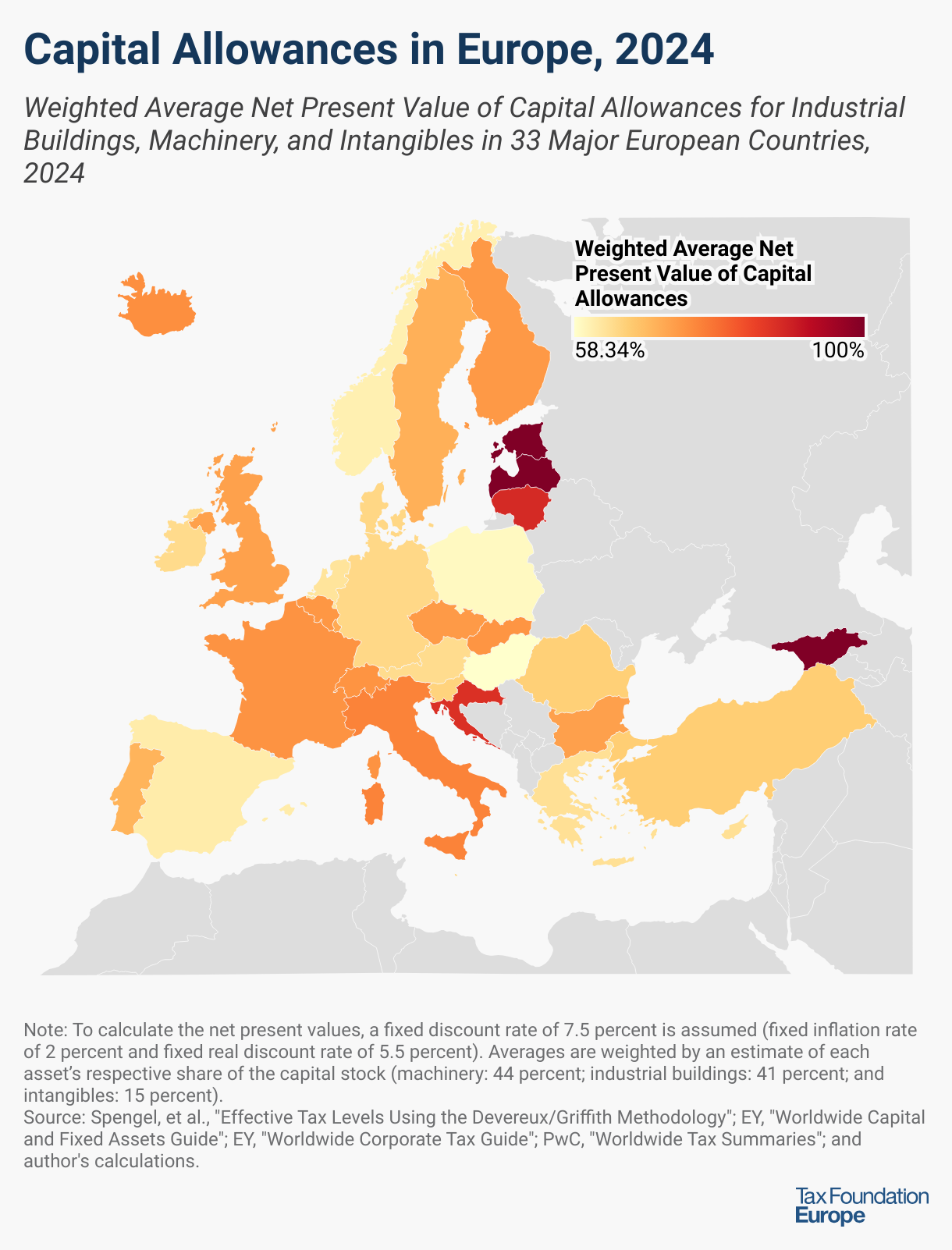

The map reflects the weighted average capital allowances of three asset types: machinery, industrial buildings, and intangibles (patents and “know-how”). Capital allowances are expressed as a percentage of the present value cost that businesses can write off over the life of an asset. The average is weighted by the capital stock’s respective share in an economy (machinery: 44 percent; industrial buildings: 41 percent; and intangibles: 15 percent). For instance, a capital allowanceA capital allowance is the amount of capital investment costs, or money directed towards a company’s long-term growth, a business can deduct each year from its revenue via depreciation. These are also sometimes referred to as depreciation allowances.

rate of 100 percent represents a business’s ability to fully deduct the cost of an asset—either through full immediate expensing or neutral cost recovery.

Estonia, Georgia, and Latvia only taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities.

distributed profits while reinvested earnings are untaxed. This allows for 100 percent of the present value of all capital investment to be written off, making their treatment of capital investment the most attractive in Europe.

Among countries without distribution-based systems, Lithuania (88.2 percent), Croatia (87.2 percent), and Italy (76.3 percent) provided the best tax treatment of capital investment in 2024, while businesses in Norway (60.7 percent), Poland (59.3 percent), and Hungary (58.3 percent) could write off the lowest shares of their investment costs.

On average, in 2024, businesses in Europe could write off 71.9 percent of the present value cost of their investments in machinery, industrial buildings, and intangibles. By asset category, the highest capital allowances were for machinery (86.8 percent), intangibles (82.6 percent), and industrial buildings (52.1 percent).

For comparison, in 2024, the US allowed its businesses to recover 65.6 percent of capital investment costs on average. Bonus depreciationBonus depreciation allows firms to deduct a larger portion of certain “short-lived” investments in new or improved technology, equipment, or buildings in the first year. Allowing businesses to write off more investments partially alleviates a bias in the tax code and incentivizes companies to invest more, which, in the long run, raises worker productivity, boosts wages, and creates more jobs.

, which was adopted in 2017, was phasing out in 2024. However, in 2025, the US returned to permanent full expensingFull expensing allows businesses to immediately deduct the full cost of certain investments in new or improved technology, equipment, or buildings. It alleviates a bias in the tax code and incentivizes companies to invest more, which, in the long run, raises worker productivity, boosts wages, and creates more jobs.

. Additionally, the US will temporarily provide 100 percent expensing of qualifying structures (covering close to 100 percent of all industrial buildings), with the beginning of construction occurring after Jan. 19, 2025, and before Jan. 19, 2029, and placed in service before Jan. 1, 2031.

In 2024, Estonia, Georgia, and Latvia had distribution-based systems, allowing businesses to deduct the full cost of investment. Other countries like the United Kingdom provided full deductions for certain investments in equipment. Unfortunately, some of these policies are temporary, and as they expire, the after-tax cost of investment will rise.

Notable Changes

The Czech Republic applied extraordinary depreciation of machinery from 2020 to 2023, allowing businesses to deduct 60 percent of investment costs in the first year and the remaining 40 percent in the second year. The provision expired in 2024.

Countries like Finland, Germany, and the United Kingdom recognized the importance of capital allowances in supporting business investment and decided to prolong, renew, or modify the policies set to expire.

In Finland, the declining-balance depreciation rate for machinery was temporarily doubled for the years 2020-2023. The policy was extended until 2025. In Germany, accelerated depreciation schedules for machinery that were in place for the years 2020-2022 expired at the end of 2022, though they were partially renewed for the year 2024. The renewal was paired with accelerated depreciation for dwellings until 2029. Additionally, the government has recently increased and extended the accelerated depreciation schedules for machinery into 2027.

The United Kingdom implemented full expensing for machinery and equipment in April 2023, along with a 50 percent first-year deduction for long-life asset investments, and increased the corporate tax rate from 19 percent to 25 percent. Originally set to expire on March 31, 2026, the 2023 Autumn Statement made full expensing and the 50 percent first-year deduction permanent features of the tax code.

In 2025, Lithuania introduced draft legislation that would allow for full expensing for machinery and equipment, as well as for software and acquired rights, starting on January 1, 2026.

As European countries try to support investment, policymakers should aim to permanently provide immediate deductions for investments in machinery and equipment, and for all other capital investments, they should provide adjustments for inflation and the time value of money.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe