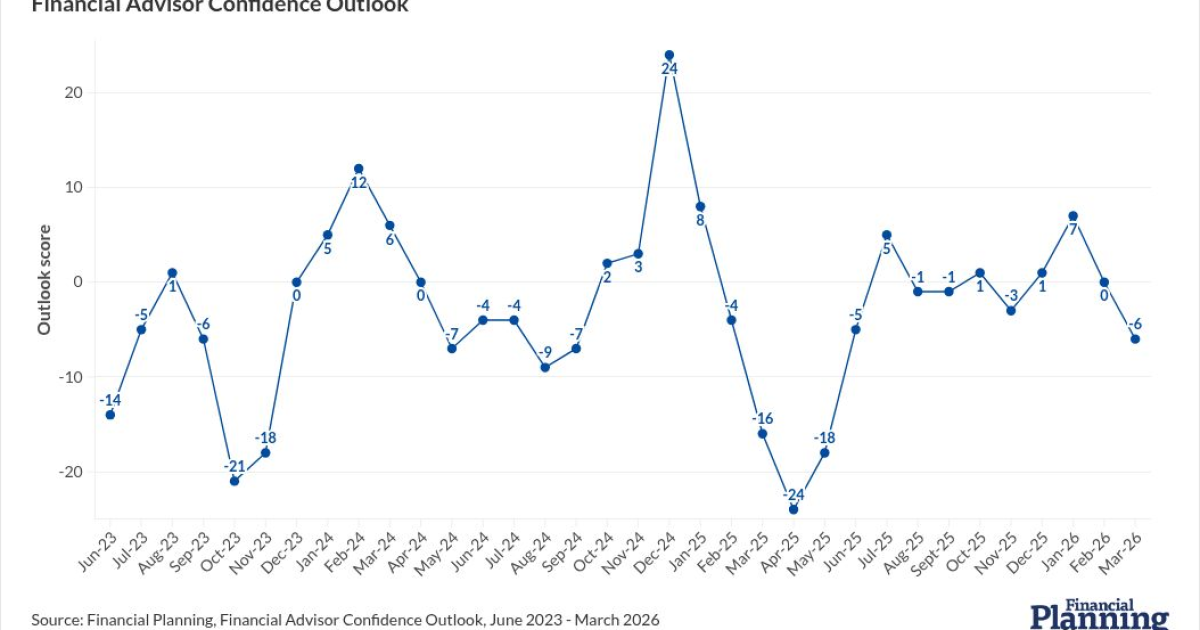

The market goes up. The market goes down. And with volatility, one thing many advisors see consistently is increased interest in fixed-income investments.

Curiosity in fixed income was also sparked after interest rates started to move higher three years ago, said Erin Lyons, co-head of credit research firm CreditSights. After the 2008 financial crisis until about 2022, rates were quite low, so it was hard to make any money in fixed income.

“It didn’t make sense for you to put your cash there. So we saw a lot of investors focusing on equity markets and then moving into alternatives,” she said. “Now that rates are back up … it’s a viable asset class.”

Protecting portfolios and retirement income from volatility via fixed income

The baby boomer generation is now in the retirement phase, and many clients want more predictable income and less of a roller coaster with their nest egg, said Brennan Decima, owner of Decima Wealth Consulting in St. Petersburg, Florida.

“The two themes from our clients are that they don’t want their lifestyle dependent on the market and that they don’t have the same stomach for risk that they did when they were working. Fixed income addresses both of those,” he said. “Fortunately, current rates are compelling and by building out each client’s bond ladder for their specific needs, we have had no issue with meeting demand.”

READ MORE: The worst-performing fixed-income ETFs of the past 10 years

Income and yield-focused portfolios are gaining popularity with clients for several reasons, said Mike Casey, president of American Executive Advisors in Washington, D.C. One of the main factors is the ability to gain earnings even when the market is flat or choppy, he said.

“A portfolio with strong yield and income can help offset some downside volatility and preserve overall portfolio value,” he said. “There are more income and yield generating options now than ever before including traditional bonds, structured products, private credit funds, equity income ETFs and more.”

READ MORE: For fixed-income investors, waiting for a return to normal rates may not be an option

Dane May, co-founder and principal of DePaolo & May Strategic Wealth in Irvine, California, said he has also seen a strong resurgence in interest in fixed income, particularly in shorter-duration instruments. Even more notably, he said, is rising interest in ETFs that stack Treasury bill yields with additional income from risk premiums. These are similar in spirit to structured notes but delivered in ETF form, such as Simplify Enhanced Income ETF (HIGH) and Simplify Treasury Option Income ETF (BUCK).

“Clients are generally seeking ways to boost yield without taking on the equity risk they’re increasingly wary of,” he said. “After back-to-back years of strong equity performance, combined with a new administration pushing meaningful policy shifts, many investors are turning to fixed income. Add in attractive T-bill rates and greater access to ETF-based strategies that reduce correlation without relying on traditional credit or duration, and it’s easy to see why this space is gaining traction.”

Understanding the risks and rewards of fixed income

Advisors should help clients understand the potential perils of fixed income, including price risk, said Brian Rhoads, founder of Checkpoint Financial Planning in Highland Park, Illinois. Many clients were surprised in 2022 when bond prices dropped substantially, having believed that bonds are always “safe,” he said.

“As a result, investors might have sold bonds in a panic, often increasing their allocation to stocks, thus increasing overall portfolio risks,” he said. “The advisor could help by showing the expected price performance of bonds if interest rates go up or down by 1% to 2%, and how the price might evolve if rates hold steady thereafter. The investor will be better prepared to weather actual price volatility and stay the course.”

Most people find the fixed-income space confusing, said Kevin C. Feig, founder of Walk You To Wealth in Boston, so it’s usually best to begin with a foundational education on what it is, why it matters, and its role within a portfolio.

“The recent volatility in the stock and crypto markets, coupled with escalating conflicts across the globe, typically prompts people to reevaluate their investment allocation,” he said. “Advisors should serve as objective parties regarding portfolio decisions. For instance, a client shouldn’t alter their entire allocation to be significantly more conservative based on the latest social media post from the president or any other individual. An advisor can help you make more thoughtful and rational decisions when markets feel chaotic.”

Fixed income in 2025 has been characterized by anxious anticipation, said Henry Yoshida, CEO and founder of Rocket Dollar. Every month this year, there has been pent-up interest that the Fed will lower rates based on trailing economic data, but rates haven’t materially changed.

“When rates start to decline, bond values will increase, but not by as much as equity markets,” he said. “If fixed income serves as a tool in your portfolio to generate an income stream, then it’s fulfilling a specific purpose regardless of the immediate interest rate environment. However, if you are holding fixed income in your portfolio solely for diversification, investors may benefit from other assets that are noncorrelated to equities, such as private credit, real estate and other alternative investments.”

When it comes to investing, it is important to have a carefully planned mix of bonds as well as stocks, and to diversify the portfolio within those different types of investments, said David B. Rosenstrock, director of financial planning and investments at Wharton Wealth Planning in New York City. This can help investors ride out periods of uncertainty, such as the one we are currently experiencing with tariffs, he said.

“Given where cash interest rate yields are, there is a strong case for bonds right now and some key advantages that bonds can offer versus other fixed-income categories,” he said. “One is that when you purchase bonds and longer maturity fixed-income investments, you can lock in a higher yield for longer. So, if you buy a five-year bond or a 10-year bond, that means that interest rate will prevail over your holding period. As we think of rates potentially going lower in the future, the fixed-income investor can benefit from some appreciation in such an environment.”

One role of bonds in a portfolio in addition to providing income is to smooth out and reduce the volatility, said Rosenstrock. Bonds can provide an additional stream of income in a portfolio, with less risk than stocks, he said.

“Incorporating fixed-income investments like municipal bonds is a prudent choice for rebalancing right now in the fixed-income category, particularly for those in high tax brackets,” he said. “Current market volatility, driven by tariff concerns and policy uncertainty, has led to fluctuating municipal yields, presenting a favorable entry point. Municipal bonds are relatively inexpensive compared to U.S. Treasury securities. Additionally, the income from municipal bonds is exempt from federal income tax and often from state and local taxes if purchased from your home state.”