Around 200,000 service members transition to civilian life each year. A significant number land in management, business or financial roles, and many find their way to financial planning. That’s no surprise, as the same qualities that help those in uniform lead under pressure, make decisions and stick to a mission translate directly into serving clients.

For Army veteran Meredith H. Schneider, the founder of Schneider Wealth Management in Palo Alto, California, those abilities form the basis of her advisory work.

“In the military, we were trained to always have contingency plans because no matter how well you prepare, reality rarely, if ever, unfolds exactly as expected,” she said. “I take the same approach to financial planning. We cannot predict the future, but we can design strategies intended to be resilient, structured to adapt and hold steady even when life takes an unexpected turn.”

Veterans across the industry echo that sentiment. From discipline to problem solving, financial advisors who are vets say the lasting skills they learned in the service give them an advantage and help them go from serving their country to serving their clients.

Discipline and strength under pressure

Schneider said her military background taught her to stay composed in unpredictable conditions and work together toward a shared mission while remaining grounded under pressure — all skills that she now uses to help clients “gain clarity and confidence in their financial lives.”

Marine Corps veteran Tim Thornberry, founding partner of Cornerstone Financial Partners in Johns Creek, Georgia, said the mindset carries directly into advising.

“The military teaches you how to assess risk, follow a plan and stay disciplined under pressure,” he said. “Those same traits are at the heart of smart financial planning and investing.”

High-stakes judgment calls and a decision-making advantage

Many service members enter the industry already trained to think in cycles of rapid observation and action.

Omen Quelvog, founder of Formynder Wealth Management in Spotsylvania, Virginia, and co-host of “The Fiscal Foxhole Podcast,” said this is what the military calls the “OODA loop” (observe, orient, decide and act) — and it’s a great fit for advising.

“This mindset is a tremendous asset in financial planning, where clients’ lives, tax laws and markets are constantly shifting,” he said. “Former service members tend to make decisions based on the best information available at the time, stay alert to changes and adapt their recommendations as needed.”

Two-time Iraq War veteran and ex-Goldman Sachs financial advisor Brad Genser is the co-founder and chief technology officer at wealth management platform Farther. His time in the service gave him years of experience in which he made high-stakes decisions with limited tools, led teams and managed complex technology. He’s been able to take that skill set to his post-military roles, applying his leadership, analytical and culture-building abilities to new goals.

“In the military, you operate on a big stage with high stakes,” he said. “In civilian life, and in launching a startup, the stakes are still high, but in a different way.”

Genser credits his military training in part with preparing him for being able to confidently make decisions on cutting-edge technology — like AI tools — in wealth management.

“Military members are trained in structured approaches to risk management, and everything they do is in that blended context where people and technology work together,” he said. “This takes a level of judgment developed through practice, and military members have ample practice problem-solving in hybrid systems.”

Resilience, grit and mission focus

Building an advisory practice takes perseverance, especially in the early years. Many veterans say resilience is one of the most valuable traits they offer.

When Thornberry started his firm two decades ago, the transition was challenging, though ultimately rewarding.

“Building my own business after two tours in Iraq took some real adjustment, but the leadership and resiliency I found in the Marines allowed me to build what we have today,” he said.

READ MORE: This is the biggest cybersecurity threat for wealth firms

A very particular set of skills: The recruiter POV

Recruiters say the skills veterans bring to the table often translate well when it comes to serving in a new way.

Jacob Gamble, a principal at Cowen Partners Executive Search, specializes in identifying and recruiting top talent for C-suite and leadership roles in the financial services industry. He has hired veterans in the past and has been pleased with the results. Veterans tend to follow processes and procedures well, he said.

“There were no challenges,” he said. “They are easier hires. On average, they follow directions and do their work better than nonmilitary employees. That reliability and discipline always translate well in the finance sector.”

Genser’s own chief of staff came to his role directly from the Army and has been an “incredible addition” to the team.

“His transition has further solidified for me how naturally military skills transfer to this industry,” he said. “His task-oriented and mission-focused mindset has carried over seamlessly to our work. In combat, you need to learn quickly, have a go-getter mentality, communicate under pressure and operate with a strong sense of accountability.”

A service mindset

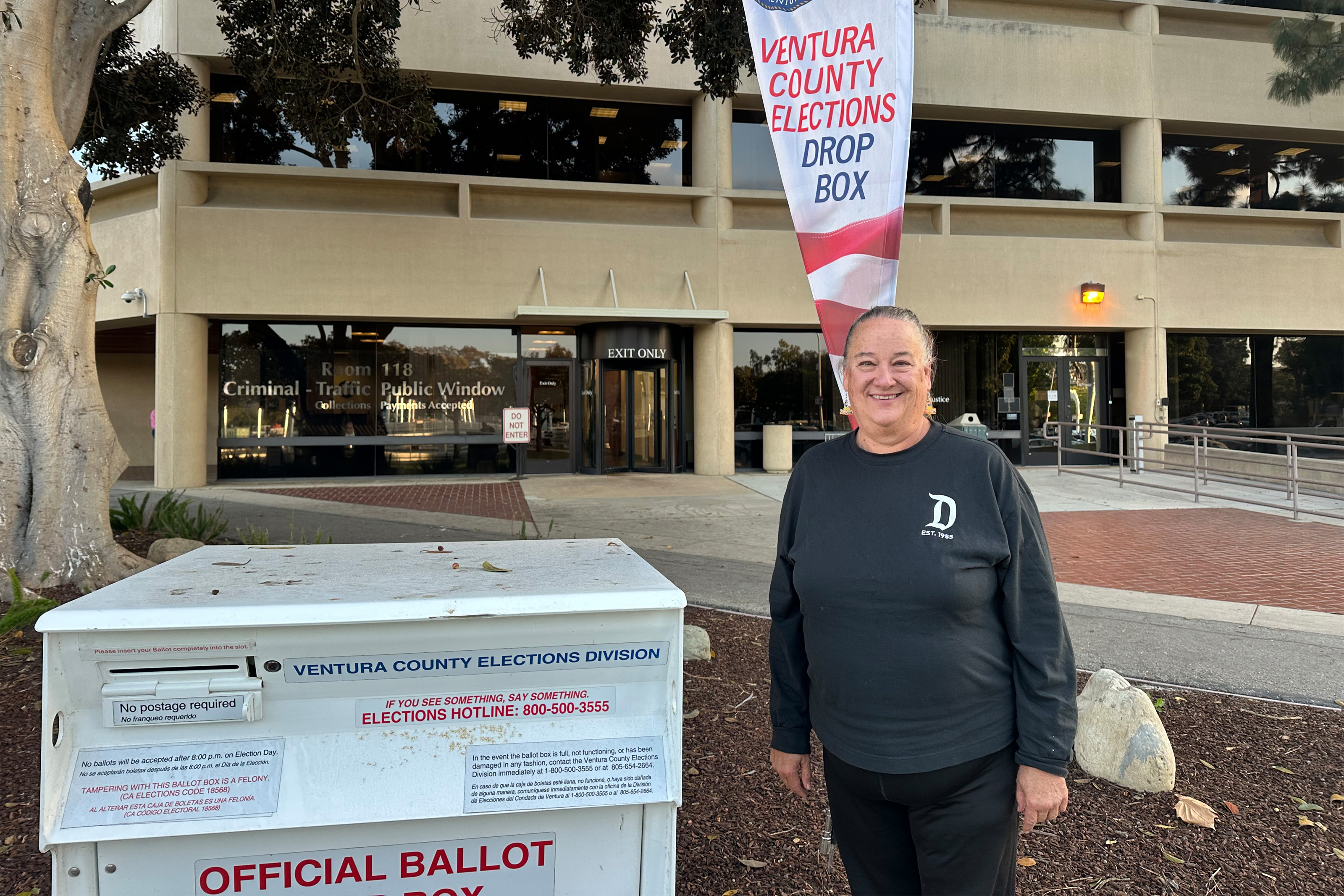

For many veterans, the transition into financial planning is a natural continuation of service. After a quarter century in the Air Force, Mike Hunsberger founded Next Mission Financial Planning in Saint Charles, Missouri, to serve military members, former military members and military retirees.

“Most military that transition into the financial services space are probably DIYers that really enjoy it,” he said. “They are also service-oriented. … The military expects you to be a self-starter, especially as you move up in rank, and be able to figure out what is needed and then to get the job done. I think these translate well into financial services.”

Thornberry says he now makes a point of hiring veterans when he can.

“Vets bring leadership, grit and service commitment, which fits perfectly in our business,” he said.