Owners of IRAs and qualified retirement accounts might name a trust as the account’s beneficiary for a number of reasons. They might want to have more control over how the account assets are distributed to their beneficiaries. Or they might want to protect any of their beneficiaries who qualify for means-tested public benefits. In some cases, it might simply be more convenient to name a single entity – like a trust – as the beneficiary of all their retirement accounts, so that any future changes to be made to the trust itself rather than needing to be reflected across all the owner’s beneficiary designation form. Whatever the reason, naming a trust as the beneficiary of a retirement account subjects the account to a complex series of rules regarding how the account must be distributed after the owner’s death.

The general rule is that trusts are treated as “Non-Designated Beneficiaries” and therefore must fully distribute the retirement account by the end of the fifth year after the owner’s death. However, some trusts – specifically, ‘see-through’ trusts whose beneficiaries all consist of identifiable individuals – can qualify for the more favorable distribution schedules available to Designated Beneficiaries. The caveat is that no matter how many beneficiaries the trust has, the entire trust will generally be treated as a single beneficiary for distribution purposes. That means the distribution schedule is typically based on the least favorable treatment among all of its individual beneficiaries. If all of the trust’s beneficiaries are considered Eligible Designated Beneficiaries, the trust may take ‘stretch’ distributions based on the life expectancy of the oldest beneficiary. But if even one of the trust beneficiaries is a Non-Eligible Designated Beneficiary, then the entire trust is subject to the 10-Year Rule and must be fully distributed by the end of the tenth year after the account owner’s death.

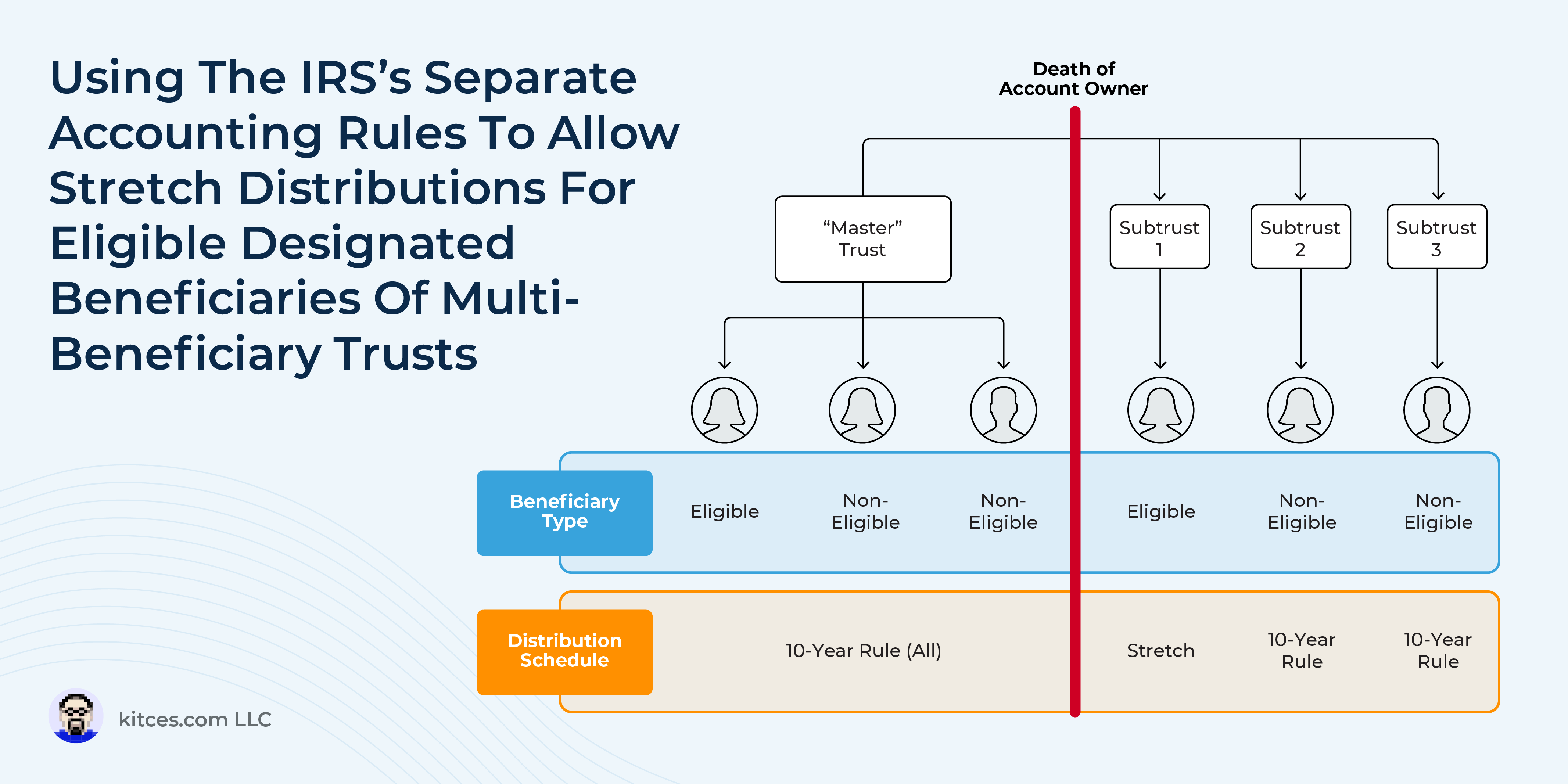

When the IRS released its Final RMD Regulations in July of 2024, it introduced a significant new carve-out to the ‘single distribution schedule’ rule. Under the new rules, if a see-through trust is split into separate subtrusts immediately following the account owner’s death, each subtrust can use its own distribution schedule. In other words, under the old rules, a trust with a mix of Eligible and Non-Eligible Designated Beneficiaries would have been automatically subject to the 10-Year Rule for Non-Eligible Designated Beneficiaries. Under the new rule, if the trust is divided into separate subtrusts for each beneficiary, the Eligible Designated Beneficiaries can each receive “stretch” distributions over their own life expectancy – while only the Non-Eligible Designated Beneficiaries will be subject to the 10-Year Rule.

Notably, the IRS regulations only allow this ‘separate accounting’ treatment when the trust document includes a provision to divide the trust into separate subtrusts before the account owner’s death. The trust document must also specify how the retirement account is to be allocated among the individual subtrusts– the trustee cannot be granted discretion to make those decisions after the fact. Additionally, the trust must already qualify as a see-through trust; otherwise, any non-individual beneficiaries will cause the entire trust to be considered a Non-Designated Beneficiary, regardless of whether it’s divided into separate subtrusts after the owner’s death.

Ultimately, the new “separate accounting” rule creates more flexibility for retirement account owners who want to name a trust as their account beneficiary while still optimizing the tax treatment of distributions for each of the trust beneficiaries. Under the new rules, retirement plan owners with beneficiaries who are both Eligible and Non-Eligible Designated Beneficiaries can ensure that their Eligible Designated Beneficiaries can still receive stretch distribution treatment. But because the provision to divide the trust must be written into the trust document itself, it’s important for advisors to work with their clients (and their estate attorneys) to implement any necessary changes in advance!

Read More…