing pressures are another consideration. When hit with tariffs, businesses must decide whether to pass the expense on to their customers, absorb it, or utilize other legal options such as foreign trade zones (FTZs) to defer duties and mitigate the impact. Their decision can impact profitability, revenue recognition, and the timing of income for tax purposes. Helping clients navigate pricing decisions and the implications for cash flow and tax liabilities is important.

Trade-specific considerations

For global trade professionals, the turbulent tariff landscape has underscored the need to rethink sourcing patterns and ramp up efforts to reduce costs and mitigate risks. Not only have tariff rates increased, but ensuring compliance with them has become even more challenging.

Classification

Today, proper product classification is more important than ever, as even minor errors under the Harmonized Tariff Schedule (HTS) can result in compliance issues, penalties, and incorrect payment of duties.

When a company imports a product, it’s not just importing that product with one assigned HTS number. The components of that product can also have their own HTS codes, so the product’s components must also be taken into consideration. Each product can involve multiple codes as well as potentially an additional HTS code based on the country of origin.

Companies that still rely on traditional methods like spreadsheets or a customized enterprise resource planning (ERP) system need to reconsider their approach to managing classification properly.

Consider, for example, Thomson Reuters ONESOURCE Global Classification with CoCounsel, which automates Harmonized System (HS) and Export Control Classification Number (ECCN) classifications with precise codes and duty rates. The solution helps companies efficiently manage regulatory changes, cutting down on time-consuming and error-prone tasks for trade compliance teams.

2025 Tariffs Report

How to thrive in a volatile environment for global trade

Read the survey ↗

Tariff mitigation

Companies can use several tariff mitigation tools, including foreign trade zones. An increasing number of companies are adopting foreign trade zones to ease tariff-related complexities and cut costs. These areas are specially designated sites within 60 miles of a U.S. port of entry that allow businesses to move goods in and out of the country with lower, deferred, or no customs duties, taxes, or fees.

Within foreign trade zones, companies are not allowed to engage in retail trade; however, many other activities are permitted. For instance, companies can store and distribute goods, as well as repackage, re-label, process, test, and sort them.

Operating in foreign trade zones can result in a more efficient supply chain, as well as the following cost savings and benefits:

No duties on waste, scrap, or defective parts

Delayed payment of duties on goods entering the U.S. market

Reduced merchandise processing fees (MPFs)

No duties on imported goods that are later re-exported

Ultimately, proactive planning is key for trade professionals as management increasingly asks them to think more strategically and reduce costs.

Next steps for tax and trade leaders

In today’s economic environment, having an integrated tariff response strategy isn’t optional; it’s essential.

To mitigate exposure and reduce costs, trade leaders are reimagining business models, strategies, and operations. Investing in the right technology and data solutions can provide the real-time visibility needed for making faster, more informed decisions. Download Corporate tariffs survey: Mitigating global trade challenges to learn more.

At the same time, companies will increasingly turn to their accountants for guidance on both the tax and financial implications of tariffs. For accounting firms that offer strategic advisory services and leverage the power of AI, this represents significant growth opportunities.

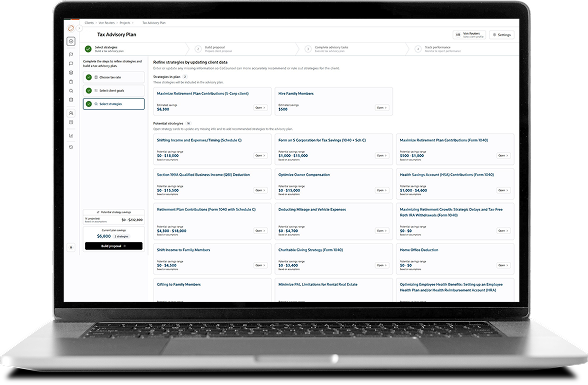

Thomson Reuters Ready to Advise is a tax planning tool that enables firms to transform their advisory strategy through AI-powered insights, automated workflows, and expert implementation guidance. Learn how your firm can elevate its tax planning advisory services today.

Ready to Advise

Elevate your tax planning advisory services with Ready to Advise

Learn more ↗