Learn the qualifications for claiming this credit in 2026.

The Child Tax Credit (CTC) is a tax benefit provided by the U.S. federal government to help families with the cost of raising children. It is designed to provide financial assistance to eligible parents or guardians, ultimately reducing their federal income tax liability.

As an effective tool in providing financial support to American families, the Child Tax Credit is often seen as a lifeline for parents. By reducing overall tax liability, it can offer substantial tax relief.

In recent years, the CTC has undergone significant changes, thus demonstrating the importance of keeping pace with ever-changing tax legislation. For accountants, understanding the intricacies of the Child Tax Credit can have a meaningful impact on the families you serve.

Let’s take a look at some commonly asked questions related to the Child Tax Credit.

Jump to ↓

What is the Child Tax Credit?

Who qualifies for the Child Tax Credit?

How much is the Child Tax Credit for 2025?

What is the difference between the CTC and the child and dependent care tax credit?

How can I help clients claim children on taxes?

Which tax software can accountants use for calculating the Child Tax Credit?

What is the Child Tax Credit?

The Child Tax Credit is a financial benefit designed to provide assistance to families with dependent children. It is a form of tax relief that helps eligible families reduce their tax liability and potentially receive a refund if the credit exceeds their tax owed.

This credit recognizes the financial responsibilities that come with raising children and aims to alleviate some of the economic burden for families.

Who qualifies for the Child Tax Credit?

You can claim the CTC for each qualifying child who has a Social Security number that is valid for employment in the United States.

To be a qualifying child for the 2025 tax year, your dependent generally must:

Be under age 17 at the end of the year

Be your son, daughter, stepchild, eligible foster child, brother, sister, stepbrother, stepsister, half-brother, half-sister, or a descendant of one of these (for example, a grandchild, niece or nephew)

Provide no more than half of their own financial support during the year

Have lived with you for more than half the year

Be properly claimed as your dependent on your tax return

Not file a joint return for the tax year or file it only to claim a refund of withheld income tax or estimated tax paid

Be a U.S. citizen, U.S. national or U.S. resident alien

Have a valid Social Security Number that is issued before the due date of your tax return (including extensions)

Some individuals may be able to claim the credit even if they don’t normally file a tax return. Parents and guardians with higher incomes may be eligible to claim a partial credit.

To see if you or your client qualifies for the Child Tax Credit, use the IRS Interactive Tax Assistant.

Can both parents claim the Child Tax Credit?

In cases of divorced or separated parents, determining who can claim the Child Tax Credit can get complicated.

Generally, the custodial parent — meaning the parent with whom the child lives for the majority of the year — claims the credit. However, there are situations where the non-custodial parent may be eligible to claim the credit if certain conditions are met, such as when the custodial parent agrees to waive their claim or when it’s stipulated in a divorce decree or separation agreement.

Divorced or separated parents may want to seek legal advice to ensure the appropriate party claims the credit, as an improper claim could lead to issues with the IRS.

Can you get a CTC for an unborn child?

On a federal tax return, the Child Tax Credit generally applies to children who have been born alive during the tax year.

However, changes to legislation could impact this eligibility. In the past, there have been discussions about extending certain benefits, like the Child Tax Credit, to include unborn children at state level. For example, in Georgia, an unborn child is generally eligible for the individual income tax dependent exemption.

As with all tax legislation, accountants must be sure to keep up with changes to the Child Tax Credit at the state and federal level.

Newsletter

Stay up to date with the latest changes in tax legislation with Checkpoint newsstand

Sign up ↗

How much is the Child Tax Credit for 2025?

The Child Tax Credit is worth up to $2,200 per qualifying child in tax year 2025 (up $200 from 2024). Parents with income more than $200,000 ($400,000 if filing a joint return) may be eligible to claim a partial credit.

What is the Additional Child Tax Credit?

The Additional Child Tax Credit (ACTC) is the refundable part of the CTC for taxpayers whose tax liability is less than the CTC amount. For the 2025 tax year, parents may receive up to $1,700 per qualifying child. Parents and guardians need to have an earned income of at least $2,500 to be eligible. Claims for the ACTC will be refunded after mid-February.

What is the difference between the CTC and the child and dependent care tax credit?

The Child Tax Credit and the child and dependent care tax credit are different; however, both provide financial relief to families with children.

The Child Tax Credit is designed to provide financial assistance to families with qualifying children under the age of 17 to help with the costs of raising children.

The child and dependent care tax credit is intended to help families cover the costs of child care or dependent care expenses, allowing parents to work or actively seek employment.

As an accountant, understanding the details of each of these tax credits is crucial to helping your clients maximize their tax benefits and provide a secure foundation for their families.

How can I help clients claim children on taxes?

The Child Tax Credit serves as a valuable resource for families in alleviating some of the financial challenges associated with raising children. Assisting clients with the Child Tax Credit requires a comprehensive understanding of related tax laws and regulations, as well as a tailored approach to each client’s unique financial situation.

Here are six steps to help your clients maximize the Child Tax Credit:

Begin by explaining the eligibility criteria for the Child Tax Credit, including the child’s age, relationship, residency, and other requirements. Ensure your clients understand who qualifies as a dependent child for tax purposes.

Calculate the Child Tax Credit amount (Schedule 8812 on Form 1040) based on your client’s specific circumstances, including the number of eligible children and their ages. Be aware of any changes in the credit amount due to recent legislation or tax law updates.

Assess your client’s income (Form 1040) to determine if they are subject to the phaseout of the Child Tax Credit. Understand the income thresholds for the tax year and how they affect the credit amount.

Explain the concept of refundability for the Child Tax Credit. Clients should understand that a portion of the credit may be refundable, potentially resulting in a tax refund even if they have no tax liability.

Work with your clients to strategize how to maximize their Child Tax Credit while minimizing their overall tax liability. Consider the impact of other tax credits and deductions on their tax situation.

Emphasize the importance of maintaining accurate records and documentation to support their Child Tax Credit claim. This includes ensuring that children have valid Social Security numbers.

As a tax professional, assisting your clients with claiming children on their taxes involves staying informed. With shifting IRS regulations and the need for error-free documentation, more and more accountants are turning to scan-and-populate solutions that automate the tax preparation process and integrate with AI-powered tax research tools.

Which tax software can accountants use for calculating the Child Tax Credit?

If you’re an accountant looking to help your clients accurately claim the Child Tax Credit, SurePrep software can integrate with UltraTax CS, GoSystem Tax RS, CCH Axcess Tax, and Lacerte and can help you reduce manual data entry and maximize tax benefits.

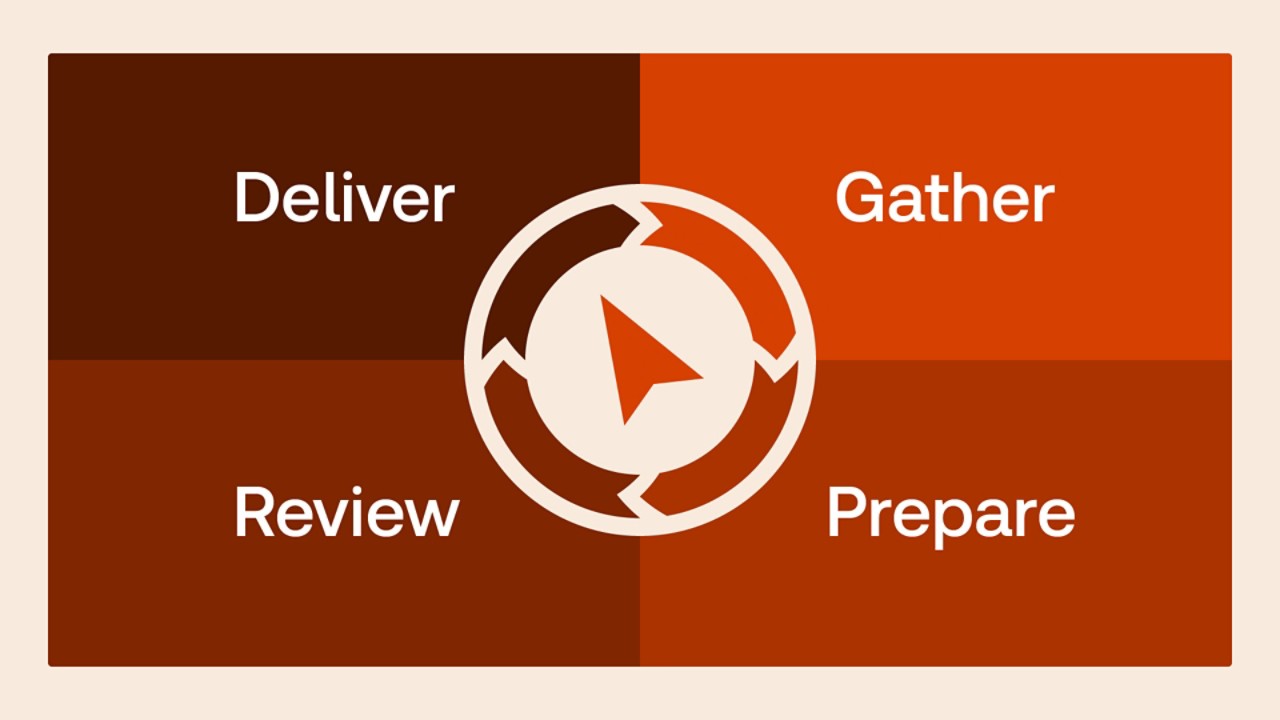

The AI-powered combination of 1040SCAN and SPbinder integrate with your existing tax software to automate each phase of the tax prep process — from gathering necessary documents from clients, to preparing and reviewing the return, to delivering and filing the completed returns with SafeSend. Tax professionals can save time at every step with the Thomson Reuters tax automation suite.

Tax automation suite

Reclaim hundreds of hours with the purpose-built, integrated suite of SafeSend, SurePrep, and UltraTax CS

Learn more ↗