In a surprising taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. code alteration that has frustrated Americans who enjoy gambling, a provision in the One Big Beautiful Bill Act (OBBBA) limits gambling losses that can be used to offset gambling winnings to 90 percent of their value. This provision, which previously allowed for 100 percent deductibility of losses against winnings, introduces a steep tax penalty for professional gamblers and certain casual bettors.

The OBBBA provision limiting the deduction of gambling losses might cause individuals to owe taxes on imaginary income, incentivizing gamblers succeeding on thin margins to exit the US or participate in illicit markets. While the Joint Committee on Taxation estimated that the deduction limit would generate $1.1 billion in tax revenue over eight years, behavioral responses and tax avoidance could quickly reverse that effect. If only a fraction of professional gamers take their bets outside of legal US markets, the effect will be a net loss to tax collections and an increase in illegal activity.

Consider Daniel Negreanu, perhaps the most famous poker player in the world. Thanks to his vlog and public tracking of poker payouts, we can estimate his tax burden under various tax designs. He successfully nets profitable payouts from his poker playing most years, though he notably lost $2.2 million in 2023.

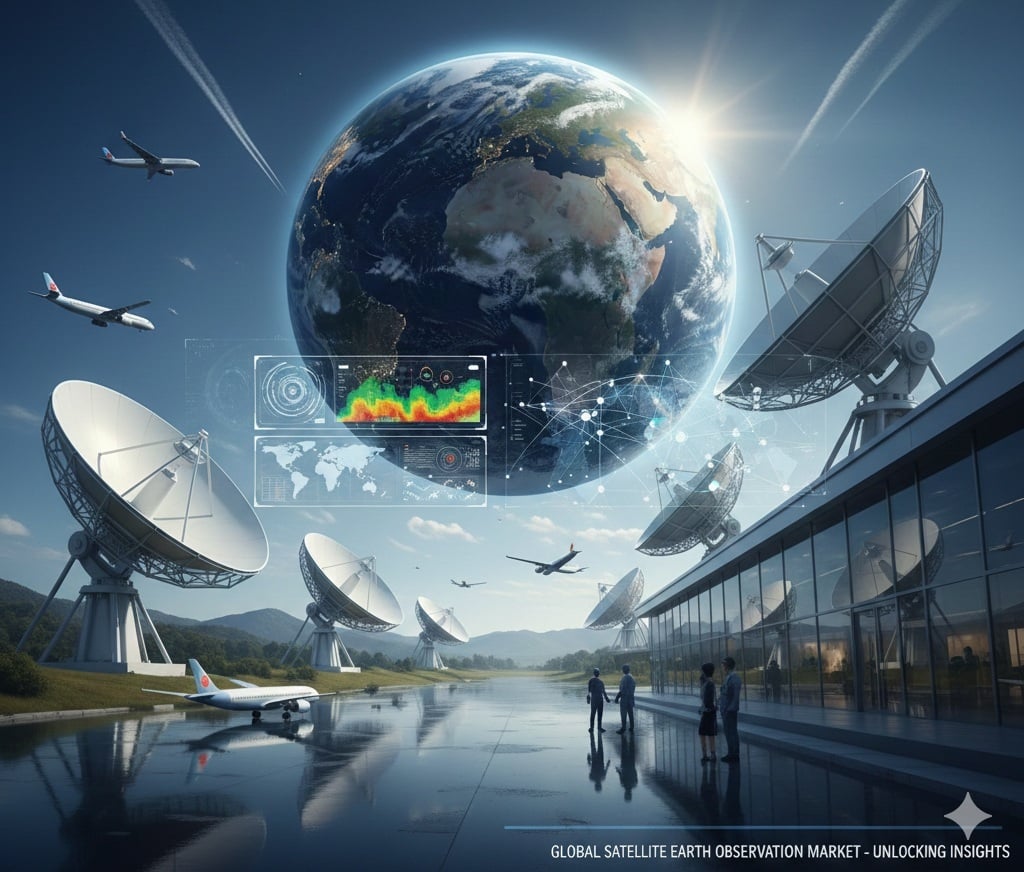

In the 2025 World Series of Poker (WSOP), Negreanu won (cashed) $1,478,240. His buy-ins for the 2025 WSOP totaled $1,297,143, for net winnings of $147,649. Under pre-OBBBA policy, he would pay income tax on that $181,097, and, assuming Negreanu’s income is taxed at 37 percent (the highest income tax bracket), his income tax liability would be $67,006, resulting in take-home pay of $114,091.

When his post-OBBBA losses are limited to 90 percent, however, his tax liability jumps to $115,000. His take-home pay is cut nearly in half to $66,097.

One Big Beautiful Bill Act Tax Provision Hurts Professional Gamblers

Professional Gambler Tax Liability Pre- and Post-OBBBA, 2025

Source: Author calculations; World Series of Poker; CardPlayer.com; @dnegspoker.

The new limit for loss deductions in the OBBBA would result in any gambler who breaks even now taking a net loss after paying taxes on money they never made. Player A’s tax liability when she broke even on $1,000,000 of wagers would increase from $0 to $37,000. Player B, even though running a profitable gambling season, netting $50,000 in winnings, would end up owing $55,500 in taxes to the IRS, resulting in negative take-home pay and an effective tax rate of more than 100 percent. This would create a unique precedent of taxing unrealized income.

Standard accounting practices allow for full deductibility of most business expenses, but it is worth noting that some limitations apply to things like meals and entertainment expenses and excessive corporate officer compensation. These limitations are fundamentally different from the proposed 90 percent wagering loss limitation though. Traditional deductibility limits are largely designed to discourage abusive corporate behavior among large companies. In contrast, the new wagering loss cap primarily affects individual taxpayers who are engaged in a legal, heavily regulated activity.

The impact of the new loss deduction limitation will likely be felt by individuals beyond Las Vegas. Seven states (Michigan, Pennsylvania, New Jersey, West Virginia, Delaware, Connecticut, and Rhode Island) have legalized online gambling, while popular land-based commercial or tribal casinos can be found in nearly every state. State tax revenues from online gaming, nearly $3 billion in 2024, will also be affected if gamblers change behavior.

Unpacking why this change was made may help explain why legislation to reverse this provision has bipartisan support, including some members of Congress who voted in support of the broader OBBBA. In the Senate, the “Byrd Rule” requires that all measures in a reconciliation bill have a significant budgetary impact. In the 2017 Tax Cuts and Jobs Act (TCJA), Congress amended Sec. 165 of the Internal Revenue Code so that professional gamblers could no longer deduct non-wagering business expenses (e.g., hotel rooms, meals, transportation) from their gambling winnings. This change aligned the tax treatment of professional gamblers with that of casual gamblers.

With that TCJA provision scheduled to expire in 2026, Senate tax writers were forced to make an adjustment to Sec. 165 in the 2025 reconciliation bill to generate a sufficient budgetary impact. Lowering the deductibility threshold to 90 percent satisfied the Byrd Rule. The original House-passed reconciliation bill, which did not have to comply with the Byrd Rule, did not include this provision.

If the change to gambling deductibility was primarily procedurally driven—and easy to overlook in legislation as substantial as the OBBBA—a reversal of this provision would make for better fiscal policy. In the House, lawmakers are co-sponsoring the bipartisan Fair Accounting for Income Realized from Betting Earnings Taxation (FAIR BET) Act, introduced by Rep. Dina Titus (D-NV) and co-sponsored by Rep. Guy Reschenthaler (R-PA). Rep. Andy Barr (R-KY) separately introduced the Winnings and Gains Expense Restoration (WAGER) Act. In the other chamber, Senators Catherine Cortez-Masto (D-NV), Ted Cruz (R-TX), and Jacky Rosen (D-NV) introduced the Facilitating Useful Loss Limitations to Help Our Unique Service Economy (FULL HOUSE) Act.

When Congress returns from August recess and Americans start to place bets on their favorite football teams, congressional efforts to restore full gambling deductions will likely be an early priority. And rightfully so: full deductibility of gambling losses is a sound tax policy that would make the treatment of gambling winnings and expenses more neutral.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe

Share this article