Tax and accounting professionals are leveraging automation and AI to streamline workflows, reduce errors, and unlock significant efficiency gains. Discover how the latest technologies are transforming daily operations and driving measurable value for firms.

Jump to ↓

Tax and accounting professionals face a perfect storm of challenges in today’s environment: talent shortage, workload compression, regulatory changes, and technological innovation. How can firms stay competitive, deliver quality services, and achieve work-life balance amid these pressures? The answer lies in tax automation.

Tax automation is the use of technology to streamline and optimize the tax preparation process, from gathering source documents to filing returns. By leveraging automation, firms can reduce manual tasks, errors, and costs, while increasing speed, accuracy, and insights. This can lead to improved profitability, client satisfaction, and staff retention.

In this blog post, we summarize key insights from our webinar with industry experts Allen Stahl and Will Hosek, who discussed the future of tax automation and how to elevate your firm’s efficiency and accuracy.

The tax environment and the need for efficiency

According to the 2025 State of Tax Professionals Report, driving operational efficiency remains the top priority for tax and accounting firms. The report highlights the ongoing challenges such as workload compression, talent shortage, regulatory changes, and technological innovation, reinforcing the need for streamlined workflows and increased productivity.

One of the ways to achieve efficiency is to adopt an open ecosystem approach, which allows firms to integrate with best-of-breed solutions and leverage data and insights from different sources.

An open ecosystem can help firms automate their processes, enhance collaboration, and improve decision-making. Thomson Reuters is committed to fostering an open ecosystem and providing firms with the tools and platforms to connect with their preferred solutions.

The role of automation, APIs, and AI in enhancing efficiency and accuracy

Automation, APIs, and AI are three key technologies that can help firms enhance their efficiency and accuracy in the tax prep process.

Automation refers to the use of software or machines to perform tasks that would otherwise require human intervention, such as data entry, verification, indexing, and classification.

APIs, or application programming interfaces, are the means by which different software applications can communicate and exchange data.

AI, or artificial intelligence, is the ability of machines to perform tasks that require human intelligence, such as natural language processing, optical character recognition, data extraction, and verification.

As Will Hosek explained in the webcast, these technologies can help firms streamline their workflows, reduce errors, improve the quality of services, and access data and insights to drive decision-making.

He also provided some examples of how Thomson Reuters and SurePrep are using automation, APIs, and AI to deliver value to their customers and foster an open ecosystem. Some of these examples are:

Generative AI: Produces text, video, images, and other types of content. ChatGPT is an example of a generative AI application that produces text based on user prompts.

Project DILLY: A generative AI model that creates natural language summaries of tax returns and provides insights and recommendations for tax professionals and their clients.

AutoVerification: Automatically verifies the accuracy of data extracted from source documents and flags discrepancies or errors.

New insights on AI from the Future of Professionals Report

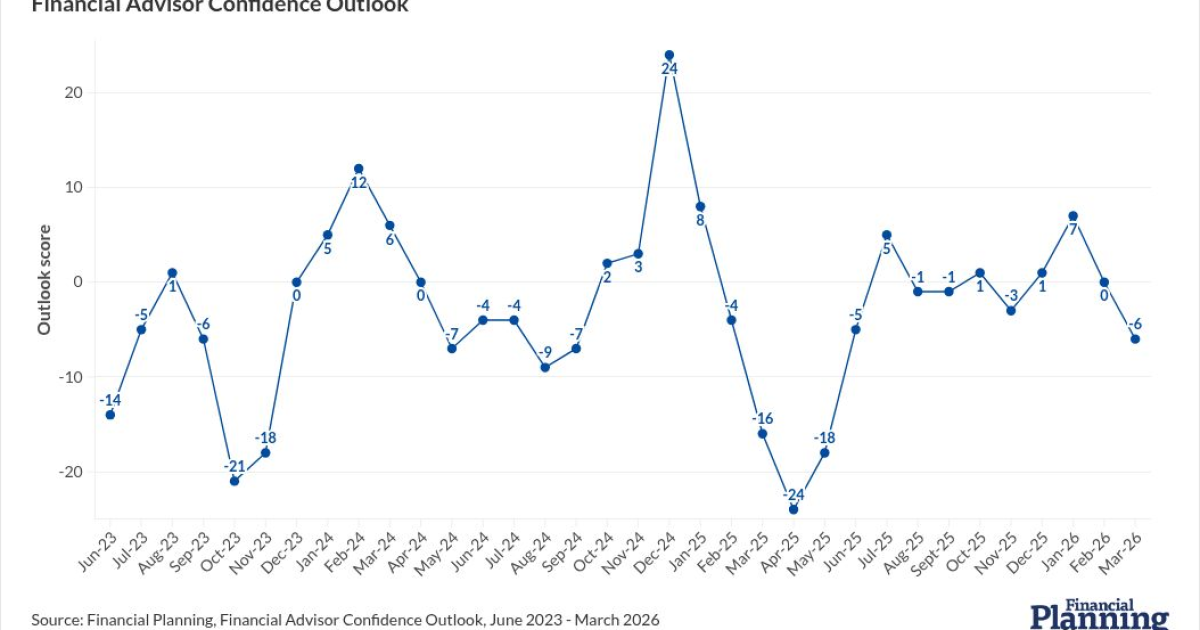

As artificial intelligence continues to reshape tax and accounting norms, recent research highlights its growing influence and tangible benefits for firms. Consider these key findings:

AI Impact: 79% of professionals believe AI will have a high or transformational impact within five years.

ROI from AI: 54% of firms are already seeing returns from AI initiatives.

Efficiency Gains: AI is projected to save professionals 5 hours per week, unlocking an average value of $24,000 per professional annually.

Real-world examples of AI optimizing tax workflows

AI is powering practical solutions that streamline everyday tasks. Here are some of the most impactful ways it’s being used to drive efficiency and accuracy in the profession:

Natural language processing (NLP): Enables tax software to automatically interpret and organize client communications, extract relevant information from emails and documents, and even draft responses or summaries.

→ This saves professionals time on manual review and correspondence.

Optical character recognition (OCR): Allows practitioners to quickly scan and digitize paper tax forms, receipts, and supporting documents.

→ This reduces data entry errors and accelerates the preparation process.

Data extraction and verification: AI tools can automatically pull key figures from source documents and cross-check them against client records or regulatory requirements.

→ This helps professionals ensure accuracy and compliance without tedious manual checks.

Agentic AI: Advanced AI systems can autonomously manage routine tasks, such as tracking deadlines, flagging missing information, or initiating follow-ups with clients.

→ This empowers tax and accounting professionals to focus on advisory work and complex problem-solving, while AI handles repetitive workflow management and adapts to evolving firm needs.

These technologies are not only improving efficiency and accuracy but also transforming client relationships and the role of the tax professional. Automation, APIs, and AI help tax professionals move from being data processors to trusted advisors who provide value-added services and insights.

Considerations for the role of AI in your tax firm

AI is not a magic bullet. It has limitations and may make mistakes, especially when using free models trained on public internet forums.

Firms need to be realistic and responsible when using AI, understanding its strengths and weaknesses. It’s not meant to replace human professionals, but to augment and assist them.

It can automate low-value and repetitive tasks, freeing up time and resources for high-value and strategic tasks, such as providing advisory services, building client relationships, and developing new skills.

The future of tax automation and opportunities for firms

Tax automation is the key to boosting your firm’s efficiency and accuracy and staying ahead of the curve in the tax and accounting industry. By leveraging automation, APIs, and AI, you can streamline workflows, reduce errors, enhance quality, and increase profitability. You can also improve client satisfaction, staff retention, and position your firm as a trusted advisor and technology leader.